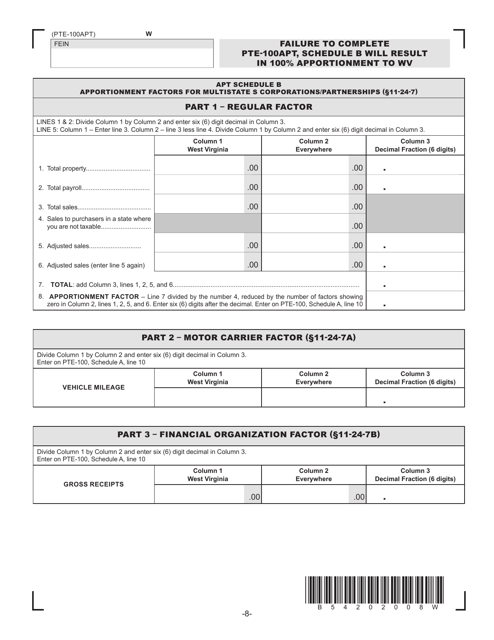

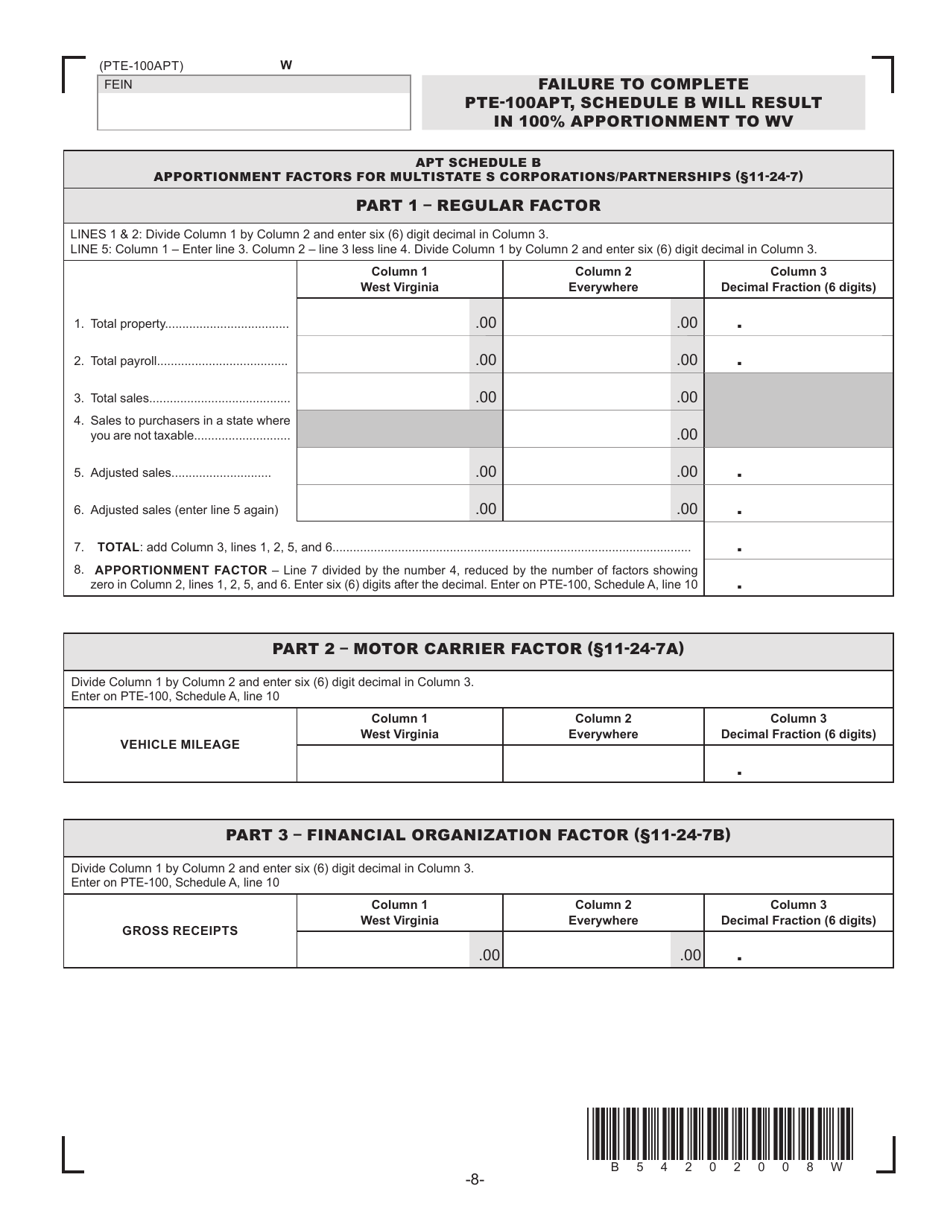

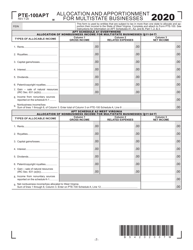

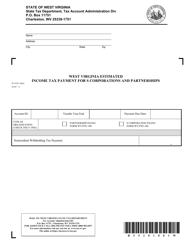

Form PTE-100APT Schedule B Apportionment Factors for Multistate S Corporations / Partnerships - West Virginia

What Is Form PTE-100APT Schedule B?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTE-100APT?

A: Form PTE-100APT is a form used to calculate apportionment factors for multistate S corporations/partnerships in West Virginia.

Q: What is the purpose of Schedule B?

A: The purpose of Schedule B is to determine the apportionment factors for multistate S corporations/partnerships in West Virginia.

Q: What are apportionment factors?

A: Apportionment factors are used to allocate income and expenses among different states for multistate corporations/partnerships.

Q: Who needs to file Form PTE-100APT?

A: Multistate S corporations/partnerships in West Virginia need to file Form PTE-100APT.

Q: What information is required to complete Schedule B?

A: To complete Schedule B, you will need information about the corporation's/partnership's business activities and sales in each state.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-100APT Schedule B by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.