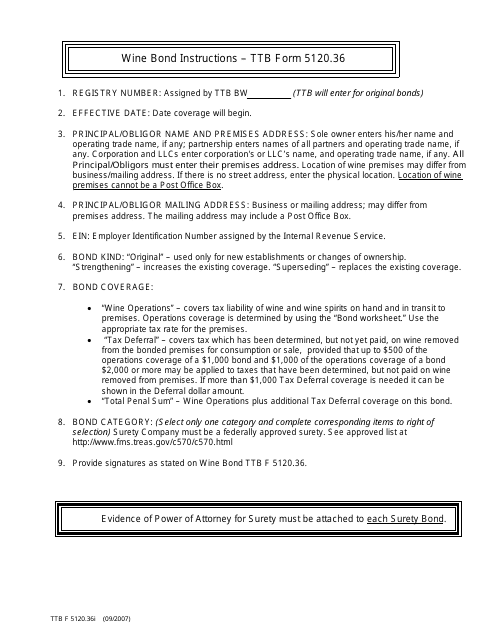

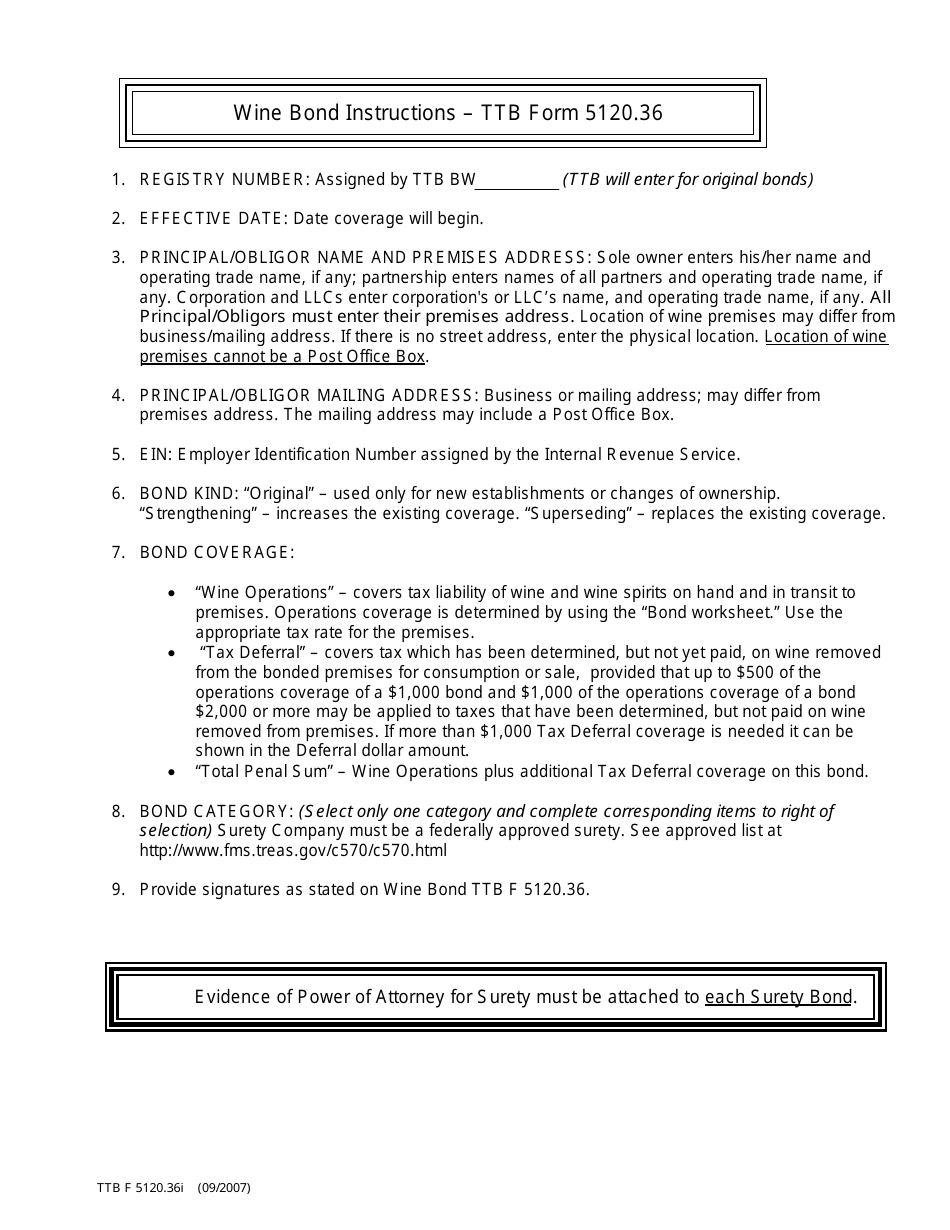

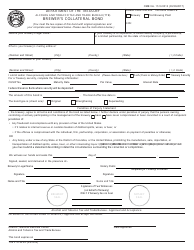

Instructions for TTB Form 5120.36I Wine Bond

This document contains official instructions for TTB Form 5120.36I , Wine Bond - a form released and collected by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.

FAQ

Q: What is TTB Form 5120.36I?

A: TTB Form 5120.36I is a form used to apply for a wine bond.

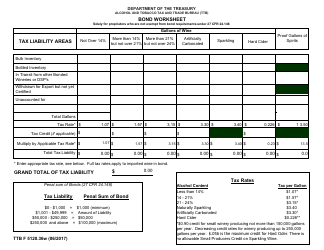

Q: What is a wine bond?

A: A wine bond is a financial guarantee required by the Alcohol and Tobacco Tax and Trade Bureau (TTB) for businesses involved in the production, distribution, or importation of wine.

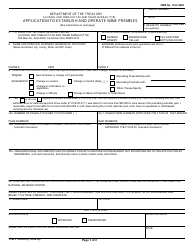

Q: Who needs to file TTB Form 5120.36I?

A: Any business involved in the production, distribution, or importation of wine is required to file TTB Form 5120.36I.

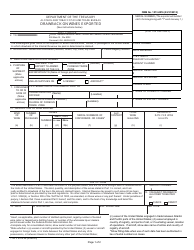

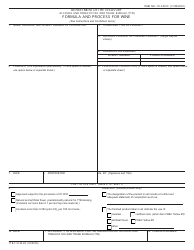

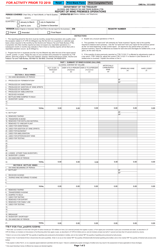

Q: What information is required on TTB Form 5120.36I?

A: The form requires information such as the business name, address, contact information, and details about the bond coverage.

Q: Are there any fees associated with filing TTB Form 5120.36I?

A: Yes, there may be fees associated with filing the form. The specific fees will depend on the size of the bond being requested.

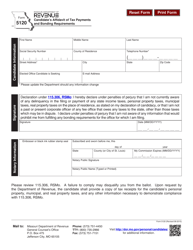

Q: How often do I need to file TTB Form 5120.36I?

A: You will need to file the form initially when applying for a wine bond, and then renew the bond annually by filing a new form.

Q: What happens if I fail to file TTB Form 5120.36I?

A: Failure to file the form or maintain a wine bond can result in penalties or the suspension of your business's operations.

Q: How long does it take for TTB Form 5120.36I to be processed?

A: The processing time for the form can vary, but it typically takes several weeks for the TTB to review and approve the application.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.