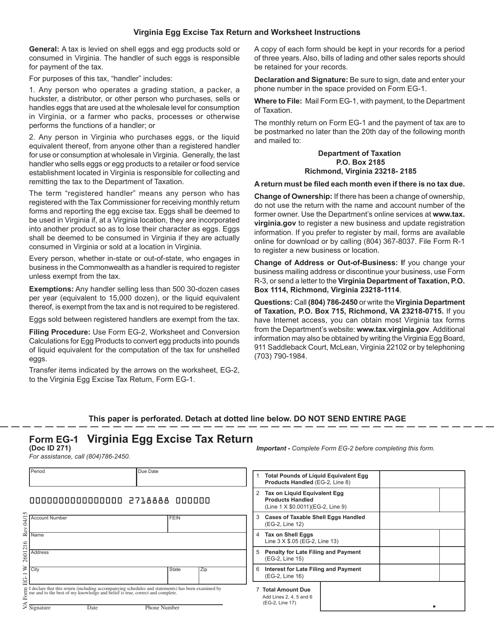

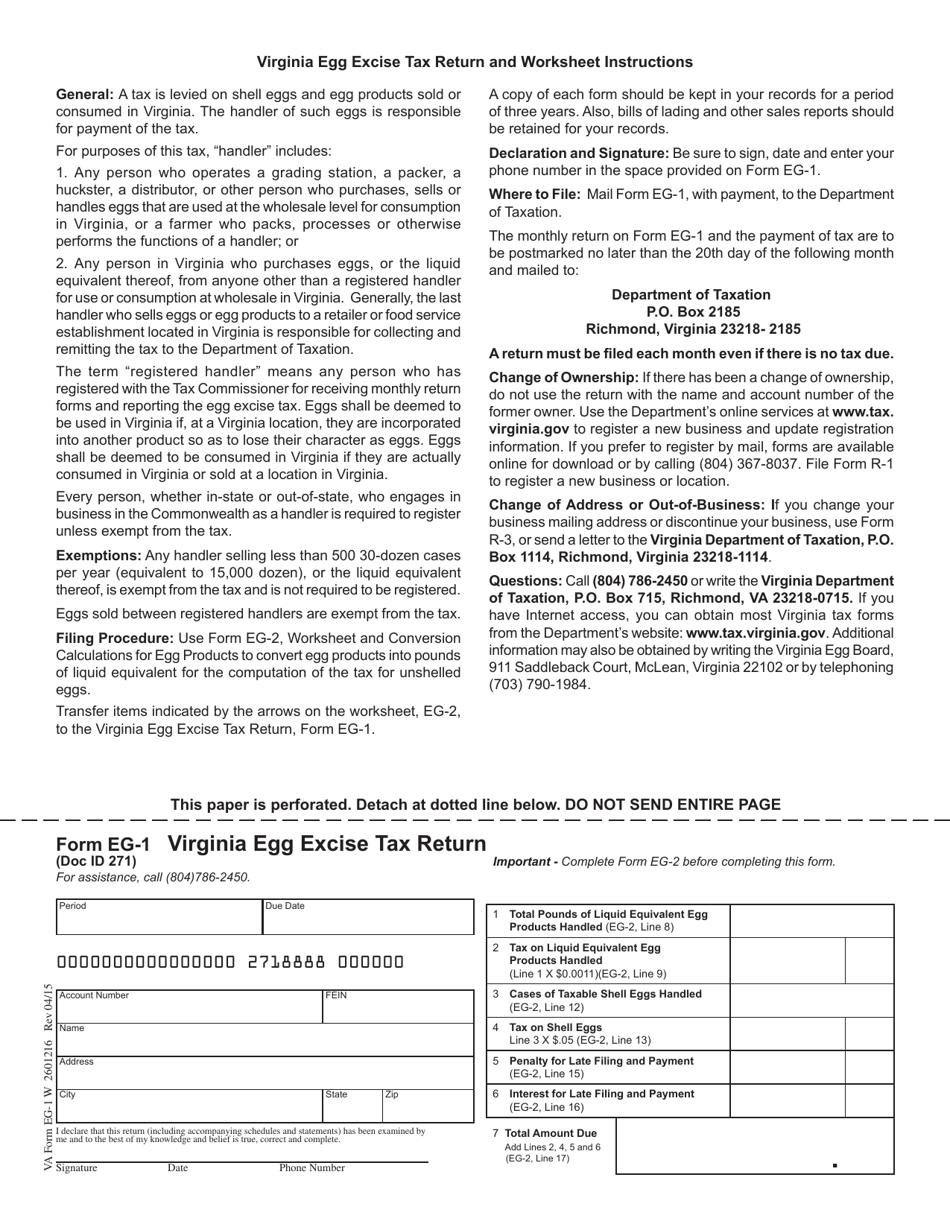

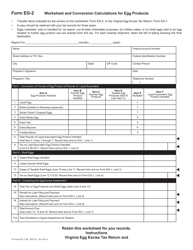

Form EG-1 Virginia Egg Excise Tax Return - Virginia

What Is Form EG-1?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form EG-1?

A: Form EG-1 is the Virginia Egg Excise Tax Return.

Q: Who needs to file Form EG-1?

A: Egg producers or distributors in Virginia who are subject to the egg excise tax need to file Form EG-1.

Q: What is the purpose of Form EG-1?

A: Form EG-1 is used to report and remit the Virginia Egg Excise Tax.

Q: How often should Form EG-1 be filed?

A: Form EG-1 should be filed on a monthly basis.

Q: What is the due date for Form EG-1?

A: Form EG-1 is due on or before the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing or non-payment of the egg excise tax?

A: Yes, there are penalties for late filing or non-payment of the egg excise tax. It is important to file and pay on time to avoid penalties and interest.

Form Details:

- Released on April 1, 2015;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EG-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.