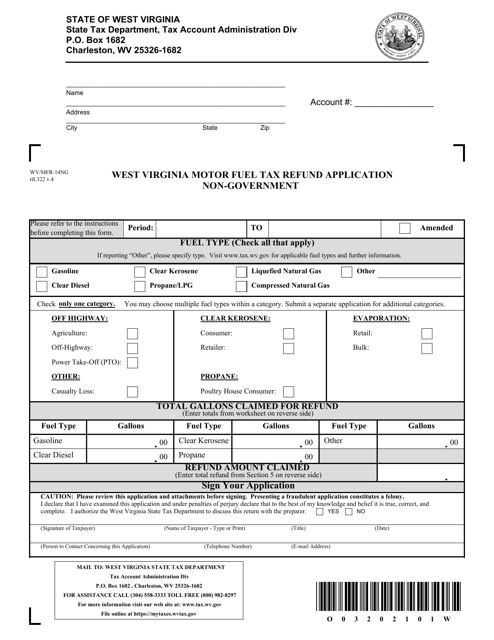

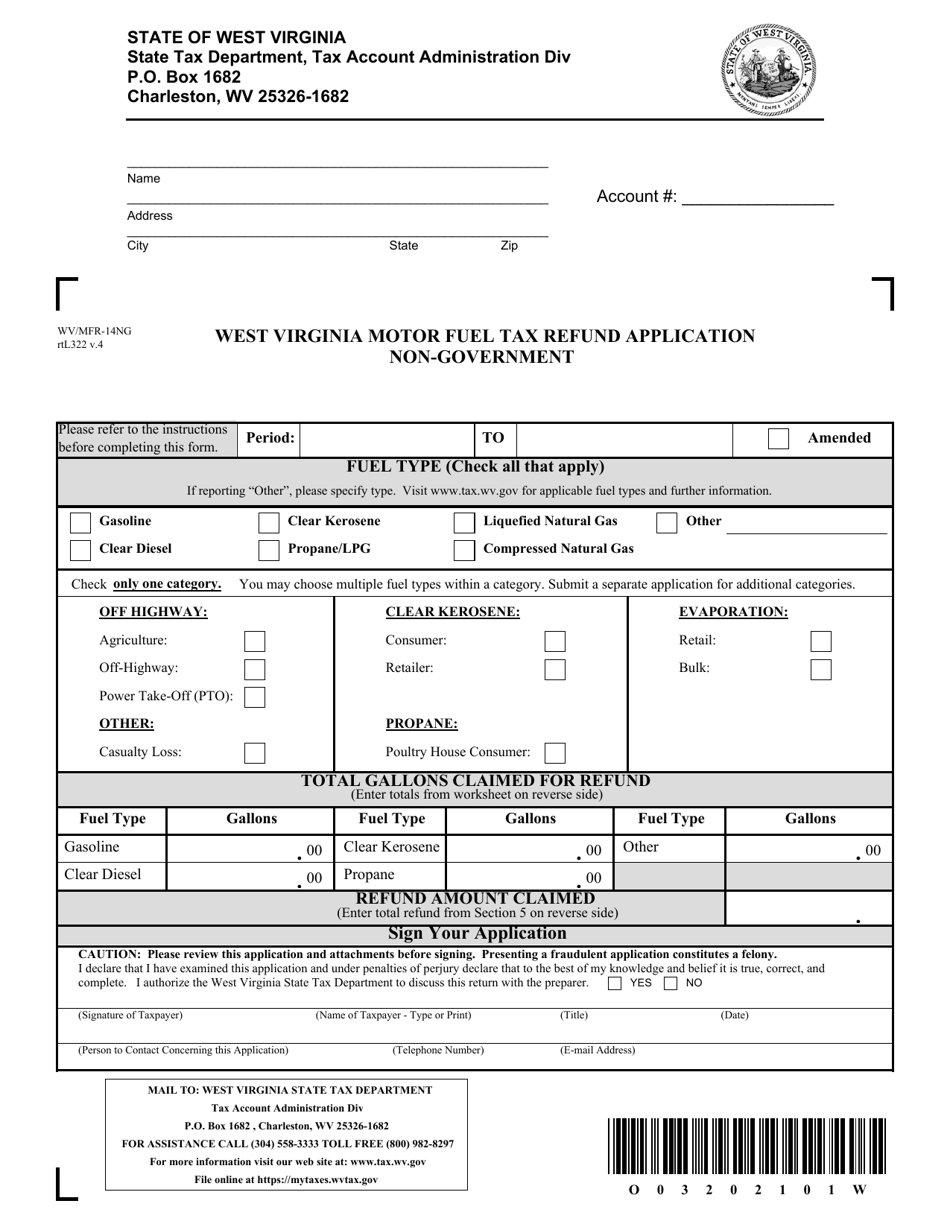

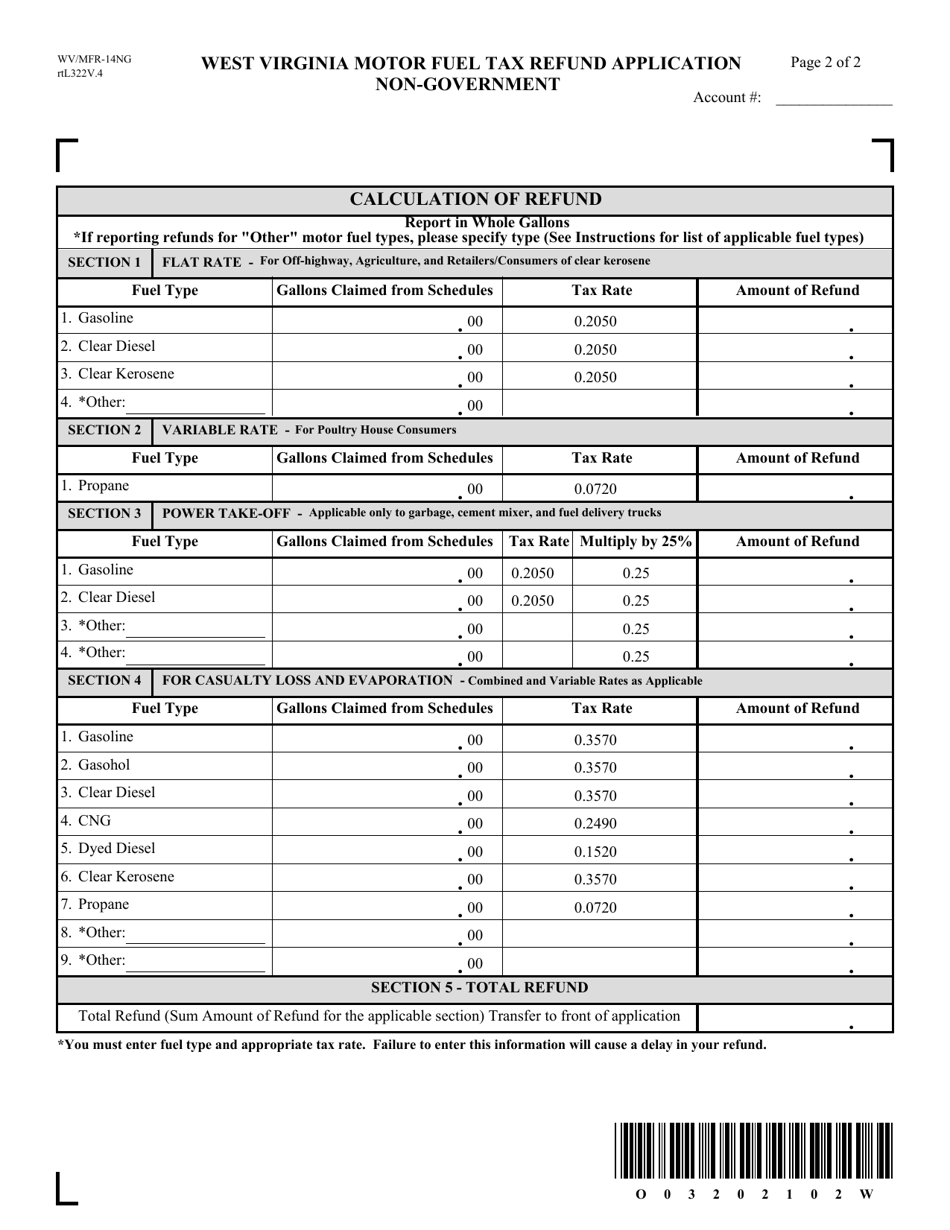

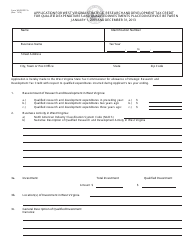

Form WV / MFR-14NG West Virginia Motor Fuel Tax Refund Application - Non-government - West Virginia

What Is Form WV/MFR-14NG?

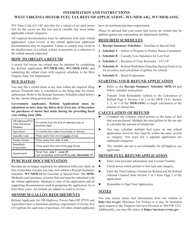

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is WV/MFR-14NG?

A: WV/MFR-14NG is the West Virginia Motor Fuel Tax Refund Application for non-government entities.

Q: Who can use WV/MFR-14NG?

A: Non-government entities in West Virginia can use WV/MFR-14NG to apply for motor fuel tax refunds.

Q: What is the purpose of WV/MFR-14NG?

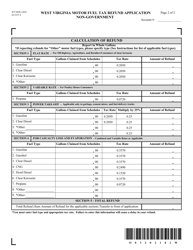

A: The purpose of WV/MFR-14NG is to claim motor fuel tax refunds for non-government entities in West Virginia.

Q: What information is required on WV/MFR-14NG?

A: WV/MFR-14NG requires information such as the taxpayer's name, address, fuel purchase details, and vehicle information.

Q: Are there any deadlines for submitting WV/MFR-14NG?

A: Yes, WV/MFR-14NG must be submitted within three years from the date of the original fuel purchase.

Q: Can I claim a refund for fuel used in vehicles that are not for highway use?

A: No, WV/MFR-14NG only allows refunds for fuel used in vehicles for highway purposes.

Q: What supporting documentation do I need to include with WV/MFR-14NG?

A: You must include copies of fuel invoices and other supporting documents with WV/MFR-14NG.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/MFR-14NG by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.