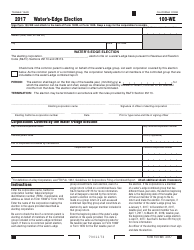

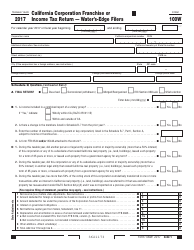

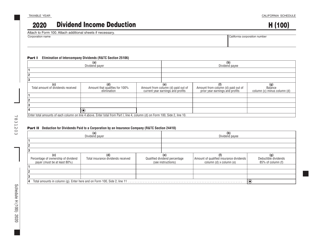

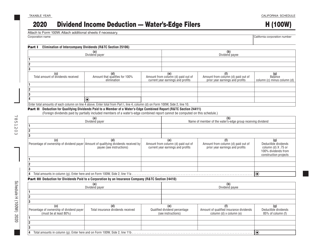

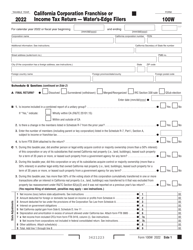

Instructions for Form 100W Schedule H Dividend Income Deduction " Water's-Edge Filers - California

This document contains official instructions for Form 100W Schedule H, Dividend Income Deduction '" Water's-Edge Filers - a form released and collected by the California Franchise Tax Board.

FAQ

Q: What is Form 100W Schedule H?

A: Form 100W Schedule H is a tax form used by water's-edge filers in California.

Q: Who needs to file Form 100W Schedule H?

A: Water's-edge filers in California need to file Form 100W Schedule H.

Q: What is the purpose of Form 100W Schedule H?

A: The purpose of Form 100W Schedule H is to claim the dividend income deduction for water's-edge filers in California.

Q: What is the dividend income deduction?

A: The dividend income deduction is a deduction that reduces the amount of taxable dividend income for water's-edge filers in California.

Q: How do I fill out Form 100W Schedule H?

A: To fill out Form 100W Schedule H, you need to provide information about your dividend income and calculate the deduction.

Q: When is the deadline to file Form 100W Schedule H?

A: The deadline to file Form 100W Schedule H is the same as the deadline for filing your California tax return.

Q: Are there any specific requirements for claiming the dividend income deduction?

A: Yes, there are specific requirements that must be met to claim the dividend income deduction. These requirements are outlined in the instructions for Form 100W Schedule H.

Q: What happens if I don't file Form 100W Schedule H?

A: If you are a water's-edge filer in California and you don't file Form 100W Schedule H, you may not be able to claim the dividend income deduction.

Q: Can I e-file Form 100W Schedule H?

A: Yes, you can e-file Form 100W Schedule H if you file your California tax return electronically.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Franchise Tax Board.