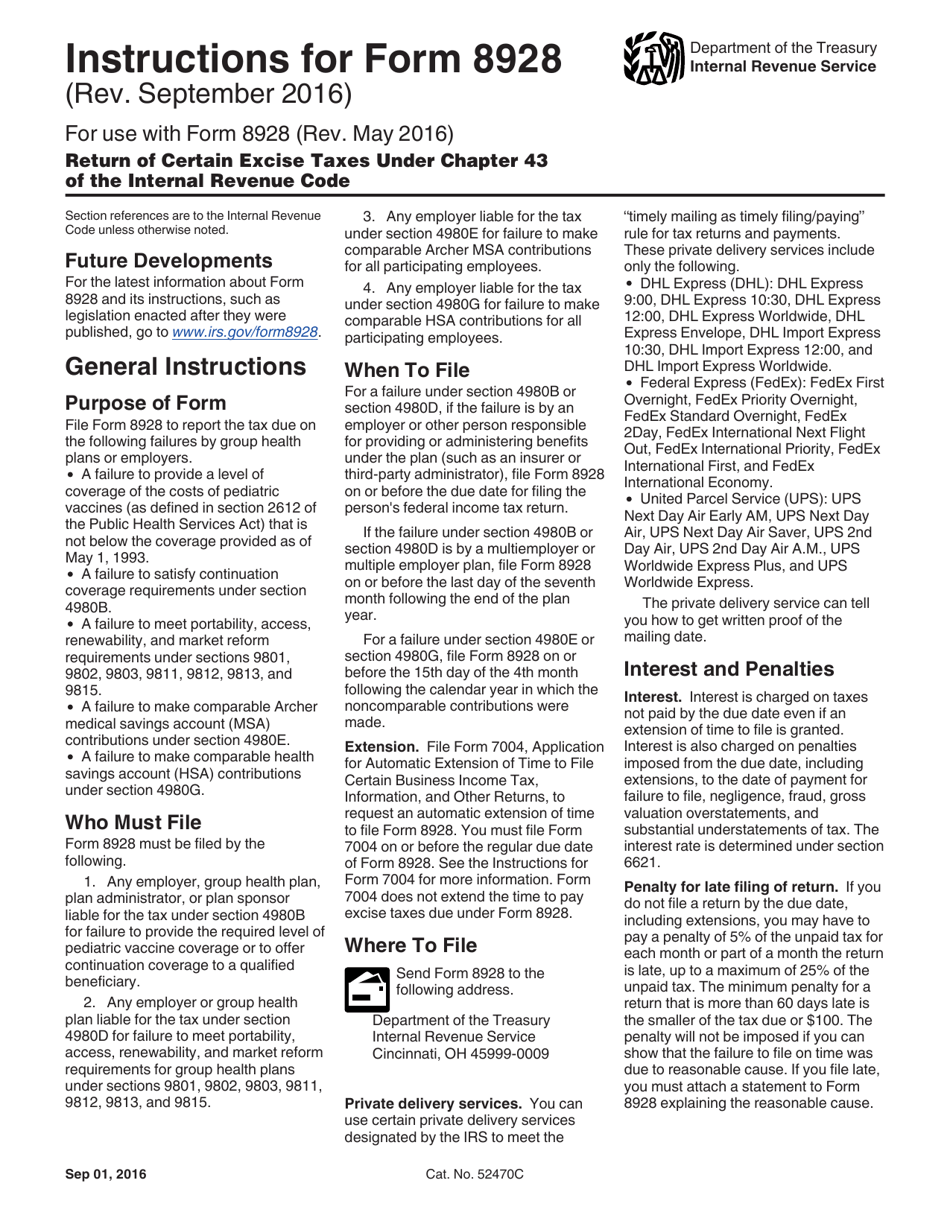

Instructions for IRS Form 8928 Return of Certain Excise Taxes Under Chapter 43 of the Internal Revenue Code

This document contains official instructions for IRS Form 8928 , Return of Certain Excise Taxes Under Chapter 43 of the Internal Revenue Code - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8928 is available for download through this link.

FAQ

Q: What is IRS Form 8928?

A: IRS Form 8928 is used to report and pay certain excise taxes under Chapter 43 of the Internal Revenue Code.

Q: What is the purpose of Form 8928?

A: The purpose of Form 8928 is to report and pay excise taxes on activities such as excessive executive compensation or failure to meet the requirements of a charitable hospital.

Q: Who is required to file Form 8928?

A: Organizations that engage in activities subject to excise taxes under Chapter 43 of the Internal Revenue Code are required to file Form 8928.

Q: Which taxes are reported on Form 8928?

A: Form 8928 is used to report taxes such as the excess parachute payment tax, the excess benefit tax, and the tax on failure to meet the requirements of a charitable hospital.

Q: When is Form 8928 due?

A: Form 8928 is generally due on the 15th day of the 5th month after the end of the organization's tax year.

Q: Is there a penalty for not filing Form 8928?

A: Yes, failure to file Form 8928 or pay the required excise taxes may result in penalties and interest.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.