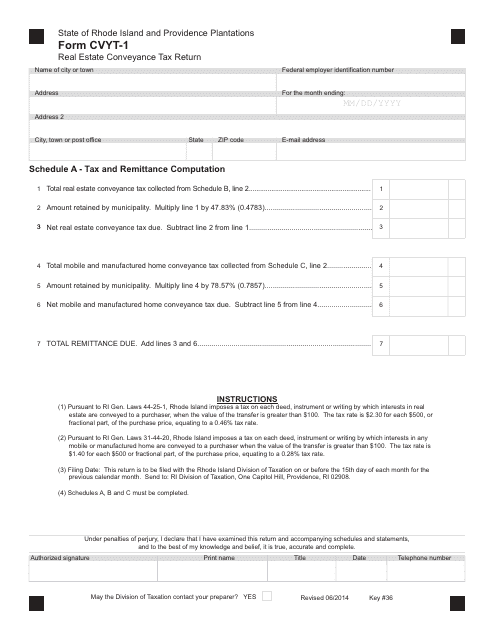

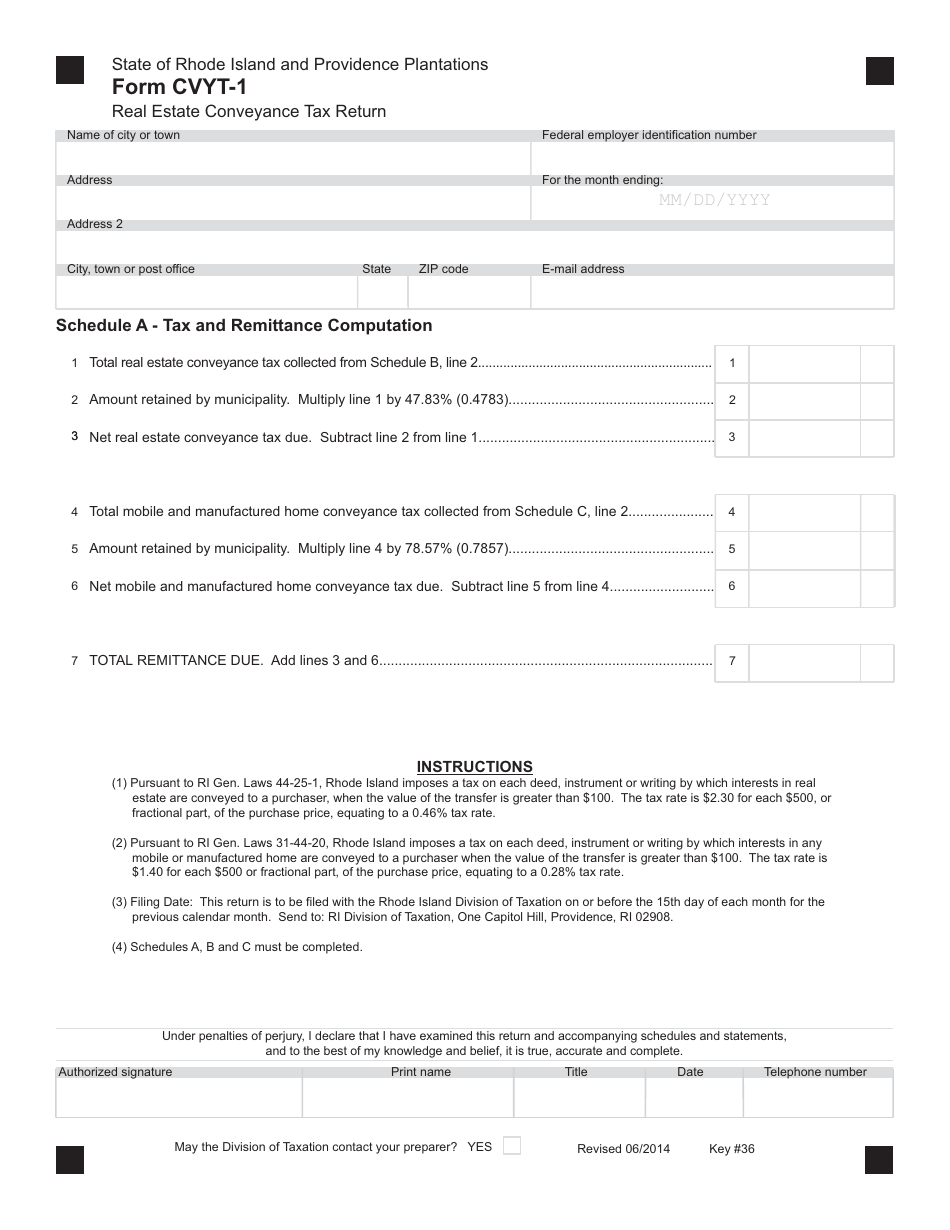

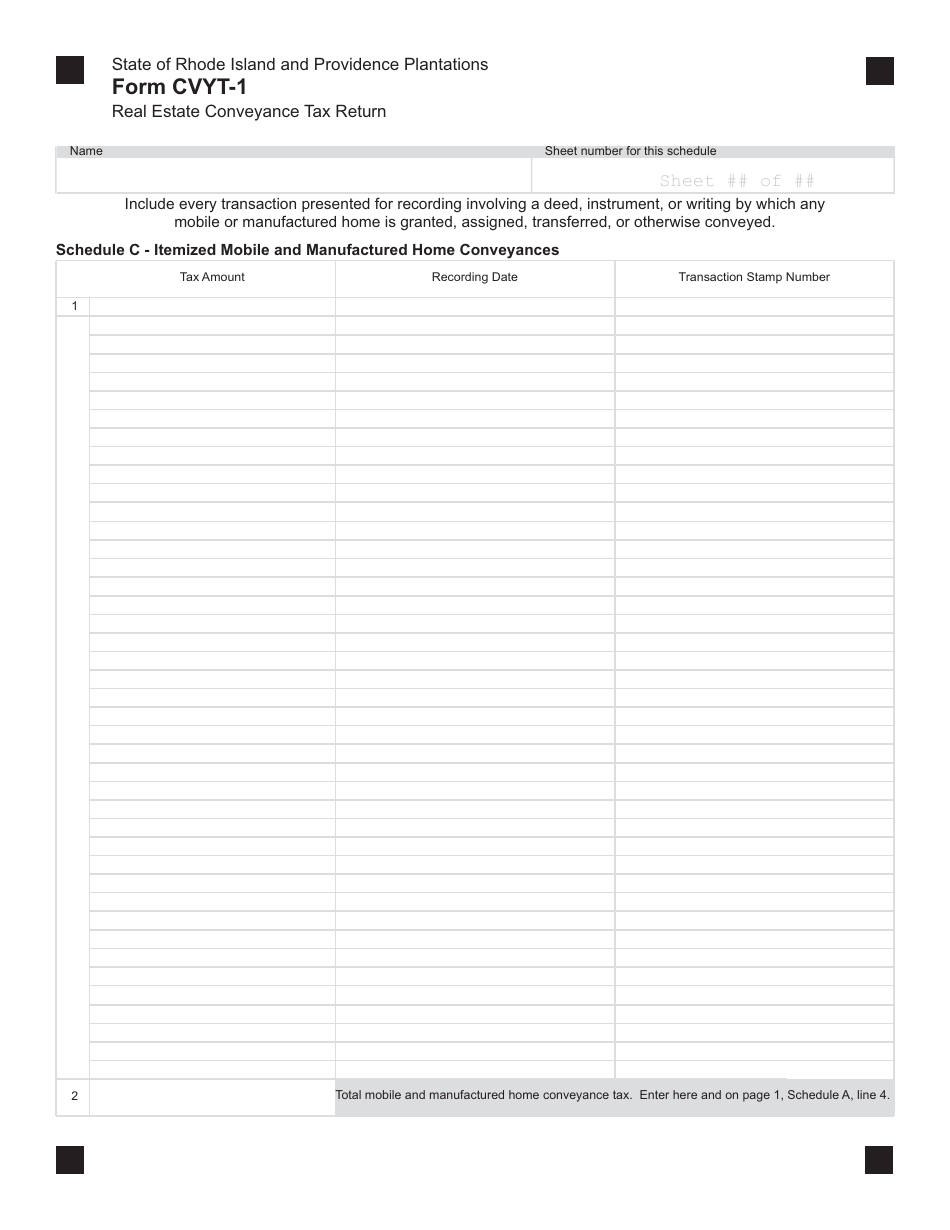

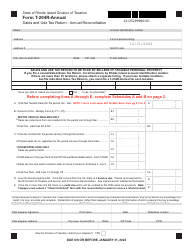

Form CVYT-1 Real Estate Conveyance Tax Return - Rhode Island

What Is Form CVYT-1?

This is a legal form that was released by the Rhode Island Department of Revenue - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CVYT-1?

A: Form CVYT-1 is the Real Estate Conveyance Tax Return used in Rhode Island.

Q: Who needs to file Form CVYT-1?

A: Individuals, corporations, and other entities who transfer real estate in Rhode Island need to file this form.

Q: What is the purpose of Form CVYT-1?

