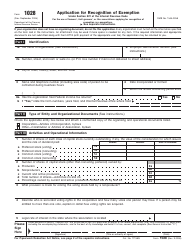

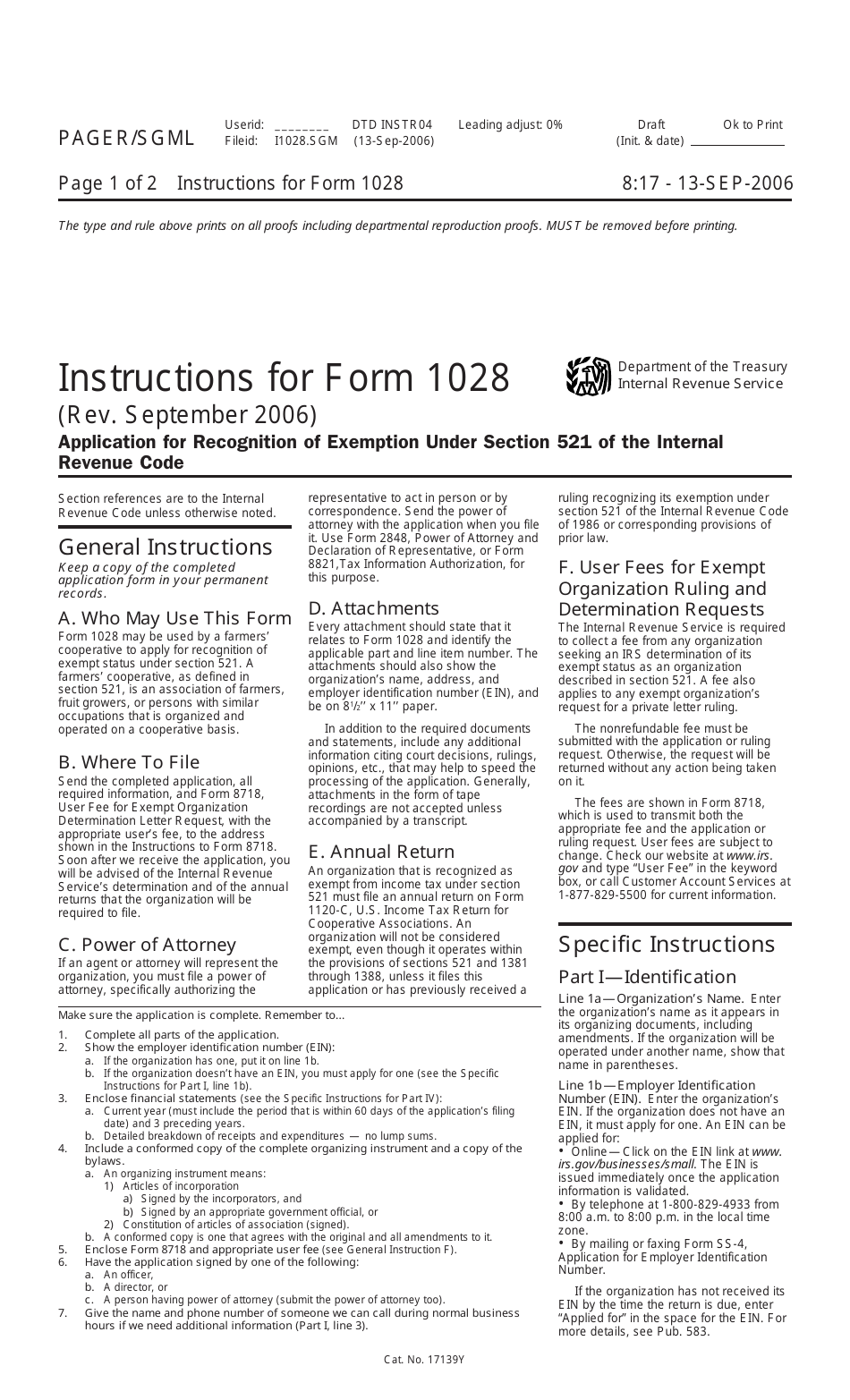

Instructions for IRS Form 1028 Application for Recognition of Exemption Under Section 521 of the Internal Revenue Code

This document contains official instructions for IRS Form 1028 , Application for Recognition of Exemption Under Section 521 of the Internal Revenue Code - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1028 is available for download through this link.

FAQ

Q: What is IRS Form 1028?

A: IRS Form 1028 is an application for recognition of exemption under section 521 of the Internal Revenue Code.

Q: What is the purpose of Form 1028?

A: The purpose of Form 1028 is to apply for tax-exempt status under section 521 of the Internal Revenue Code.

Q: Who needs to file Form 1028?

A: Organizations seeking tax-exempt status as a farmers' cooperative must file Form 1028.

Q: What is a farmers' cooperative?

A: A farmers' cooperative is an organization formed by farmers to market and distribute their agricultural products.

Q: Are there any fees associated with filing Form 1028?

A: No, there are no fees associated with filing Form 1028.

Q: What documents should be included with Form 1028?

A: You should include a copy of your organizing documents and financial statements with Form 1028.

Q: How long does it take for the IRS to process Form 1028?

A: The processing time for Form 1028 can vary, but it generally takes several months.

Q: Can I check the status of my Form 1028 application?

A: Yes, you can check the status of your Form 1028 application by contacting the IRS.

Q: What should I do if my Form 1028 application is denied?

A: If your Form 1028 application is denied, you can appeal the decision within a certain timeframe.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.