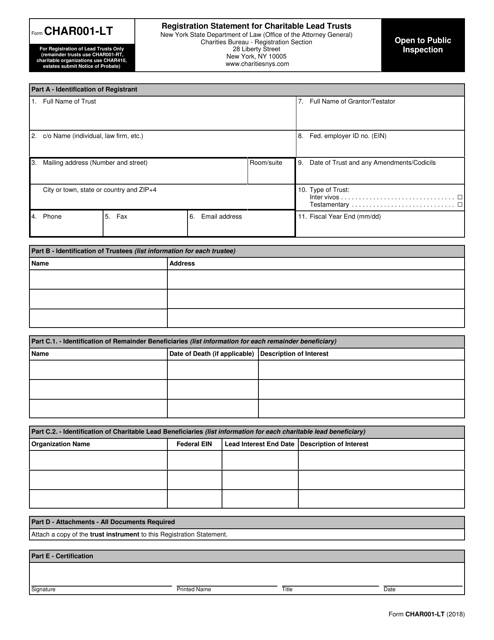

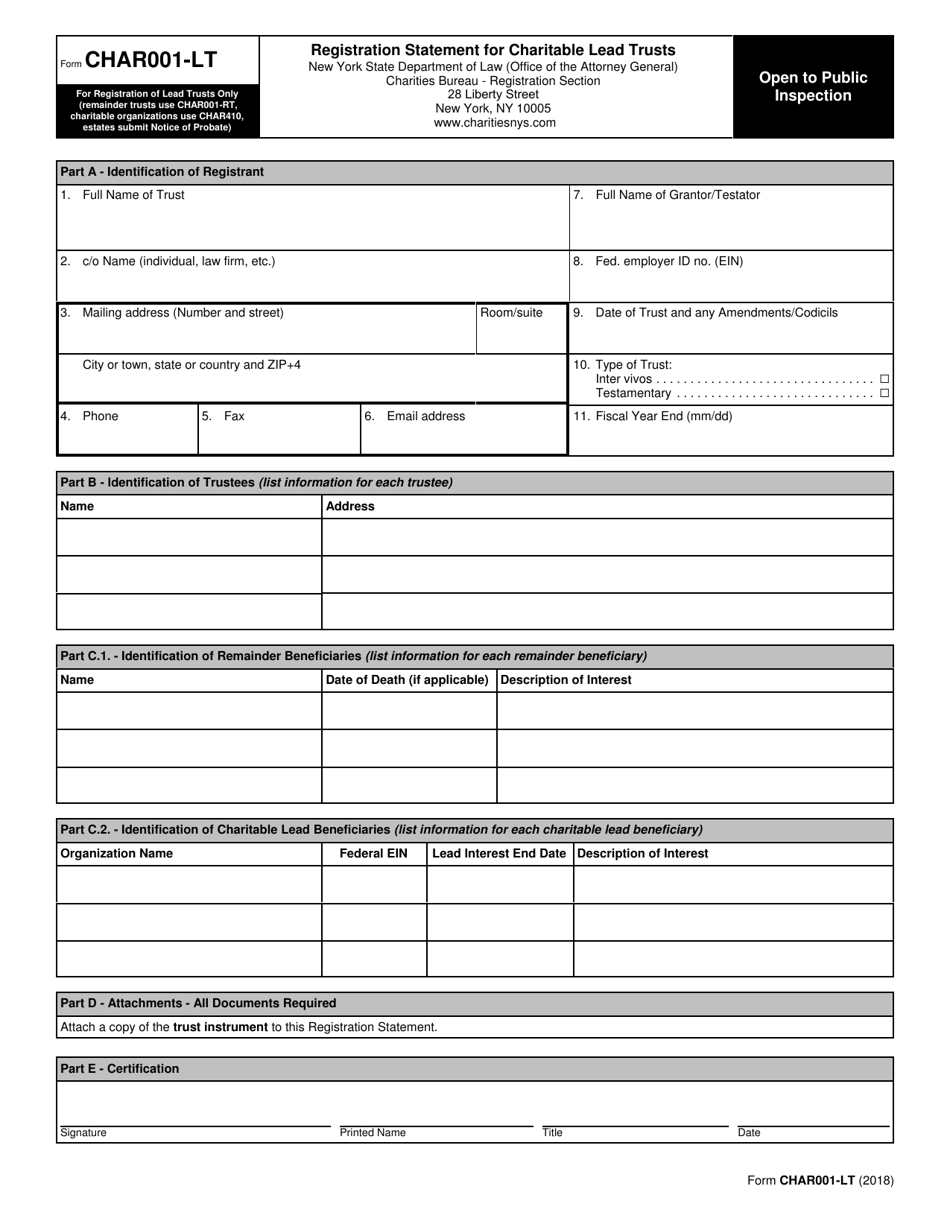

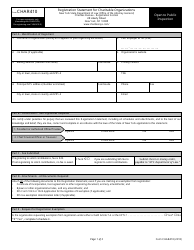

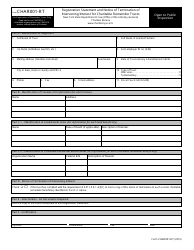

Form CHAR001-LT Registration Statement for Charitable Lead Trusts - New York

What Is Form CHAR001-LT?

This is a legal form that was released by the New York State Attorney General - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is a CHAR001-LT Registration Statement?

A: The CHAR001-LT Registration Statement is a form used to register a Charitable Lead Trust in the state of New York.

Q: What is a Charitable Lead Trust?

A: A Charitable Lead Trust is a type of trust where the income generated from the trust assets is donated to a charity for a certain period of time, after which the remaining assets are distributed to beneficiaries.

Q: Who needs to file the CHAR001-LT Registration Statement?

A: The person(s) establishing a Charitable Lead Trust in the state of New York need to file the CHAR001-LT Registration Statement.

Q: What information is required on the registration statement?

A: The registration statement requires information about the trustee(s), the charitable organization receiving the income, the beneficiaries, and the terms of the trust.

Q: What is the deadline for filing the registration statement?

A: The registration statement should be filed with the New York State Department of Law, Charities Bureau prior to or within 30 days of the establishment of the Charitable Lead Trust.

Q: Are there any ongoing reporting requirements for the Charitable Lead Trust?

A: Yes, the Charitable Lead Trust is required to submit an annual report to the New York State Department of Law, Charities Bureau.

Q: Can I make changes to the Charitable Lead Trust after filing the registration statement?

A: Yes, changes or amendments to the Charitable Lead Trust can be made by filing a written notice with the New York State Department of Law, Charities Bureau.

Q: What happens if I fail to comply with the registration and reporting requirements?

A: Failure to comply with the registration and reporting requirements may result in penalties and/or legal consequences.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the New York State Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CHAR001-LT by clicking the link below or browse more documents and templates provided by the New York State Attorney General.