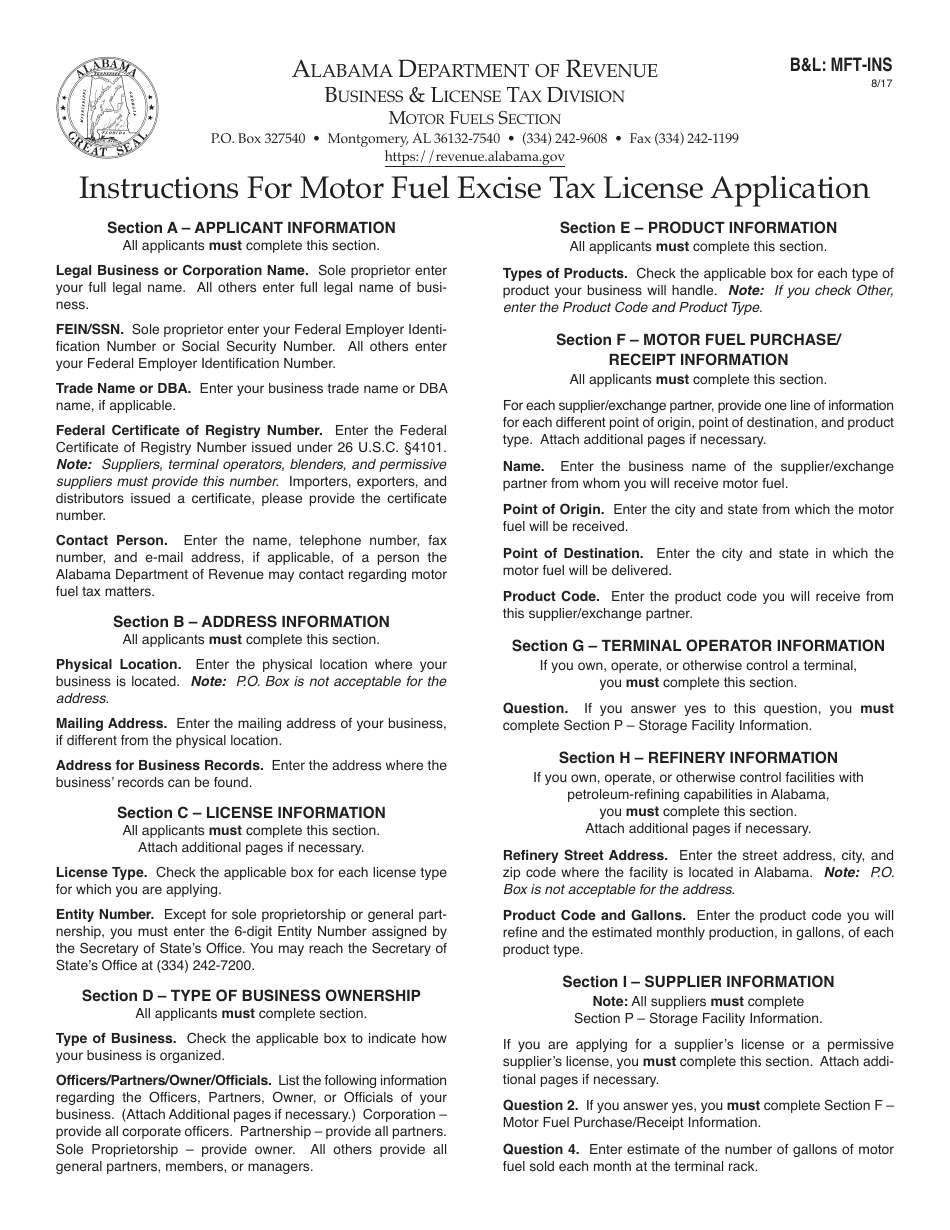

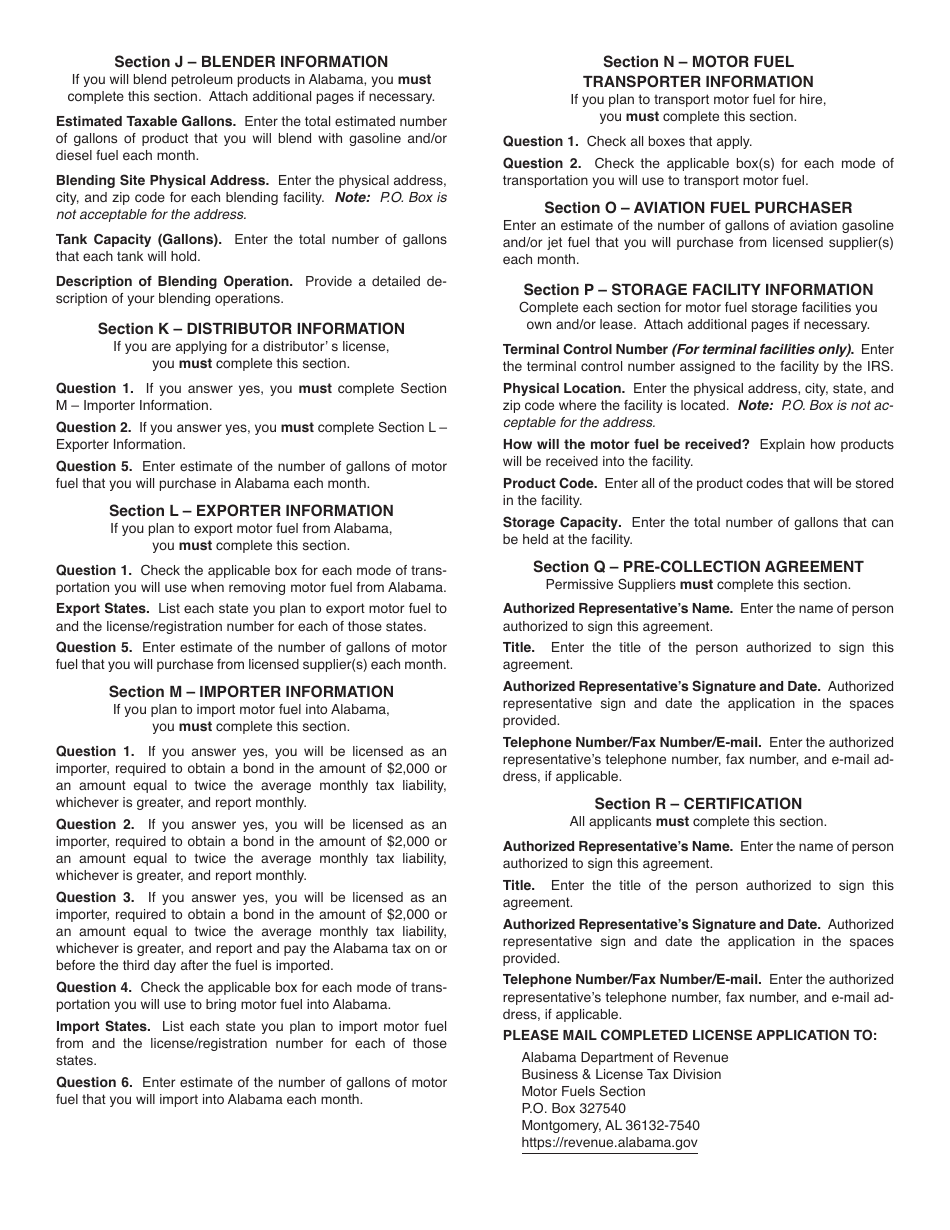

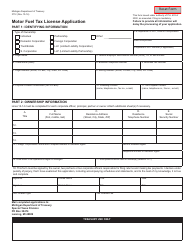

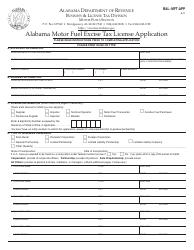

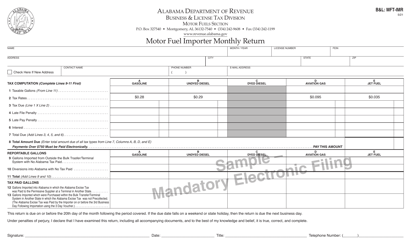

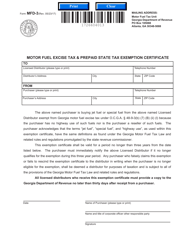

Instructions for Form B&L: MFT-INS, B&L:MFT-APP Motor Fuel Excise Tax License Application - Alabama

This document contains official instructions for Form B&L: MFT-INS , and Form B&L:MFT-APP . Both forms are released and collected by the Alabama Department of Revenue.

FAQ

Q: What is Form B&L: MFT-INS?

A: Form B&L: MFT-INS is the Alabama Motor Fuel Excise Tax License Application.

Q: What does MFT stand for?

A: MFT stands for Motor Fuel Tax.

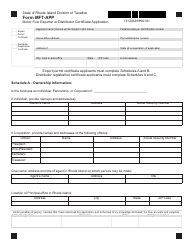

Q: What is the purpose of Form B&L: MFT-APP?

A: Form B&L: MFT-APP is used to apply for a Motor Fuel Excise Tax License in Alabama.

Q: What information do I need to provide on Form B&L: MFT-APP?

A: You will need to provide your business information, including your business name, address, and contact information, as well as information about the types of fuels you will be selling.

Q: Are there any fees associated with applying for a Motor Fuel Excise Tax License?

A: Yes, there are fees associated with applying for a Motor Fuel Excise Tax License. The specific fees depend on various factors, such as the types and volumes of fuel you will be selling.

Q: How long does it take to process a Motor Fuel Excise Tax License Application?

A: The processing time for a Motor Fuel Excise Tax License Application can vary, but it typically takes several weeks for the application to be reviewed and approved.

Q: What should I do if I have questions or need assistance with Form B&L: MFT-APP?

A: If you have questions or need assistance with Form B&L: MFT-APP, you can contact the Alabama Department of Revenue directly for support.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Alabama Department of Revenue.