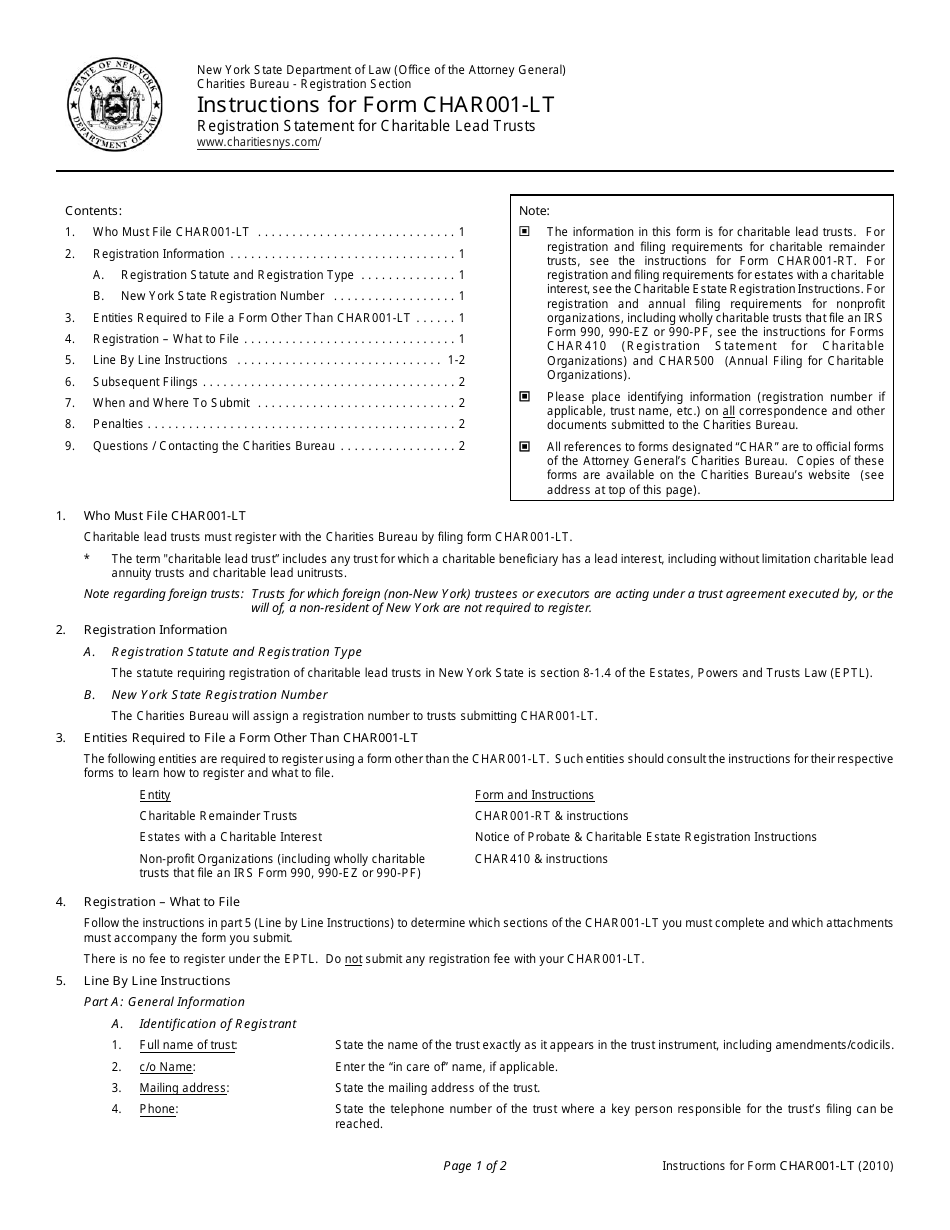

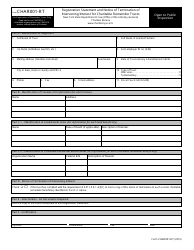

Instructions for Form CHAR001-LT Registration Statement for Charitable Lead Trusts - New York

This document contains official instructions for Form CHAR001-LT , Registration Statement for Charitable Lead Trusts - a form released and collected by the New York State Attorney General. An up-to-date fillable Form CHAR001-LT is available for download through this link.

FAQ

Q: What is Form CHAR001-LT?

A: Form CHAR001-LT is a registration statement for Charitable Lead Trusts in New York.

Q: What is a Charitable Lead Trust?

A: A Charitable Lead Trust is a trust that provides income to a charitable organization for a specific period, and then distributes the remaining assets to non-charitable beneficiaries.

Q: Who needs to file Form CHAR001-LT?

A: Anyone in New York creating a Charitable Lead Trust needs to file Form CHAR001-LT.

