This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 4720

for the current year.

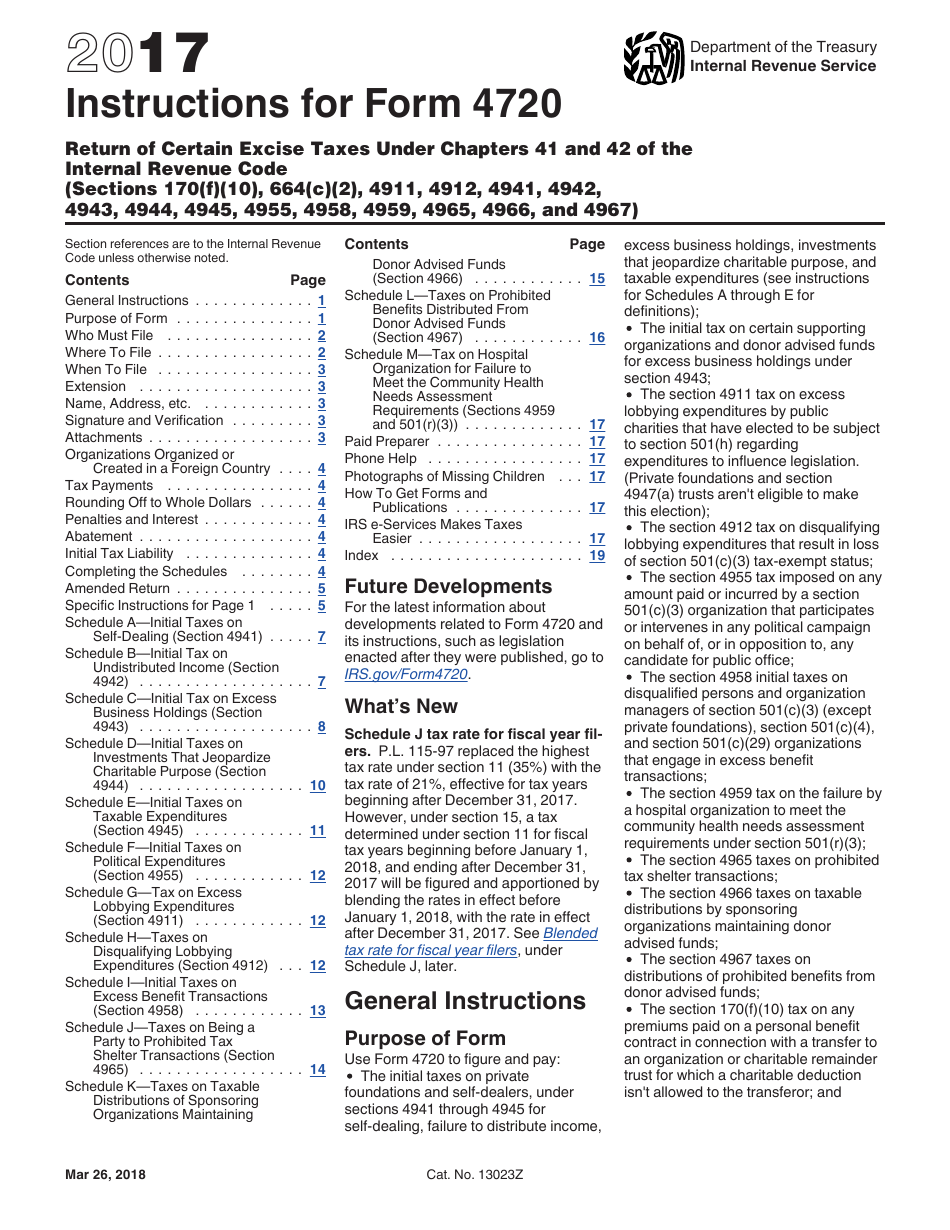

Instructions for IRS Form 4720 Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code

