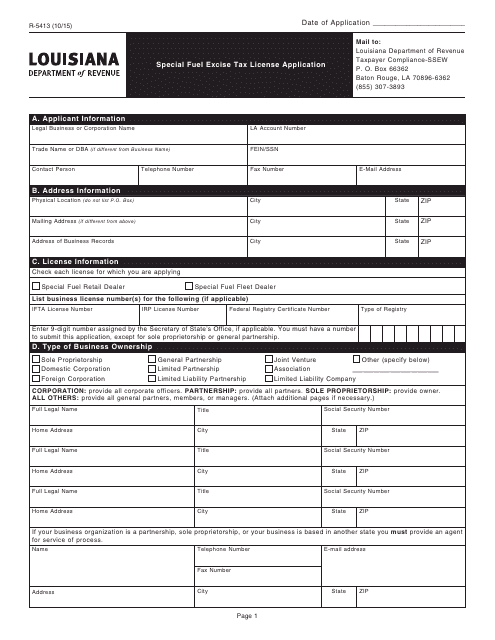

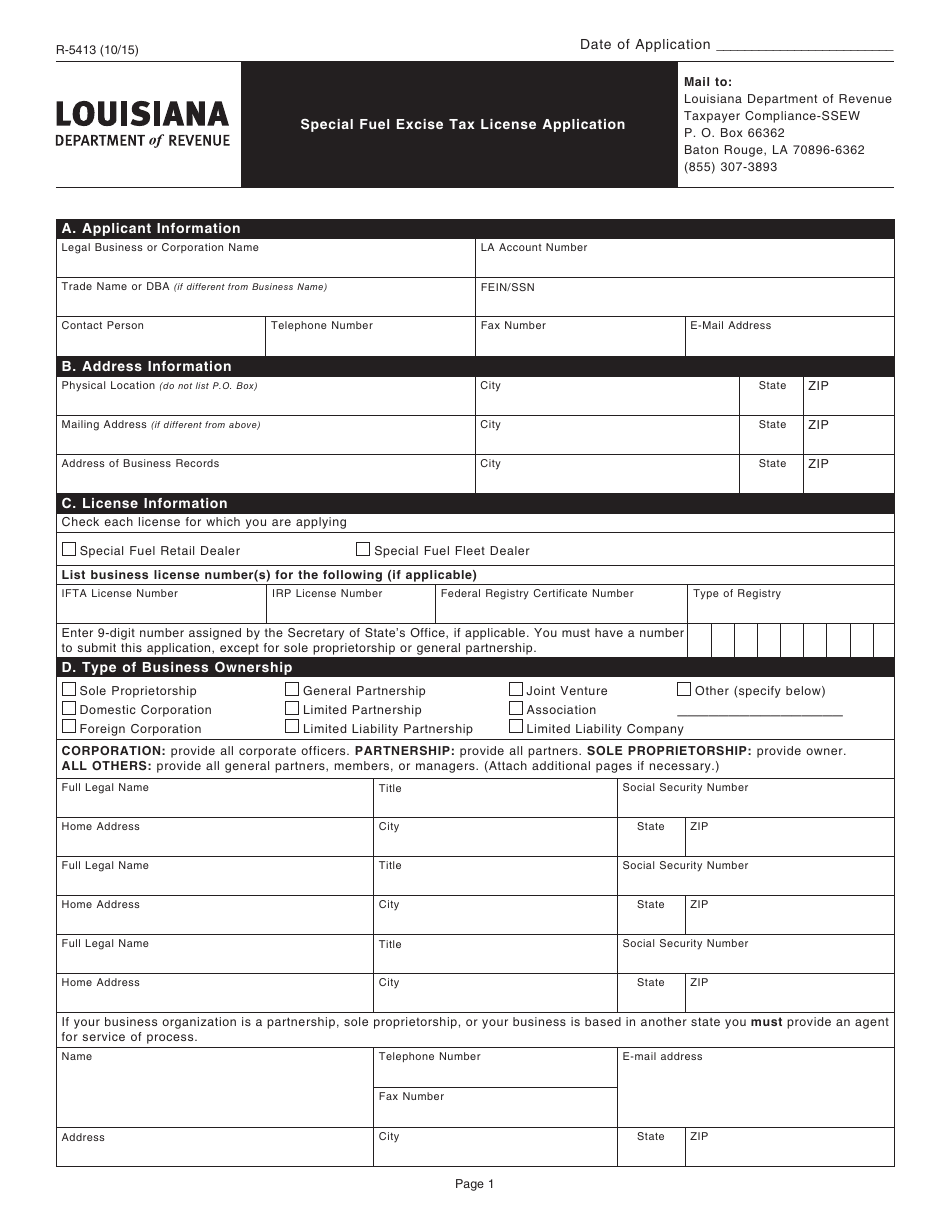

Form R-5413 Special Fuel Excise Tax License Application - Louisiana

What Is Form R-5413?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-5413?

