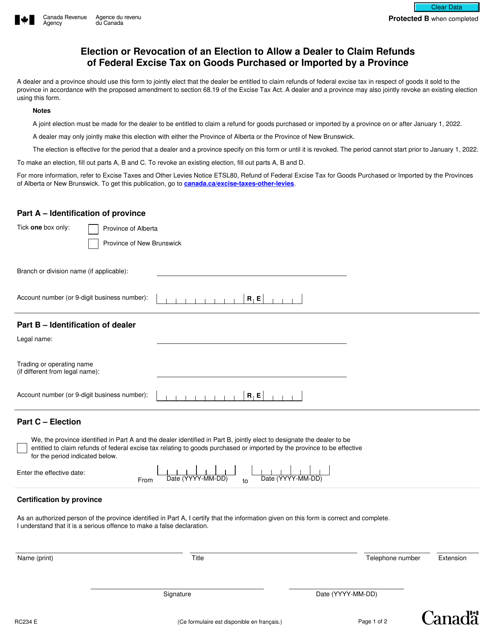

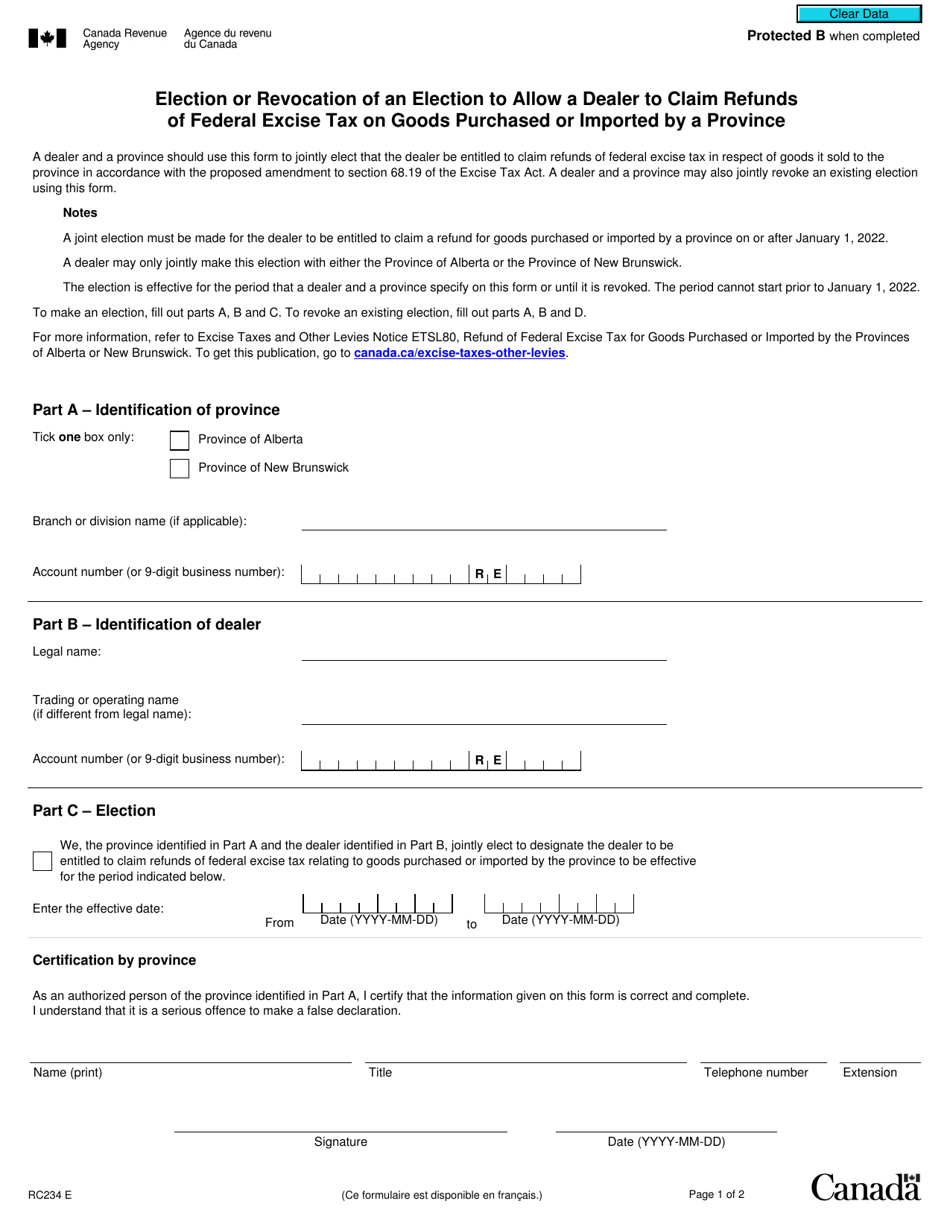

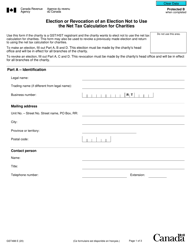

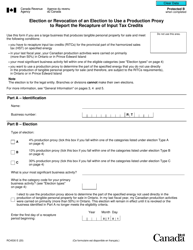

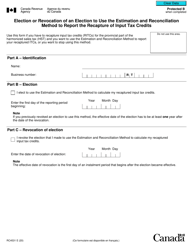

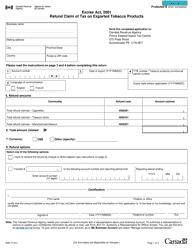

Form RC234 Election or Revocation of an Election to Allow a Dealer to Claim Refunds of Federal Excise Tax on Goods Purchased or Imported by a Province - Canada

