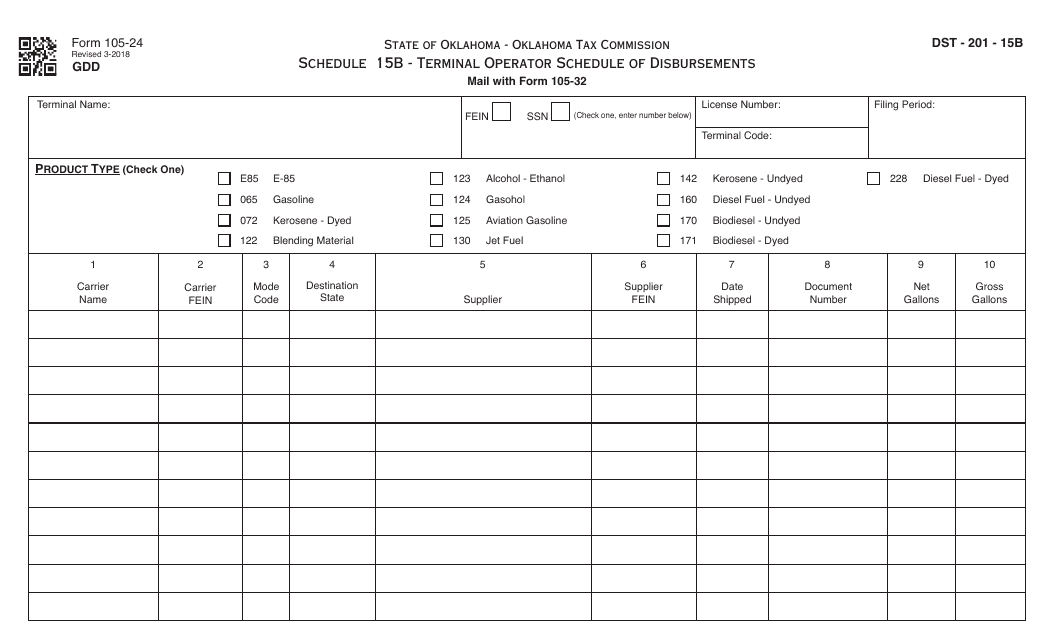

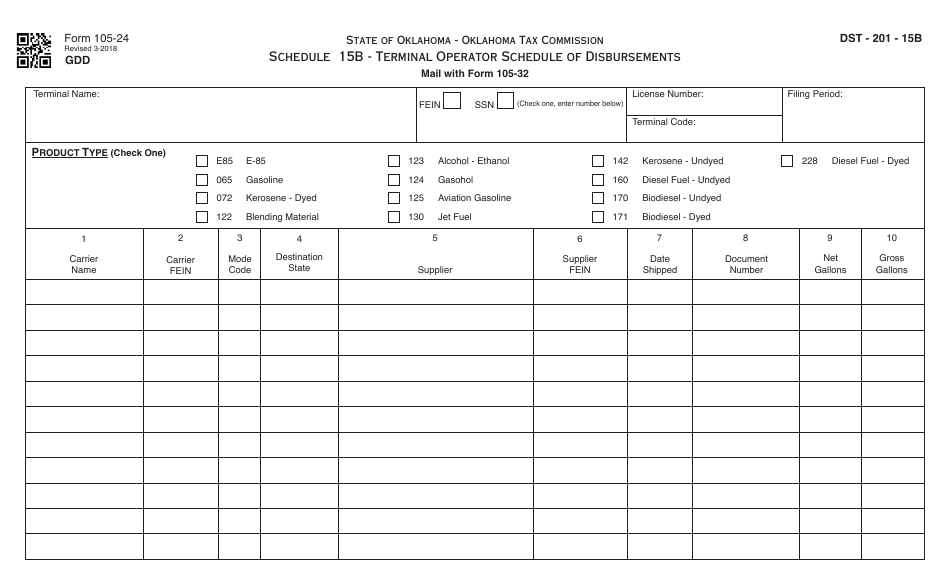

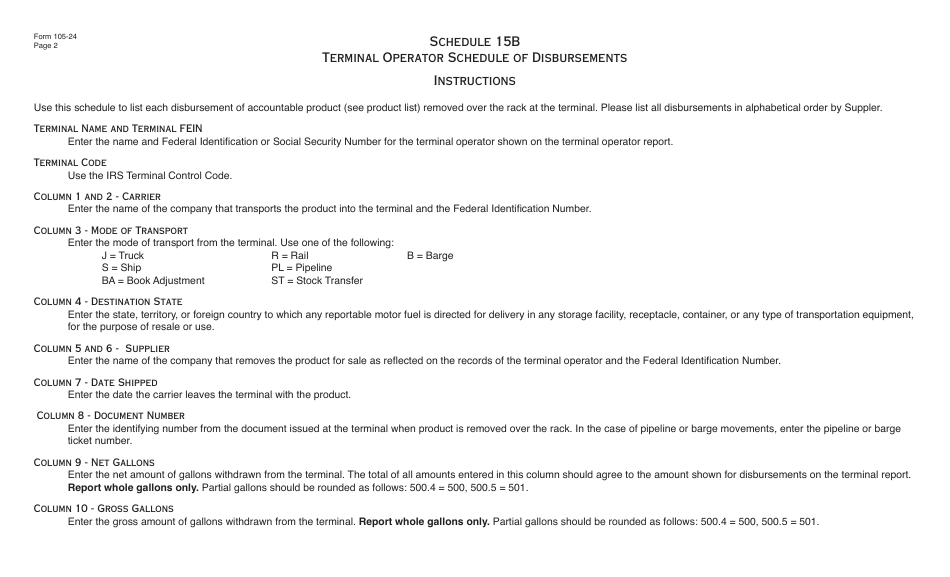

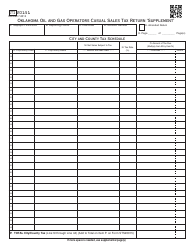

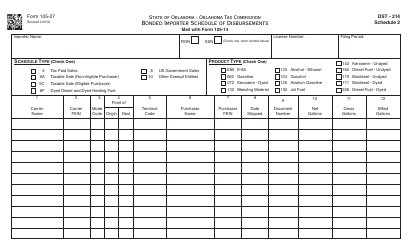

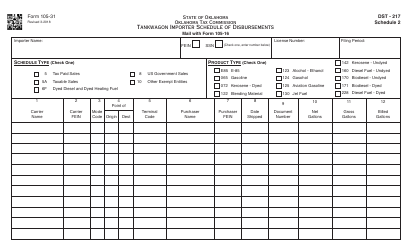

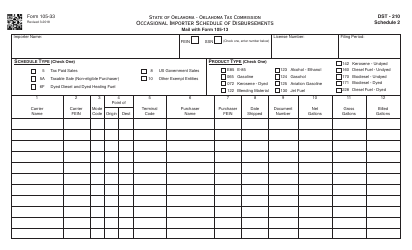

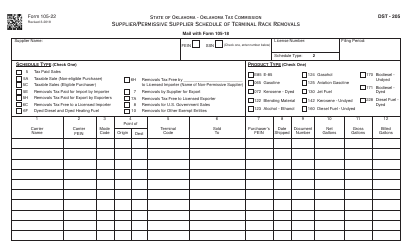

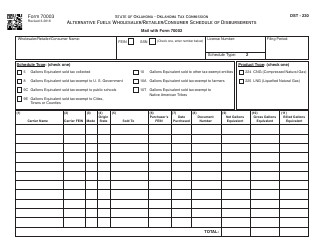

OTC Form 105-24 Schedule 15B Terminal Operator Schedule of Disbursements - Oklahoma

What Is OTC Form 105-24 Schedule 15B?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 105-24 Schedule 15B?

A: OTC Form 105-24 Schedule 15B is a document used for reporting the schedule of disbursements by terminal operators in Oklahoma.

Q: What is a Terminal Operator?

A: A terminal operator is a person or company that operates a terminal facility where petroleum products are stored or distributed.

Q: What is the purpose of Schedule 15B?

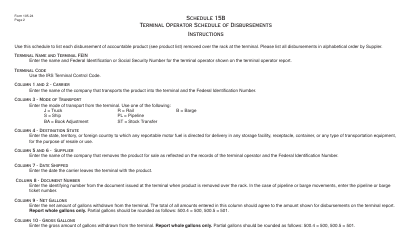

A: The purpose of Schedule 15B is to provide a detailed breakdown of the disbursements made by terminal operators, including information about taxes paid, credits applied, and other relevant financial information.

Q: Who is required to file Schedule 15B?

A: Terminal operators in Oklahoma are required to file Schedule 15B.

Q: How often is Schedule 15B filed?

A: Schedule 15B is filed monthly by terminal operators.

Q: Are there any penalties for late or non-filing of Schedule 15B?

A: Yes, there are penalties for late or non-filing of Schedule 15B. It is important to file the form by the specified due date to avoid penalties.

Q: What kind of information is required in Schedule 15B?

A: Schedule 15B requires terminal operators to provide information about their disbursements, including details about taxes paid, credits applied, and other financial information.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 105-24 Schedule 15B by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.