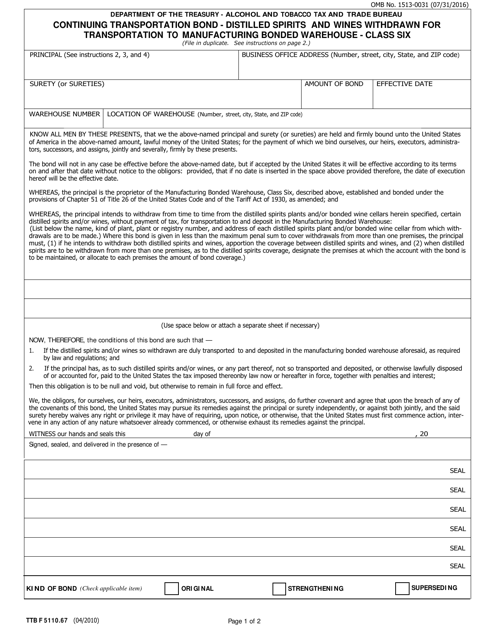

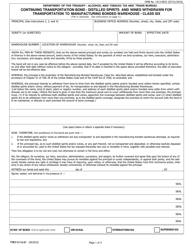

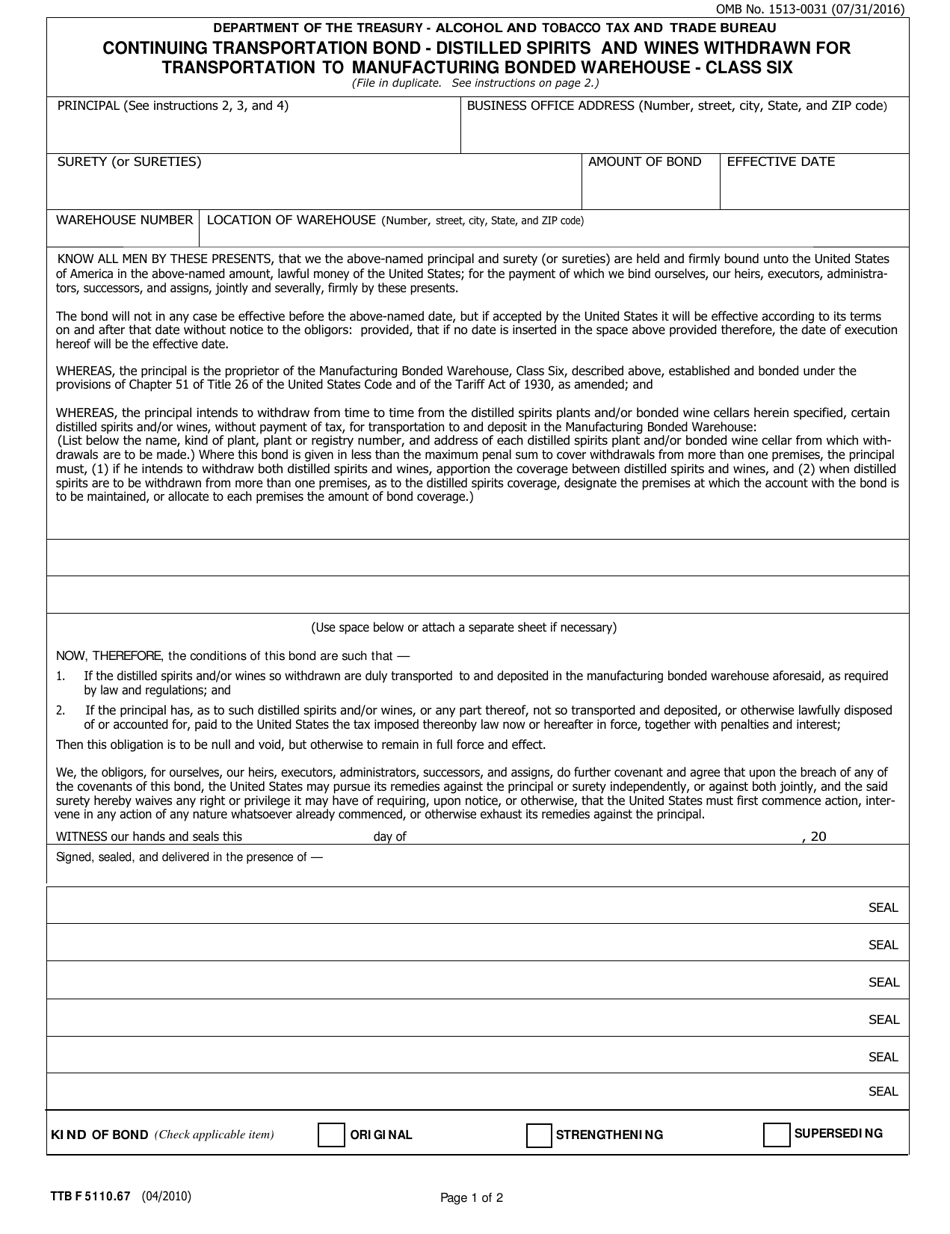

TTB Form 5110.67 Continuing Transportation Bond - Distilled Spirits and Wines Withdrawn for Transportation to Manufacturing Bonded Warehouse - Class Six

What Is TTB Form 5110.67?

