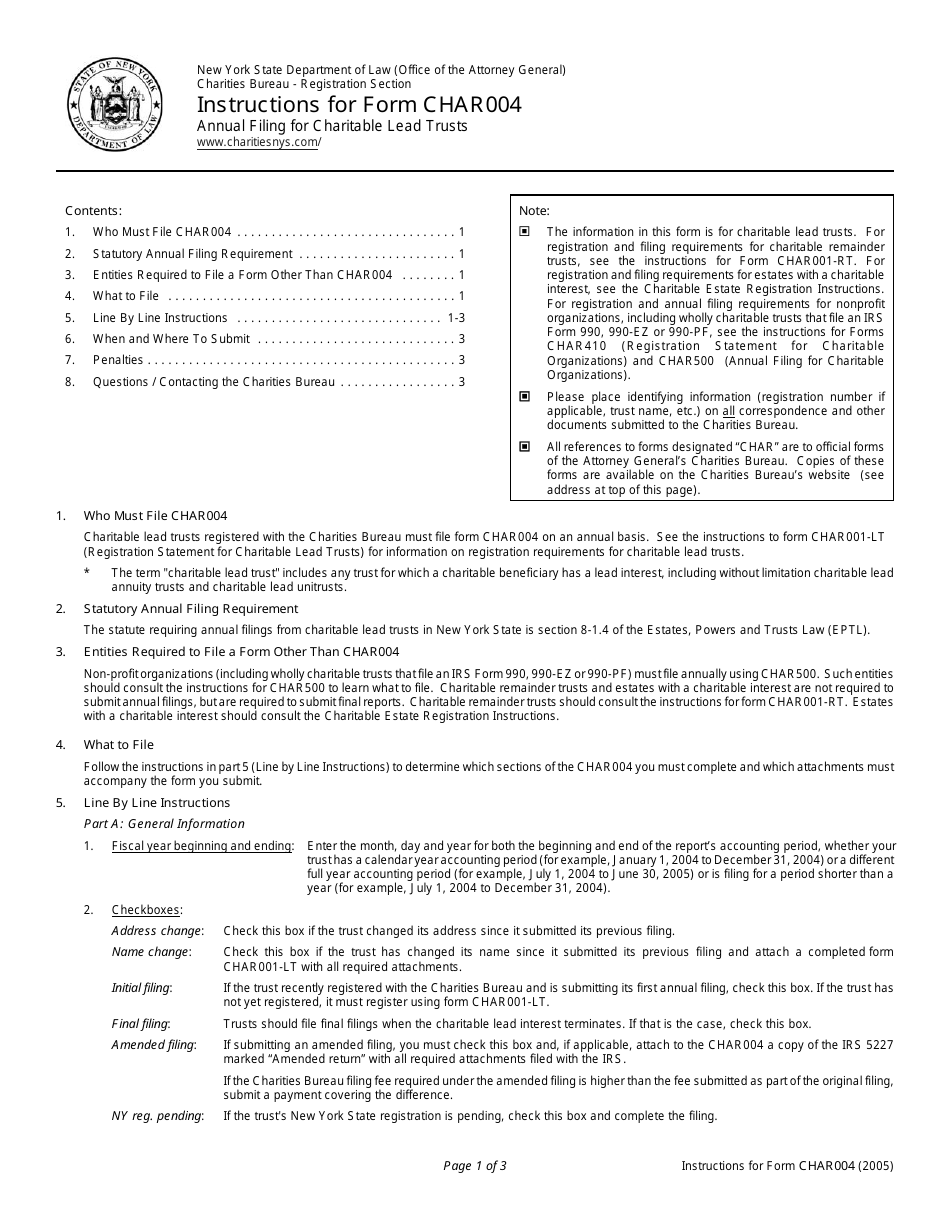

Instructions for Form CHAR004 Annual Filing for Charitable Lead Trusts - New York

This document contains official instructions for Form CHAR004 , Annual Filing for Charitable Lead Trusts - a form released and collected by the New York State Attorney General.

FAQ

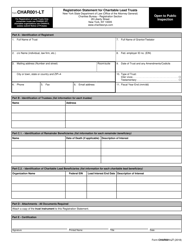

Q: What is Form CHAR004?

A: Form CHAR004 is the annual filing for Charitable Lead Trusts in New York.

Q: Who needs to file Form CHAR004?

A: Charitable Lead Trusts in New York need to file Form CHAR004 annually.

Q: What is the purpose of Form CHAR004?

A: Form CHAR004 is used to provide information about the activities and financial status of Charitable Lead Trusts in New York.

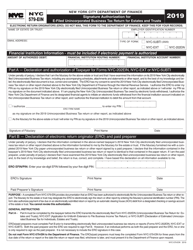

Q: When is Form CHAR004 due?

