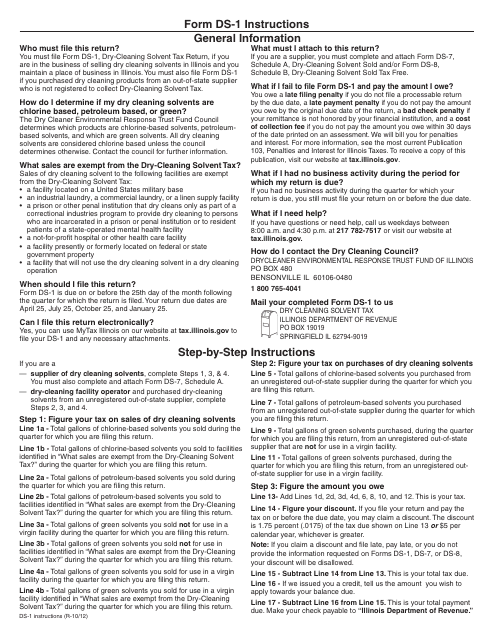

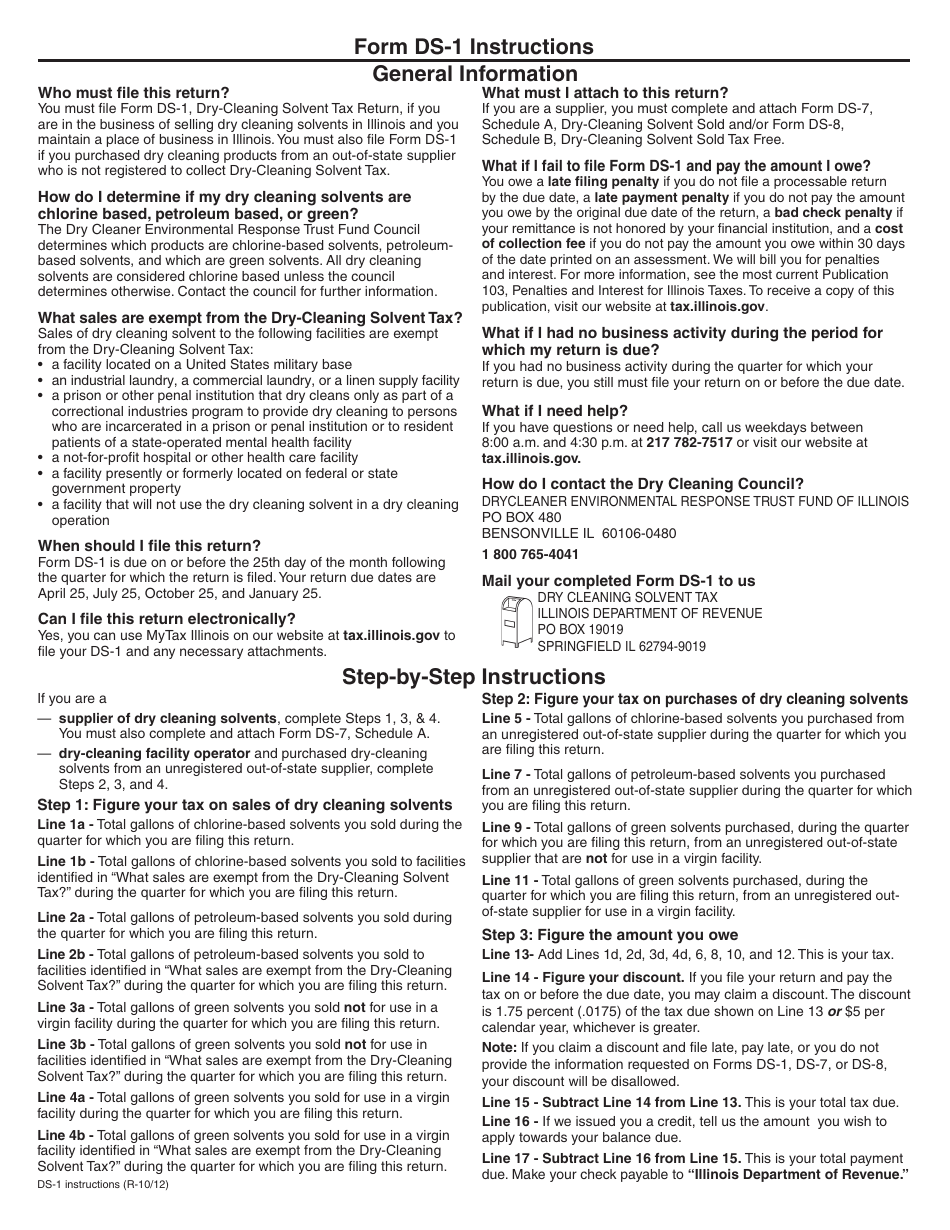

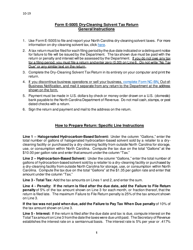

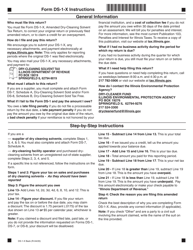

Instructions for Form DS-1 Dry-Cleaning Solvent Tax Return - Illinois

This document contains official instructions for Form DS-1 , Dry-Cleaning Solvent Tax Return - a form released and collected by the Illinois Department of Revenue.

FAQ

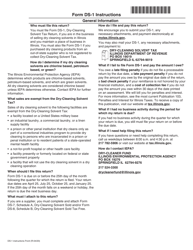

Q: What is Form DS-1?

A: Form DS-1 is a tax return used to report and pay the dry-cleaning solvent tax in the state of Illinois.

Q: Who needs to file Form DS-1?

A: Any person or business that sells or uses dry-cleaning solvents in Illinois needs to file Form DS-1.

Q: What is the dry-cleaning solvent tax in Illinois?

A: The dry-cleaning solvent tax in Illinois is a tax imposed on the sale or use of certain solvents used in dry-cleaning operations.

Q: When is Form DS-1 due?

A: Form DS-1 is generally due on a quarterly basis, with due dates falling on the last day of January, April, July, and October.

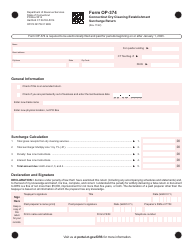

Q: What information is required on Form DS-1?

A: Form DS-1 requires information such as the total gallons of dry-cleaning solvent purchased or imported, the amount of tax due, and any credits or exemptions being claimed.

Q: Are there any penalties for not filing or paying the dry-cleaning solvent tax?

A: Yes, failure to file or pay the tax can result in penalties, including interest charges and potential legal action.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.