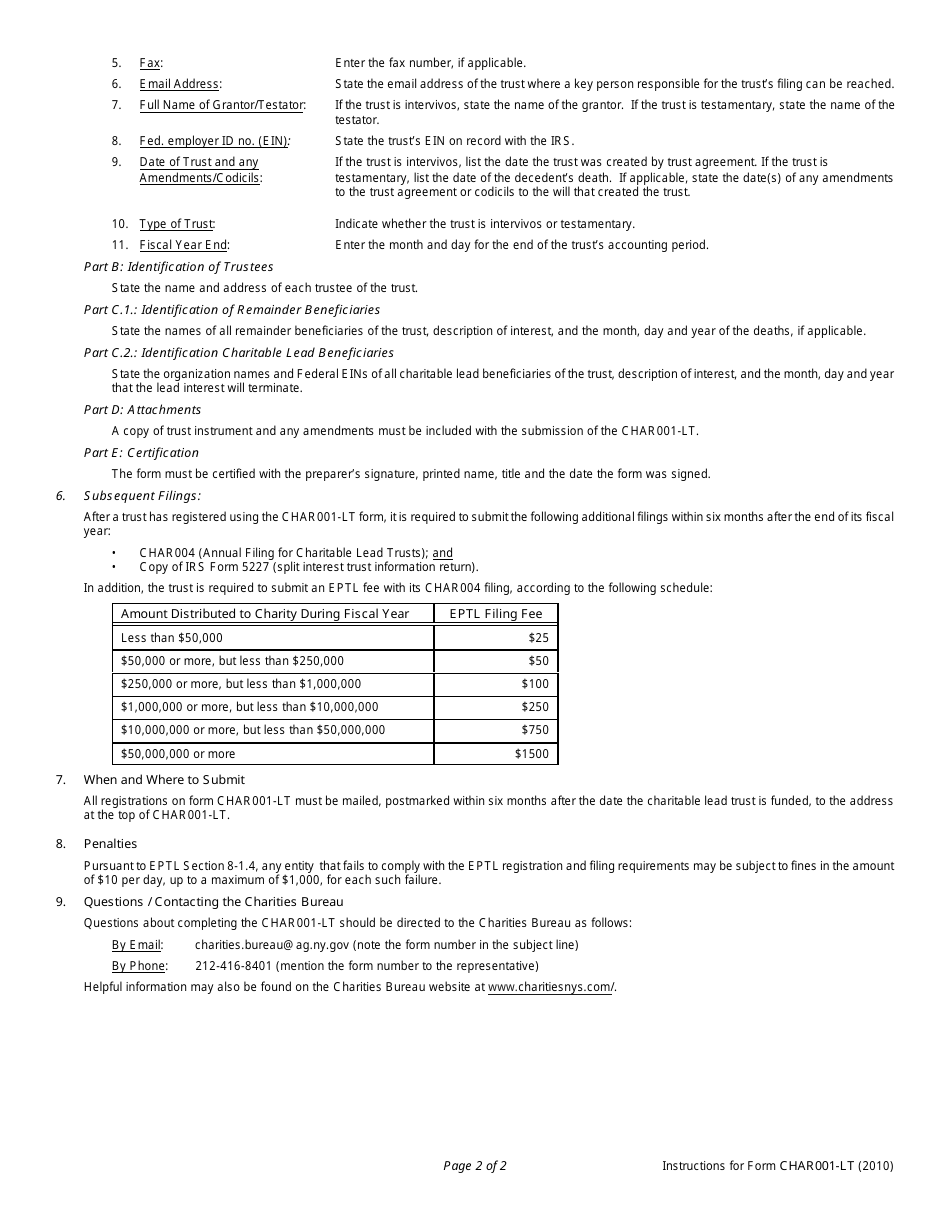

Q: Are there any fees to file Form CHAR001-LT?

A: Yes, there are fees associated with filing Form CHAR001-LT. The fee amount can be found on the form.

Q: Are there any instructions available for filling out Form CHAR001-LT?

A: Yes, detailed instructions for filling out Form CHAR001-LT are included with the form.

Q: What information do I need to provide on Form CHAR001-LT?

A: You will need to provide information about the trust, the charitable organization receiving income, and the non-charitable beneficiaries.

Q: When is the deadline to file Form CHAR001-LT?

A: The deadline to file Form CHAR001-LT is typically the same as the deadline for filing your New York state tax return.

Q: Can Form CHAR001-LT be filed electronically?

A: No, Form CHAR001-LT cannot be filed electronically and must be filed by mail.

Q: Are there any penalties for not filing Form CHAR001-LT?

A: Yes, failure to file Form CHAR001-LT may result in penalties imposed by the New York State Department of Taxation and Finance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Attorney General.