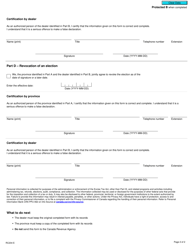

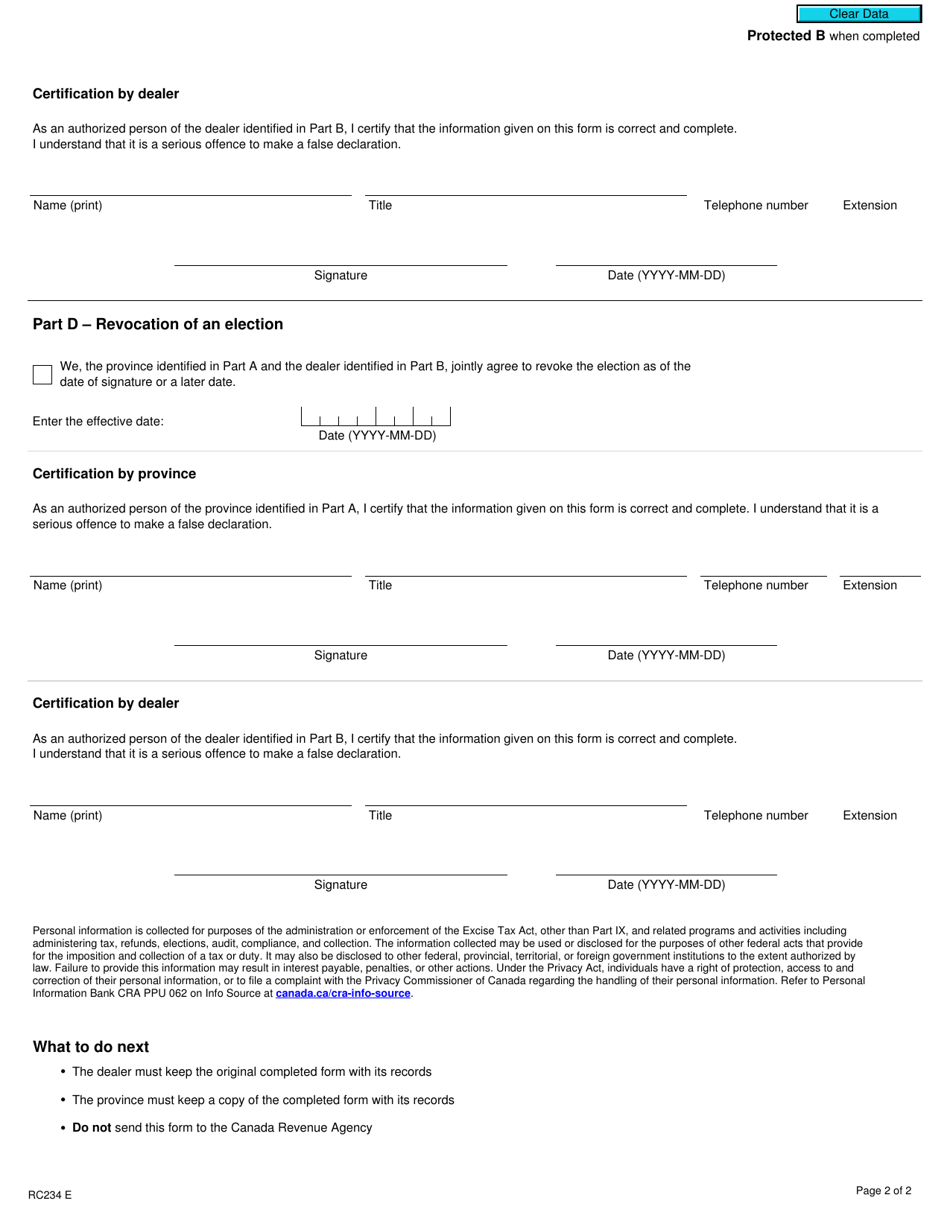

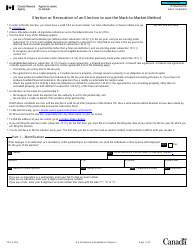

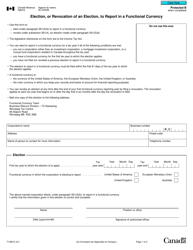

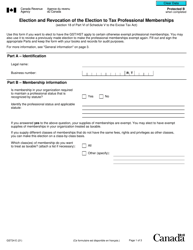

Form RC234 is used in Canada to allow a dealer to claim refunds of federal excise tax on goods purchased or imported by a province. It is used for the election or revocation of an election to claim these refunds.

The form RC234 Election or Revocation of an Election to Allow a Dealer to Claim Refunds of Federal Excise Tax on Goods Purchased or Imported by a Province in Canada is filed by the dealer themselves.

FAQ

Q: What is Form RC234?

A: Form RC234 is a document used in Canada to elect or revoke an election for a dealer to claim refunds of federal excise tax on goods purchased or imported by a province.

Q: Who can use Form RC234?

A: Dealers in Canada can use Form RC234.

Q: What is the purpose of Form RC234?

A: The purpose of Form RC234 is to allow dealers in Canada to claim refunds of federal excise tax on goods purchased or imported by a province.

Q: What information is required on Form RC234?

A: Form RC234 requires information such as the dealer's name, address, business number, election or revocation of election, and the period for which the election is in effect.