This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IL-1120 Schedule J

for the current year.

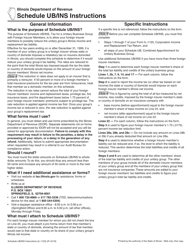

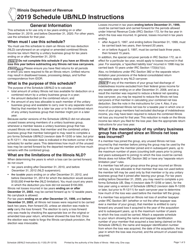

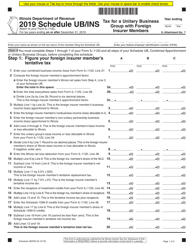

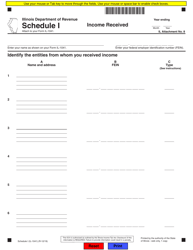

Instructions for Form IL-1120 Schedule J Foreign Dividends - Illinois

This document contains official instructions for Form IL-1120 Schedule J, Foreign Dividends - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form IL-1120 Schedule J?

A: Form IL-1120 Schedule J is a supplemental form for reporting foreign dividends on the Illinois corporate income tax return.

Q: Who needs to file Form IL-1120 Schedule J?

A: Businesses that have received foreign dividends need to file Form IL-1120 Schedule J along with their Illinois corporate income tax return.

Q: What information is required on Form IL-1120 Schedule J?

A: Form IL-1120 Schedule J requires the taxpayer to provide details about the foreign dividends received, including the amount, country of origin, and any applicable exemptions.

Q: Are there any exemptions for foreign dividends on Form IL-1120 Schedule J?

A: Yes, there are certain exemptions available for foreign dividends on Form IL-1120 Schedule J, such as the Subpart F exemption and the dividends-received deduction.

Q: When is the deadline for filing Form IL-1120 Schedule J?

A: Form IL-1120 Schedule J must be filed along with the Illinois corporate income tax return by the original due date, which is generally the 15th day of the 3rd month following the close of the tax year.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.