Gambling Tax Templates

Are you a professional gambler or a business that operates within the gambling industry? It's important to understand the rules and regulations surrounding gambling taxes. Whether you're an individual or a business, complying with your jurisdiction's gambling tax requirements is crucial to avoid penalties and ensure a smooth operation.

At our website, we provide comprehensive information and resources on gambling tax, also known as gambling taxes or gambling tax forms. Our aim is to simplify the process and help you navigate the complexities of gambling taxation.

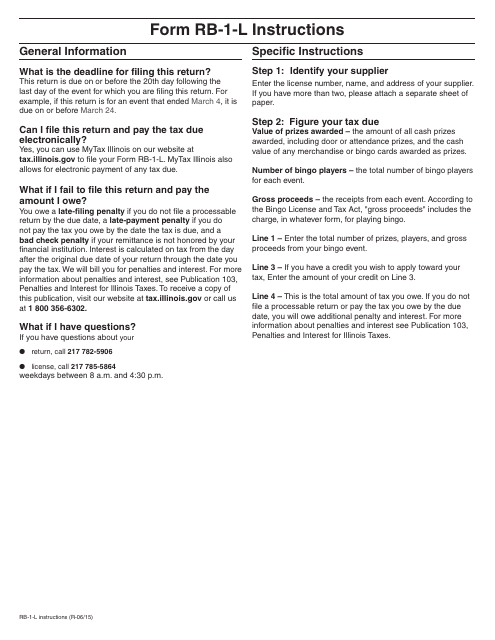

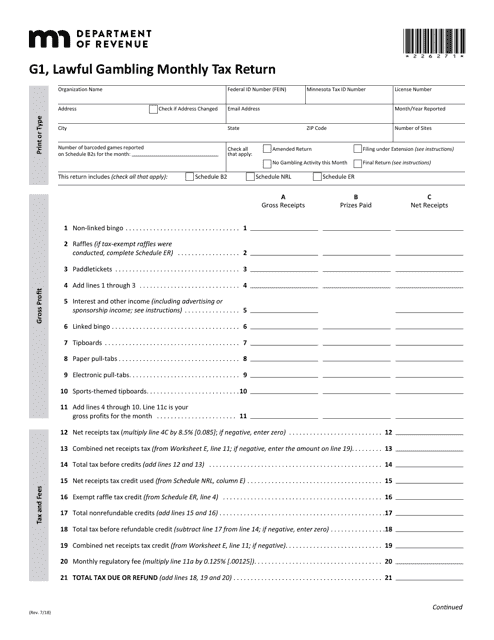

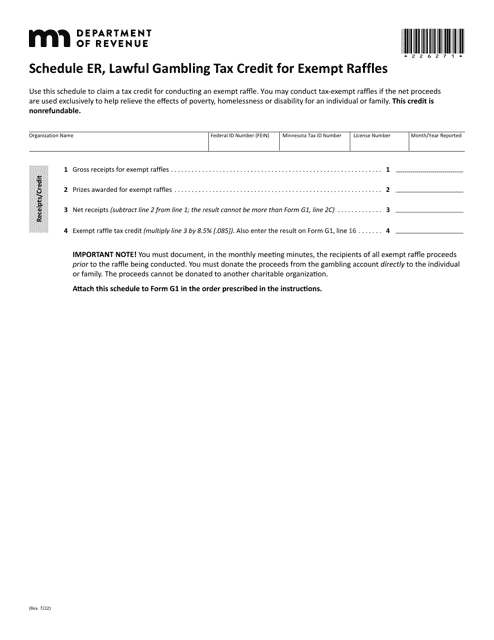

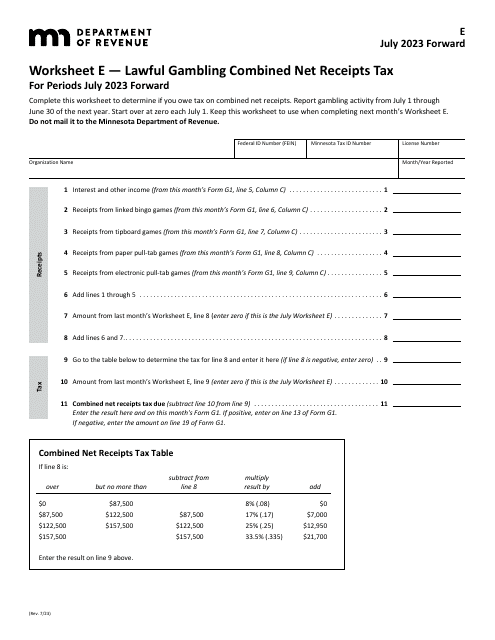

Explore our collection of helpful documents, including state-specific instructions for tax return forms such as the "Instructions for Form RB-1-L Limited Bingo Tax Return" in Illinois and the "Form G1 Lawful GamblingMonthly Tax Return" in Minnesota. These documents provide step-by-step guidance on how to accurately report your gambling income and calculate your tax liability.

