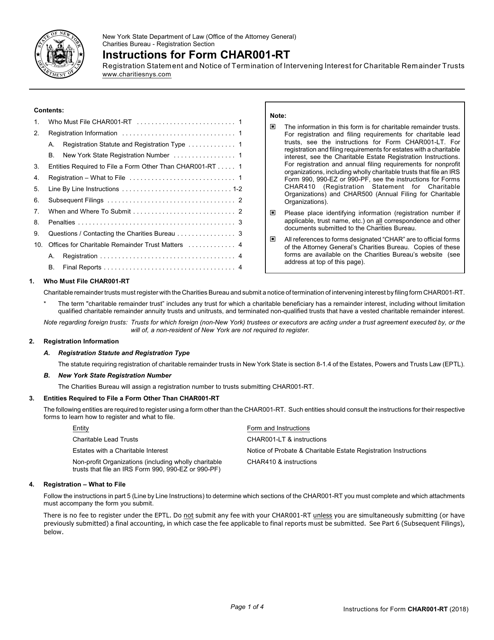

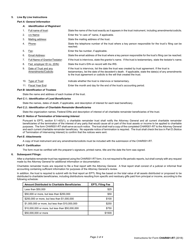

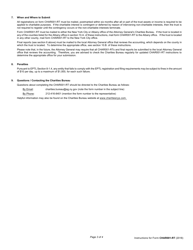

Instructions for Form CHAR001-RT Registration Statement and Notice of Termination of Intervening Interest for Charitable Remainder Trusts - New York

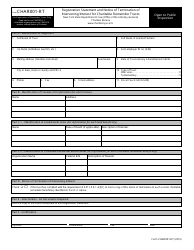

This document contains official instructions for Form CHAR001-RT , Registration Statement and Notice of Termination of Intervening Interest for Charitable Remainder Trusts - a form released and collected by the New York State Attorney General. An up-to-date fillable Form CHAR001-RT is available for download through this link.

FAQ

Q: What is Form CHAR001-RT?

A: Form CHAR001-RT is a registration statement and notice of termination of intervening interest for charitable remainder trusts in New York.

Q: What is a charitable remainder trust?

A: A charitable remainder trust is a legal arrangement where a person donates assets to a trust, receives income from the trust for a period of time, and then the remaining assets are distributed to a designated charity.

Q: Who needs to file Form CHAR001-RT?

A: Individuals or organizations that have established a charitable remainder trust in New York need to file Form CHAR001-RT.

Q: What is the purpose of filing Form CHAR001-RT?

A: The purpose of filing Form CHAR001-RT is to register a charitable remainder trust with the New York State Department of Taxation and Finance.

Q: When should Form CHAR001-RT be filed?

A: Form CHAR001-RT should be filed within 10 days of the creation of the charitable remainder trust.

Q: Are there any fees associated with filing Form CHAR001-RT?

A: Yes, a fee of $10,000 is required for filing Form CHAR001-RT.

Q: What happens if Form CHAR001-RT is not filed?

A: Failure to file Form CHAR001-RT may result in penalties and the loss of certain tax benefits associated with the charitable remainder trust.

Q: Can a charitable remainder trust be terminated?

A: Yes, a charitable remainder trust can be terminated by filing a notice of termination of intervening interest using Form CHAR001-RT.

Q: Are there any additional requirements for charitable remainder trusts in New York?

A: Yes, charitable remainder trusts in New York are subject to additional reporting and compliance requirements as specified by the Department of Taxation and Finance.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Attorney General.