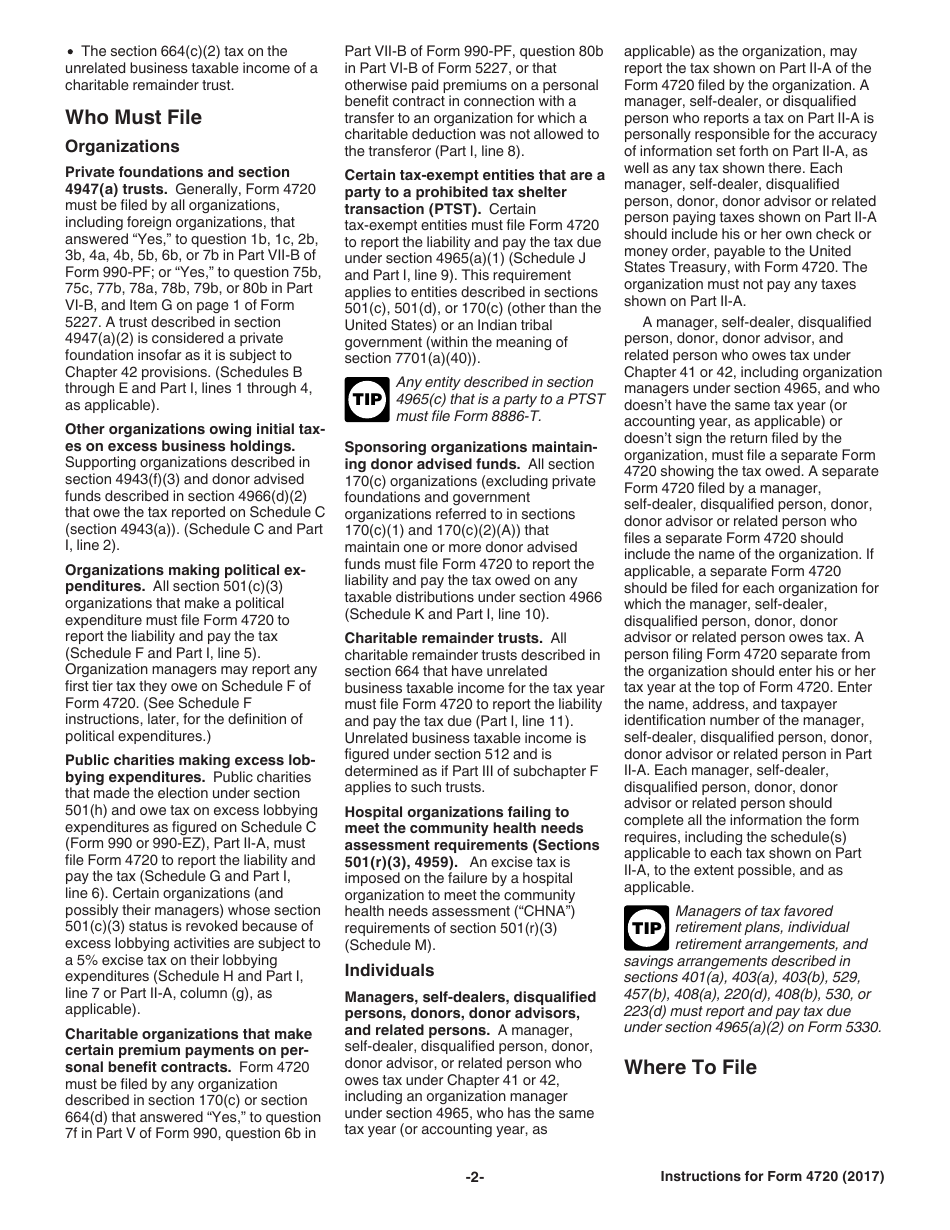

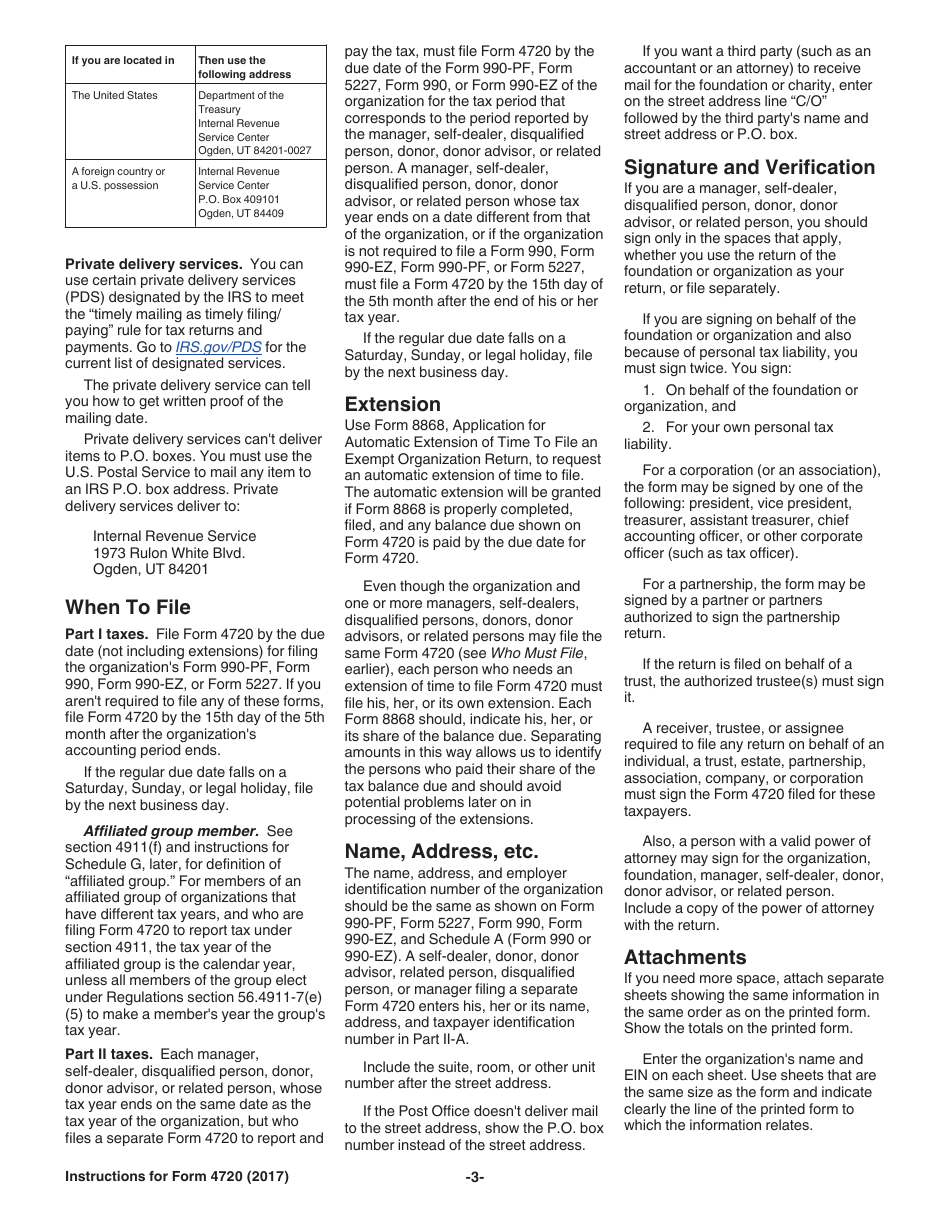

This document contains official instructions for IRS Form 4720 , Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 4720?

A: IRS Form 4720 is a form used to report and pay certain excise taxes under Chapters 41 and 42 of the Internal Revenue Code.

Q: What are excise taxes?

A: Excise taxes are taxes imposed on the sale or use of certain goods or services, such as alcohol, tobacco, and transportation fuels.

Q: Which chapters of the Internal Revenue Code does Form 4720 cover?

A: Form 4720 covers excise taxes under Chapters 41 and 42 of the Internal Revenue Code.

Q: When is Form 4720 due?

A: Form 4720 is generally due on the 15th day of the 5th month after the end of the organization's tax year.

Q: What information do I need to complete Form 4720?

A: You will need information such as your organization's name, taxpayer identification number, and details of the excise taxes you owe.

Q: Can I file Form 4720 electronically?

A: Currently, Form 4720 cannot be filed electronically. You must mail a paper copy of the form.

Q: Are there any penalties for failing to file Form 4720?

A: Yes, there can be penalties for failing to file Form 4720, such as a failure-to-file penalty and potential interest on unpaid taxes.

Q: Can I claim a refund on Form 4720?

A: Yes, you can claim a refund on Form 4720 if you overpaid your excise taxes.

Instruction Details:

- This 19-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.