A: Form CVYT-1 is used to report and pay the Real Estate Conveyance Tax, which is a tax imposed on the transfer of real estate ownership.

Q: When should Form CVYT-1 be filed?

A: Form CVYT-1 must be filed within 30 days from the date of transfer.

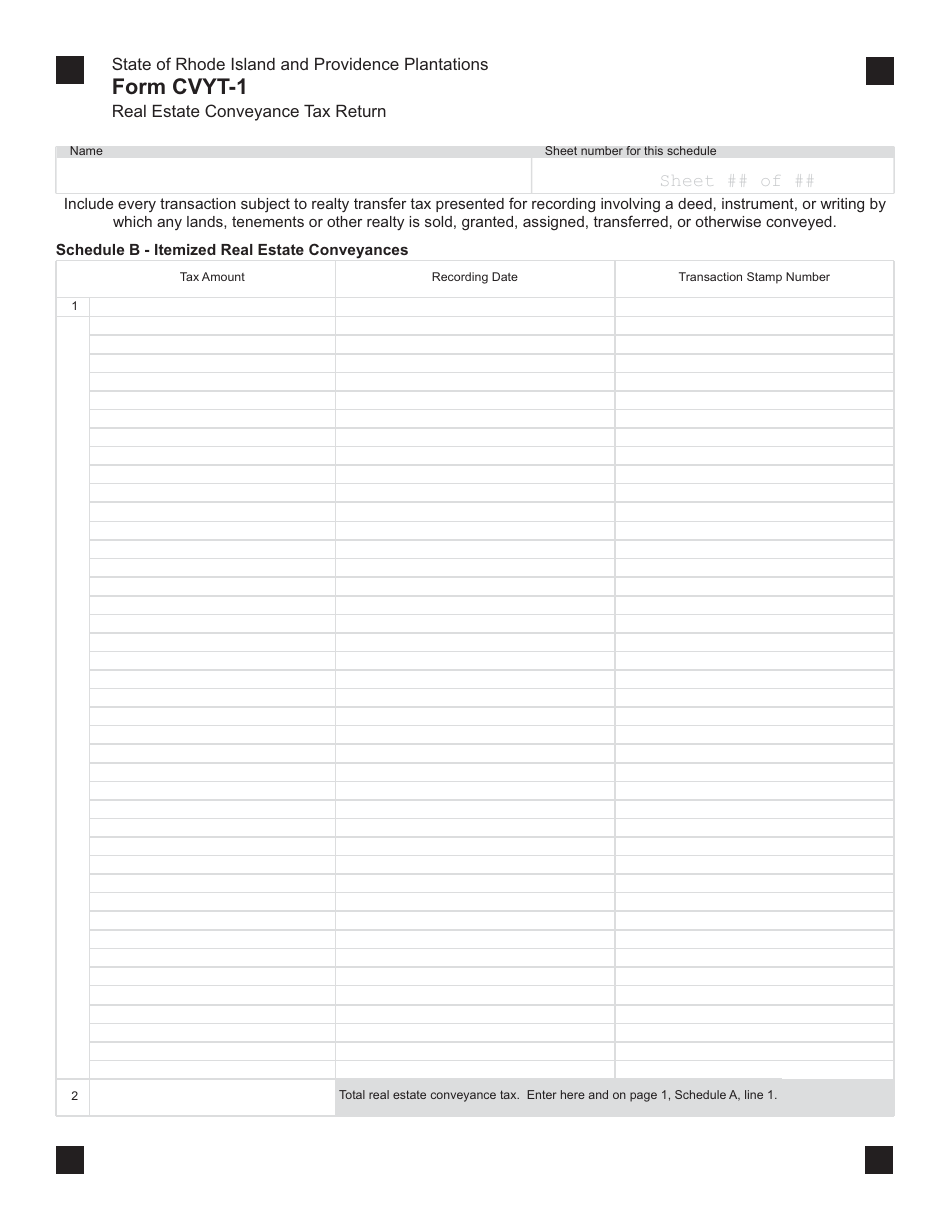

Q: What information is required on Form CVYT-1?

A: Some of the information required includes details about the property, the parties involved in the transfer, and the sales price.

Q: Are there any exemptions to the Real Estate Conveyance Tax?

A: Yes, there are certain exemptions for transfers such as gifts, inheritance, and transfers between spouses.

Q: How do I pay the Real Estate Conveyance Tax?

A: The tax payment can be made by check or money order, payable to the Rhode Island Division of Taxation.

Q: What happens if I don't file Form CVYT-1?

A: Failure to file Form CVYT-1 or pay the Real Estate Conveyance Tax can result in penalties and interest.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the Rhode Island Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CVYT-1 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue.