Income Tax Form Templates

Documents:

2505

Instructions for IRS Form 1041-N U.S. Income Tax Return for Electing Alaska Native Settlement Trusts

This form is used for filing an amended U.S. Individual Income Tax Return. It allows taxpayers to make corrections or changes to their previously filed tax return.

This type of document provides instructions for filling out IRS Form 1099-CAP, which is used to report changes in corporate control and capital structure.

This form is used for reporting the compensation of corporate officers for tax purposes. It provides instructions on how to fill out IRS Form 1125-E.

This form is used for reconciling the net income (or loss) of S Corporations with total assets of $10 million or more on Form 1120S. It provides detailed instructions for completing the Schedule M-3 section.

This Form is used for filing the U.S. Income Tax Return specifically for an S Corporation. It provides instructions on how to report income, deductions, and credits for the corporation.

This document provides instructions on how to calculate interest using the look-back method for property depreciated under the income forecast method. It is used for IRS Form 8866.

This document is a test for volunteers who assist with tax preparation through the IRS Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) programs.

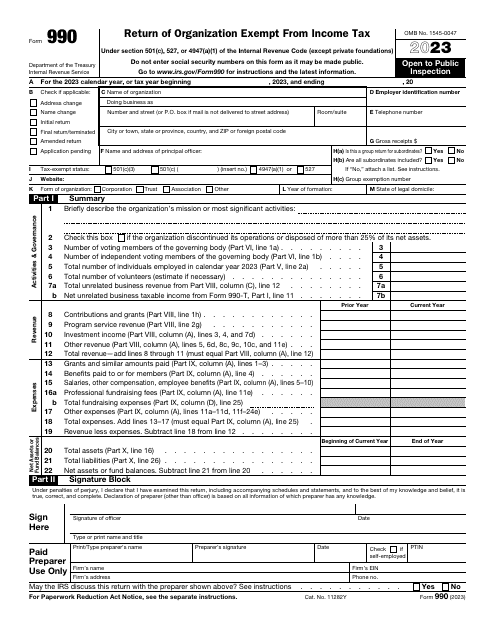

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

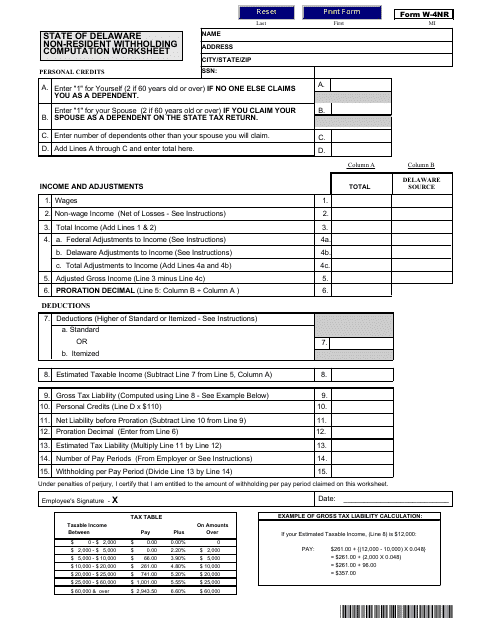

This form is used for calculating withholding taxes for non-resident taxpayers in Delaware.

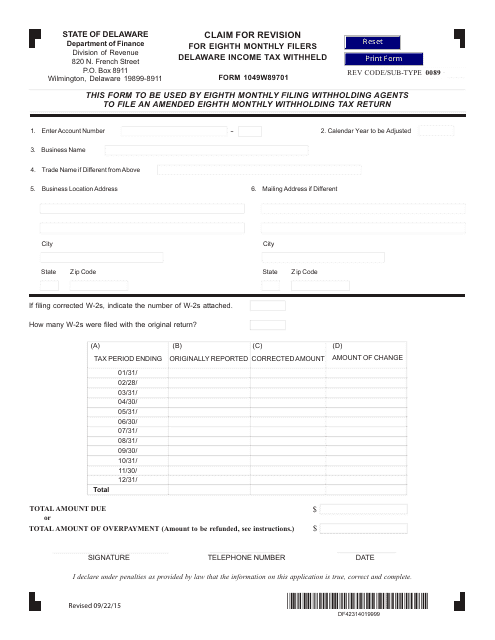

Form 1049W89701 Claim for Revision for Eighth Monthly Filers Delaware Income Tax Withheld - Delaware

This form is used for claiming a revision for eighth monthly filers of Delaware Income Tax Withheld.

