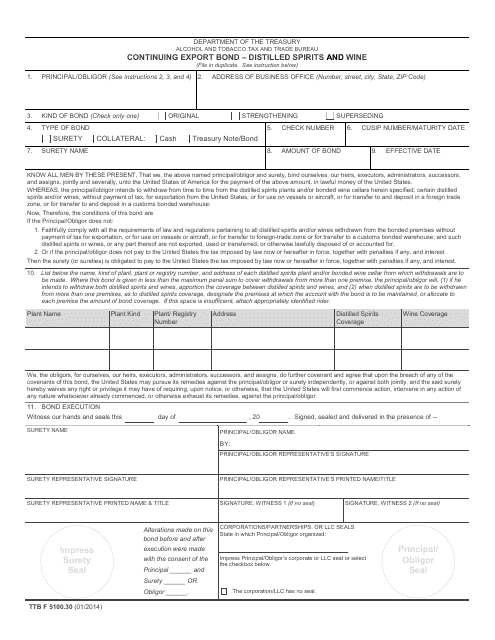

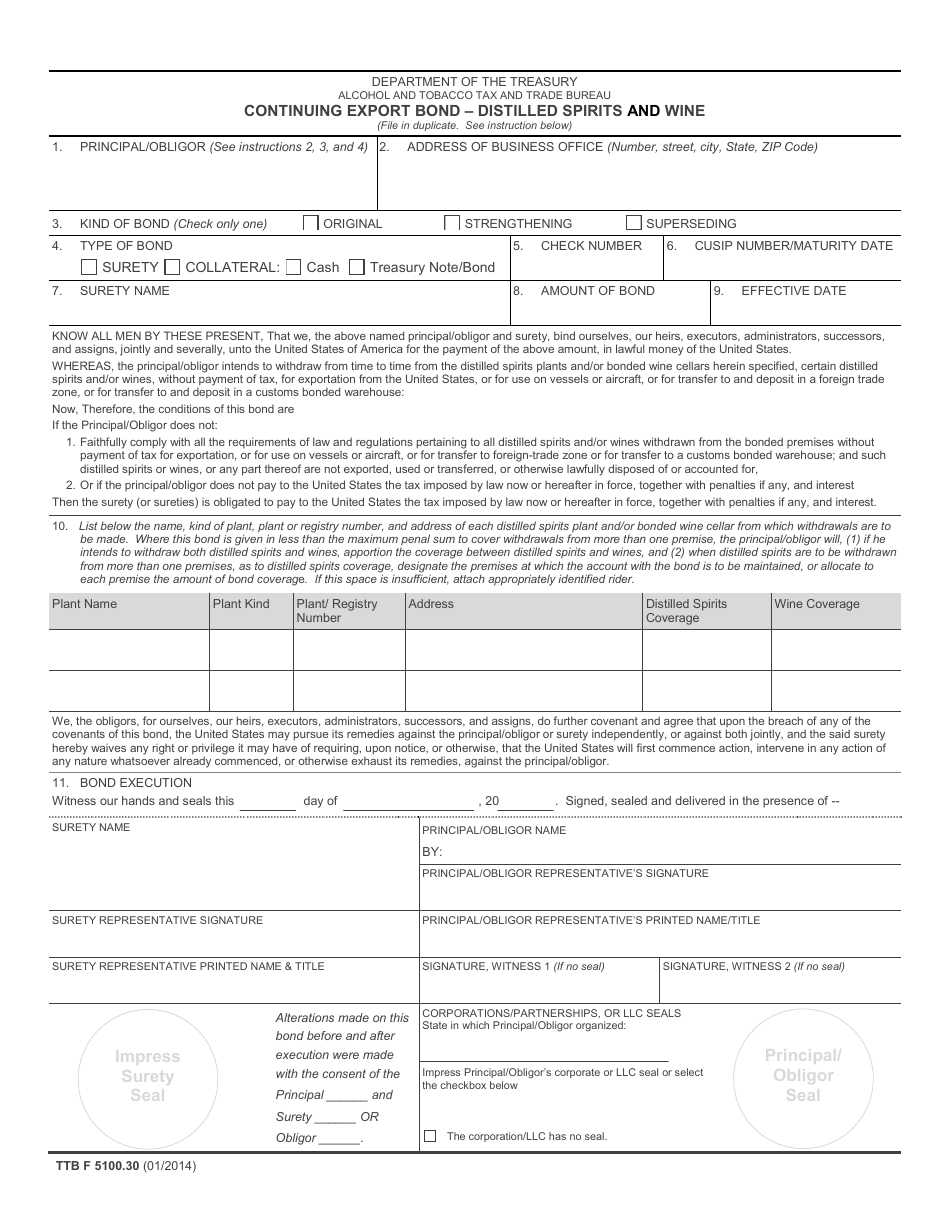

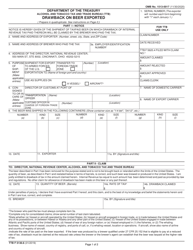

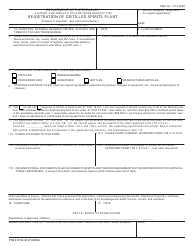

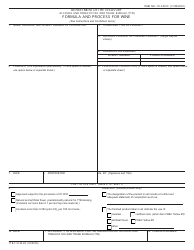

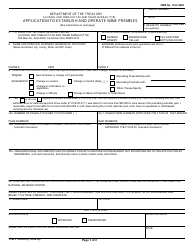

TTB Form 5100.30 Continuing Export Bond - Distilled Spirits and Wine

What Is TTB Form 5100.30?

