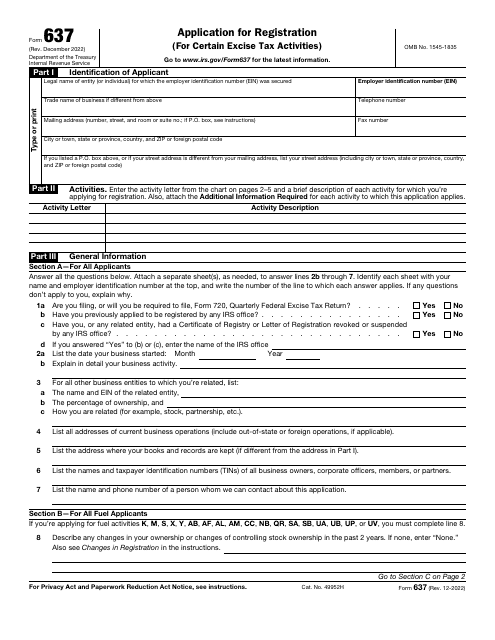

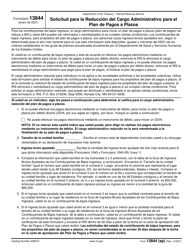

IRS Form 637 Application for Registration (For Certain Excise Tax Activities)

What Is IRS Form 637?

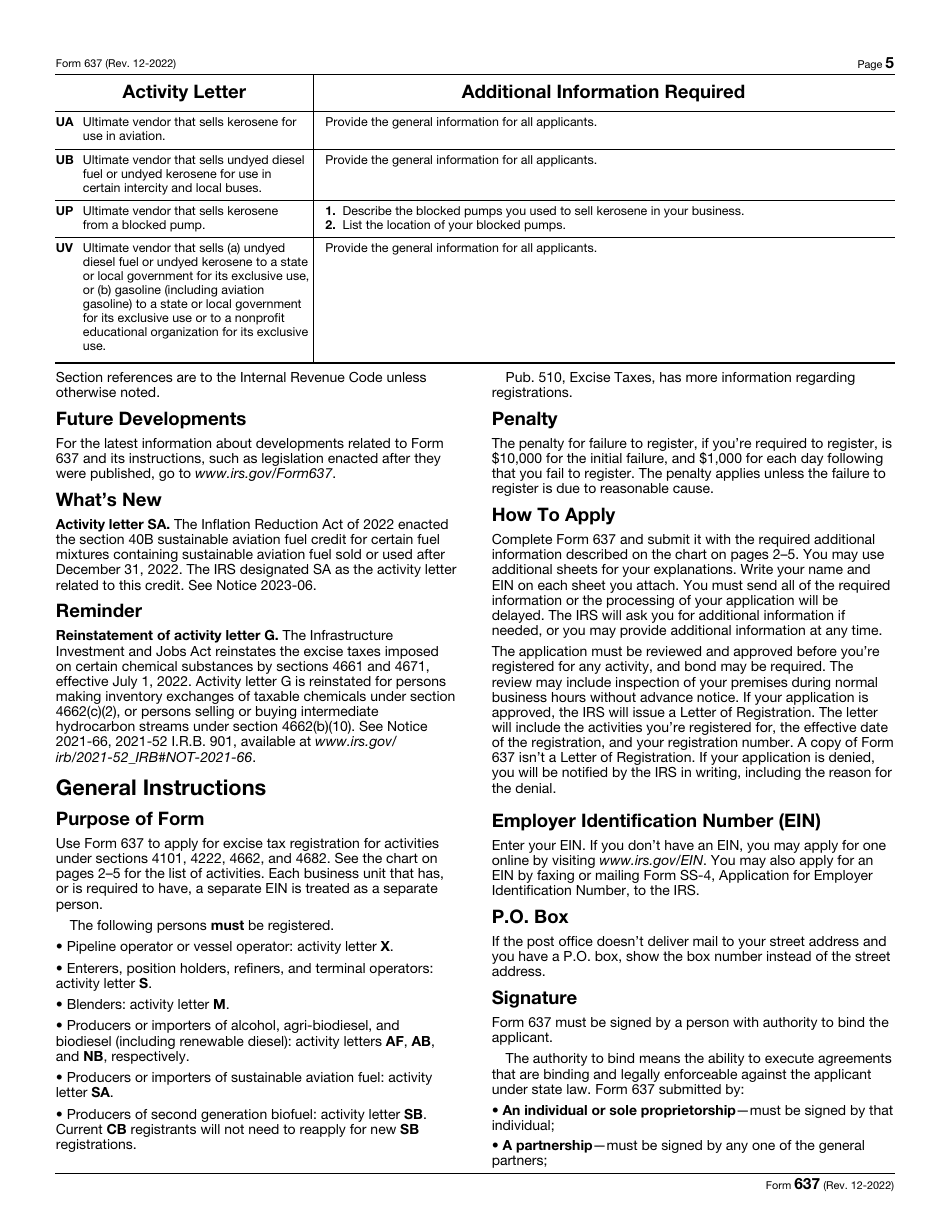

IRS Form 637, Application for Registration (For Certain Excise Tax Activities) , is a document developed for taxpayers who would like to apply for excise tax registration with certain activities. A list of these activities can be found in the Internal Revenue Code (Sections 4101, 4222, and 4682).