A: Form R-5413 is the Special Fuel Excise Tax License Application for Louisiana.

Q: Who needs to file Form R-5413?

A: Anyone engaged in the business of selling special fuel in Louisiana needs to file Form R-5413.

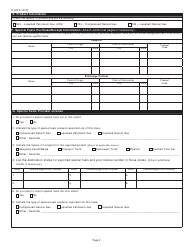

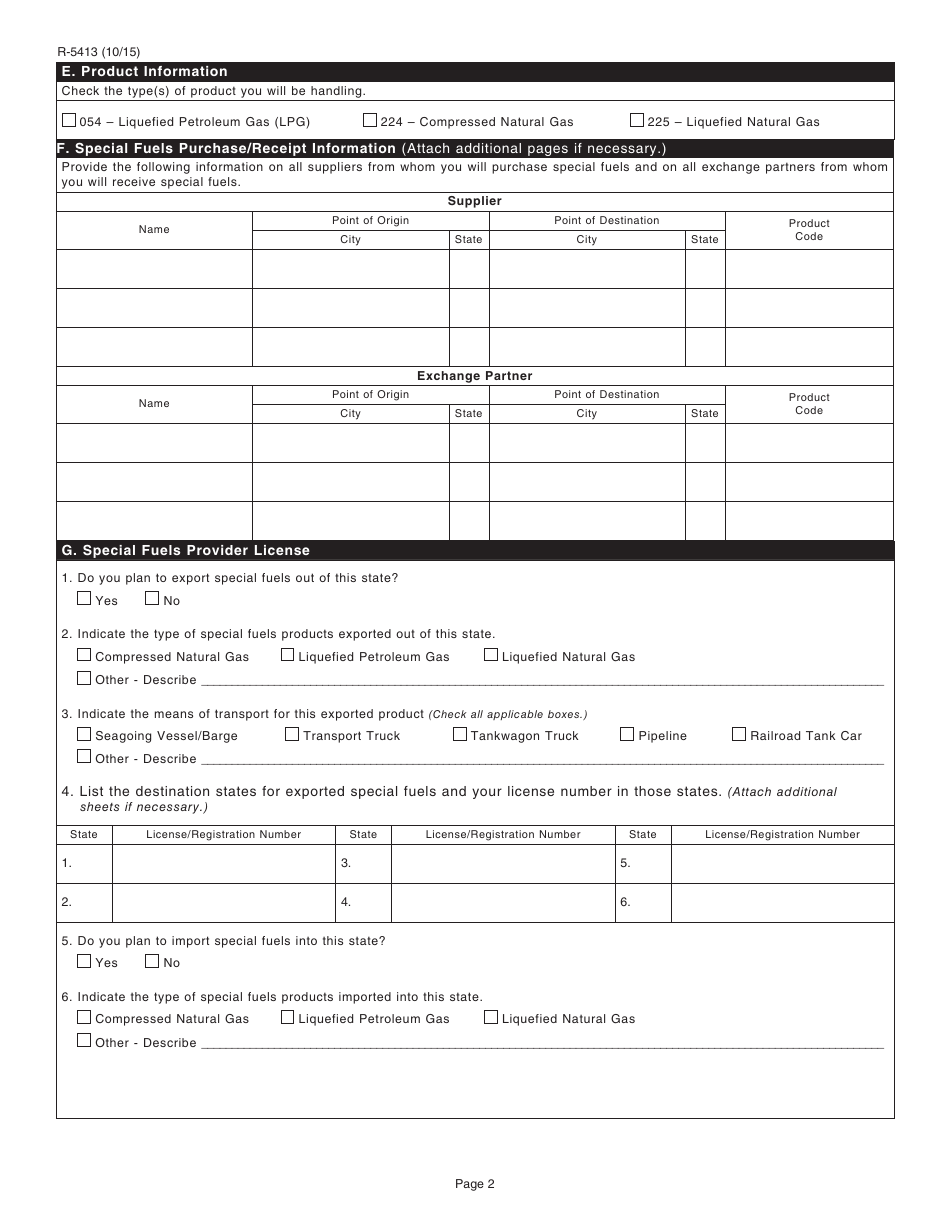

Q: What is special fuel?

A: Special fuel refers to any liquid product used as fuel for propulsion, such as gasoline, diesel, biodiesel, and other alternative fuels.

