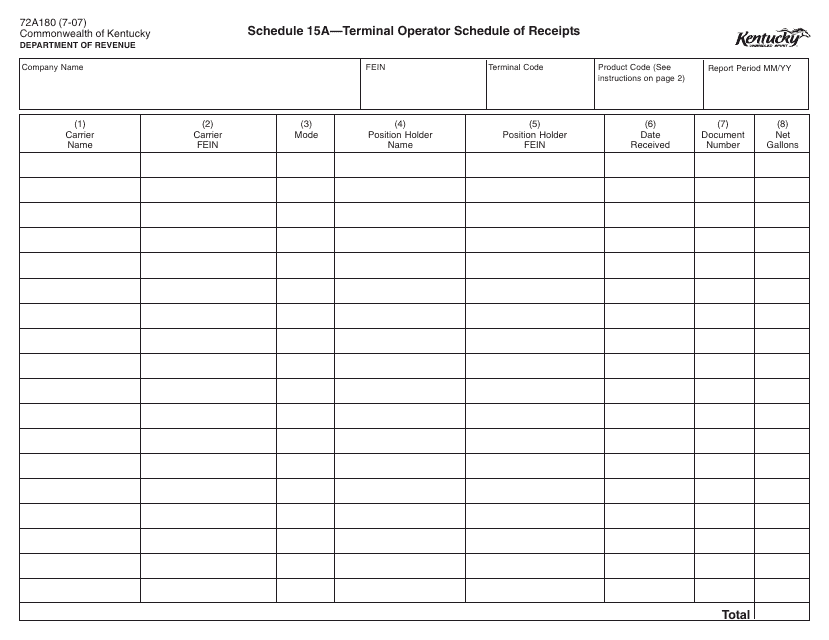

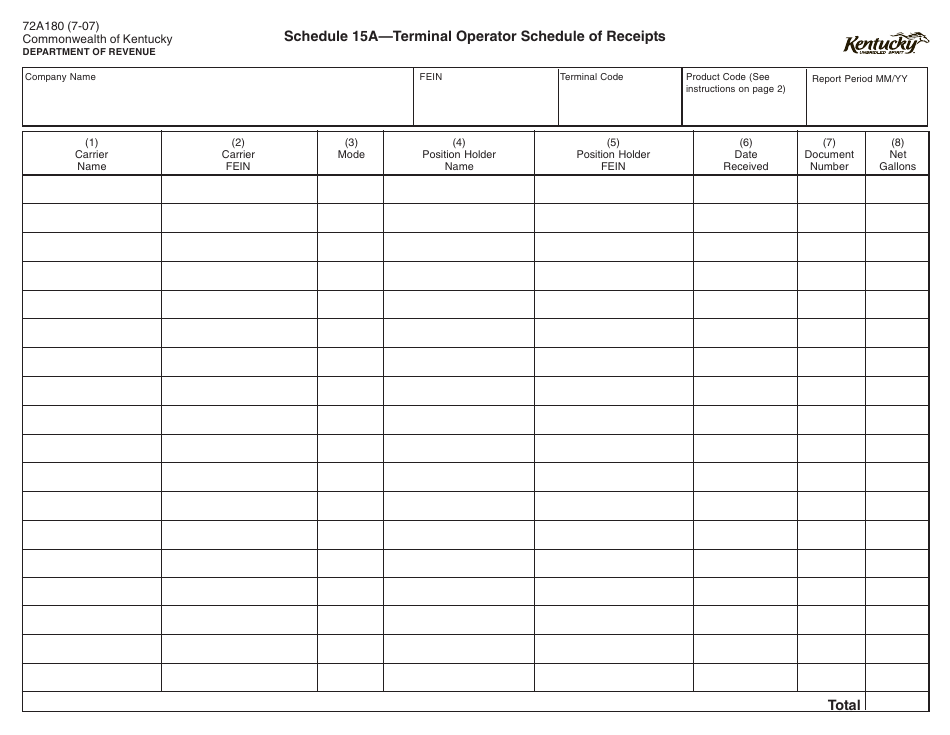

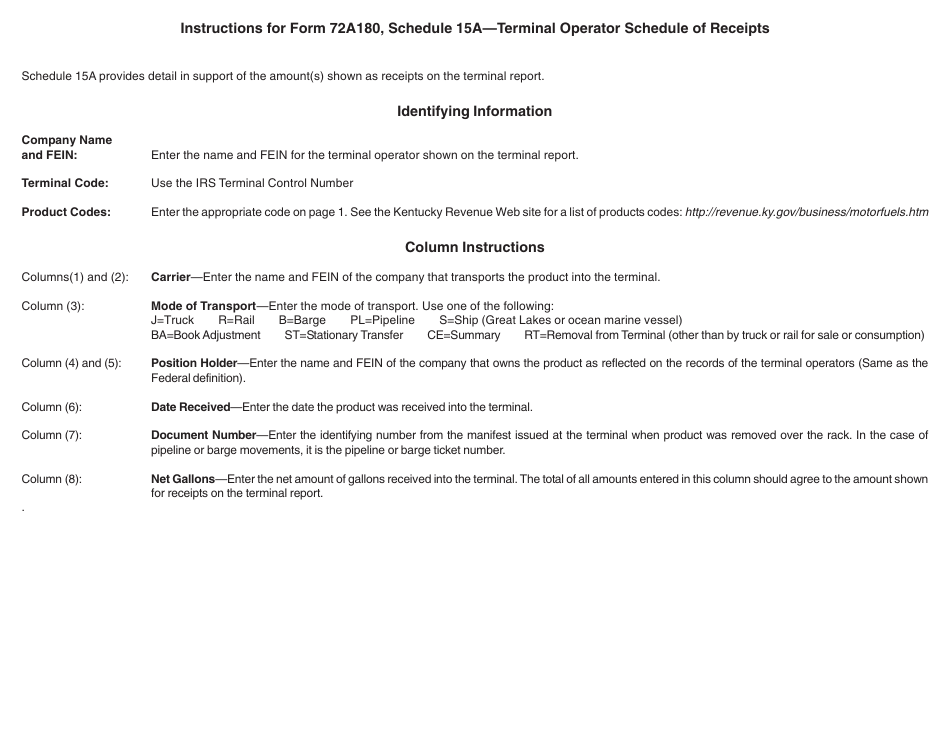

Form 72A180 Schedule 15A Terminal Operator Schedule of Receipts - Kentucky

What Is Form 72A180 Schedule 15A?

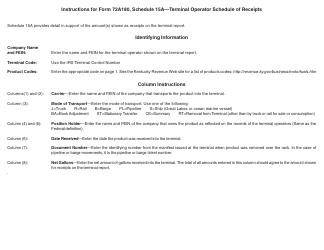

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 72A180?

A: Form 72A180 is a schedule used for reporting receipts by terminal operators in Kentucky.

Q: What is Schedule 15A?

A: Schedule 15A is a specific schedule within Form 72A180 that focuses on terminal operator receipts.

Q: What is a terminal operator?

A: A terminal operator is a person or company responsible for the operation of a terminal, such as a storage facility or distribution center.

Q: What are receipts?

A: Receipts refer to the income or revenue generated by the terminal operator.

Q: Why is it important to report receipts?

A: Reporting receipts is important for accurate tax assessment and compliance with state regulations.

Form Details:

- Released on July 1, 2007;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 72A180 Schedule 15A by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.