The purpose of this form is to provide filers with a Certificate of Registry or a Letter of Registration issued by the Internal Revenue Service (IRS), which they will then receive after the IRS processes and approves their application.

The application was last revised on December 1, 2022 . A fillable Form 637 is available for download below.

What Is Form 637 Used For?

A 637 Form is used for submitting certain types of data. To complete an application, filers must fill in the gaps which can be divided into several parts. Those parts include the following:

- The identification of an applicant . In the first part an applicant must designate the legal name of the entity filing in the form, their employer identification number, mailing address, telephone number, fax number, etc.;

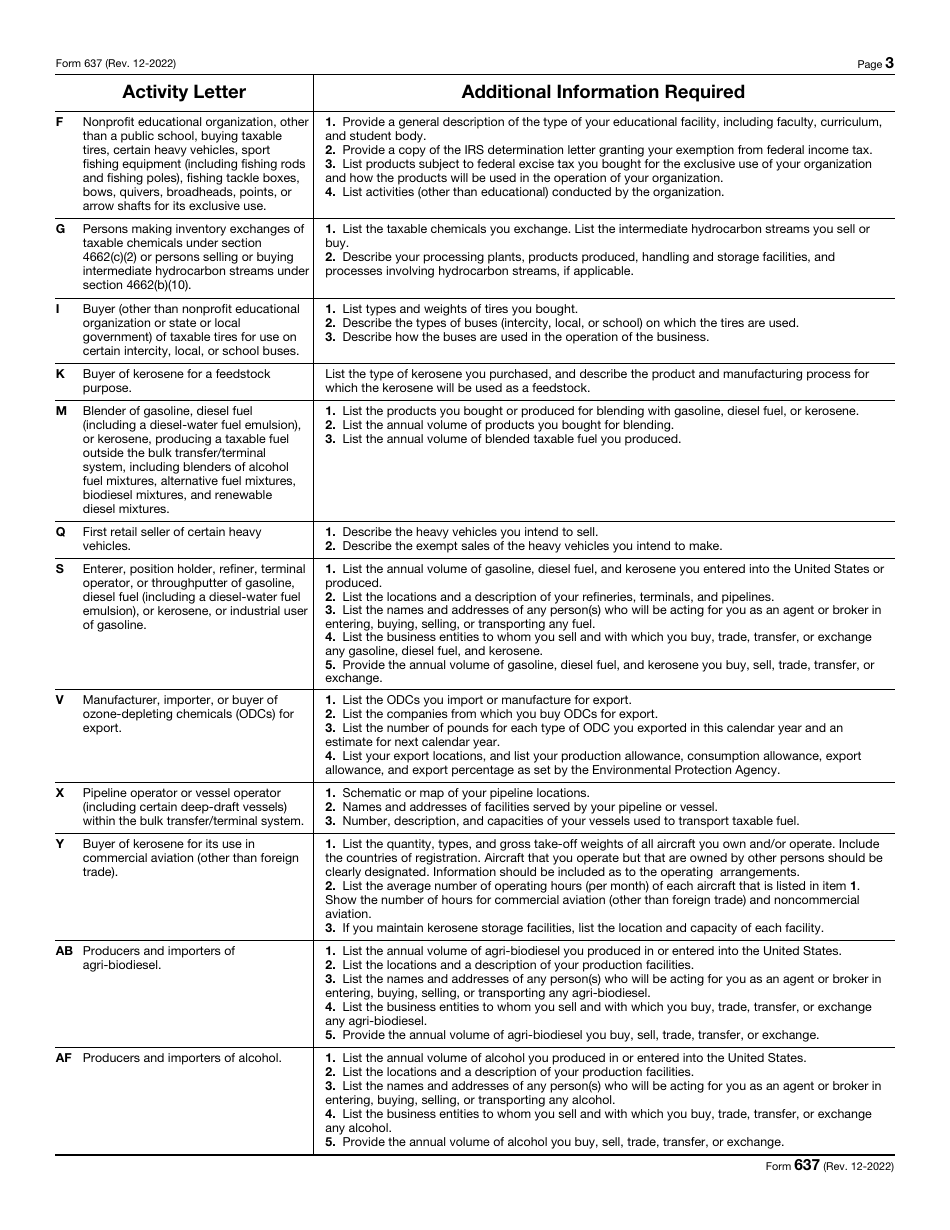

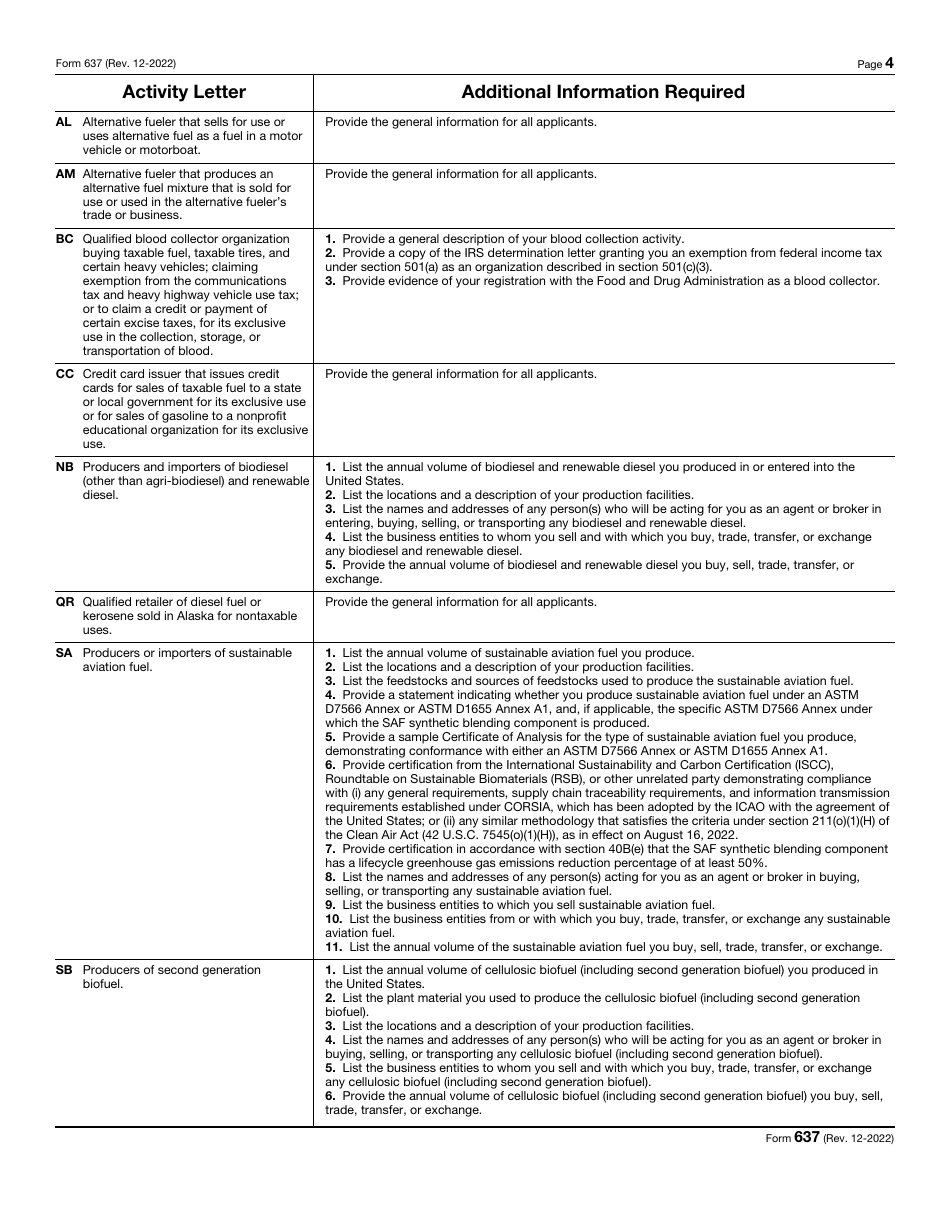

- Activities . Here filers must enter the activity for which they are applying for registration and a brief description in regards to it. A list of activities and additional required information are listed in the instructions that follow the form;