A: Form CHAR004 is due on the fifteenth day of the fifth month following the close of the trust's taxable year.

Q: Are there any penalties for late filing of Form CHAR004?

A: Yes, there may be penalties for late filing of Form CHAR004. It is important to file the form on time to avoid any penalties or late fees.

Q: What information do I need to provide on Form CHAR004?

A: You will need to provide information about the trust's activities, financial status, and any distributions made during the taxable year.

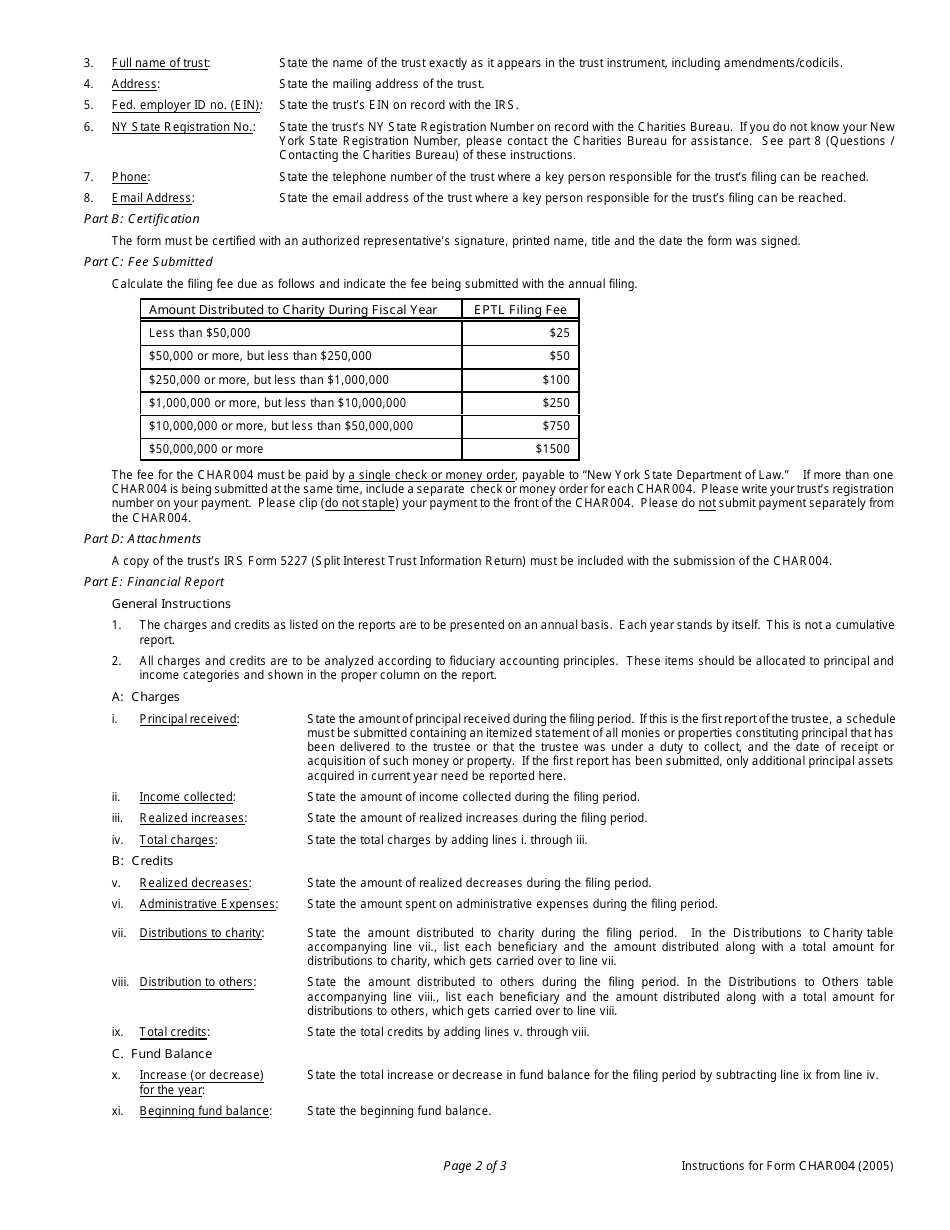

Q: Is there a fee for filing Form CHAR004?

A: No, there is no fee for filing Form CHAR004.

Q: Is there any additional documentation required to be submitted with Form CHAR004?

A: No, there is no additional documentation required to be submitted with Form CHAR004.

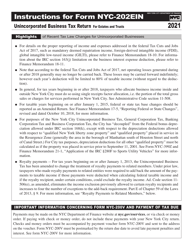

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Attorney General.