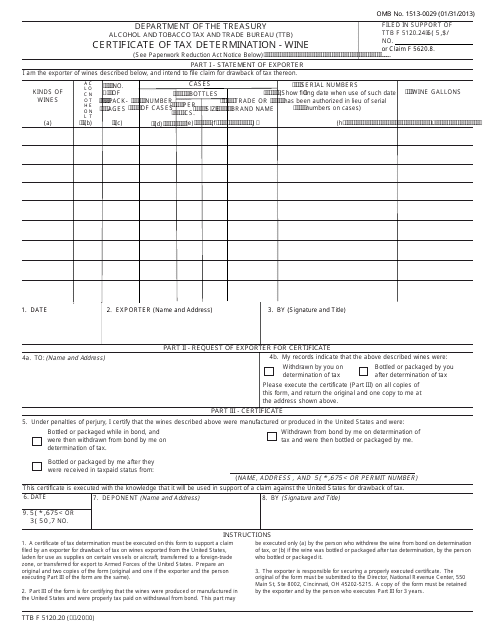

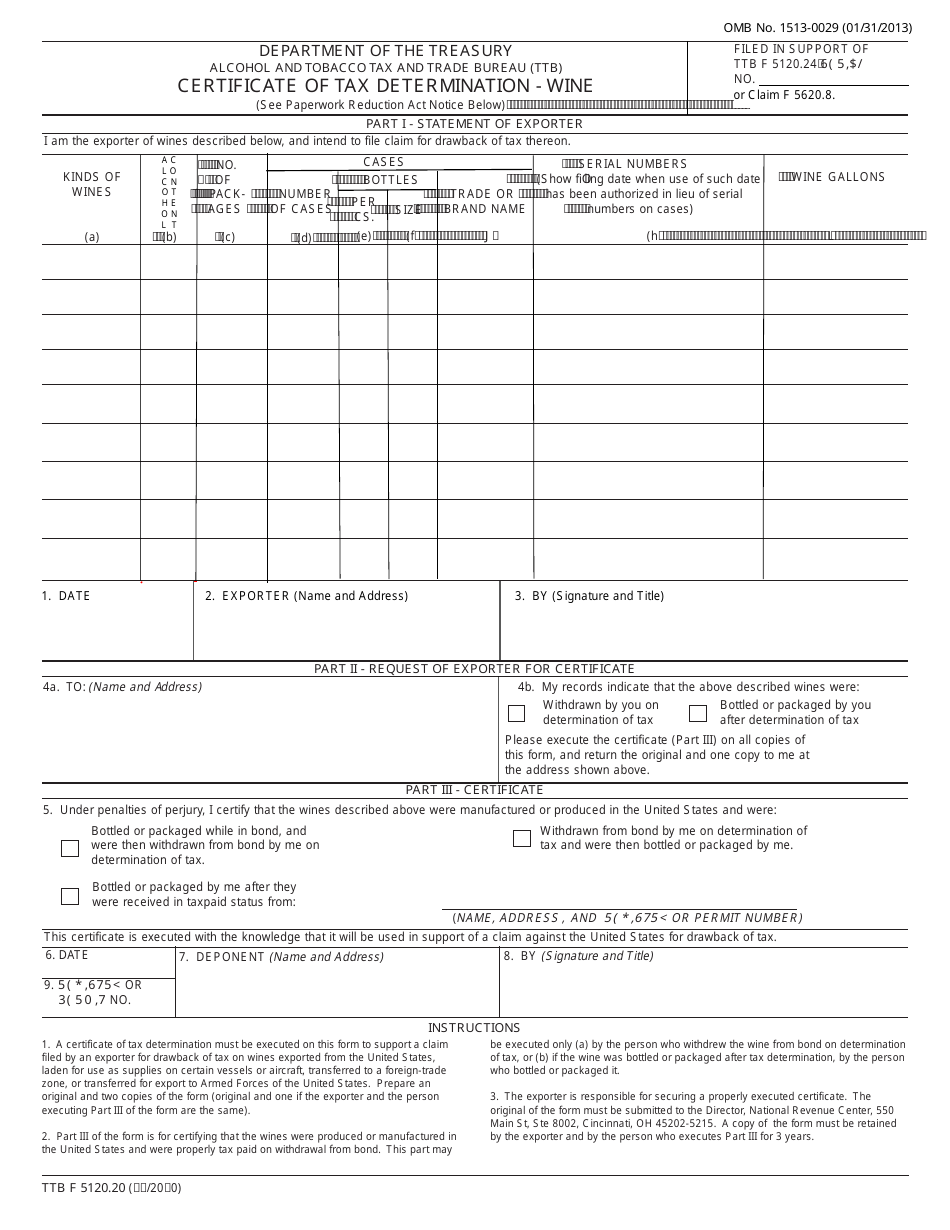

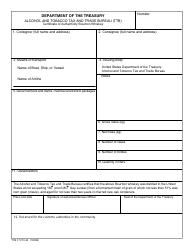

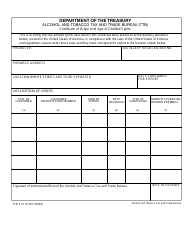

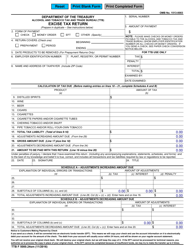

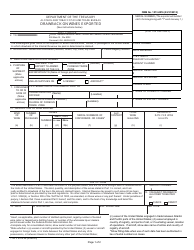

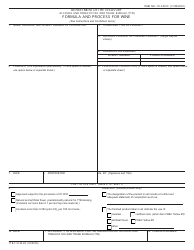

TTB Form 5120.20 Certificate of Tax Determination - Wine

What Is TTB Form 5120.20?

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on January 1, 2010 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5120.20?

A: TTB Form 5120.20 is a Certificate of Tax Determination for Wine.

Q: What is the purpose of TTB Form 5120.20?

A: The purpose of TTB Form 5120.20 is to certify the tax status of wine.

Q: Who needs to file TTB Form 5120.20?

A: Anyone engaged in the production, distribution, or importation of wine may be required to file TTB Form 5120.20.

Q: What information is required on TTB Form 5120.20?

A: TTB Form 5120.20 requires information such as the name and address of the producer, distributor, or importer, as well as the tax class and type of wine being certified.

Q: When should TTB Form 5120.20 be filed?

A: TTB Form 5120.20 should be filed before the removal of wine from bonded premises, or within a specified time period after removal, depending on the circumstances.

Q: Are there any fees associated with filing TTB Form 5120.20?

A: There are no fees associated with filing TTB Form 5120.20.

Q: What are the consequences of not filing TTB Form 5120.20?

A: Failure to file TTB Form 5120.20 may result in penalties, including the loss of certain tax privileges.

Q: What should I do if I have questions about TTB Form 5120.20?

A: If you have questions about TTB Form 5120.20, you should contact your local TTB office for assistance.

Q: Is TTB Form 5120.20 specific to the United States or Canada?

A: TTB Form 5120.20 is specific to the United States only.

Form Details:

- Released on January 1, 2010;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5120.20 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.