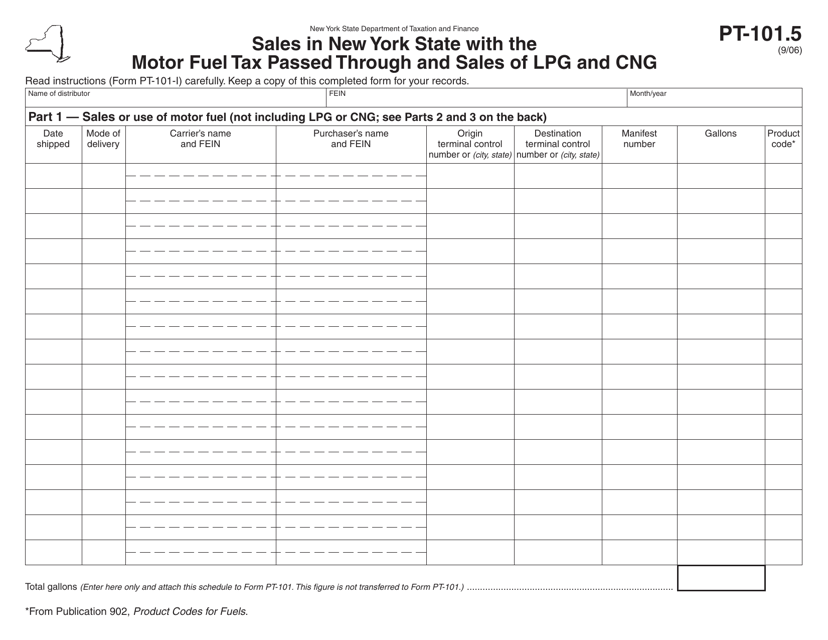

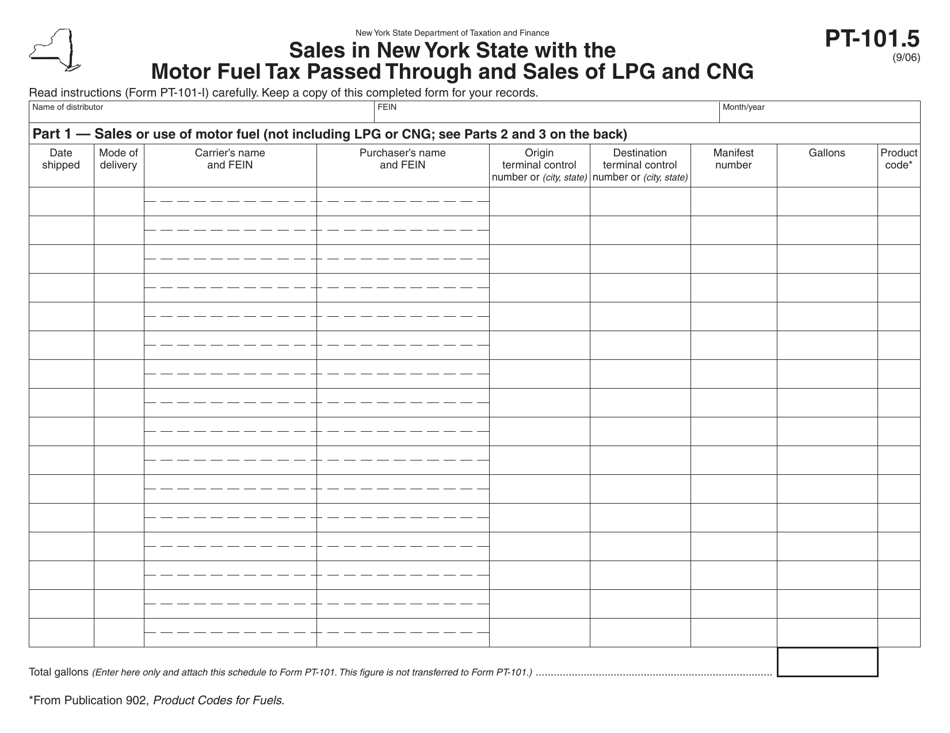

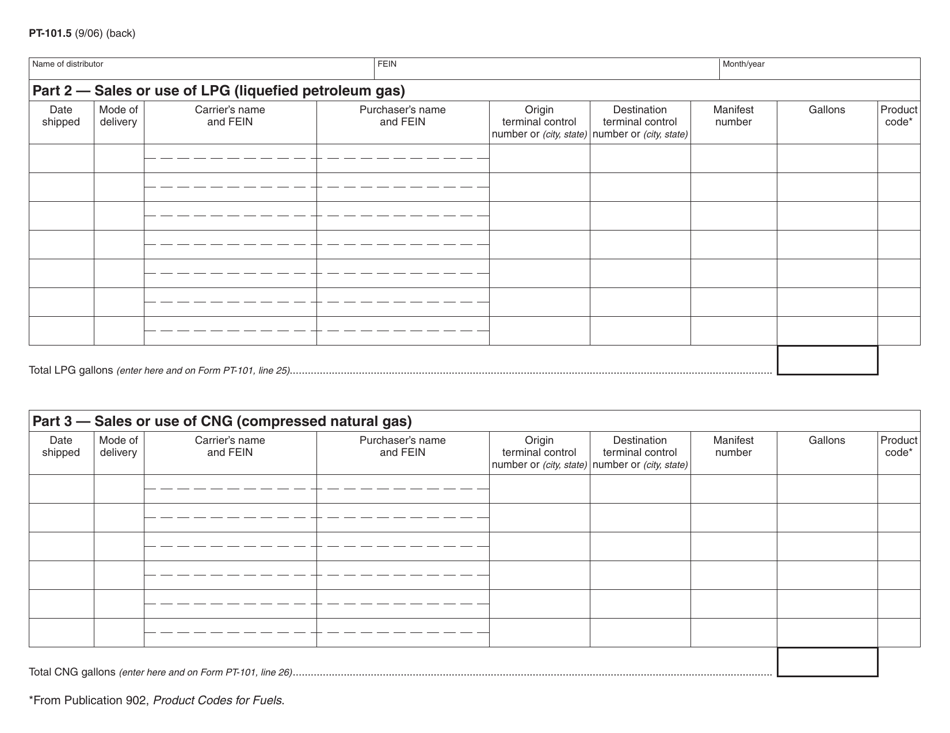

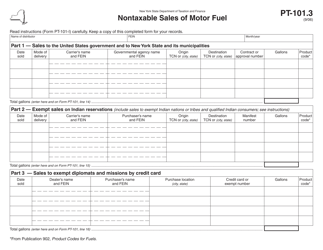

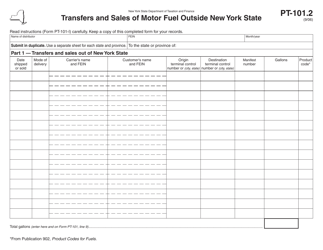

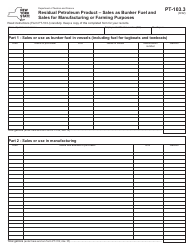

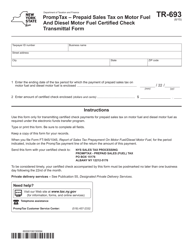

Form PT-101.5 Sales in New York State With the Motor Fuel Tax Passed Through and Sales of Lpg and Cng - New York

What Is Form PT-101.5?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-101.5?

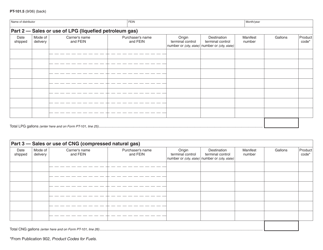

A: Form PT-101.5 is a form used in New York State to report sales with the Motor Fuel Tax Passed Through and Sales of Lpg and Cng.

Q: What does the form PT-101.5 report?

A: The form PT-101.5 reports sales in New York State with the Motor Fuel Tax Passed Through and Sales of Lpg and Cng.

Q: Who needs to file Form PT-101.5?

A: Anyone who has sales in New York State with the Motor Fuel Tax Passed Through and Sales of Lpg and Cng needs to file Form PT-101.5.

Q: What is Motor Fuel Tax Passed Through?

A: Motor Fuel Tax Passed Through refers to the tax on motor fuel that is passed on to the consumer.

Q: What is Lpg?

A: Lpg stands for liquefied petroleum gas, which is a flammable hydrocarbon gas used as fuel.

Q: What is Cng?

A: Cng stands for compressed natural gas, which is a cleaner-burning alternative fuel for vehicles.

Form Details:

- Released on September 1, 2006;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-101.5 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.