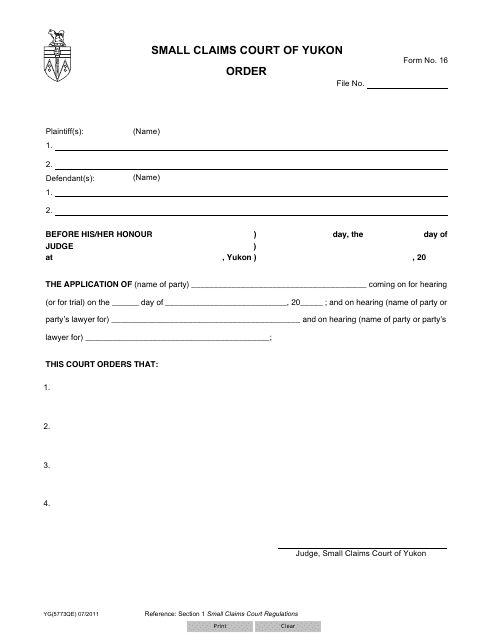

This Form is used for ordering a Form 16 (YG5773) in Yukon, Canada.

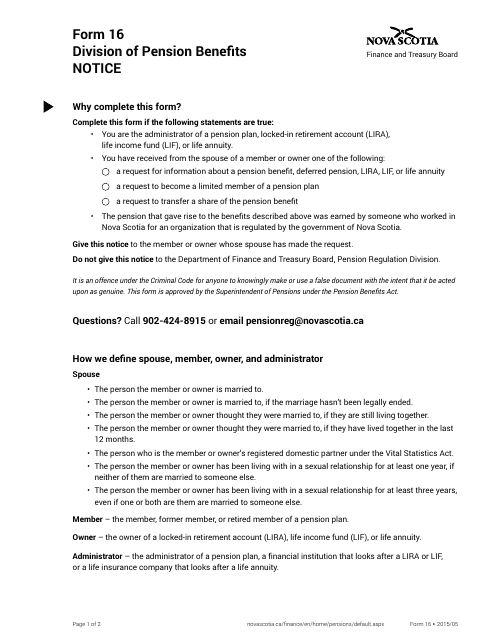

This Form is used for notifying the division of pension benefits in Nova Scotia, Canada.

