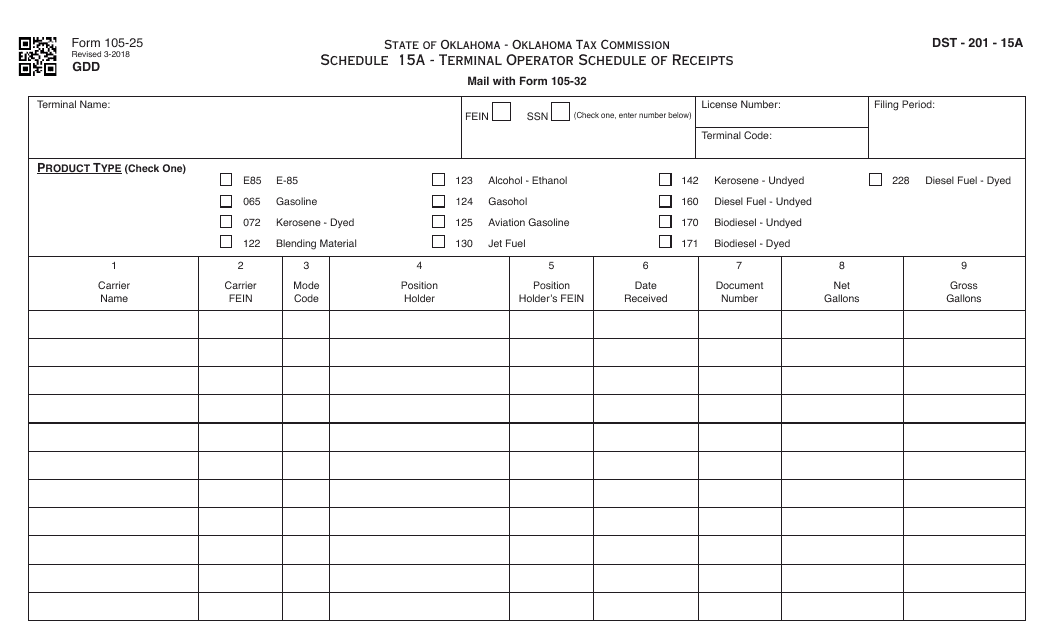

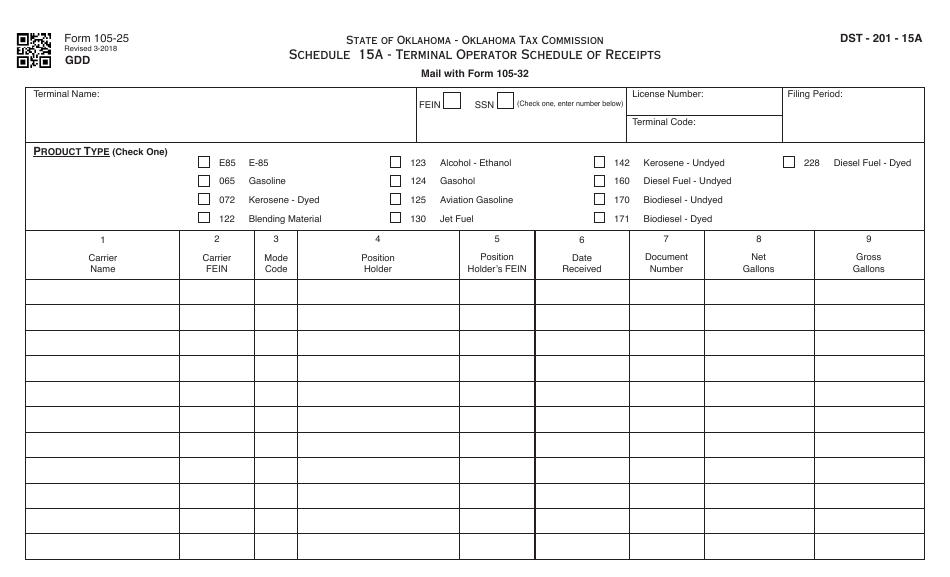

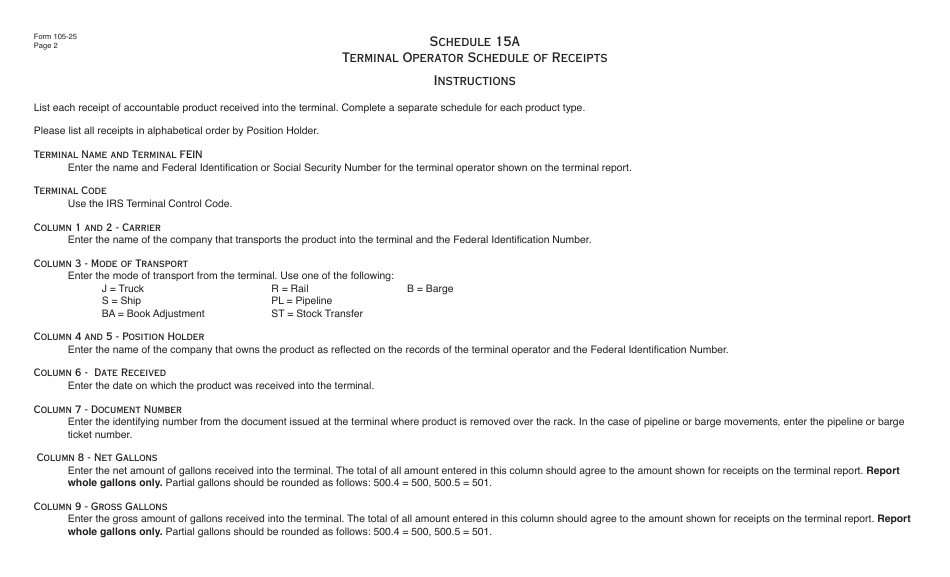

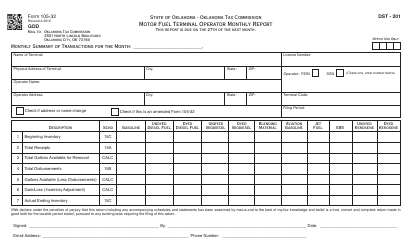

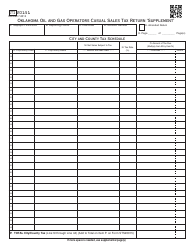

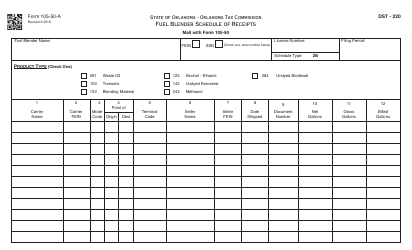

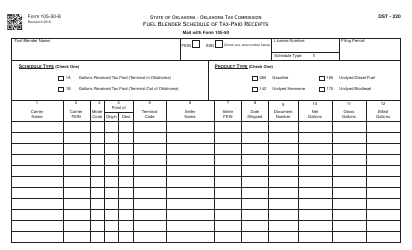

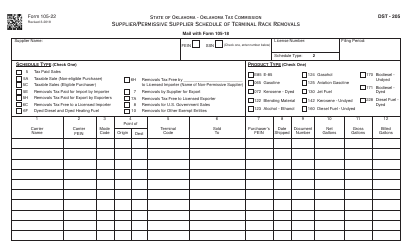

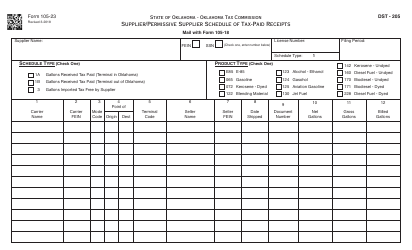

OTC Form 105-25 Schedule 15A Terminal Operator Schedule of Receipts - Oklahoma

What Is OTC Form 105-25 Schedule 15A?

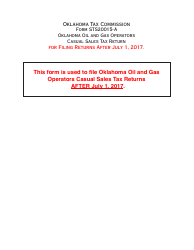

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 105-25?

A: OTC Form 105-25 is a document used for reporting receipts by terminal operators in Oklahoma.

Q: What is Schedule 15A?

A: Schedule 15A is a specific section within OTC Form 105-25 that is used by terminal operators.

Q: What does Schedule 15A include?

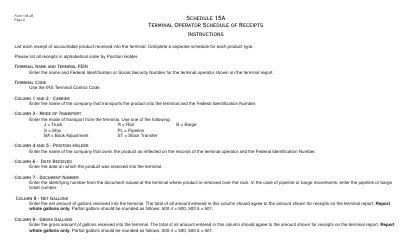

A: Schedule 15A includes information about the receipts acquired by the terminal operator.

Q: Who uses OTC Form 105-25?

A: Terminal operators in Oklahoma use OTC Form 105-25.

Q: What is the purpose of OTC Form 105-25?

A: The purpose of OTC Form 105-25 is to report and document receipts acquired by terminal operators in Oklahoma.

Q: What kind of receipts are reported in Schedule 15A?

A: Schedule 15A reports the receipts acquired by terminal operators, which can include various types of products or goods.

Q: Is OTC Form 105-25 specific to Oklahoma?

A: Yes, OTC Form 105-25 is specific to Oklahoma and is used by terminal operators in the state.

Q: Are terminal operators required to file OTC Form 105-25?

A: Yes, terminal operators in Oklahoma are required to file OTC Form 105-25 to report their receipts.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 105-25 Schedule 15A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.