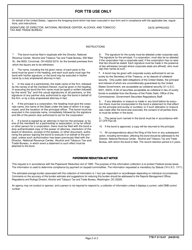

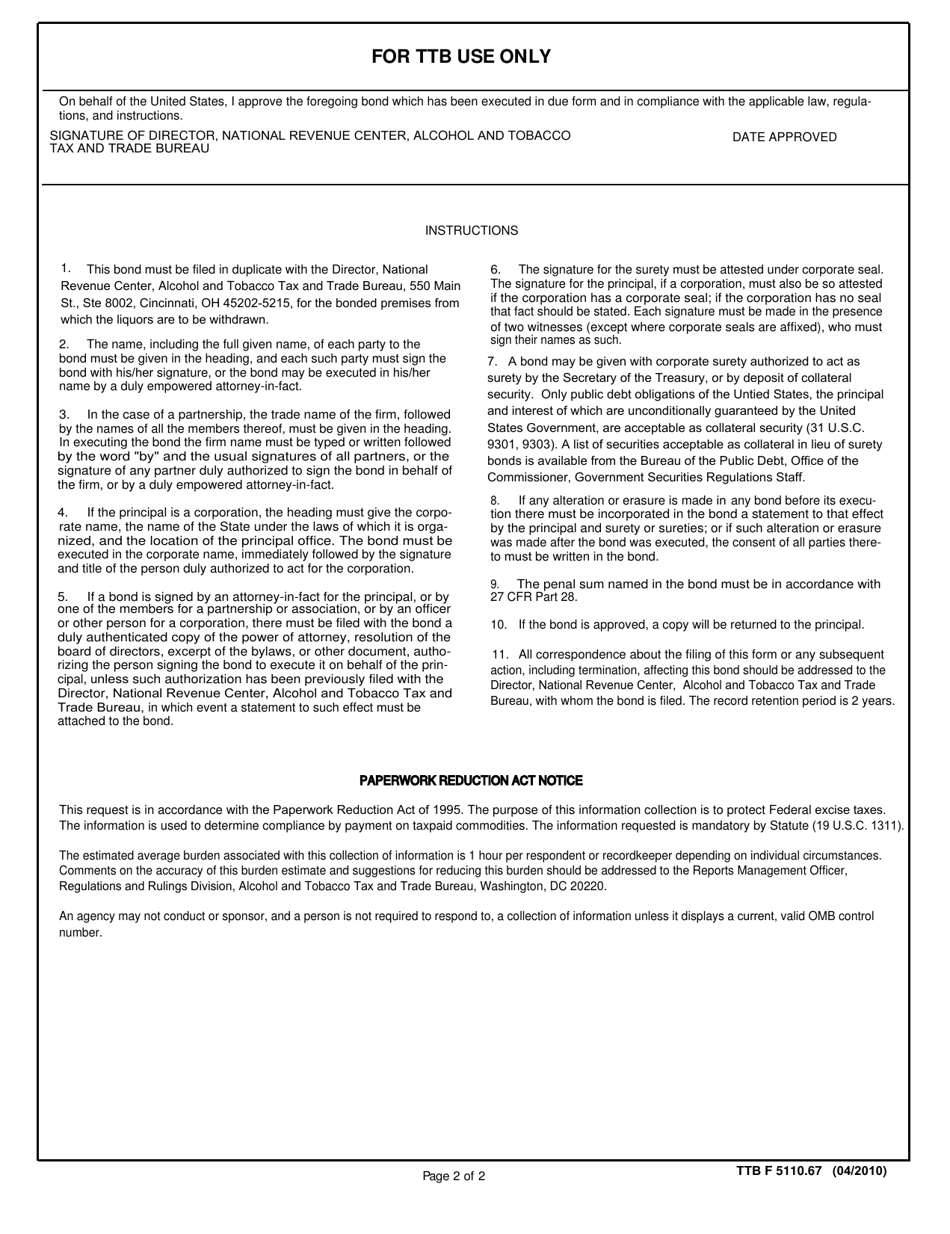

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on April 1, 2010 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5110.67?

A: TTB Form 5110.67 is a Continuing Transportation Bond for Distilled Spirits and Wines Withdrawn for Transportation to Manufacturing Bonded Warehouse - Class Six.

Q: What is the purpose of TTB Form 5110.67?

A: The purpose of TTB Form 5110.67 is to provide a bond to cover the transportation of distilled spirits and wines to a manufacturing bonded warehouse.

Q: Who needs to fill out TTB Form 5110.67?

A: Importers or proprietors of distilled spirits and wines who are withdrawing these products for transportation to a manufacturing bonded warehouse need to fill out TTB Form 5110.67.

Q: What does Class Six mean in the context of TTB Form 5110.67?

A: Class Six refers to the specific type of bonded warehouse where the distilled spirits and wines are being transported to.

Q: What is a manufacturing bonded warehouse?

A: A manufacturing bonded warehouse is a facility where distilled spirits and wines can be further processed or manufactured into different products.

Q: Why is a bond required for transportation to a manufacturing bonded warehouse?

A: A bond is required to ensure that any excise taxes and regulations related to the transportation and storage of distilled spirits and wines are properly followed.

Form Details:

- Released on April 1, 2010;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5110.67 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.