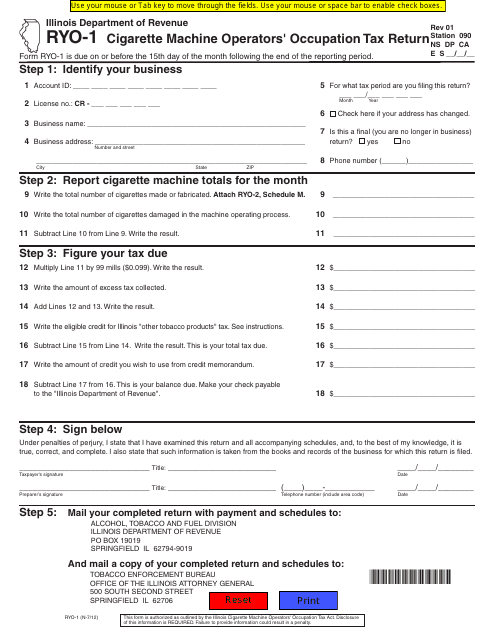

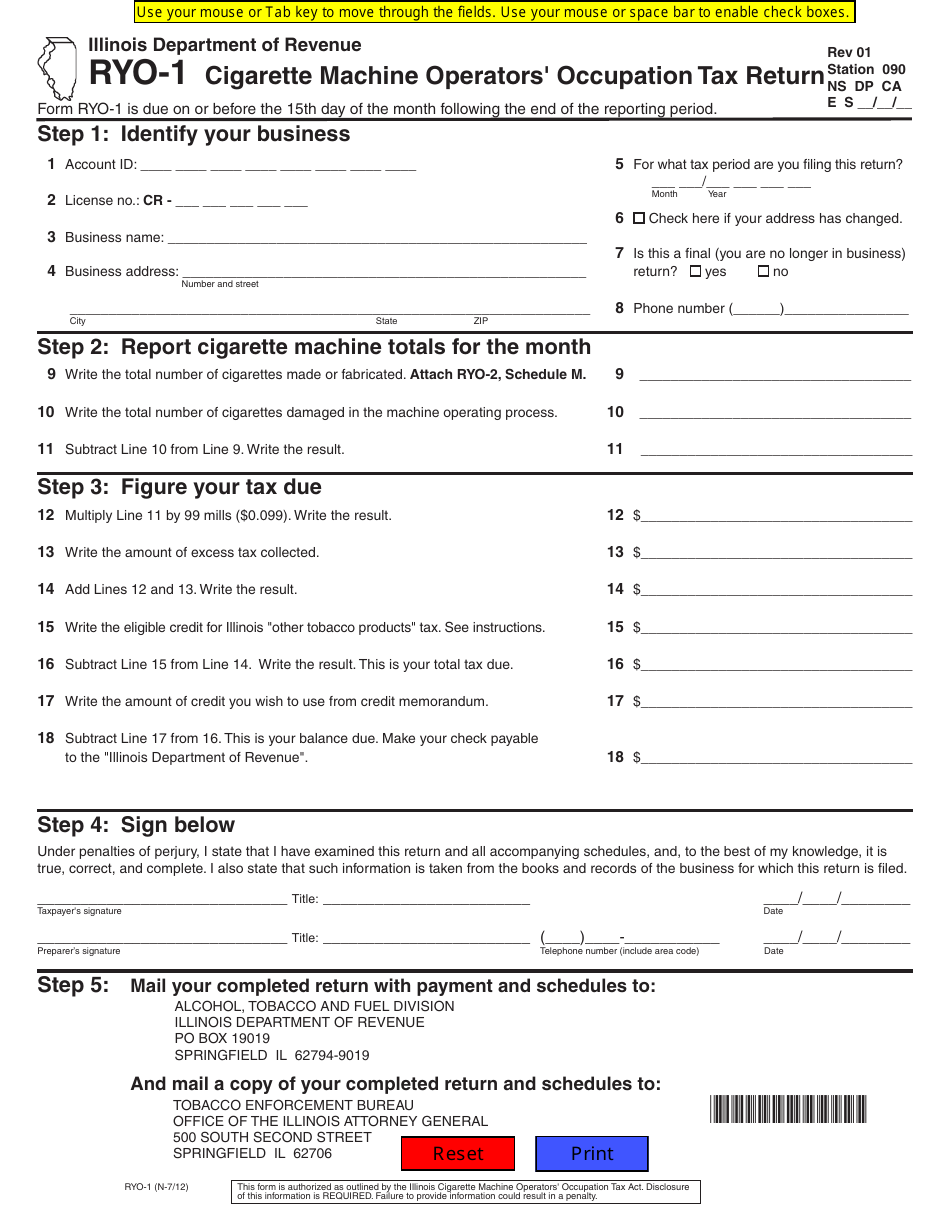

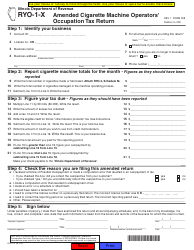

Form RYO-1 Cigarette Machine Operators' Occupation Tax Return - Illinois

What Is Form RYO-1?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RYO-1?