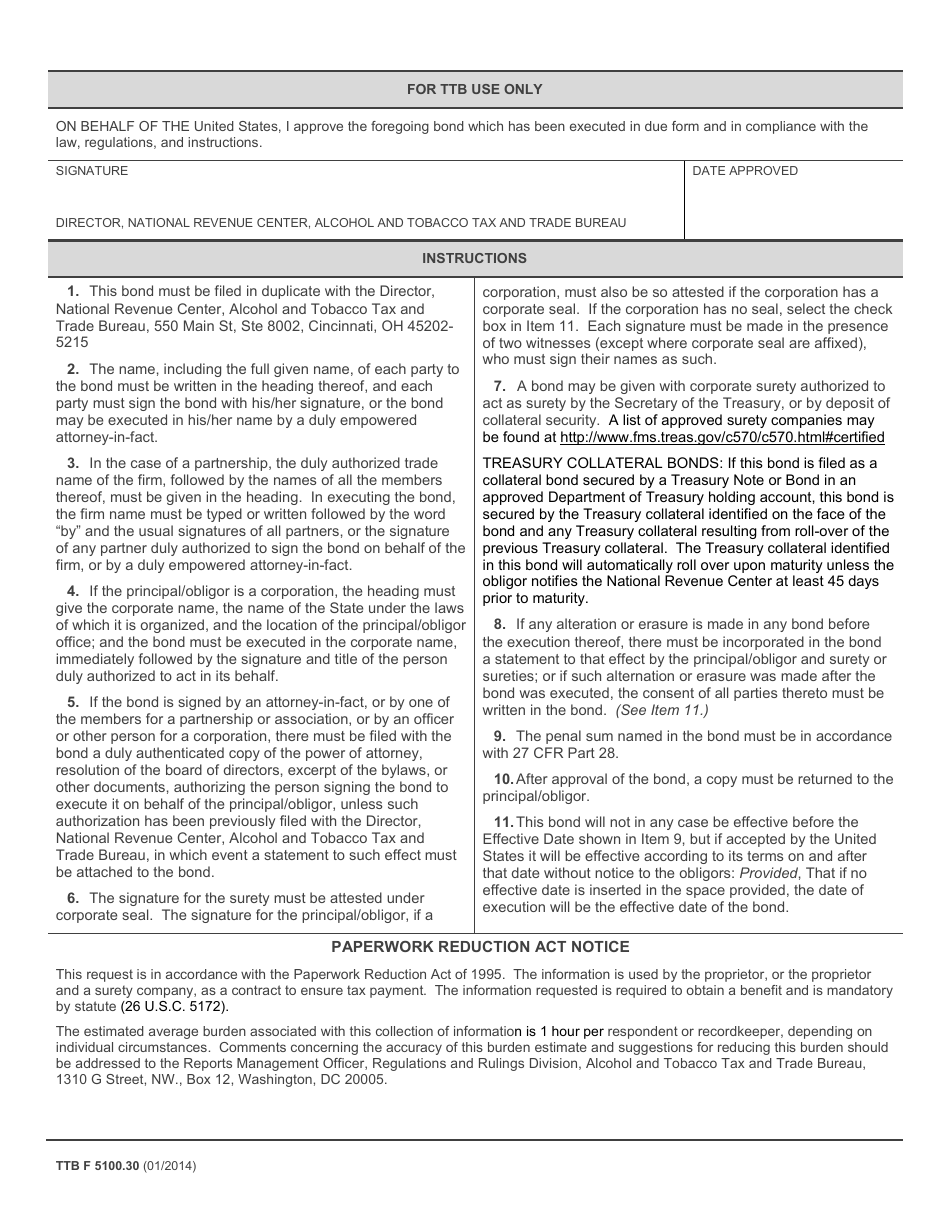

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on January 1, 2014 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5100.30?

A: TTB Form 5100.30 is a form for applying for a Continuing Export Bond for distilled spirits and wine.

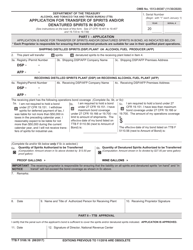

Q: What is a Continuing Export Bond?

A: A Continuing Export Bond is a type of bond required by the Alcohol and Tobacco Tax and Trade Bureau (TTB) for exporters of distilled spirits and wine.

Q: Who needs to fill out TTB Form 5100.30?

A: Exporters of distilled spirits and wine who want to apply for a Continuing Export Bond need to fill out TTB Form 5100.30.

Q: What is the purpose of the Continuing Export Bond?

A: The Continuing Export Bond ensures that the exporter will comply with all applicable laws and regulations regarding the exportation of distilled spirits and wine.

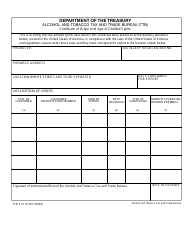

Form Details:

- Released on January 1, 2014;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

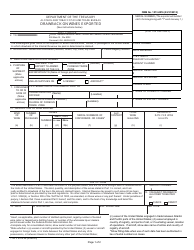

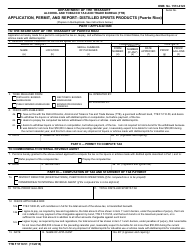

Download a fillable version of TTB Form 5100.30 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.