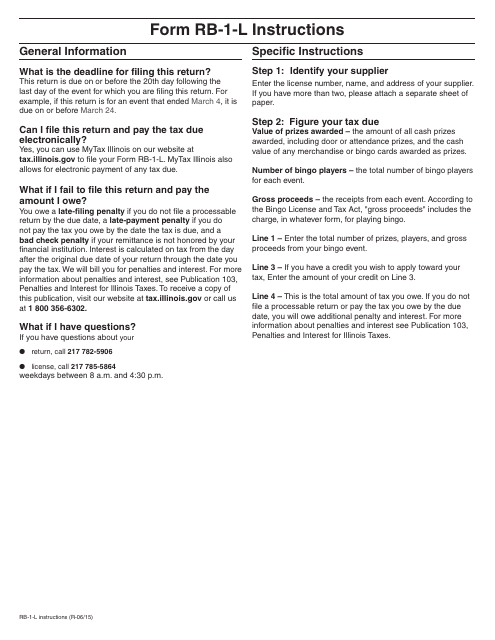

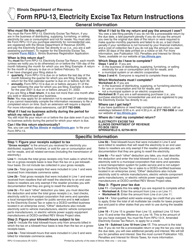

Instructions for Form RB-1-L Limited Bingo Tax Return - Illinois

This document contains official instructions for Form RB-1-L , Limited Bingo Tax Return - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form RB-1-L?

A: Form RB-1-L is the Limited Bingo Tax Return specific to the state of Illinois.

Q: Who needs to file Form RB-1-L?

A: Organizations that conduct limited bingo games in Illinois need to file Form RB-1-L.

Q: What is the purpose of Form RB-1-L?

A: Form RB-1-L is used to report and pay taxes on the proceeds from limited bingo games.

Q: When is Form RB-1-L due?

A: Form RB-1-L is due on or before the 15th day of the month following the end of the reporting period.

Q: What information do I need to complete Form RB-1-L?

A: To complete Form RB-1-L, you will need information about the total receipts from limited bingo games and the amount of taxes due.

Q: Are there any penalties for late filing of Form RB-1-L?

A: Yes, there are penalties for late filing of Form RB-1-L, including interest on unpaid taxes.

Q: What other forms do I need to include with Form RB-1-L?

A: You may need to include a schedule of receipts and a payment voucher with Form RB-1-L.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.