A: RYO-1 refers to the Cigarette Machine Operators' Occupation Tax Return form in Illinois.

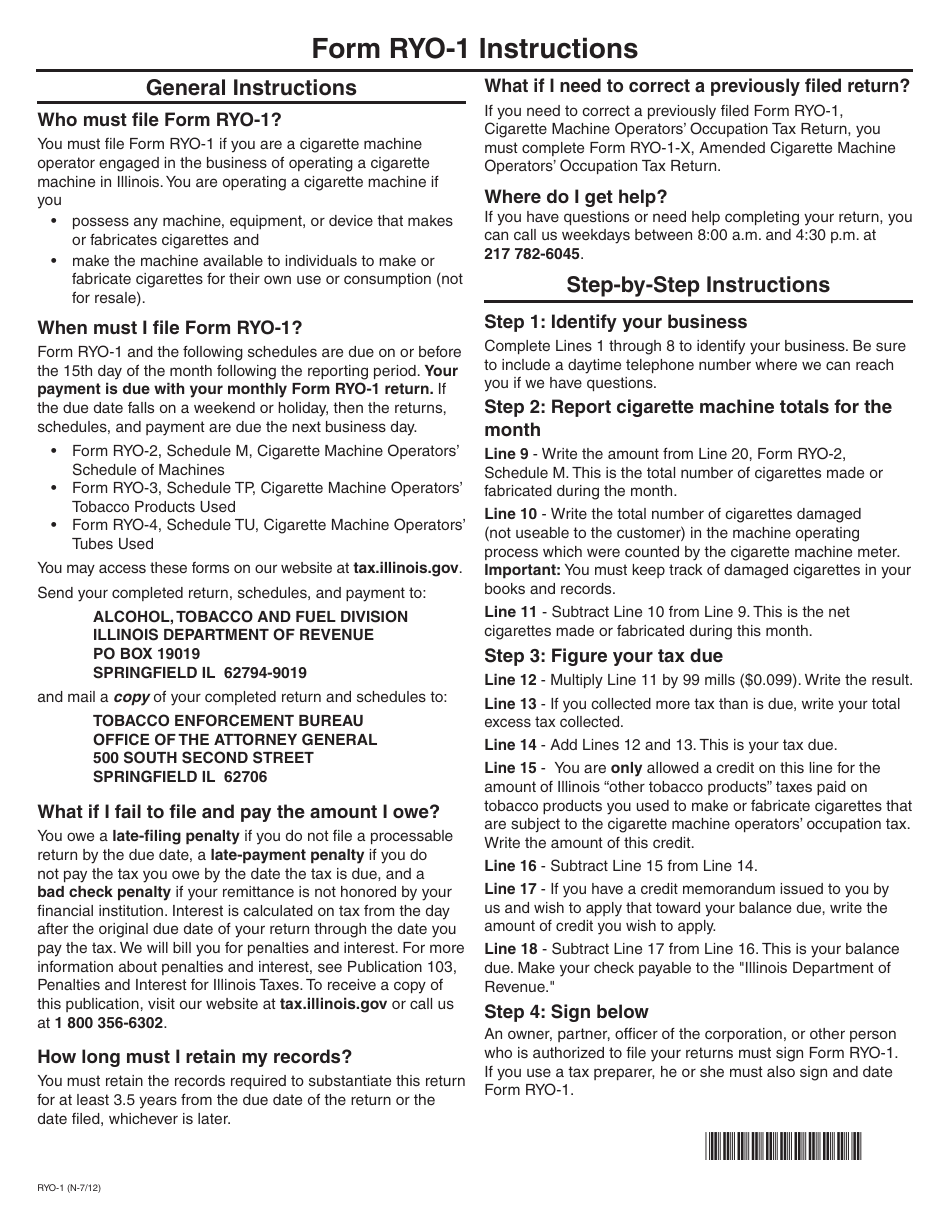

Q: Who needs to file the RYO-1 form?

A: Cigarette machine operators in Illinois need to file the RYO-1 form.

Q: What is the purpose of the RYO-1 form?

A: The RYO-1 form is used to report and pay the occupation tax on cigarettes produced using cigarette rolling machines.

Q: When is the RYO-1 form due?

A: The RYO-1 form is due on a monthly basis, with the tax payment for the previous month.

Q: What information is required on the RYO-1 form?

A: The RYO-1 form requires information about the number of cigarettes produced, the tax rate, and the amount of tax due.

Q: Are there any penalties for late filing of the RYO-1 form?

A: Yes, there are penalties for late filing of the RYO-1 form, including interest charges and possible legal consequences.

Q: Is there any other documentation required with the RYO-1 form?

A: No, there is no specific additional documentation required with the RYO-1 form.

Form Details:

- Released on July 1, 2012;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RYO-1 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.