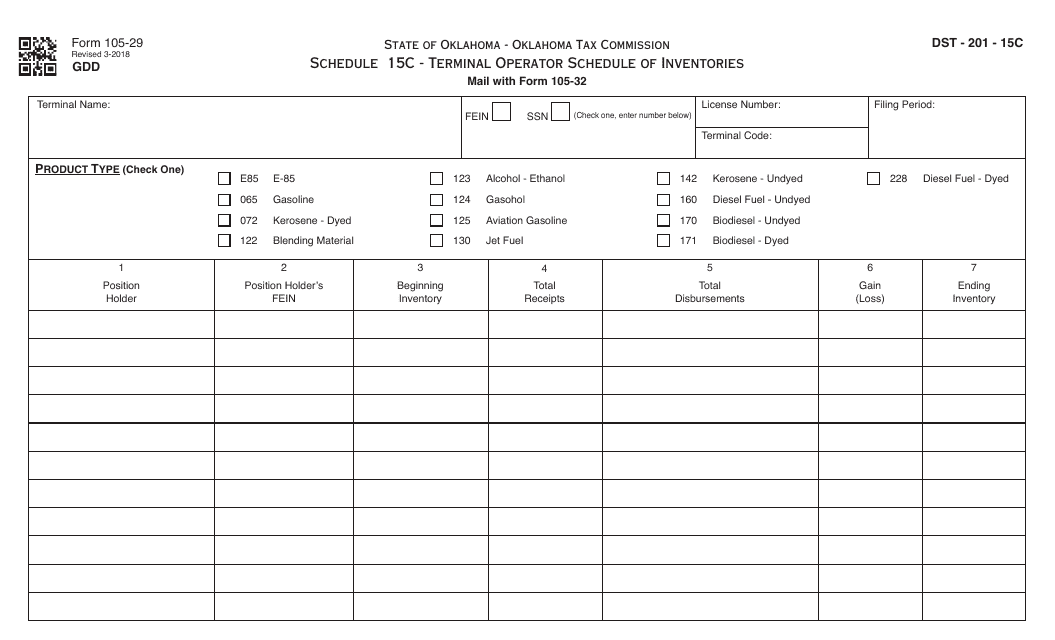

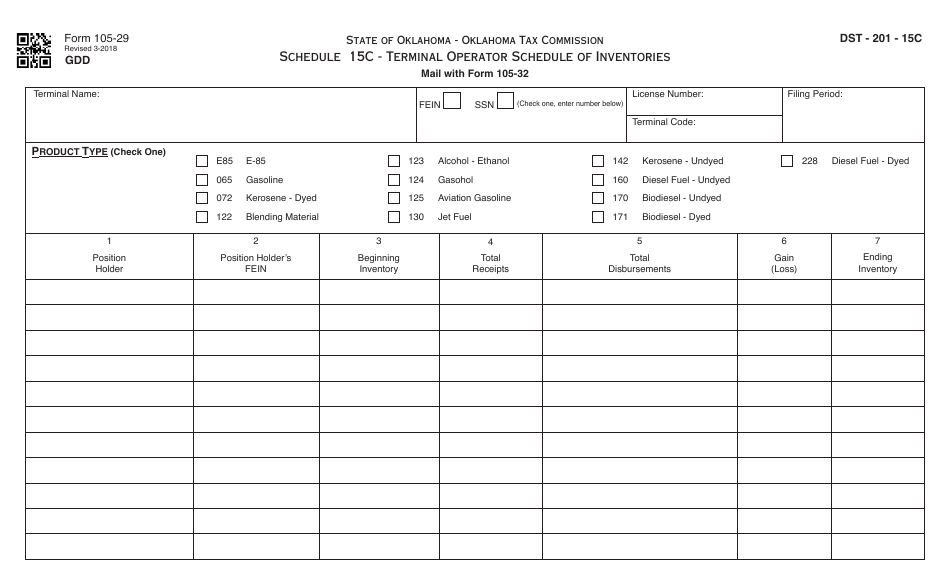

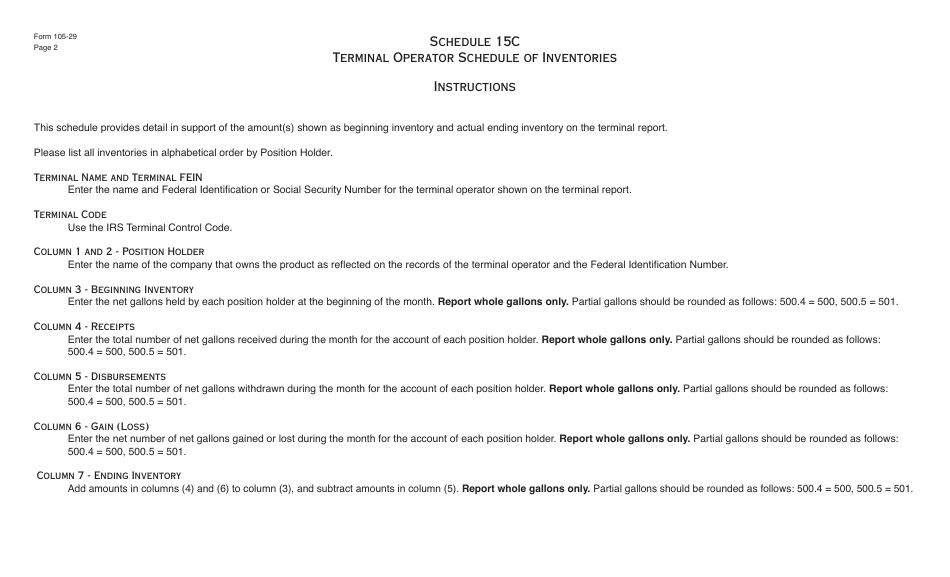

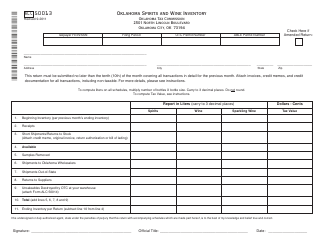

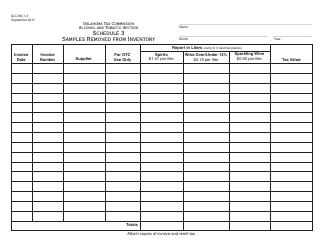

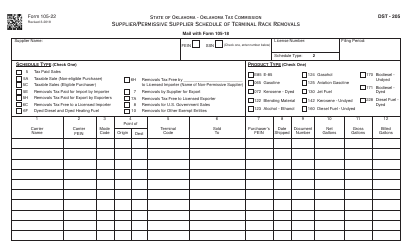

OTC Form 105-29 Schedule 15C Terminal Operator Schedule of Inventories - Oklahoma

What Is OTC Form 105-29 Schedule 15C?

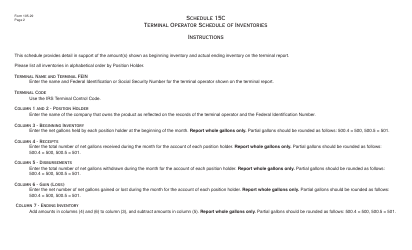

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 105-29 Schedule 15C?

A: OTC Form 105-29 Schedule 15C is a form used in Oklahoma for reporting a terminal operator's schedule of inventories.

Q: Who needs to file OTC Form 105-29 Schedule 15C?

A: Terminal operators in Oklahoma need to file OTC Form 105-29 Schedule 15C.

Q: What does OTC stand for in OTC Form 105-29 Schedule 15C?

A: OTC stands for Oklahoma Tax Commission.

Q: What is the purpose of OTC Form 105-29 Schedule 15C?

A: The purpose of OTC Form 105-29 Schedule 15C is to report a terminal operator's inventories to the Oklahoma Tax Commission.

Q: Is OTC Form 105-29 Schedule 15C only applicable in Oklahoma?

A: Yes, OTC Form 105-29 Schedule 15C is specific to Oklahoma and is not used in other states or jurisdictions.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 105-29 Schedule 15C by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.