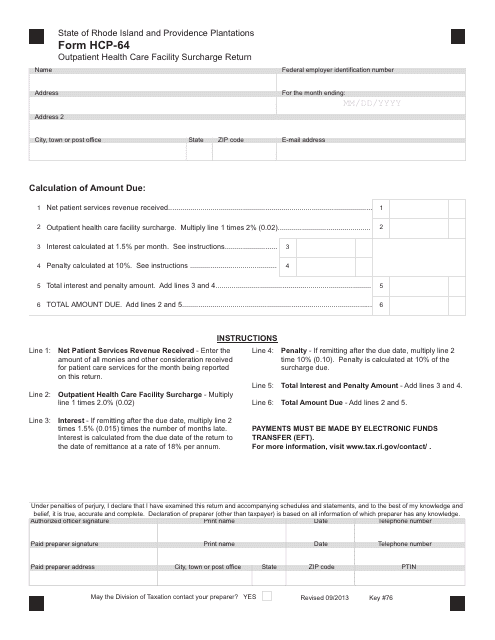

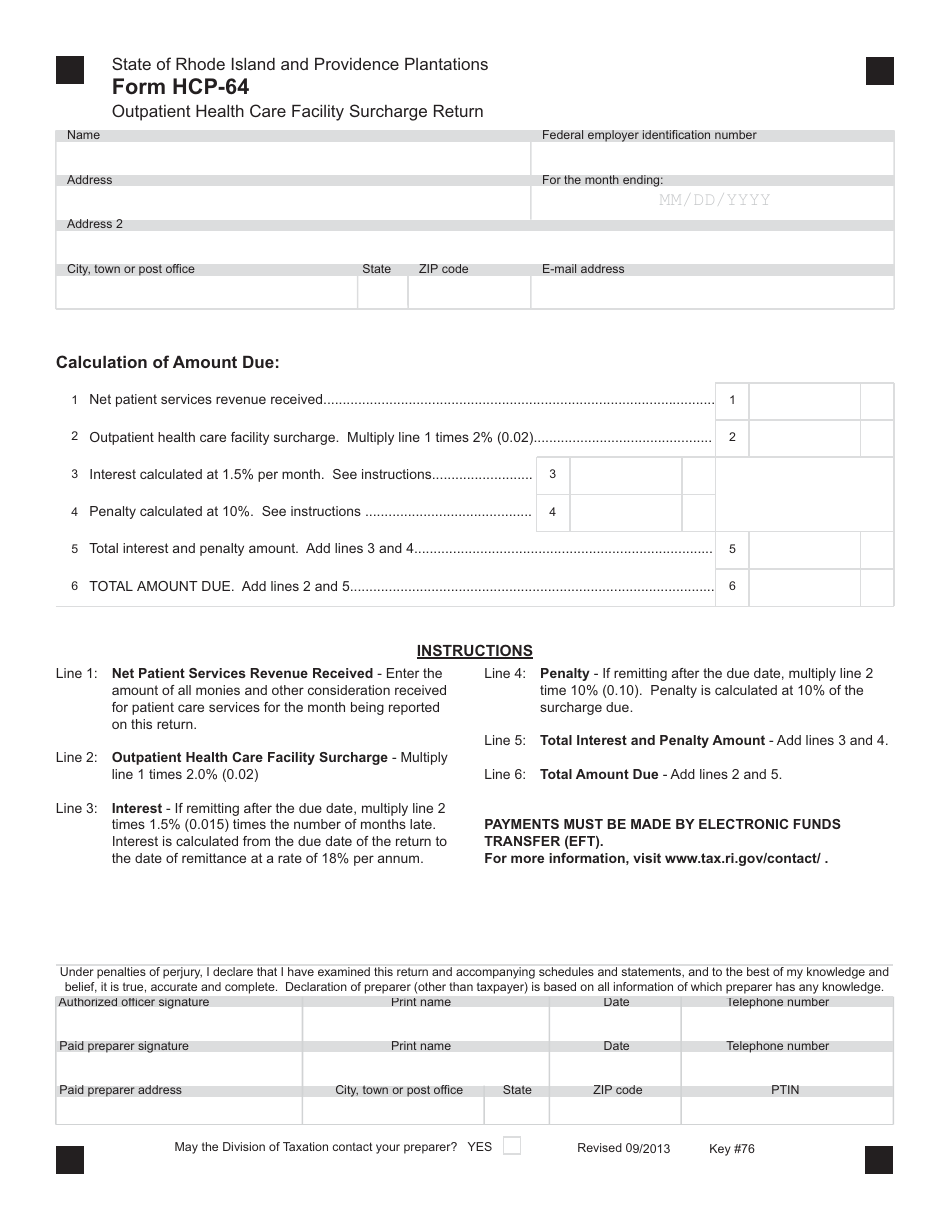

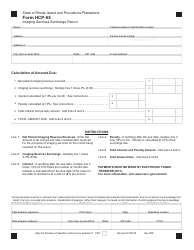

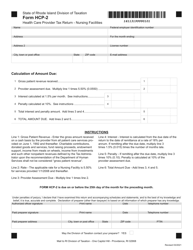

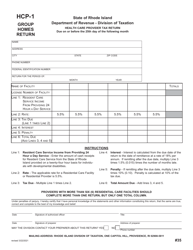

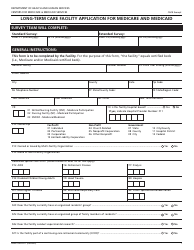

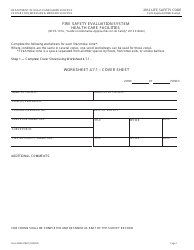

Form HCP-64 Outpatient Health Care Facility Surcharge Return - Rhode Island

What Is Form HCP-64?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HCP-64?

A: Form HCP-64 is the Outpatient Health Care Facility Surcharge Return for Rhode Island.

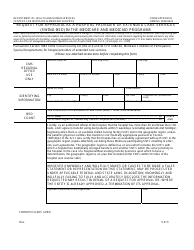

Q: Who needs to file Form HCP-64?

A: Outpatient health care facilities in Rhode Island need to file Form HCP-64.

Q: What is the purpose of Form HCP-64?

A: The purpose of Form HCP-64 is to report and pay the outpatient health care facility surcharge in Rhode Island.

Q: How often should Form HCP-64 be filed?

A: Form HCP-64 should be filed quarterly.

Q: Is there a deadline for filing Form HCP-64?

A: Yes, the deadline for filing Form HCP-64 is the last day of the month following the end of the quarter.

Q: What happens if Form HCP-64 is filed late?

A: Late filing of Form HCP-64 may result in penalties and interest charges.

Q: Are there any exemptions to the outpatient health care facility surcharge?

A: Yes, certain types of outpatient health care facilities may qualify for exemptions from the surcharge. The specific criteria for exemptions can be found in the instructions for Form HCP-64.

Q: Is there a minimum threshold for the surcharge?

A: Yes, outpatient health care facilities with gross revenues below a certain threshold are not subject to the surcharge. The current threshold can be found in the instructions for Form HCP-64.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HCP-64 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.