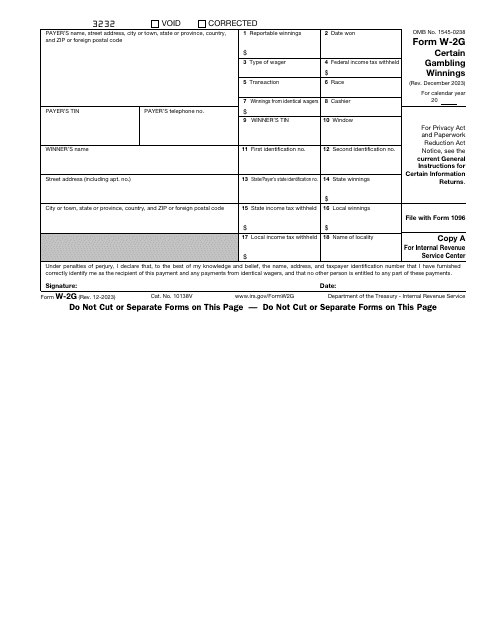

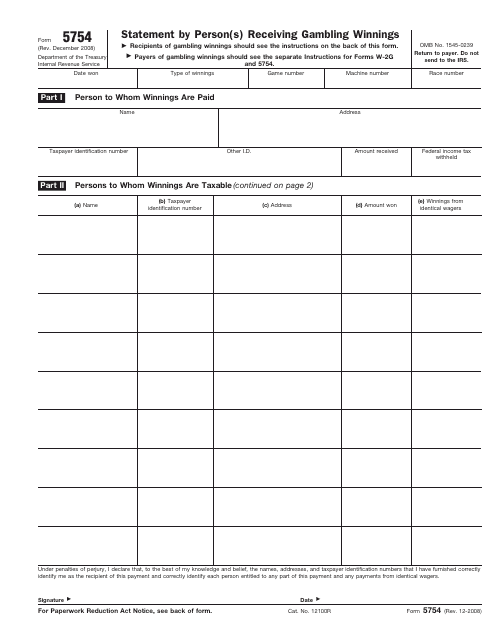

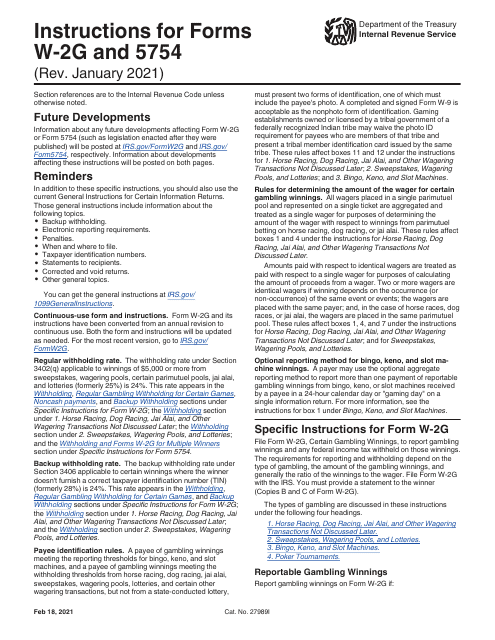

In addition to state-specific resources, we also offer valuable information on federal gambling tax requirements. Familiarize yourself with the "Instructions for IRS Form W-2 G, 5754" and the "IRS Form W-2G Certain Gambling Winnings." Understanding these forms is essential for reporting large winnings and complying with federal tax regulations.

Stay informed about the latest updates and changes in gambling tax laws by regularly visiting our website. We strive to provide up-to-date information to ensure you're well-informed and in full compliance with the law.

Take control of your gambling taxes with our helpful resources. We're here to assist you in understanding and managing your gambling tax obligations. Browse our collection of documents today and ensure a smooth and hassle-free tax filing experience.

Documents:

10

This is a formal report filed by gambling facilities to outline the winnings of their clients and certify they deducted taxes from the sum of money won.

This Form is used for filing the Limited Bingo Tax Return in the state of Illinois. It provides instructions on how to report and pay taxes related to limited bingo activities.

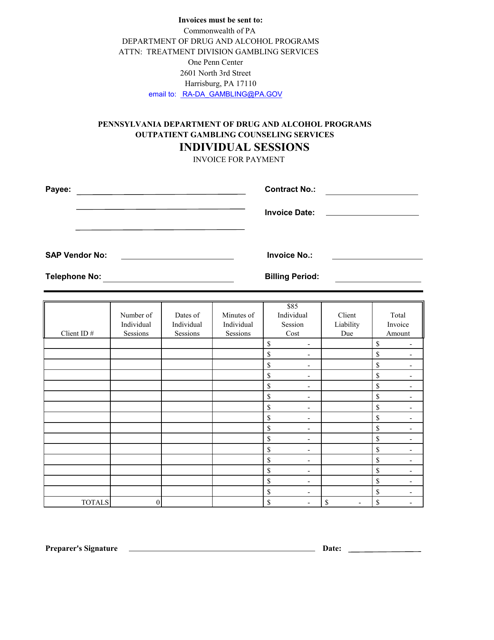

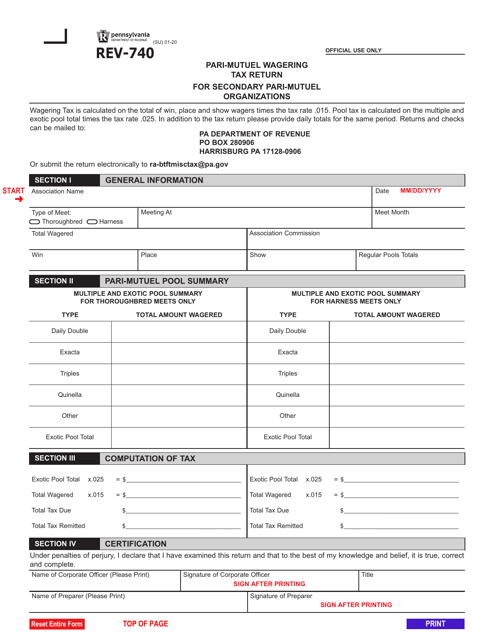

This form is used for recording and issuing invoices for individual gambling sessions held in Pennsylvania.

This Form is used for reporting and paying taxes on lawful gambling activities in the state of Minnesota.