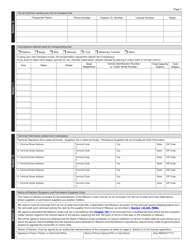

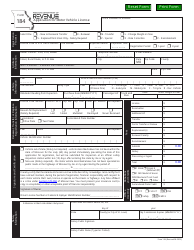

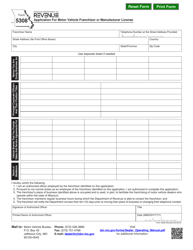

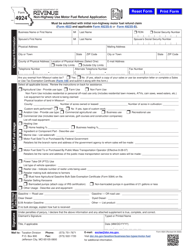

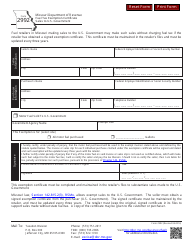

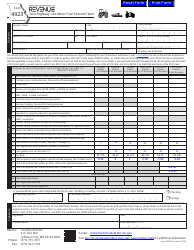

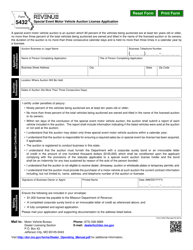

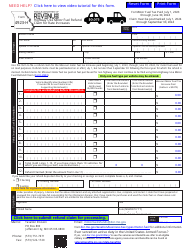

Form 795 Missouri Motor Fuel Tax License Application - Missouri

What Is Form 795?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

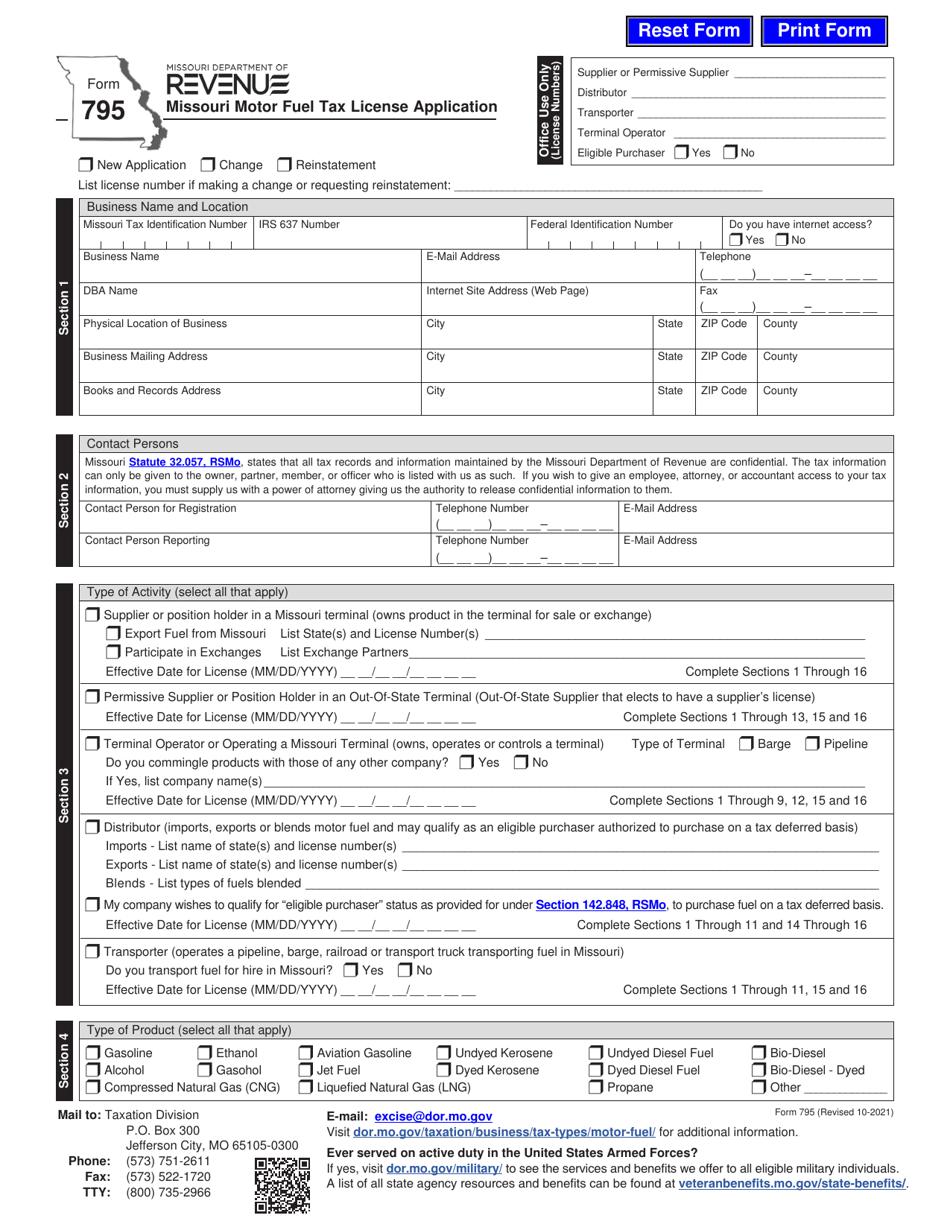

Q: What is Form 795?

A: Form 795 is the Missouri Motor FuelTax License Application.

Q: Why do I need to fill out Form 795?

A: You need to fill out Form 795 if you want to apply for a Missouri Motor Fuel Tax License.

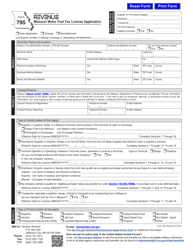

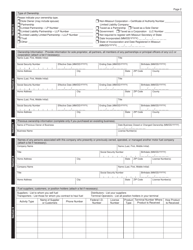

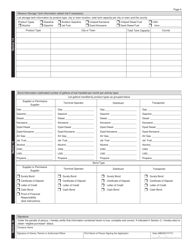

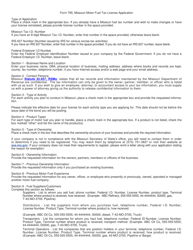

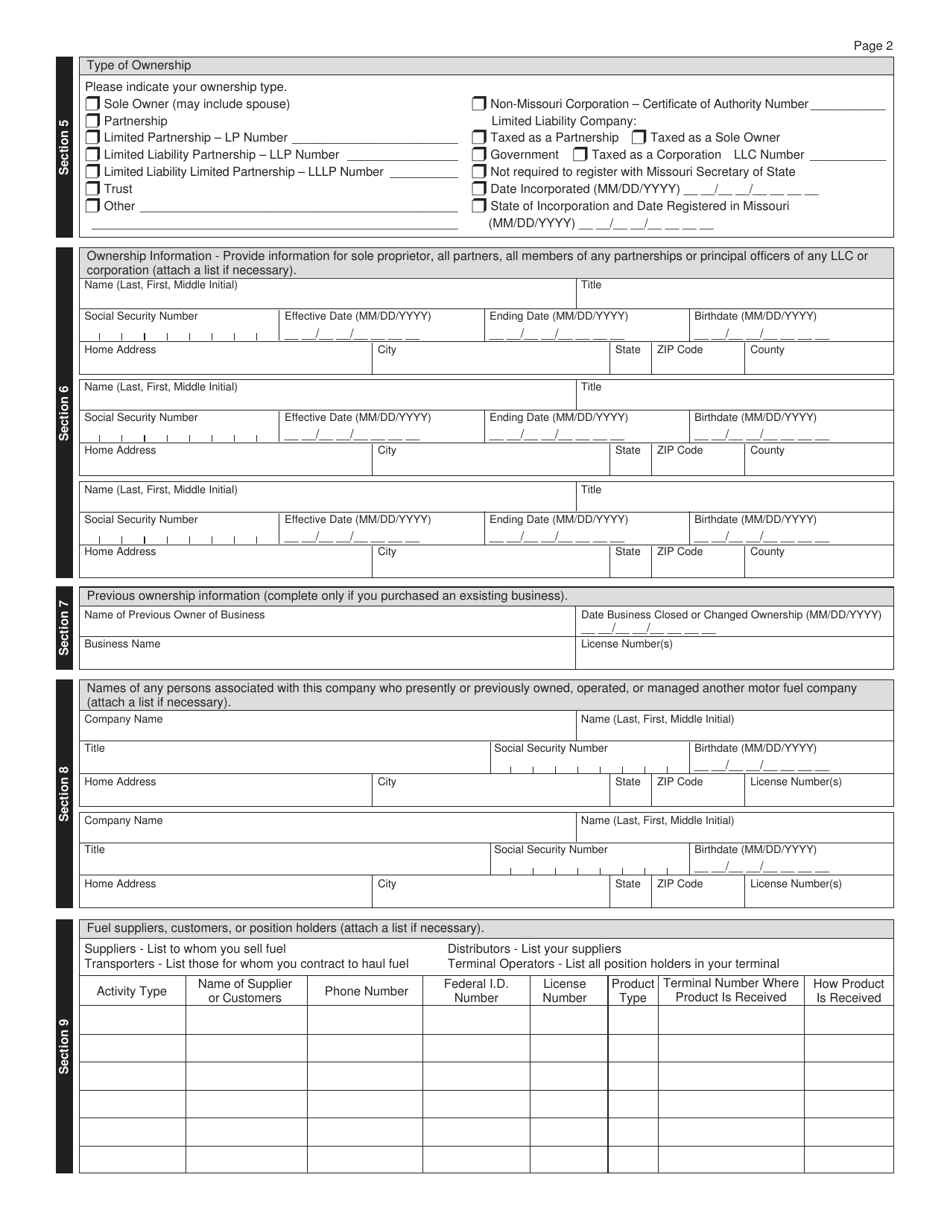

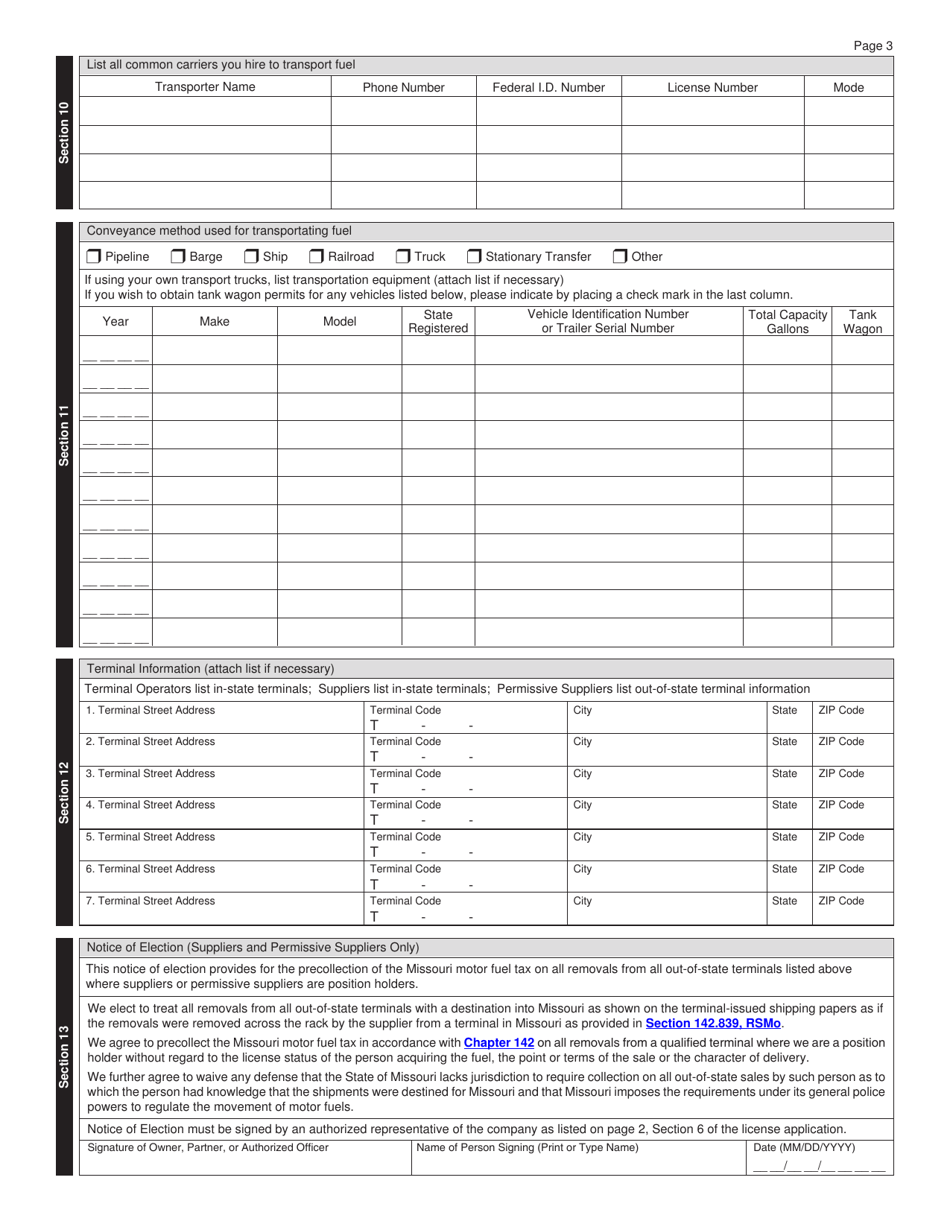

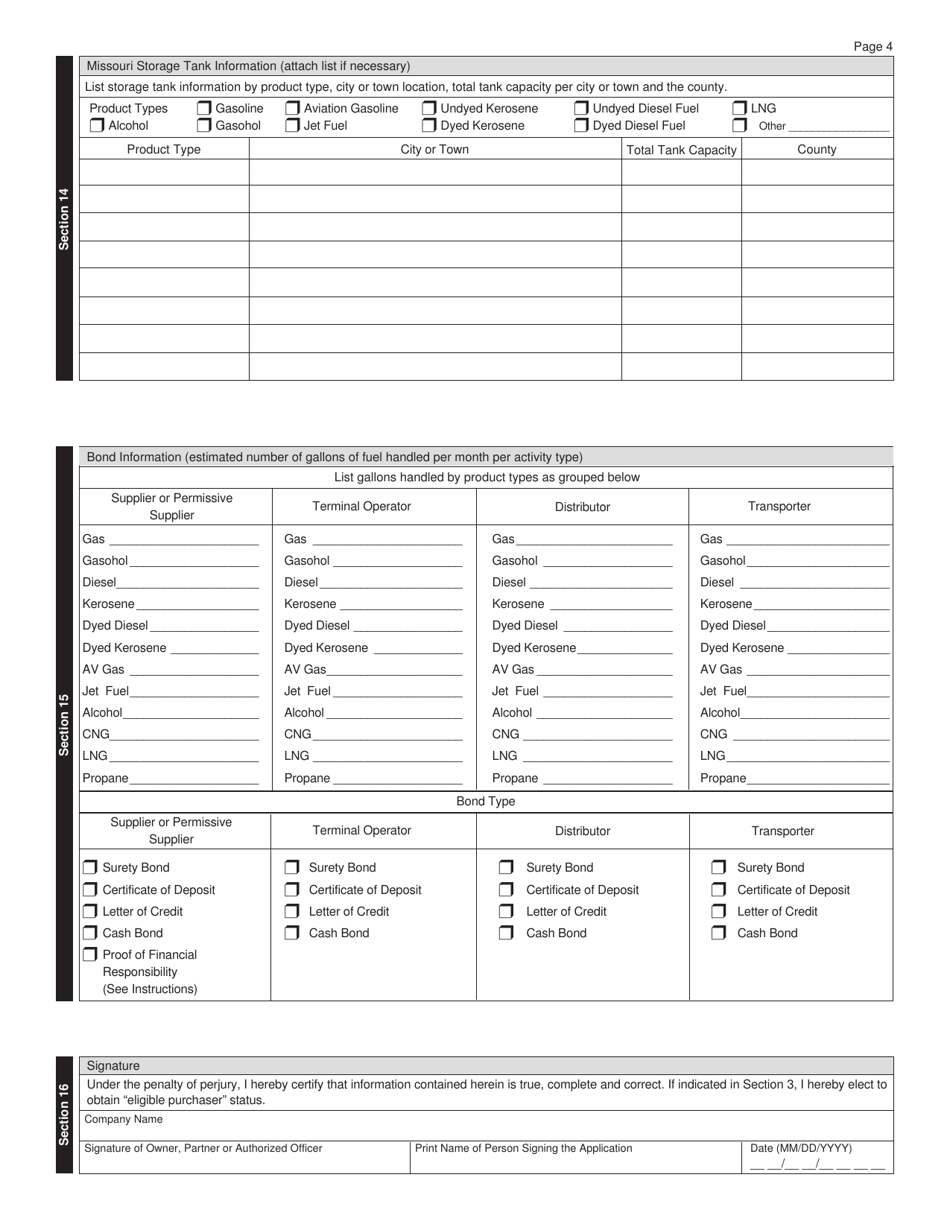

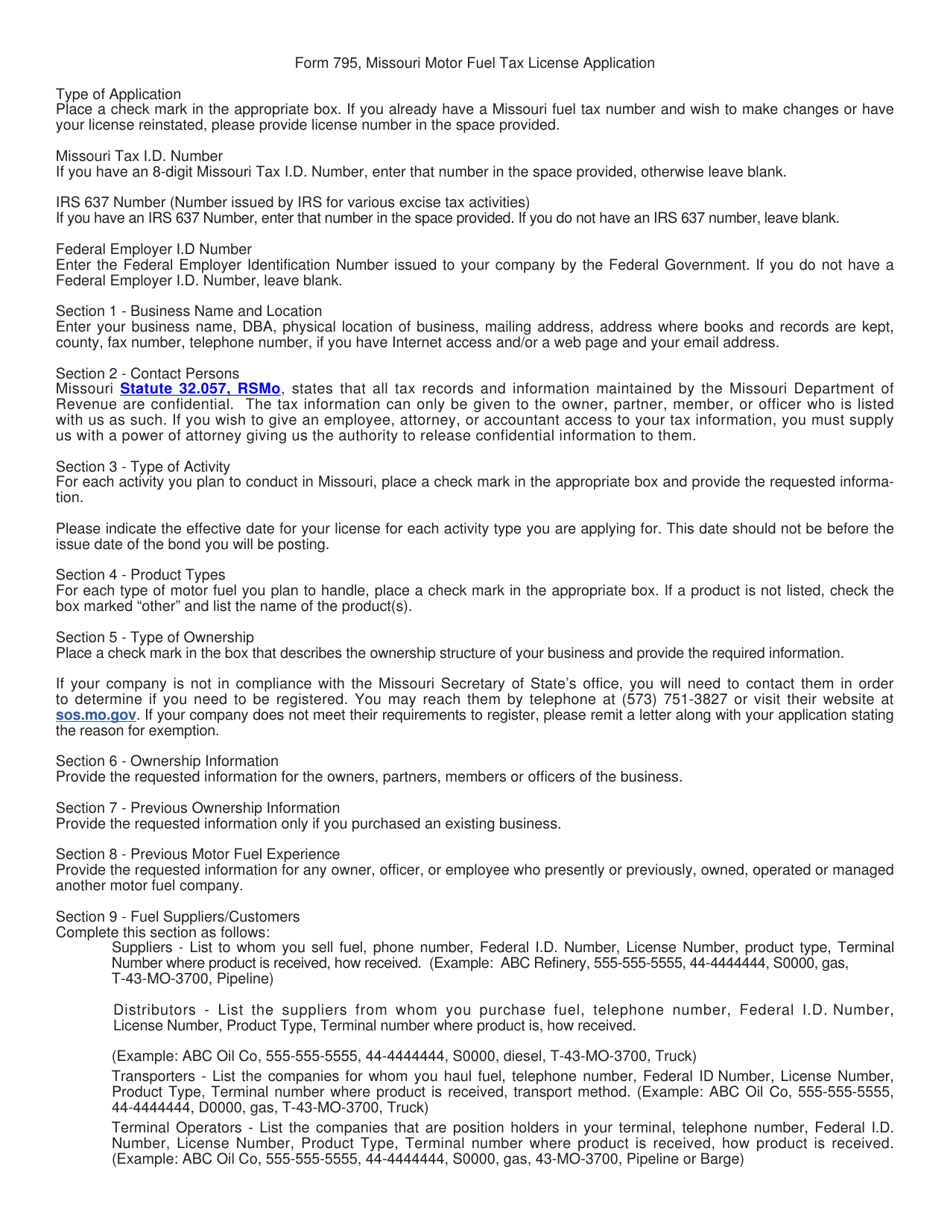

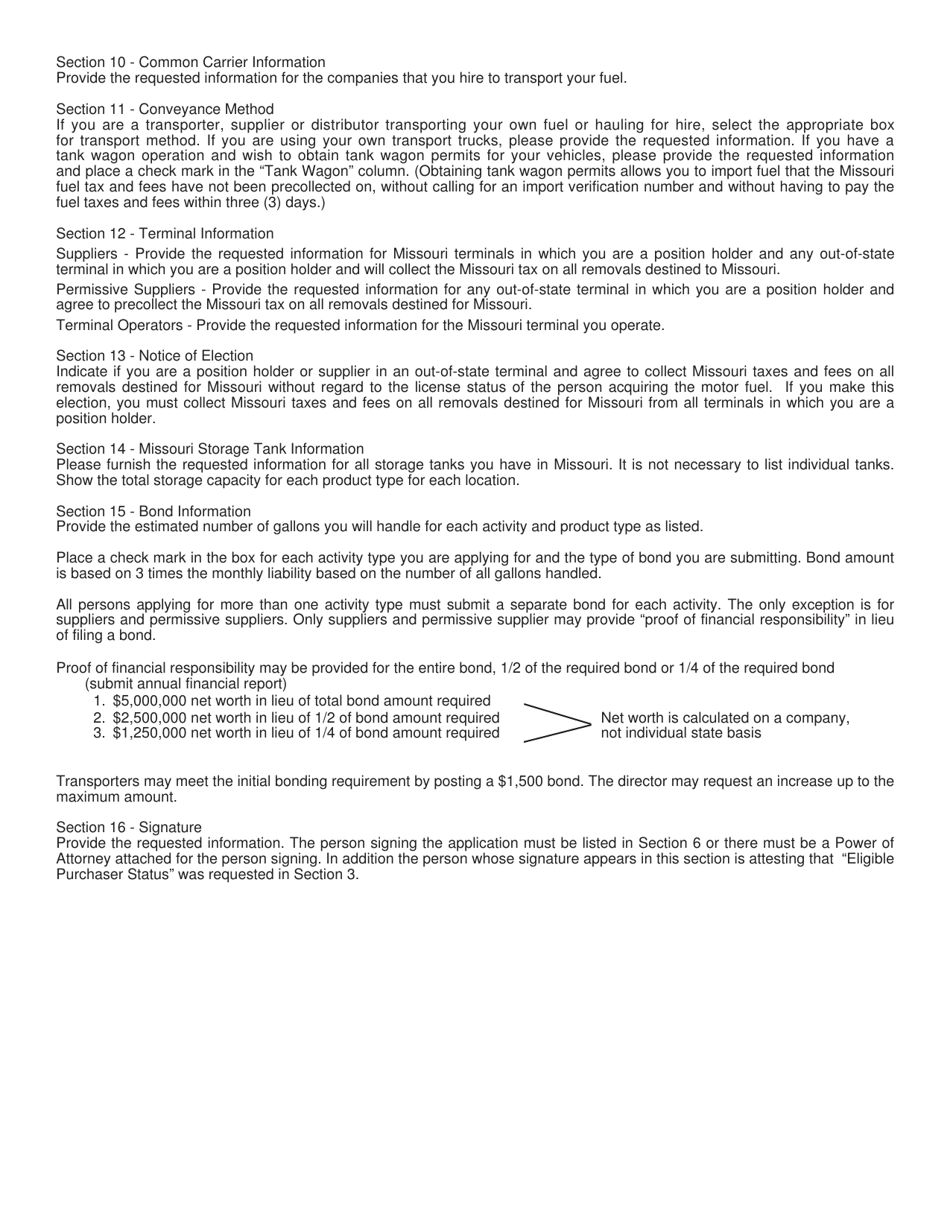

Q: What information is required on Form 795?

A: Form 795 requires information such as your business name, address, contact information, fuel type, and anticipated monthly fuel gallons.

Q: Are there any fees associated with Form 795?

A: There are no fees associated with submitting Form 795.

Q: Is Form 795 only required for businesses?

A: No, Form 795 is also required for individuals who use motor fuel for non-highway purposes.

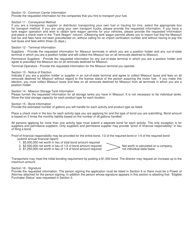

Q: How often do I need to renew my Missouri Motor Fuel Tax License?

A: Your Missouri Motor Fuel Tax License needs to be renewed annually.

Q: What happens if I fail to file Form 795 or renew my Missouri Motor Fuel Tax License?

A: Failure to file Form 795 or renew your Missouri Motor Fuel Tax License can result in penalties and interest charges.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 795 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.