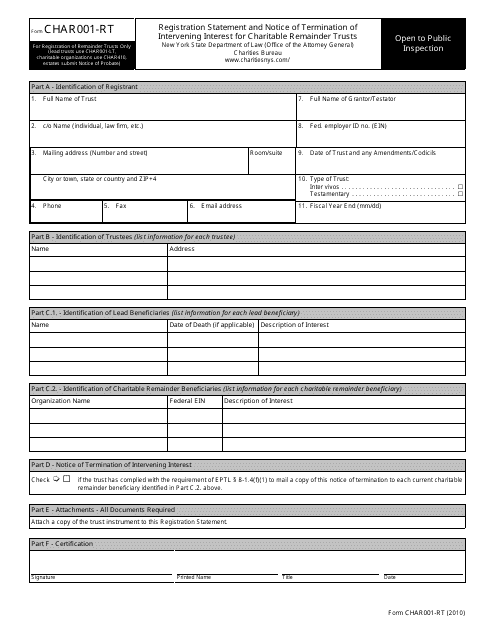

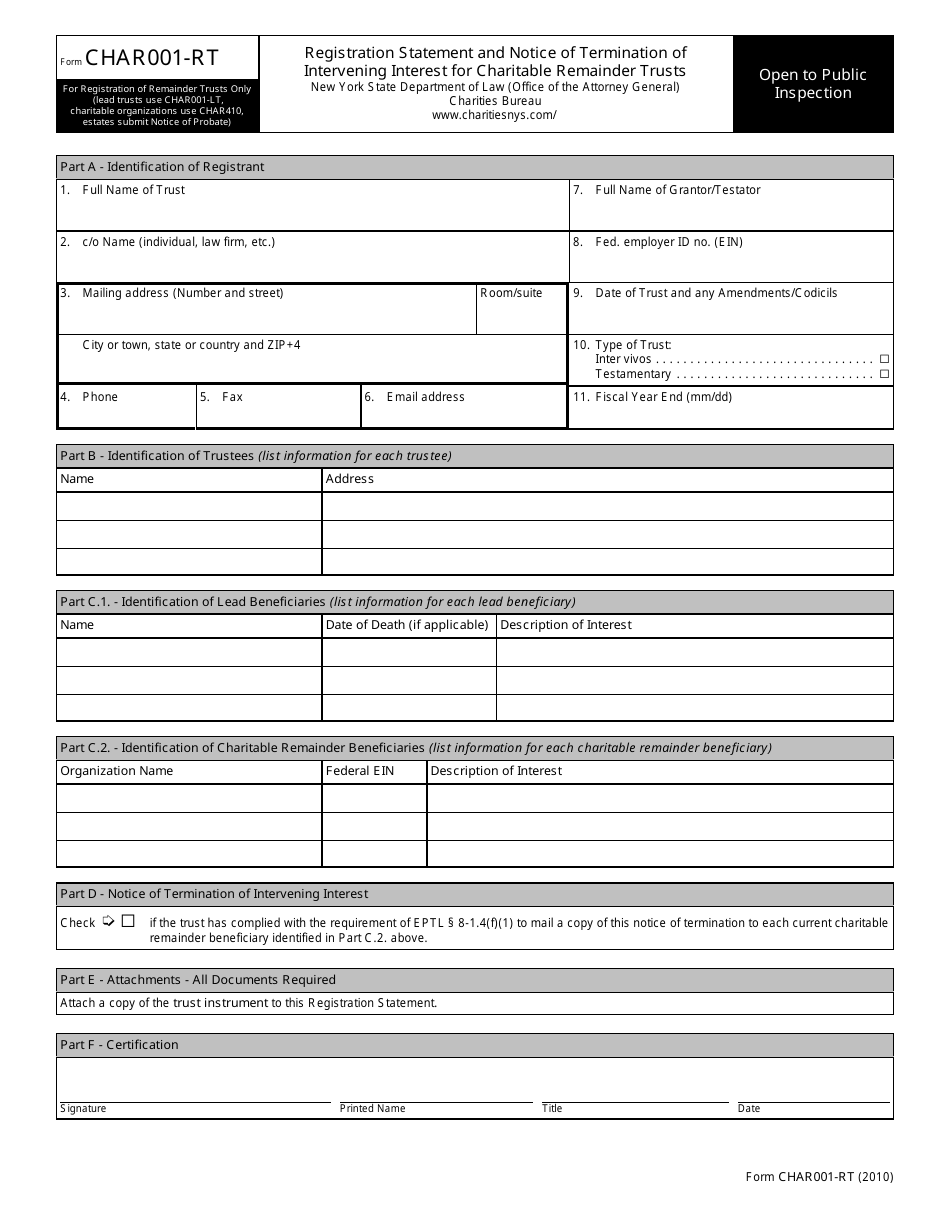

Form CHAR001-RT Registration Statement and Notice of Termination of Intervening Interest for Charitable Remainder Trusts - New York

What Is Form CHAR001-RT?

This is a legal form that was released by the New York State Attorney General - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is CHAR001-RT?

A: CHAR001-RT is a Registration Statement and Notice of Termination of Intervening Interest form for Charitable Remainder Trusts in New York.

Q: What is a Charitable Remainder Trust?

A: A Charitable Remainder Trust is a type of irrevocable trust that allows the grantor to donate assets to a charity and receive an income stream for a certain period of time.

Q: Who needs to fill out CHAR001-RT?

A: Anyone who is creating or terminating a Charitable Remainder Trust in New York needs to fill out CHAR001-RT.

Q: What is the purpose of CHAR001-RT?

A: CHAR001-RT is used to register a Charitable Remainder Trust with the New York State Department of Taxation and Finance, or to notify the department of the termination of an intervening interest in the trust.

Q: Is CHAR001-RT specific to New York?

A: Yes, CHAR001-RT is specific to Charitable Remainder Trusts in the state of New York.

Q: Is it mandatory to file CHAR001-RT?

A: Yes, it is mandatory to file CHAR001-RT when creating or terminating a Charitable Remainder Trust in New York.

Form Details:

- Released on January 1, 2010;

- The latest edition provided by the New York State Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CHAR001-RT by clicking the link below or browse more documents and templates provided by the New York State Attorney General.