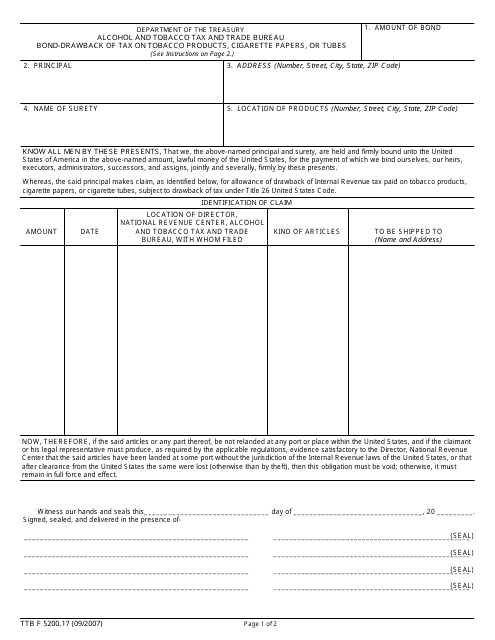

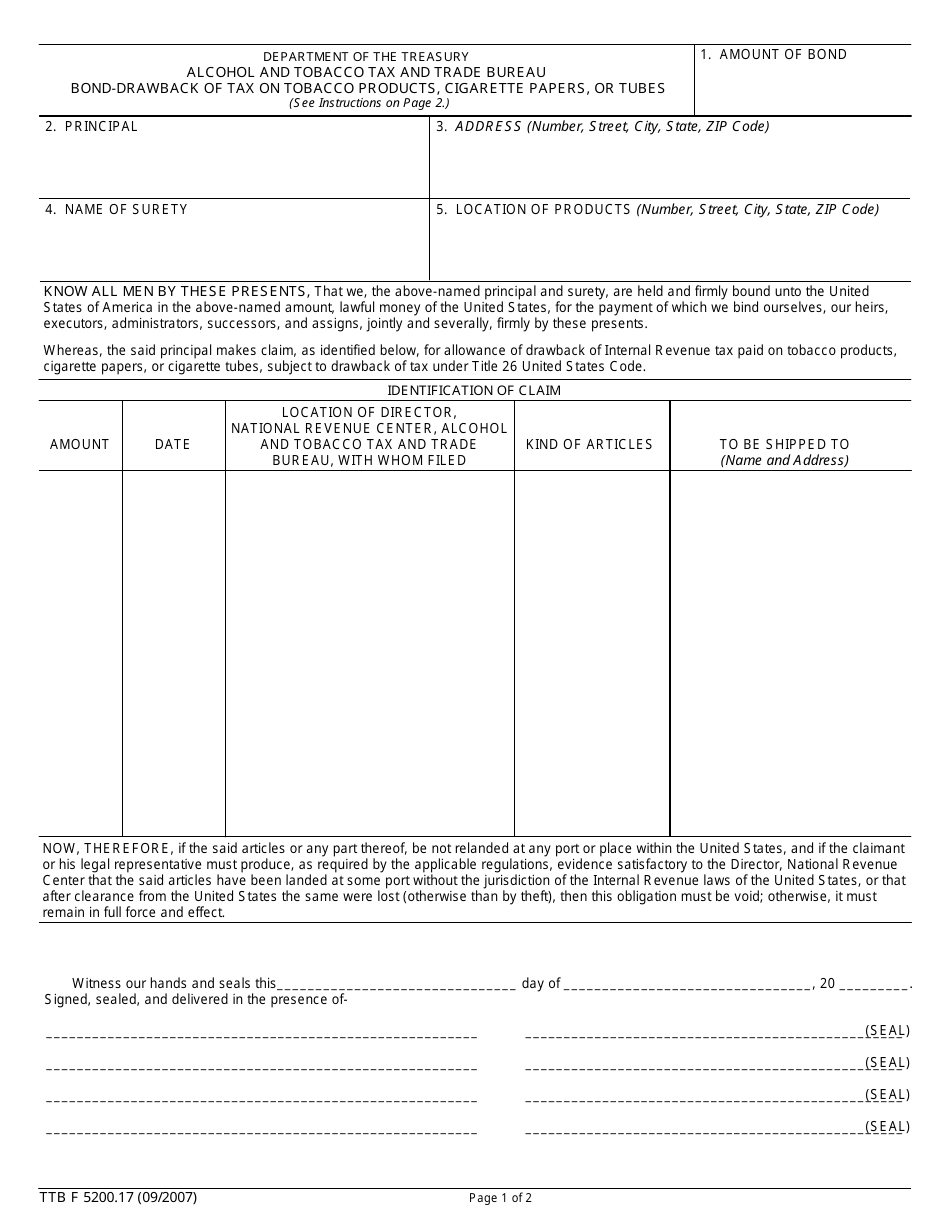

TTB Form 5200.17 Bond-Drawback of Tax on Tobacco Products, Cigarette Papers, or Tubes

What Is TTB Form 5200.17?

