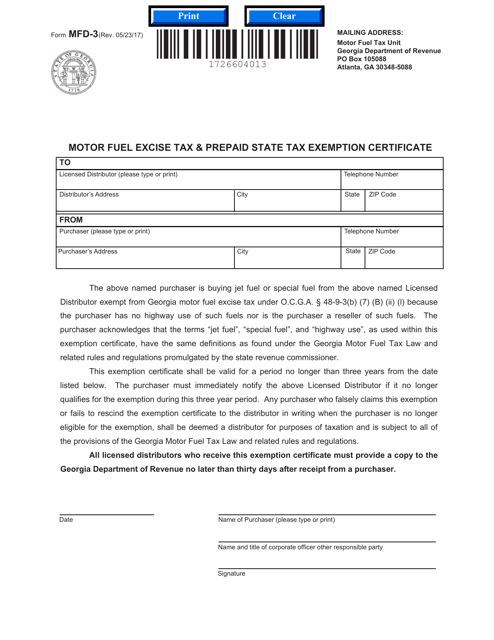

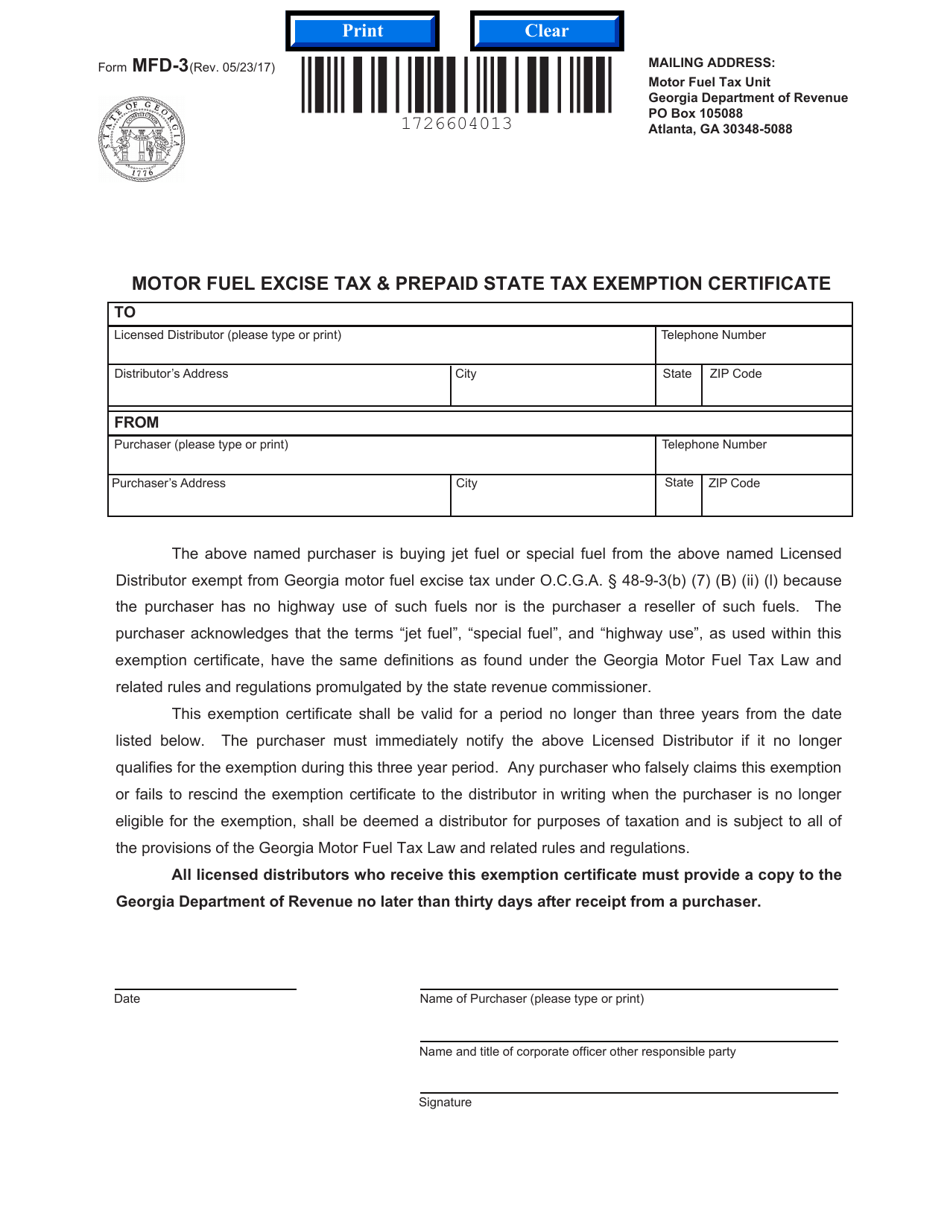

Form MFD-3 Motor Fuel Excise Tax & Prepaid State Tax Exemption Certificate - Georgia (United States)

What Is Form MFD-3?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MFD-3?

A: Form MFD-3 is the Motor Fuel Excise Tax & Prepaid State Tax Exemption Certificate.

Q: What is the purpose of Form MFD-3?

A: The purpose of Form MFD-3 is to claim exemptions from motor fuel excise tax and prepaid state tax in Georgia.

Q: Who should use Form MFD-3?

A: Form MFD-3 should be used by individuals or businesses that are eligible for exemptions from motor fuel excise tax and prepaid state tax in Georgia.

Q: What documentation is required to accompany Form MFD-3?

A: You will need to provide supporting documentation such as invoices, bills of lading, or other proof of exemption eligibility.

Q: When is the deadline to file Form MFD-3?

A: Form MFD-3 should be filed by the 20th day of the month following the end of the reporting period.

Q: What happens if I fail to file Form MFD-3?

A: Failure to file Form MFD-3 or filing it incorrectly may result in penalties or loss of exemption privileges.

Q: Are there any fees associated with filing Form MFD-3?

A: There are no fees associated with filing Form MFD-3.

Form Details:

- Released on May 23, 2017;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MFD-3 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.