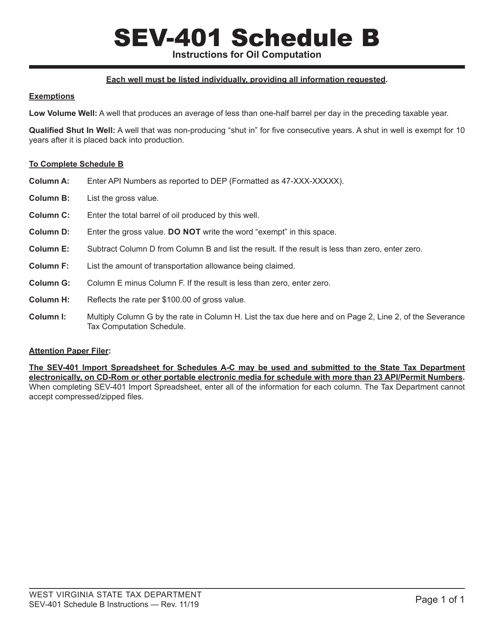

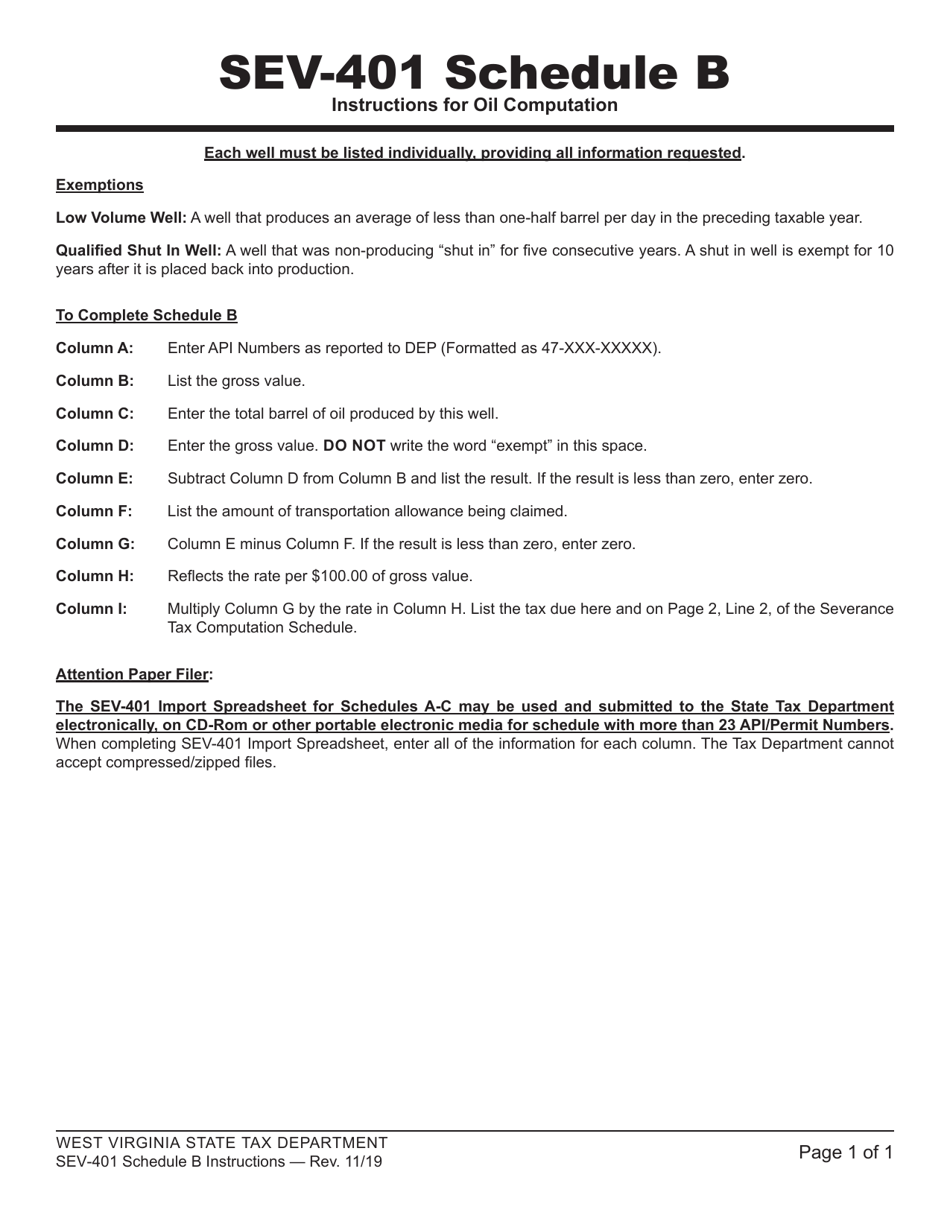

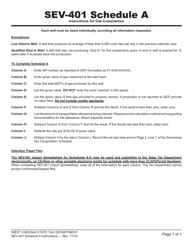

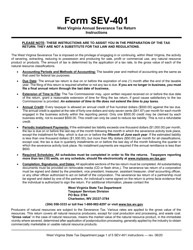

Instructions for Form SEV-401 Schedule B Oil - Tax Computation and Exemption Schedule - West Virginia

This document contains official instructions for Form SEV-401 Schedule B, Oil - Tax Computation and Exemption Schedule - a form released and collected by the West Virginia State Tax Department.

FAQ

Q: What is Form SEV-401 Schedule B?

A: Form SEV-401 Schedule B is a tax form used in West Virginia for computing oil taxes and claiming exemptions.

Q: What is the purpose of Schedule B?

A: The purpose of Schedule B is to calculate the amount of oil taxes owed and to claim any applicable exemptions.

Q: Who needs to file Schedule B?

A: Anyone engaged in the production, severance, or sale of oil in West Virginia needs to file Schedule B.

Q: What information is required on Schedule B?

A: Schedule B requires information such as the total production or severance of oil, applicable tax rates, and any exemptions claimed.

Q: How is the tax amount calculated on Schedule B?

A: The tax amount is calculated by multiplying the total production or severance of oil by the applicable tax rate.

Q: What exemptions can be claimed on Schedule B?

A: Exemptions for oil taxes in West Virginia include the exemption for oil produced in certain geological formations and the exemption for enhanced oil recovery operations.

Q: When is the deadline for filing Schedule B?

A: The deadline for filing Schedule B is typically the same as the deadline for filing your West Virginia tax return, which is April 15th of the following year.

Q: Are there any penalties for not filing Schedule B?

A: Yes, there may be penalties for not filing Schedule B or for underreporting the amount of oil production or severance.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.