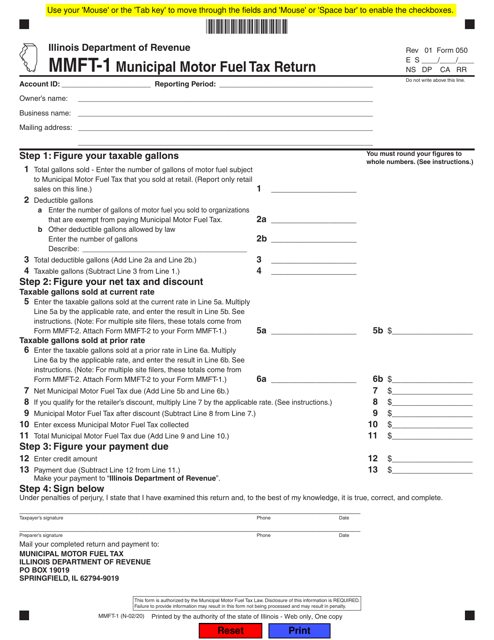

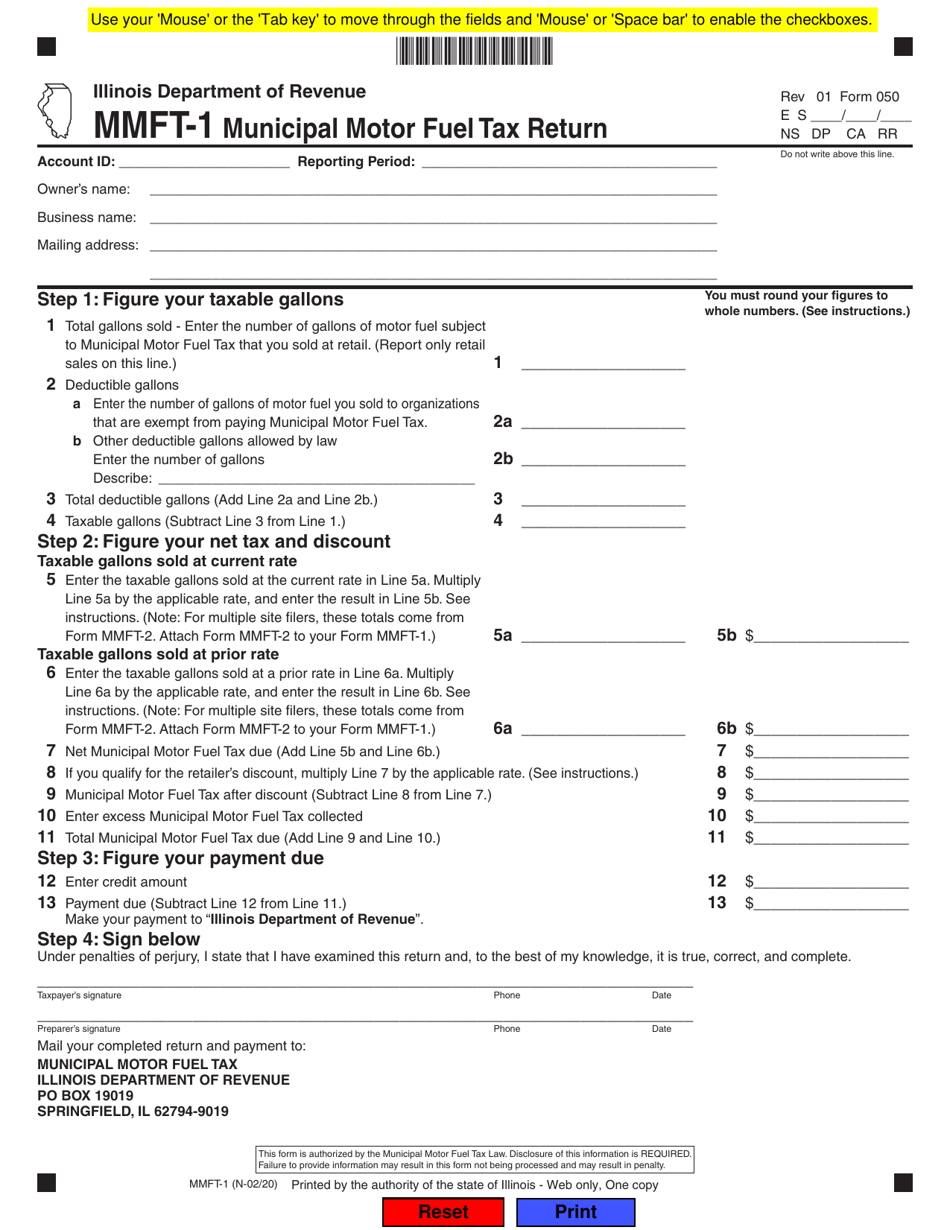

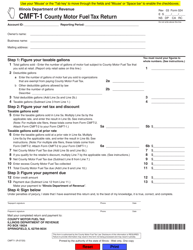

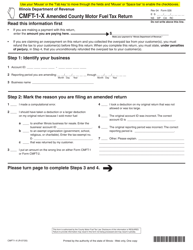

Form MMFT-1 (050) Municipal Motor Fuel Tax Return - Illinois

What Is Form MMFT-1 (050)?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form MMFT-1 (050)?

A: Form MMFT-1 (050) is the Municipal Motor Fuel Tax Return used in Illinois.

Q: Who needs to file Form MMFT-1 (050)?

A: Any entity that sells motor fuel at retail in Illinois municipalities that impose a municipal motor fuel tax needs to file Form MMFT-1 (050).

Q: What is the purpose of Form MMFT-1 (050)?

A: The purpose of Form MMFT-1 (050) is to report and remit the municipal motor fuel tax collected by retailers.

Q: When is Form MMFT-1 (050) due?

A: Form MMFT-1 (050) is due on the 20th day of the month following the end of the reporting period.

Q: Is there a penalty for late filing of Form MMFT-1 (050)?

A: Yes, there may be penalties for late filing or failure to file Form MMFT-1 (050). It is important to file the return on time to avoid penalties.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MMFT-1 (050) by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.