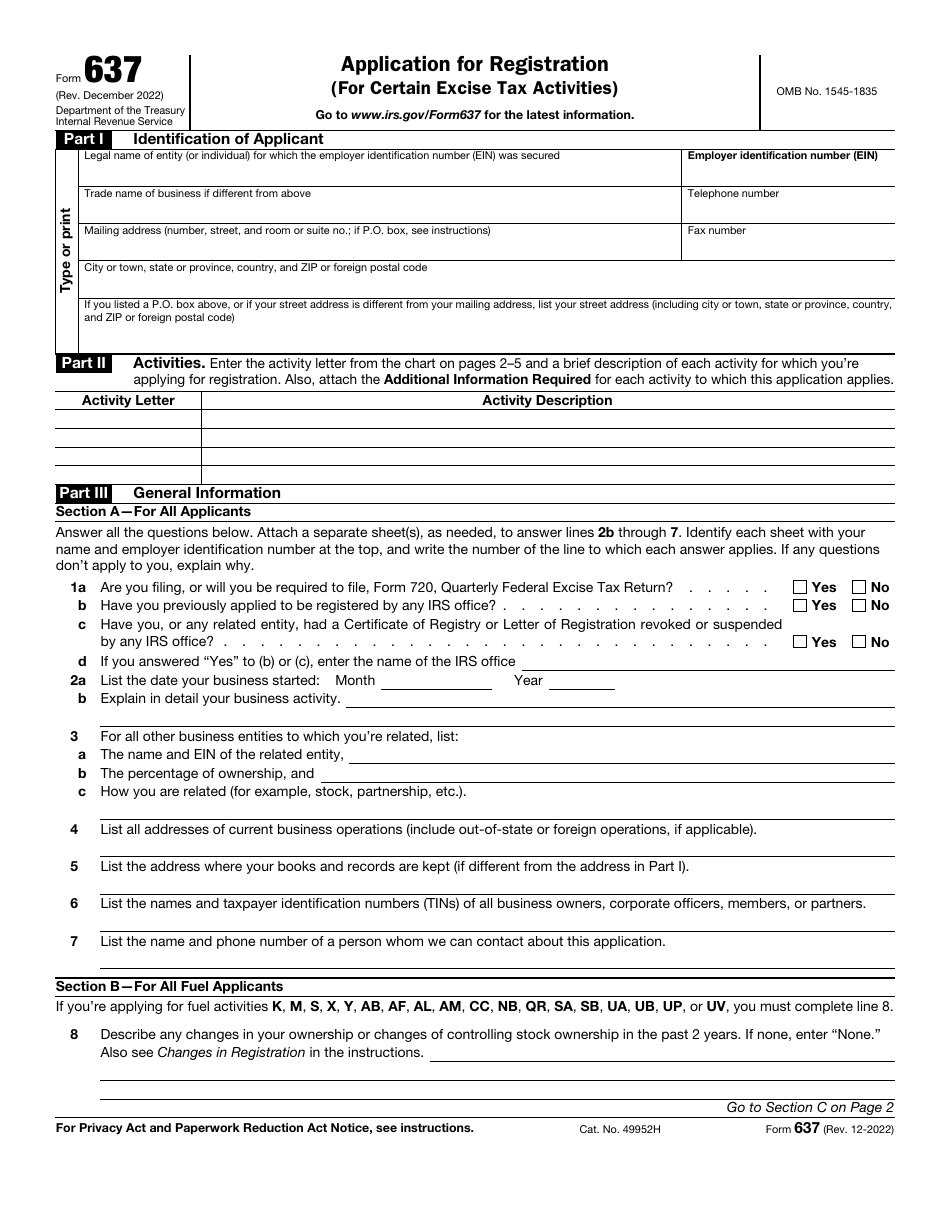

- General information . The last part of the application consists of three sections. The first section includes questions for all types of filers, the second section contains questions for all applicants that are applying for fuel activities, and the last section is only for certain fuel applicants who apply for registration for activities, like buying kerosene for feedstock purpose or buying kerosene use in commercial aviation (other than foreign trade), etc.

According to the Form 637 instructions, filers must provide information on their activities which can include:

- Fuelers who use alternative fuel as a fuel in motor vehicles or motorboats;

- Certain qualified organizations buying taxable tires, and certain heavy vehicles; who are exempt from the communications tax and heavy highway vehicle use tax;

- Producers of second-generation biofuel;

- Retailers in Alaska who sell diesel fuel or kerosene for nontaxable uses.

After the applicant has completed the form, they must submit it. Filers can fax or mail it to the Department of the Treasury, Internal Revenue Service, Excise Operations Unit - Form 637, Mail Stop 5701G, Cincinnati, OH 45999 . After the IRS processes the document, they might request additional information from the filer. If they approve the claim, they will issue a document that proves the registration of an applicant and lists the activities a filer is registered for.

If an applicant has already registered for a certain activity, they don't need to reapply for registration for the same activity (only if they are required to do so). To confirm the status of their registration they should visit the official website of the IRS and do it online.

If an entity is required to register for a certain activity and didn't do so, they may be applicable to penalties. This includes a penalty for failing the initial registration and a penalty for each following day. However, if a filer didn't register due to a reasonable cause, the IRS might not apply the penalties.