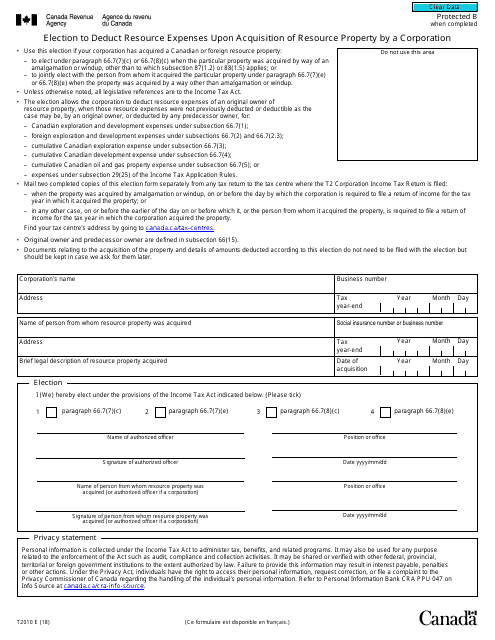

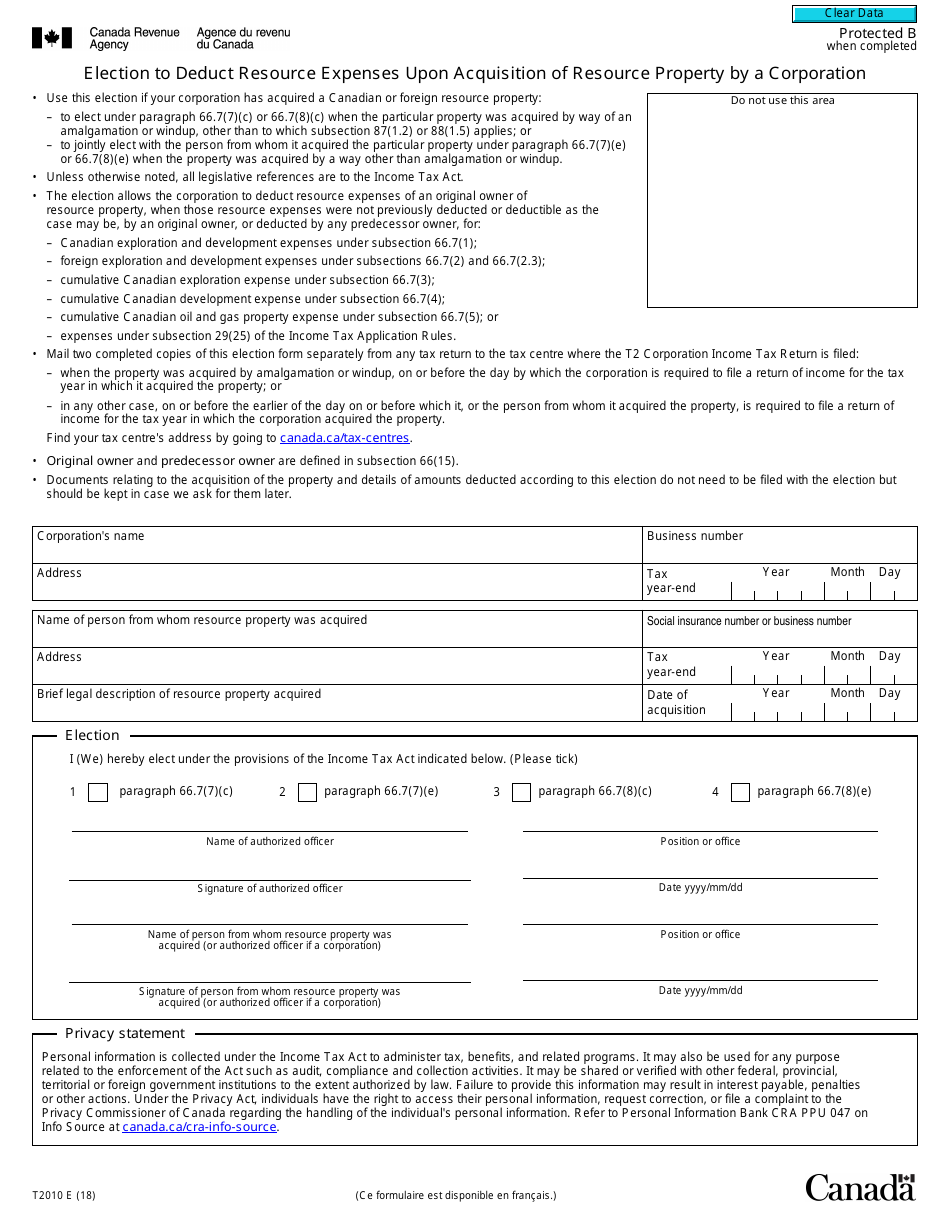

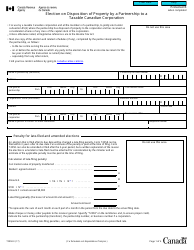

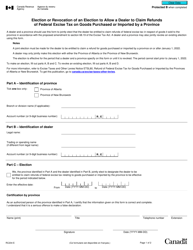

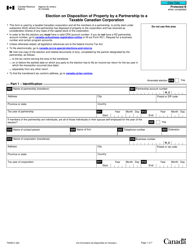

Form T2010 Election to Deduct Resource Expenses Upon Acquisition of Resource Property by a Corporation - Canada

Form T2010 Election to Deduct Resource Expenses Upon Acquisition of Resource Property by a Corporation in Canada is for corporations to elect to deduct resource expenses incurred on the acquisition of resource properties. These deductions can help reduce the overall tax liability of the corporation.

The Form T2010, Election to Deduct Resource Expenses Upon Acquisition of Resource Property by a Corporation, in Canada is typically filed by the corporation acquiring resource property.

FAQ

Q: What is Form T2010?

A: Form T2010 is a document used in Canada to elect to deduct resource expenses upon the acquisition of resource property by a corporation.

Q: Who can use Form T2010?

A: Corporations in Canada can use Form T2010 to elect to deduct resource expenses upon the acquisition of resource property.

Q: What are resource expenses?

A: Resource expenses refer to the costs incurred in connection with exploring or developing mineral, petroleum, or natural gas properties.

Q: Why would a corporation elect to deduct resource expenses?

A: By electing to deduct resource expenses, a corporation can claim a deduction for the expenses in the year they are incurred rather than capitalizing and depreciating them over time.

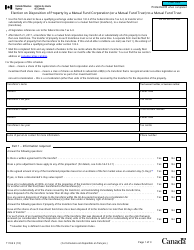

Q: Are there any deadlines for filing Form T2010?

A: Yes, the election must be filed within three years from the end of the tax year in which the property is acquired.

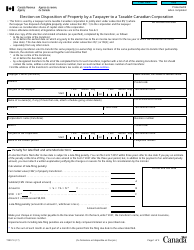

Q: Is there any specific information required to complete Form T2010?

A: Yes, you will need to provide details about the resource property being acquired, the resource expenses incurred, and the corporation's contact information.

Q: Can a corporation change or revoke the election made on Form T2010?

A: No, once the election is made, it cannot be changed or revoked.

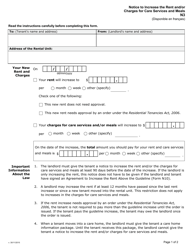

Q: What happens after Form T2010 is filed?

A: The CRA will review the form and either accept or deny the election. If accepted, the corporation can deduct the resource expenses in the year they are incurred.

Q: Are there any penalties for not filing Form T2010?

A: Yes, failing to file Form T2010 within the required timeframe can result in penalties and interest charges.