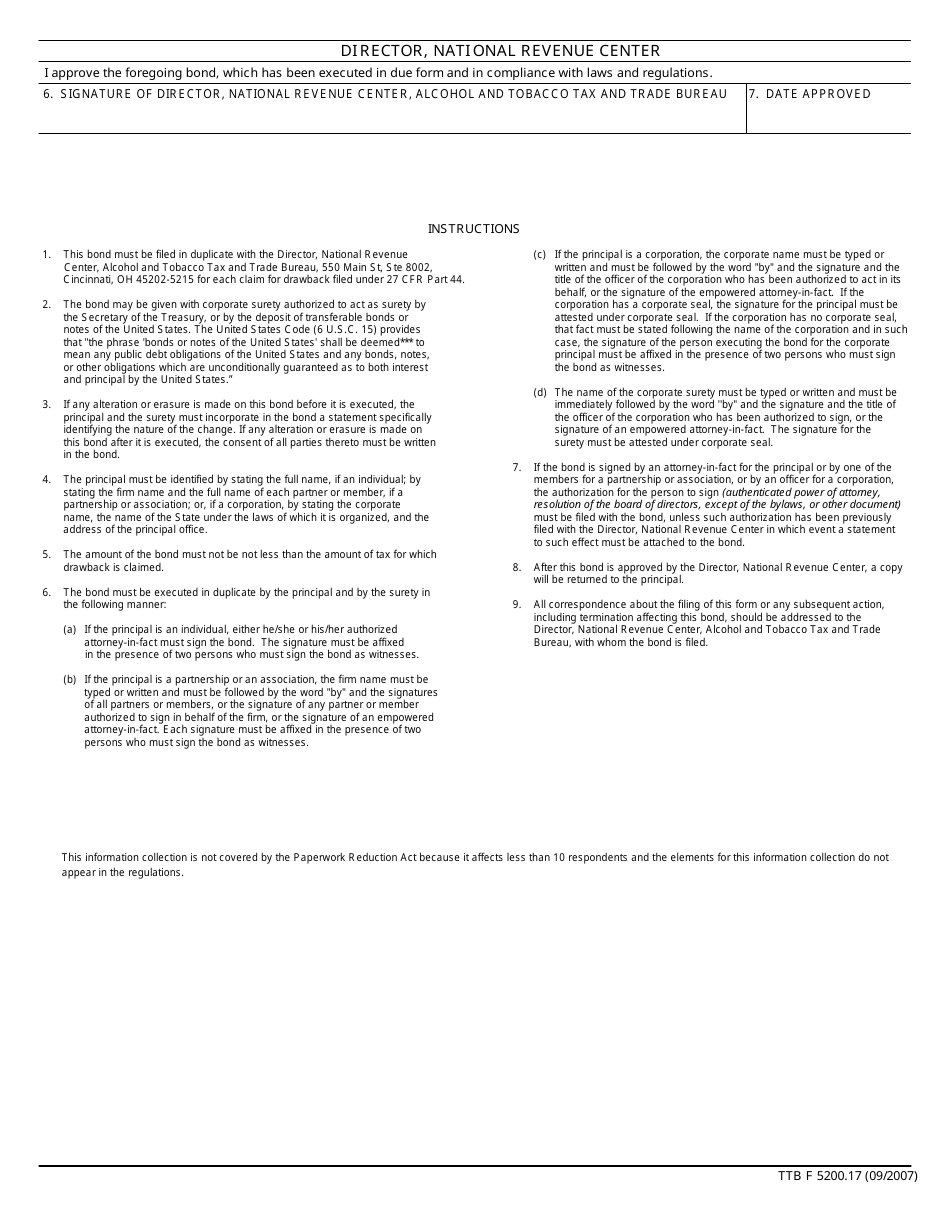

This is a legal form that was released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau on September 1, 2007 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TTB Form 5200.17?

A: TTB Form 5200.17 is a form used for Bond-Drawback of Tax on Tobacco Products, Cigarette Papers, or Tubes.

Q: What is the purpose of TTB Form 5200.17?

A: The purpose of this form is to claim a refund of excise taxes paid on tobacco products, cigarette papers, or tubes that were exported or destroyed.

Q: Who can use TTB Form 5200.17?

A: Any person or entity who has paid excise taxes on tobacco products, cigarette papers, or tubes can use this form to potentially receive a refund.

Q: How do I fill out TTB Form 5200.17?

A: You will need to provide information about the exported or destroyed tobacco products, cigarette papers, or tubes, as well as information about the taxes paid and any previous claims made.

Q: Are there any fees associated with filing TTB Form 5200.17?

A: There are no fees for filing this form.

Q: Is TTB Form 5200.17 specific to the United States or Canada?

A: TTB Form 5200.17 is specific to the United States.

Q: Can TTB Form 5200.17 be used for other types of products?

A: No, this form is specifically for claiming a refund of excise taxes on tobacco products, cigarette papers, or tubes.

Form Details:

- Released on September 1, 2007;

- The latest available edition released by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of TTB Form 5200.17 by clicking the link below or browse more documents and templates provided by the U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau.