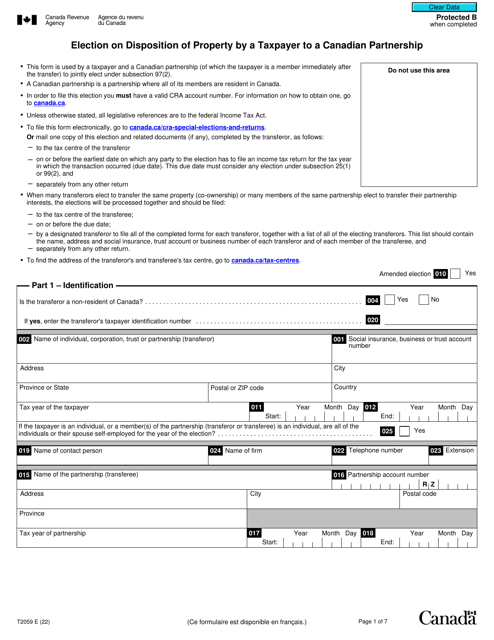

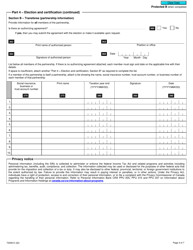

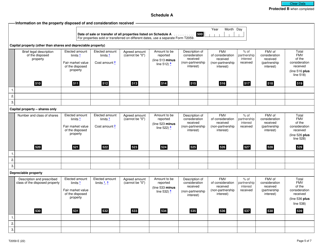

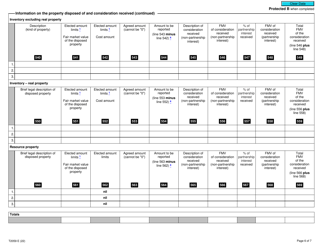

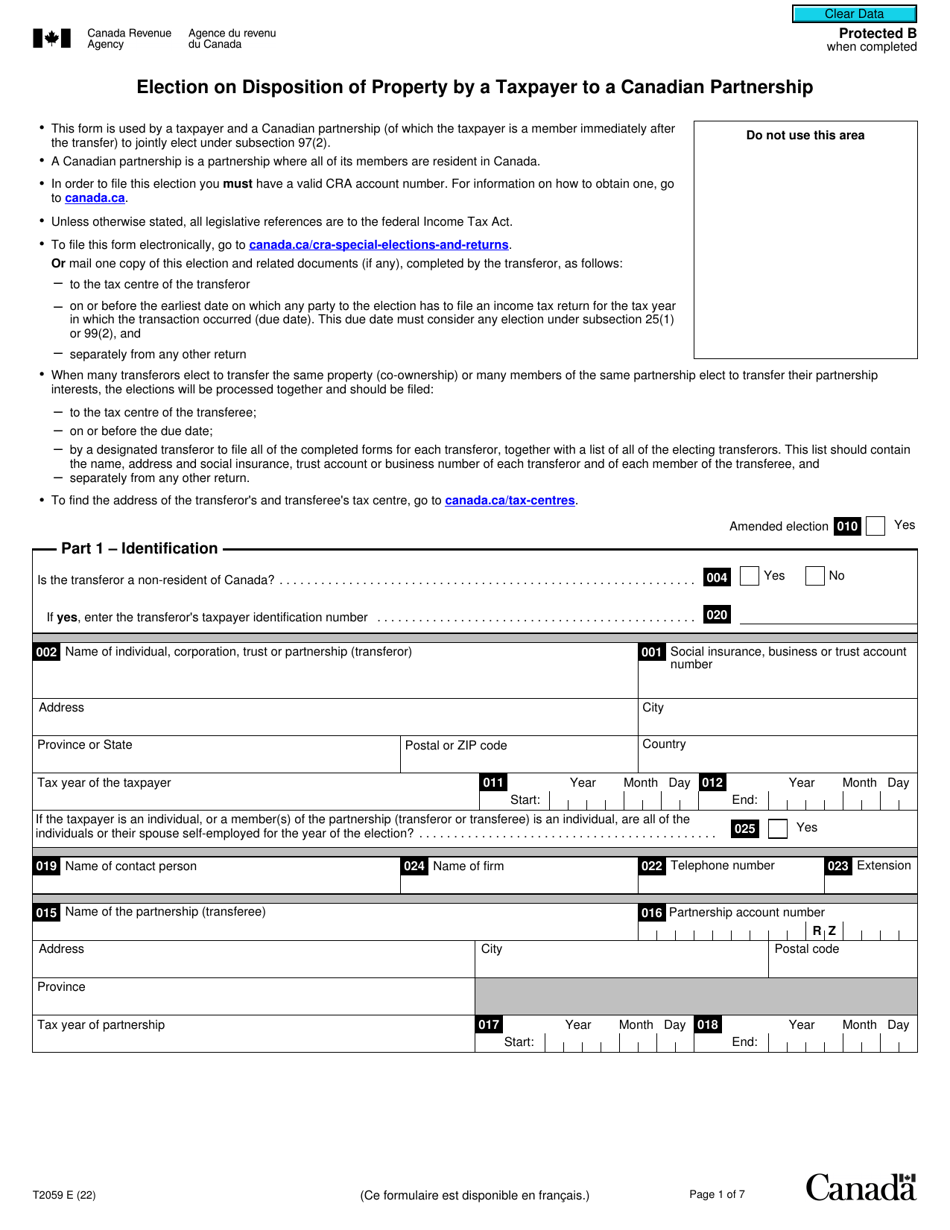

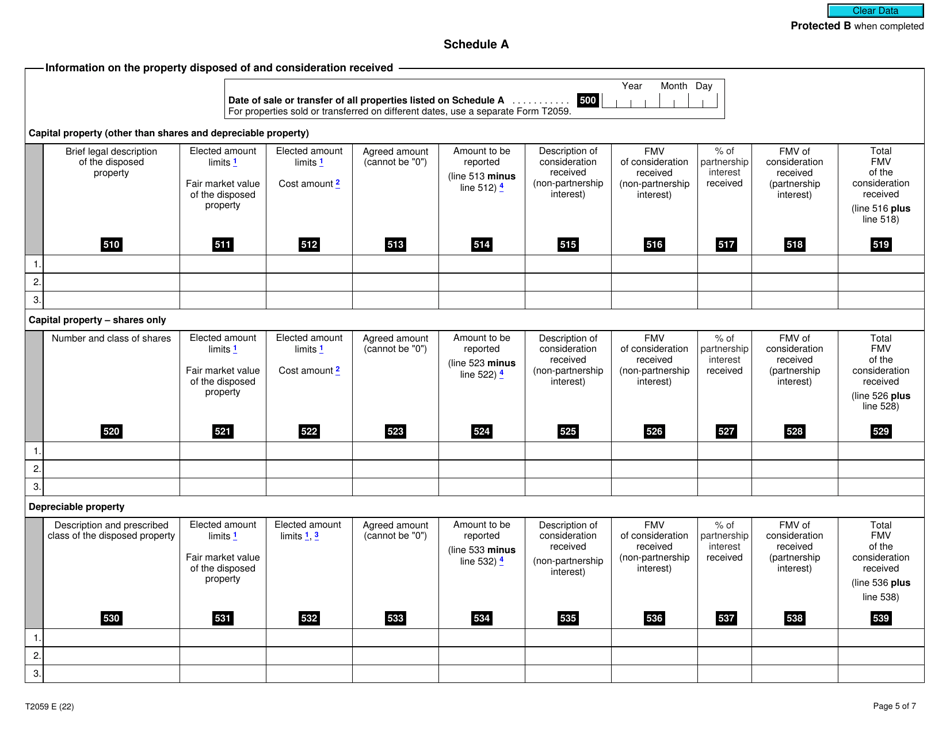

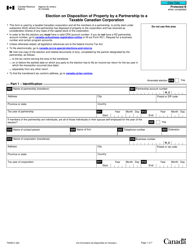

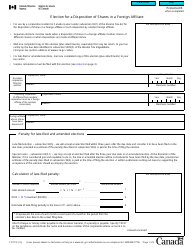

Form T2059 Election on Disposition of Property by a Taxpayer to a Canadian Partnership - Canada

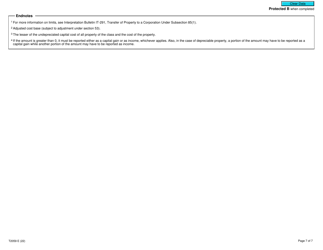

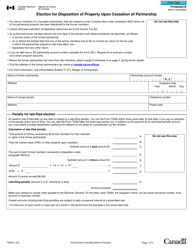

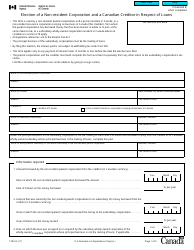

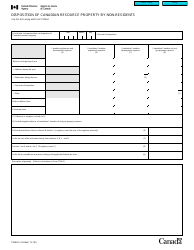

Form T2059 is used by a taxpayer in Canada to elect to report the disposition of property to a Canadian partnership. It is used to provide information to the Canada Revenue Agency (CRA) about the transfer of the property and any associated tax implications.

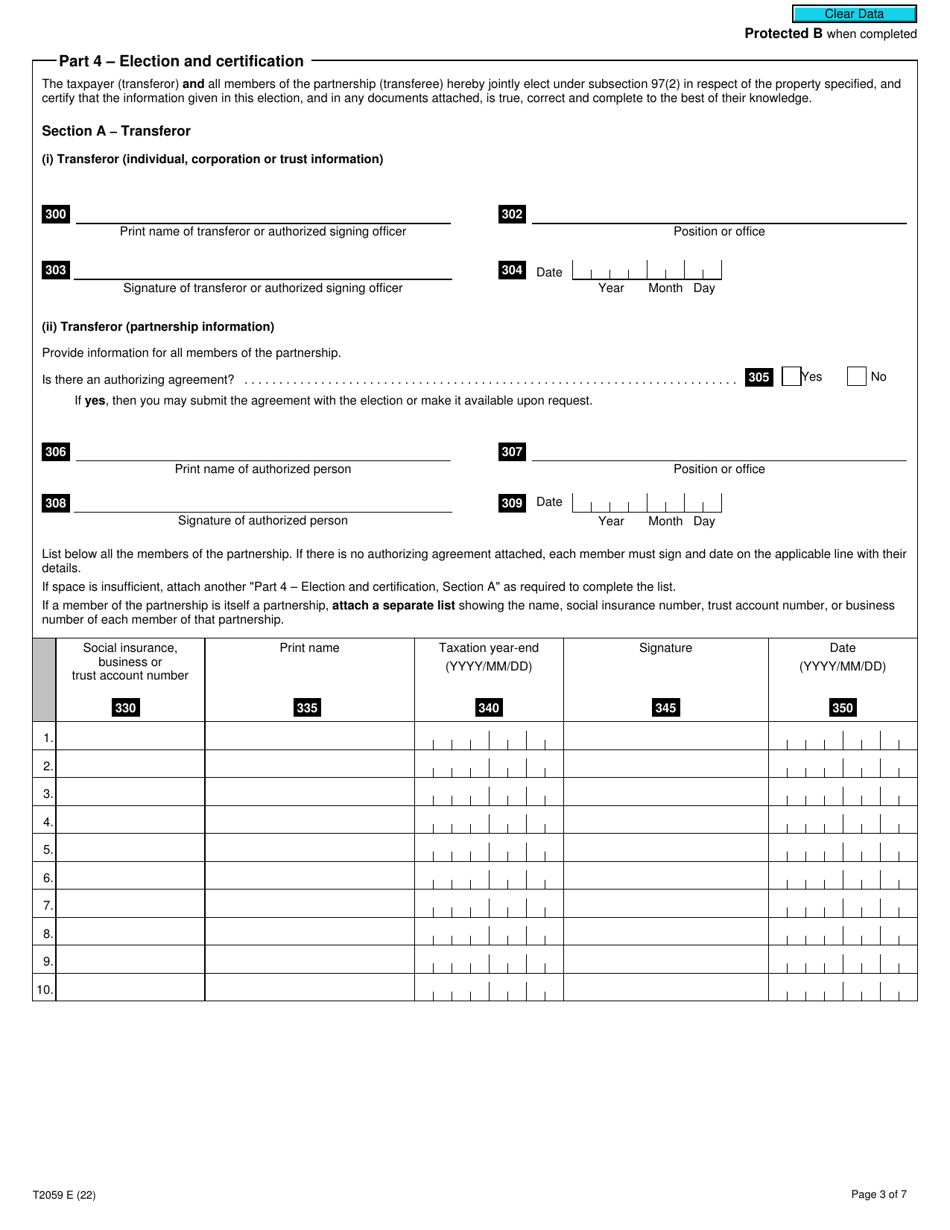

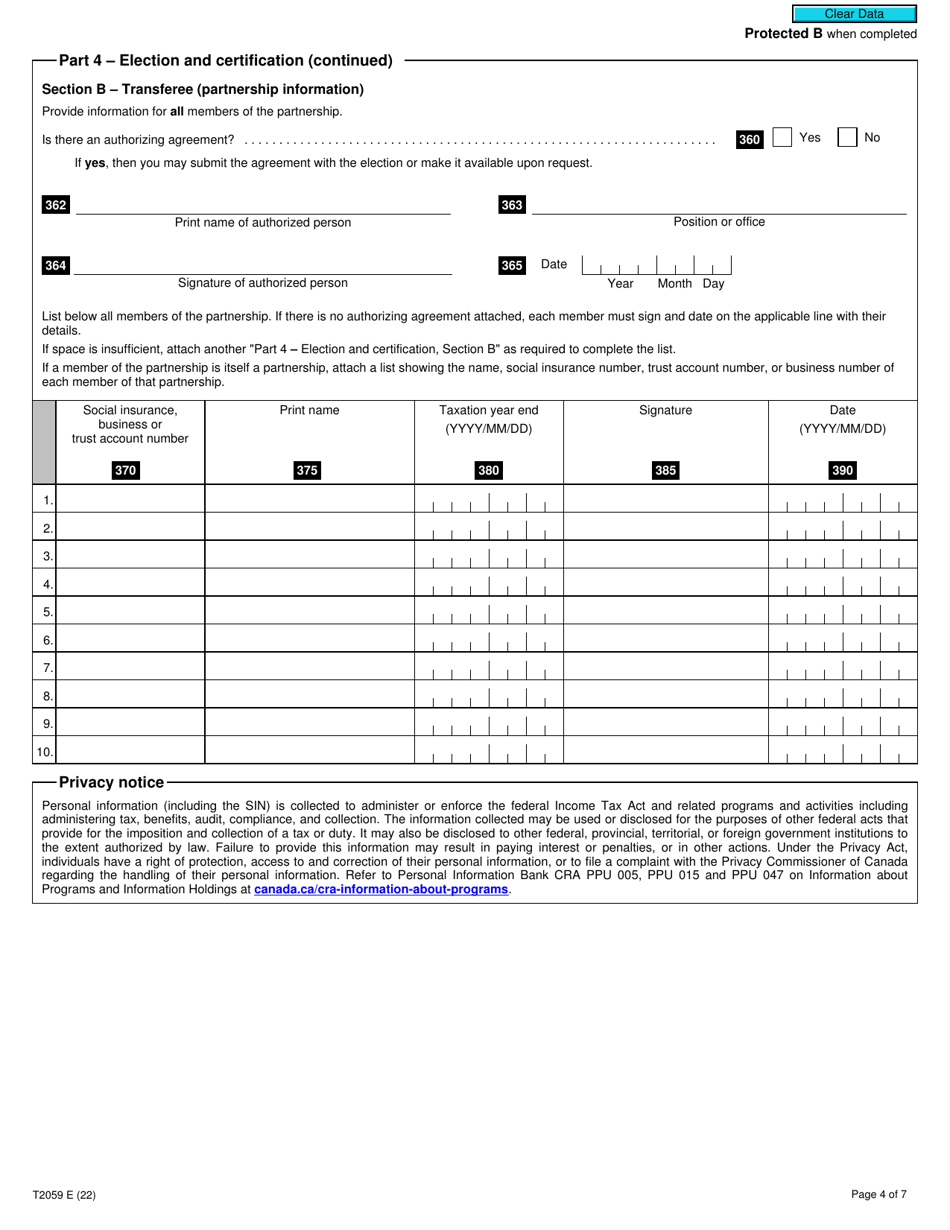

In Canada, the taxpayer who disposes of property to a Canadian partnership would file the Form T2059 Election.

Form T2059 Election on Disposition of Property by a Taxpayer to a Canadian Partnership - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2059? A: Form T2059 is a form used by a taxpayer to report the disposition of property to a Canadian partnership.

Q: How do I use Form T2059? A: You use Form T2059 to elect to have the disposition of property to a Canadian partnership considered as a non-arm's length transaction for tax purposes.

Q: Who needs to file Form T2059? A: Any taxpayer who has disposed of property to a Canadian partnership and wants to elect for it to be considered a non-arm's length transaction must file Form T2059.

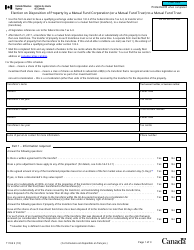

Q: What is a non-arm's length transaction? A: A non-arm's length transaction is a transaction between parties who are related or connected in a way that may affect the fairness of the transaction.

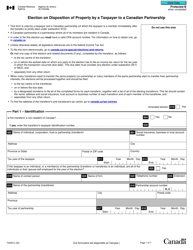

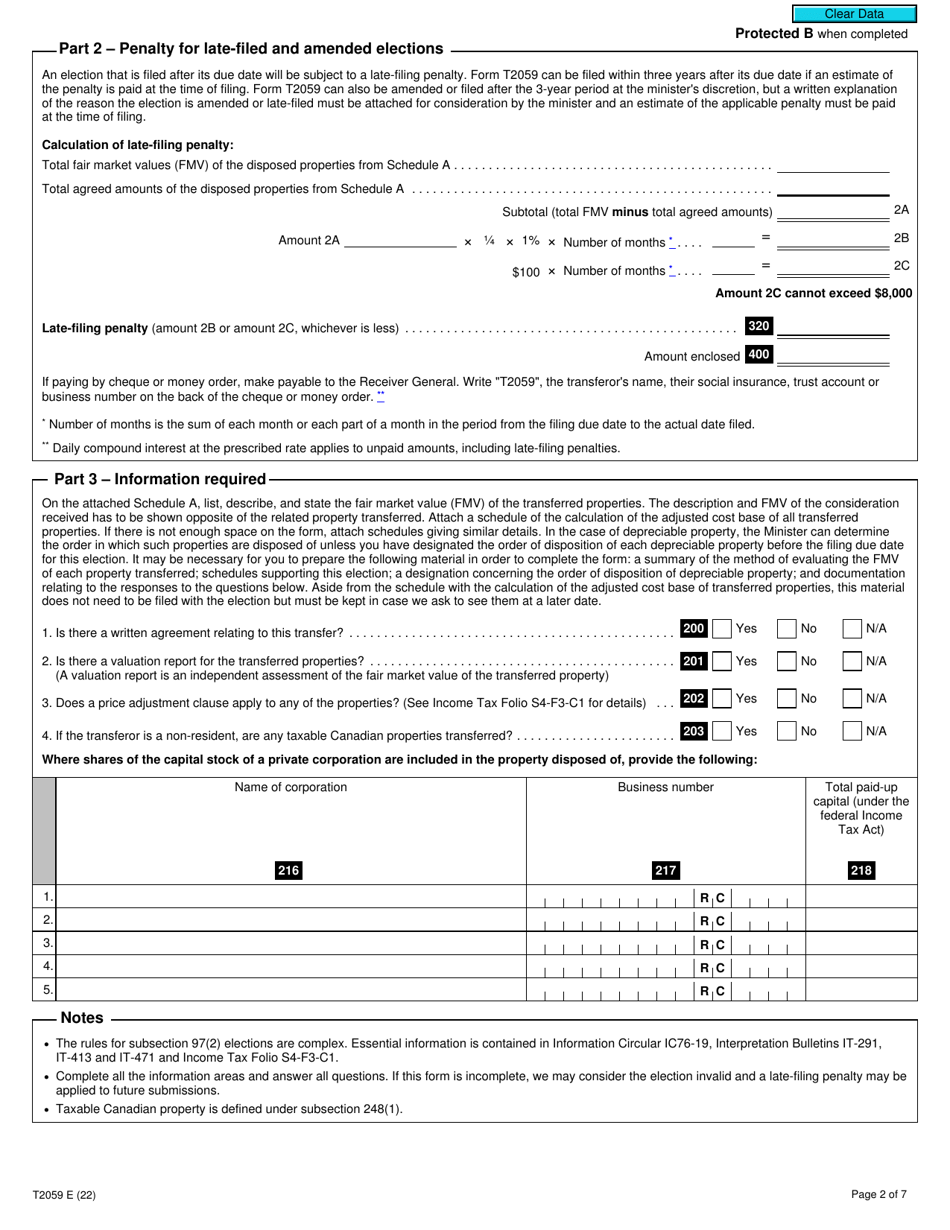

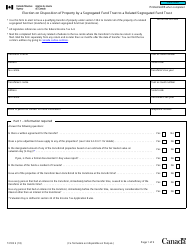

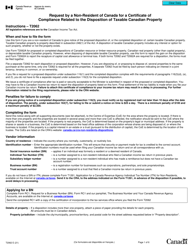

Q: Is there a deadline for filing Form T2059? A: Yes, Form T2059 must be filed within the time limit for filing your tax return for the year in which the disposition of property occurred.

Q: Are there any penalties for not filing Form T2059? A: Yes, there can be penalties for failing to file Form T2059, including potential tax consequences for not treating the disposition as a non-arm's length transaction.

Q: Can I amend my Form T2059 after filing? A: Yes, you can amend your Form T2059 within the applicable timeframe for amending your tax return.

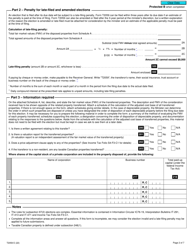

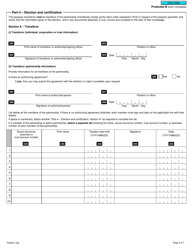

Q: Do I need to include any supporting documents with Form T2059? A: You may need to include supporting documents with Form T2059, such as a partnership agreement or other documents that support your election for the disposition to be considered a non-arm's length transaction.

Q: Should I seek professional tax advice when filing Form T2059? A: It is always recommended to seek professional tax advice when dealing with complex tax forms like Form T2059 to ensure accuracy and compliance with tax laws.