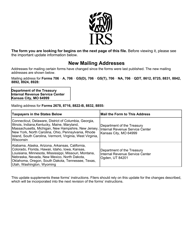

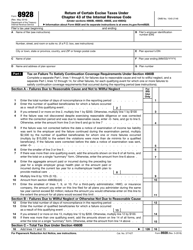

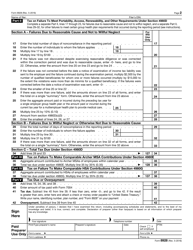

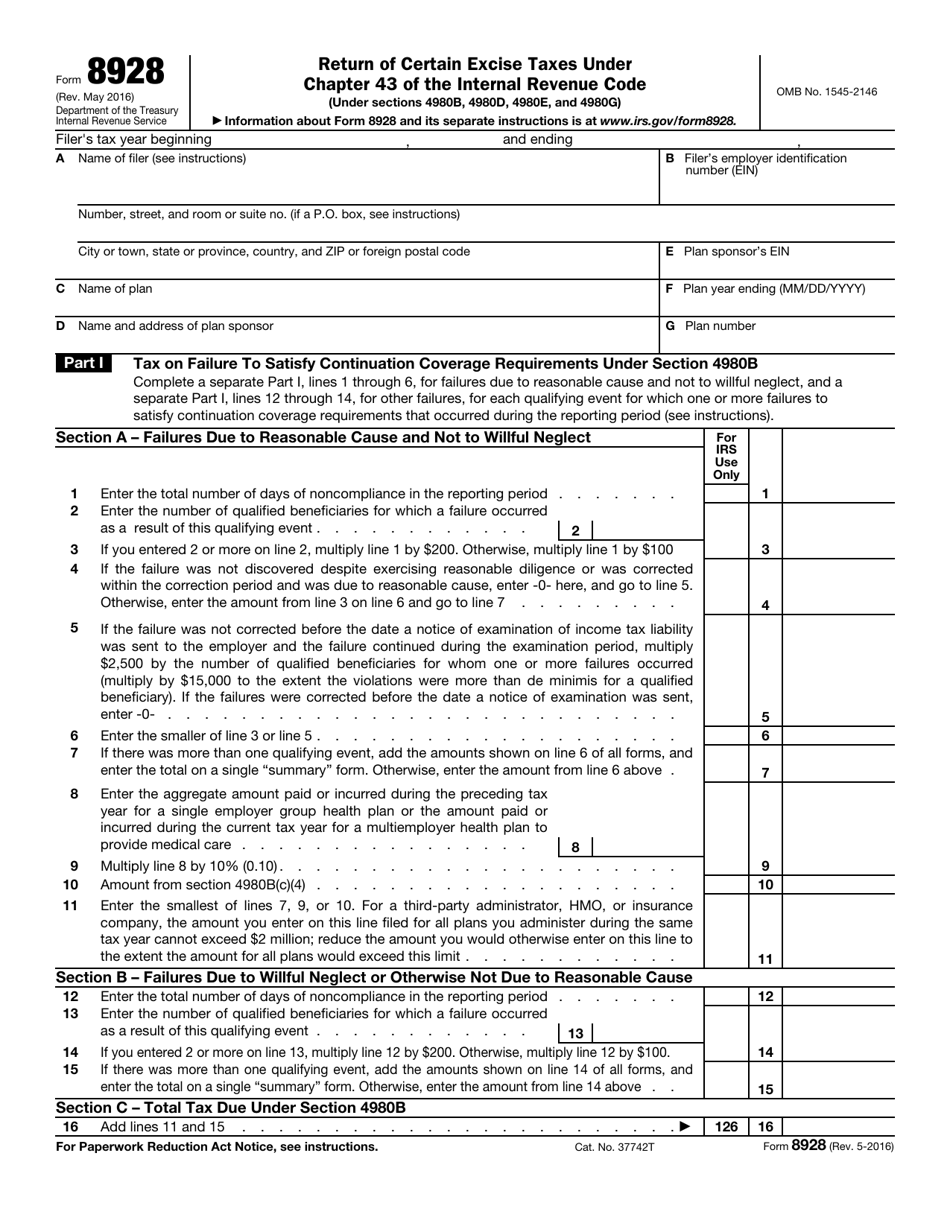

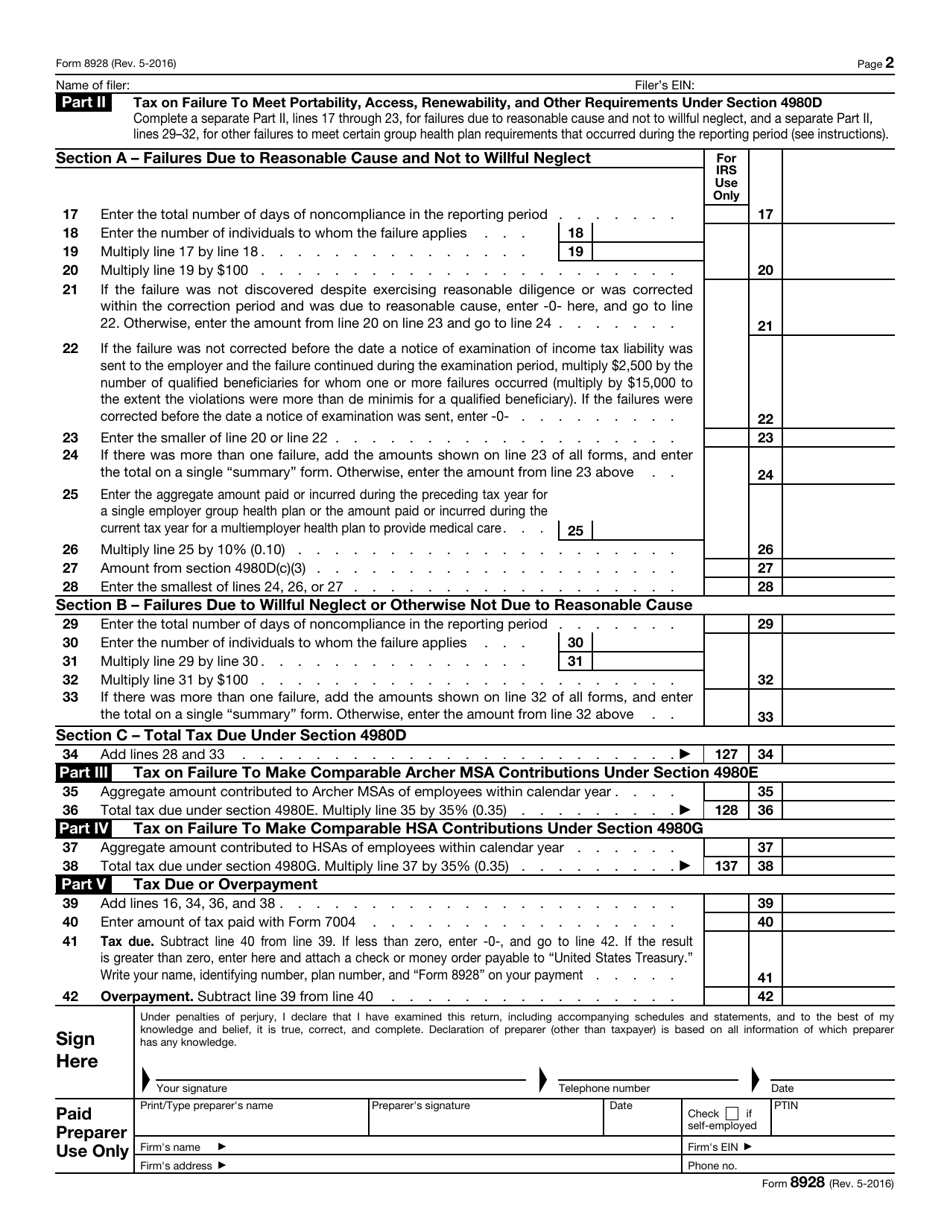

IRS Form 8928 Return of Certain Excise Taxes Under Chapter 43 of the Internal Revenue Code

What Is IRS Form 8928?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on May 1, 2016. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8928?

A: IRS Form 8928 is used to report and pay excise taxes under Chapter 43 of the Internal Revenue Code.

Q: Which taxes are reported on IRS Form 8928?

A: IRS Form 8928 is used to report and pay certain excise taxes, such as the tax on excess lobbying expenditures and the tax on political contributions.

Q: Who needs to file IRS Form 8928?

A: Taxpayers who are liable for the excise taxes covered by IRS Form 8928 must file the form.

Q: When is IRS Form 8928 due?

A: IRS Form 8928 is generally due on the 15th day of the fifth month after the end of the tax year.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8928 through the link below or browse more documents in our library of IRS Forms.