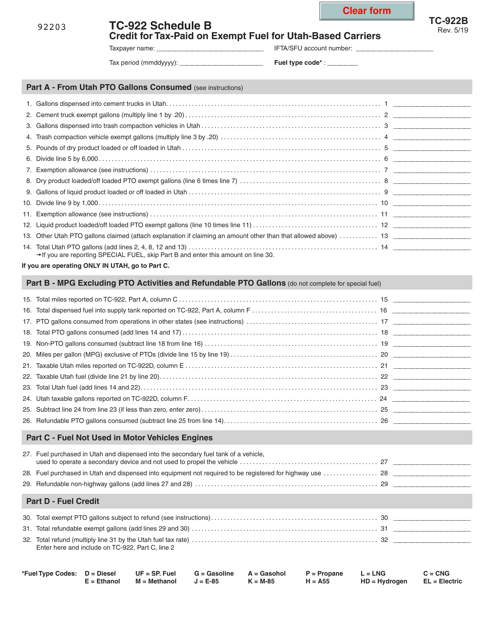

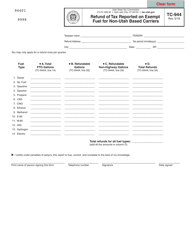

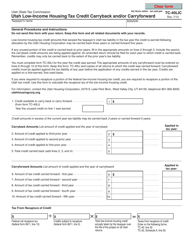

Form TC-922 Schedule B Credit for Tax-Paid on Exempt Fuel for Utah-Based Carriers - Utah

What Is Form TC-922 Schedule B?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah.The document is a supplement to Form TC-922, Ifta/Special Fuel User Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form TC-922?

A: Form TC-922 is the Schedule B Credit for Tax-Paid on Exempt Fuel for Utah-Based Carriers.

Q: Who is eligible for the credit?

A: Utah-based carriers who have paid tax on exempt fuel are eligible for this credit.

Q: What is the purpose of the credit?

A: The purpose of this credit is to provide relief to carriers who have paid tax on exempt fuel.

Q: What is exempt fuel?

A: Exempt fuel refers to fuel that is not subject to the fuel tax.

Q: How can carriers claim this credit?

A: Carriers can claim this credit by completing and submitting Form TC-922 Schedule B.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-922 Schedule B by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.