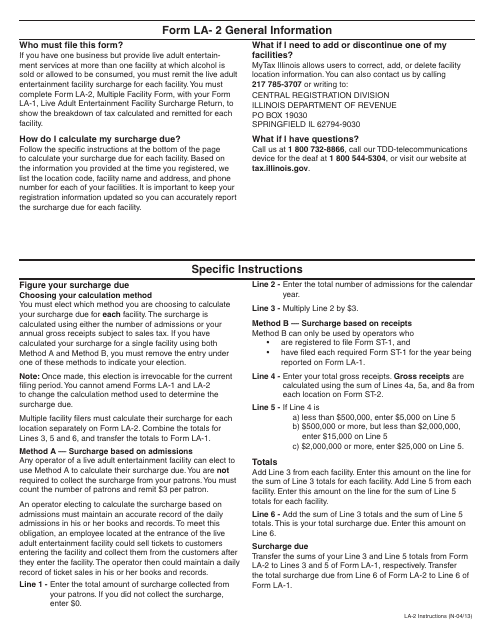

Instructions for Form LA-2 Live Adult Entertainment Facility Surcharge Return Multiple Facility - Illinois

This document contains official instructions for Form LA-2 , Live Adult Entertainment Facility Surcharge Return Multiple Facility - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Form LA-2?

A: Form LA-2 is a return for reporting and paying the Live Adult Entertainment Facility Surcharge in Illinois.

Q: Who needs to file Form LA-2?

A: Owners or operators of live adult entertainment facilities in Illinois must file Form LA-2.

Q: What is the Live Adult Entertainment Facility Surcharge?

A: The Live Adult Entertainment Facility Surcharge is a tax imposed on live adult entertainment facilities in Illinois.

Q: How often do I need to file Form LA-2?

A: Form LA-2 must be filed and the surcharge paid on a monthly basis.

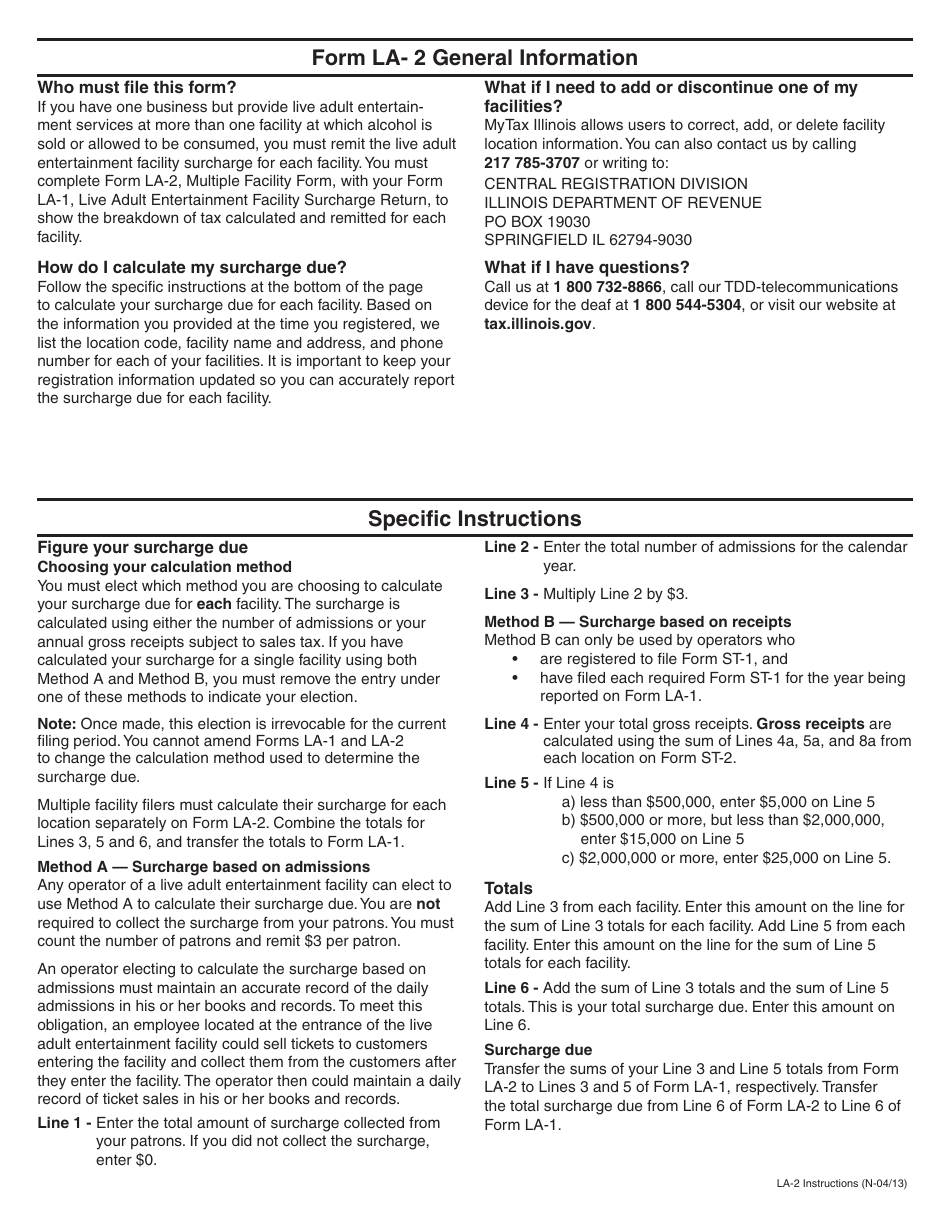

Q: How do I calculate the Live Adult Entertainment Facility Surcharge?

A: The surcharge is calculated based on the admission fees charged at the live adult entertainment facility.

Q: What are the penalties for not filing Form LA-2?

A: Failure to file Form LA-2 or pay the surcharge can result in penalties and interest.

Q: Are there any exemptions or deductions for the Live Adult Entertainment Facility Surcharge?

A: No, there are no exemptions or deductions for the Live Adult Entertainment Facility Surcharge.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.