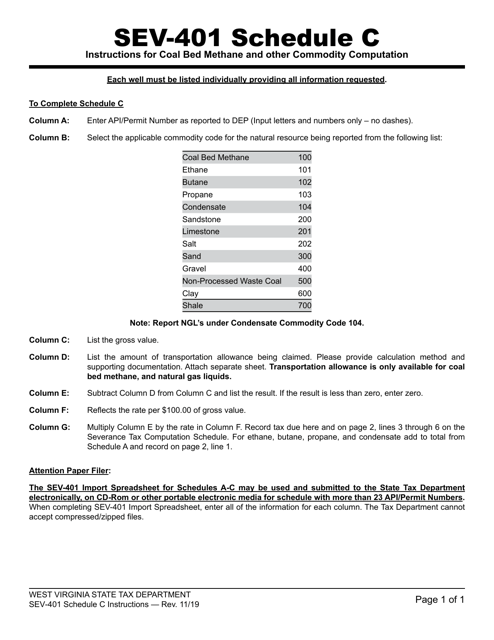

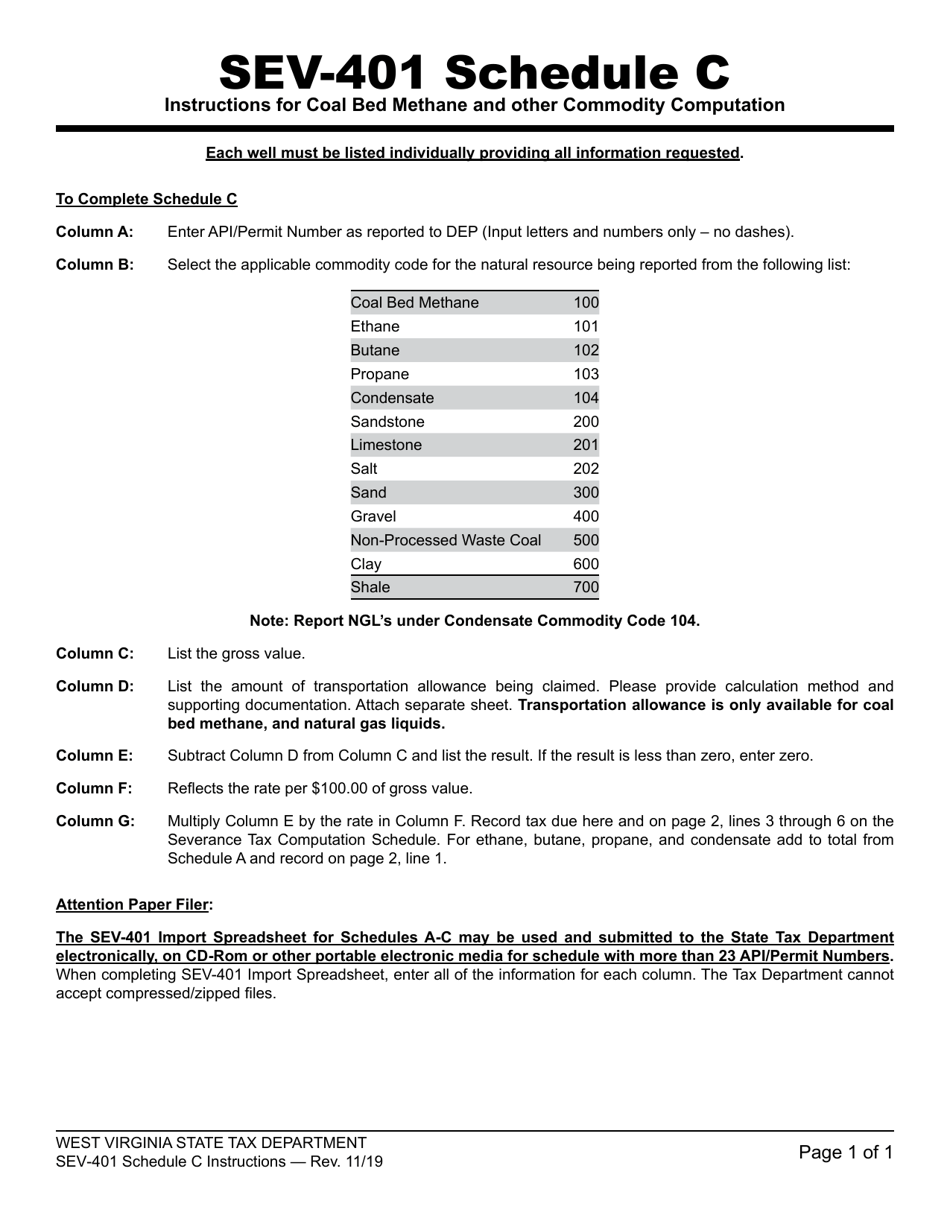

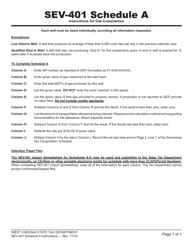

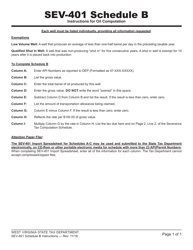

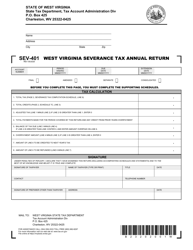

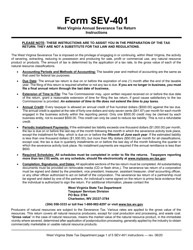

Instructions for Form SEV-401 Schedule C Coal Bed Methane and Other Commodity Computation - West Virginia

This document contains official instructions for Form SEV-401 Schedule C, Coal Bed Methane and Other Commodity Computation - a form released and collected by the West Virginia State Tax Department.

FAQ

Q: What is Form SEV-401 Schedule C?

A: Form SEV-401 Schedule C is a form used in West Virginia to report the computation of coal bed methane and other commodities.

Q: Who needs to fill out Form SEV-401 Schedule C?

A: Any taxpayer in West Virginia who produced or severed coal bed methane or other commodities during the tax year needs to fill out this form.

Q: What information is required to fill out Form SEV-401 Schedule C?

A: The form requires details such as the taxpayer's name, address, and taxpayer identification number, as well as information regarding the production or severance of coal bed methane and other commodities.

Q: What is the purpose of Form SEV-401 Schedule C?

A: The purpose of this form is to calculate the tax liability for the production or severance of coal bed methane and other commodities in West Virginia.

Q: When is the deadline for filing Form SEV-401 Schedule C?

A: Form SEV-401 Schedule C must be filed on or before March 1st of each year.

Q: Are there any penalties for not filing Form SEV-401 Schedule C?

A: Yes, there are penalties for failure to file or late filing of Form SEV-401 Schedule C. It is important to file the form by the deadline to avoid these penalties.

Q: Can I file Form SEV-401 Schedule C electronically?

A: No, Form SEV-401 Schedule C cannot be filed electronically. It must be filed by mail.

Q: Can I get assistance with filling out Form SEV-401 Schedule C?

A: Yes, if you need assistance with filling out Form SEV-401 Schedule C, you can contact the West Virginia State Tax Department for guidance.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the West Virginia State Tax Department.