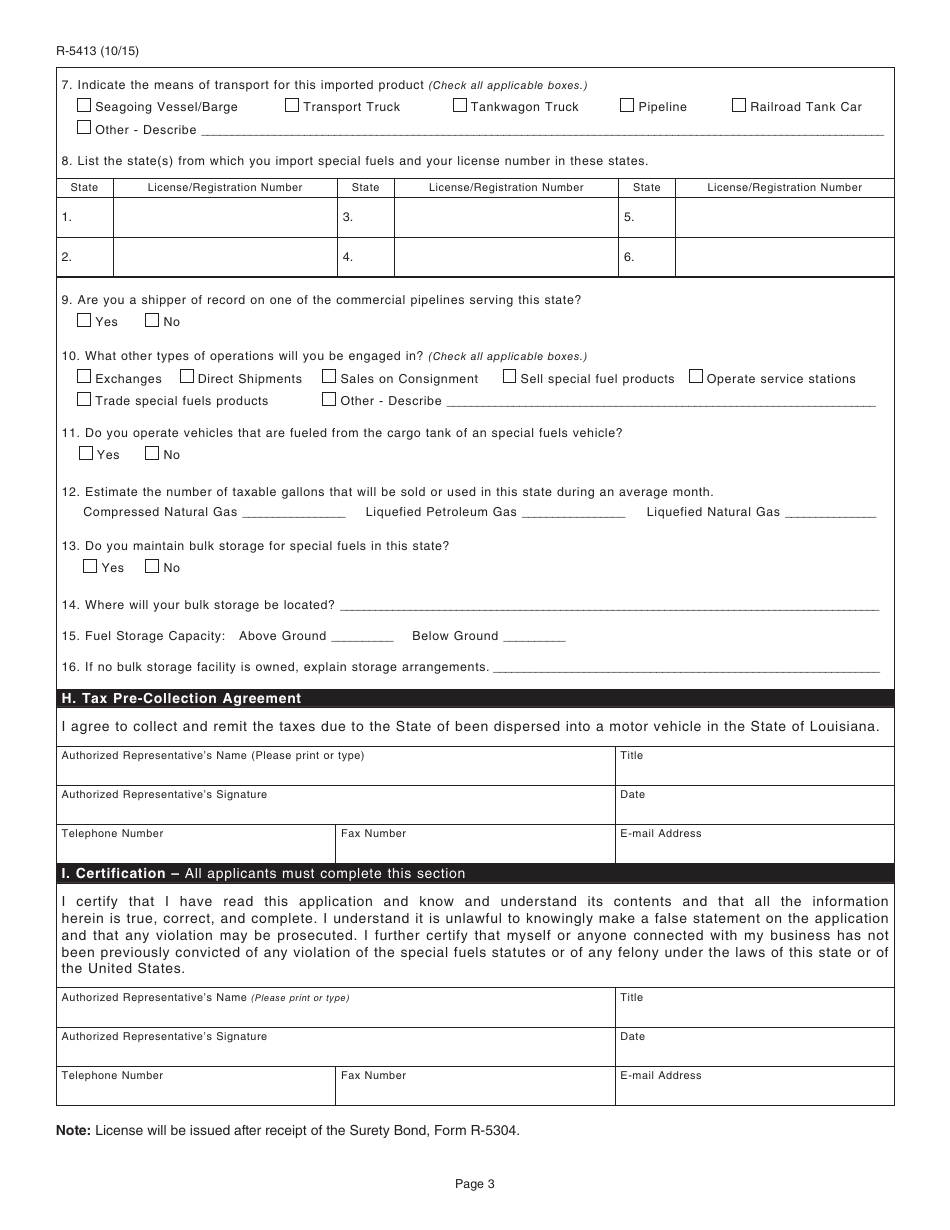

Q: Why do I need a special fuel excise tax license?

A: You need a special fuel excise tax license to sell special fuel in Louisiana and comply with state tax laws.

Q: Are there any fees associated with the special fuel excise tax license?

A: Yes, there is a fee of $100 for the initial application and a $100 annual renewal fee.

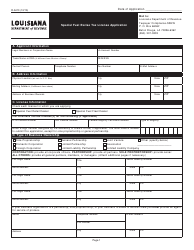

Q: What supporting documents are required with the application?

A: You need to provide a copy of your federal license, any applicable permits, and proof of liability insurance.

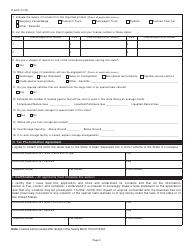

Q: When should I file Form R-5413?

A: You should file Form R-5413 at least 10 days before you plan to engage in the sale of special fuel in Louisiana.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5413 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.