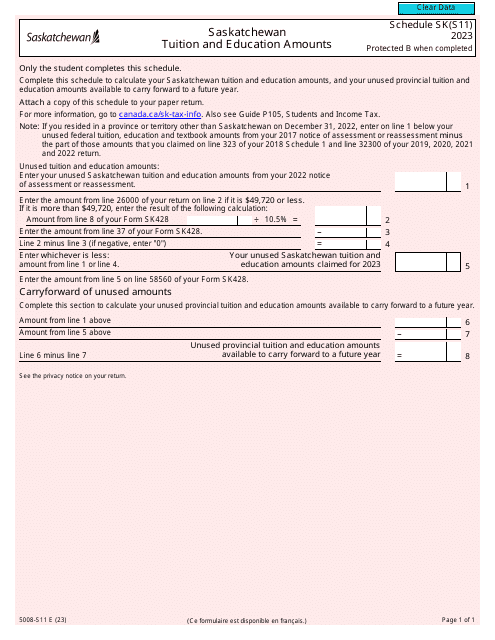

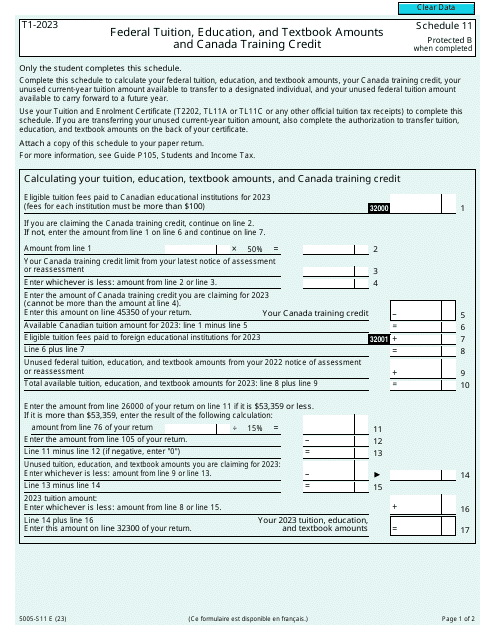

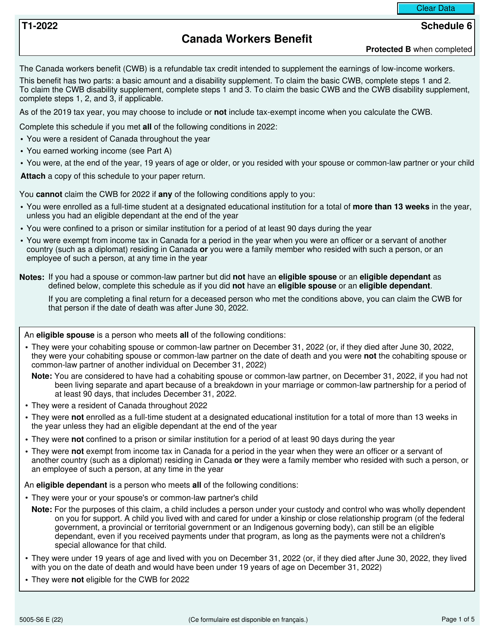

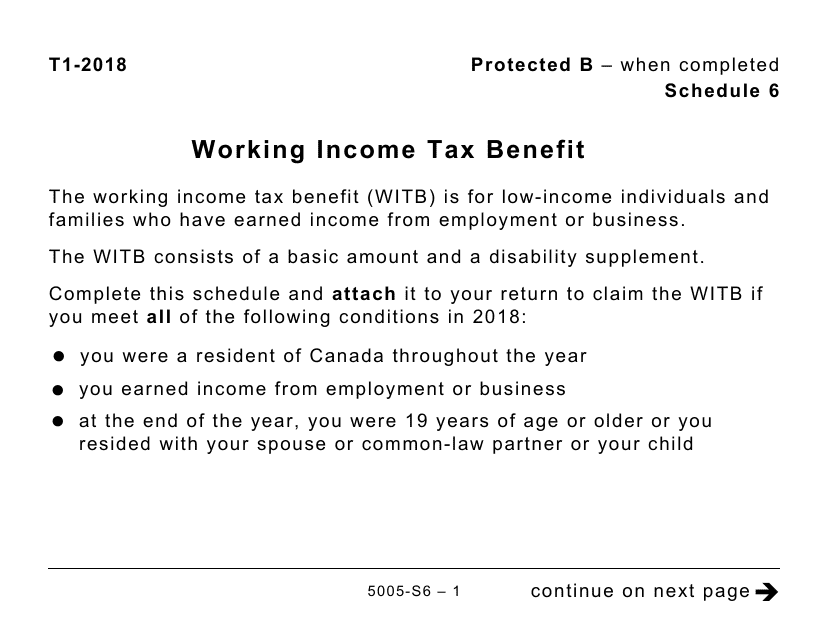

This form is used for reporting the Working Income Tax Benefit for individuals with visual impairments. It provides large print instructions for completing the Schedule 6.

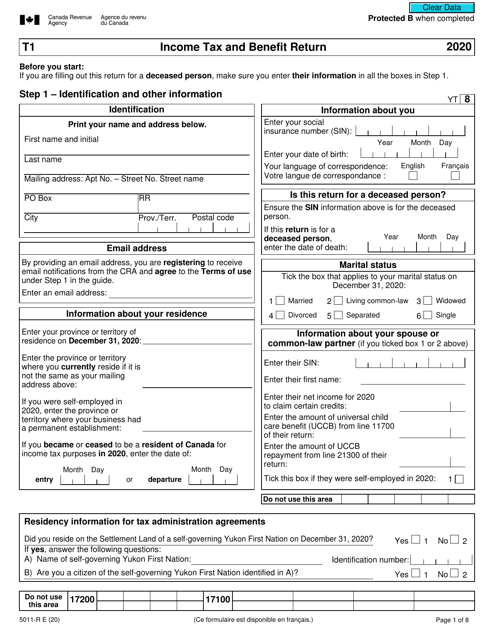

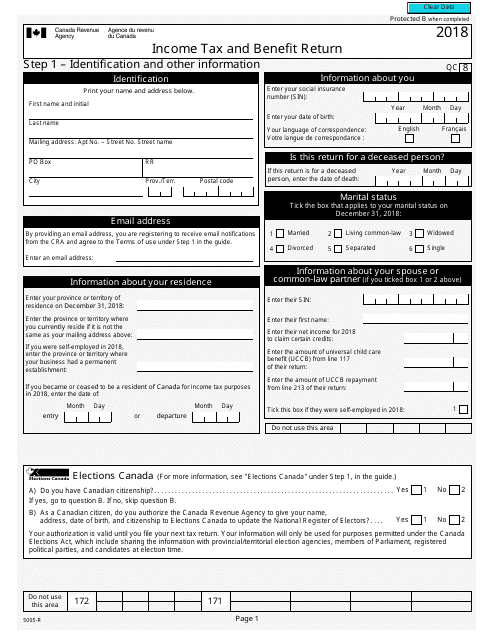

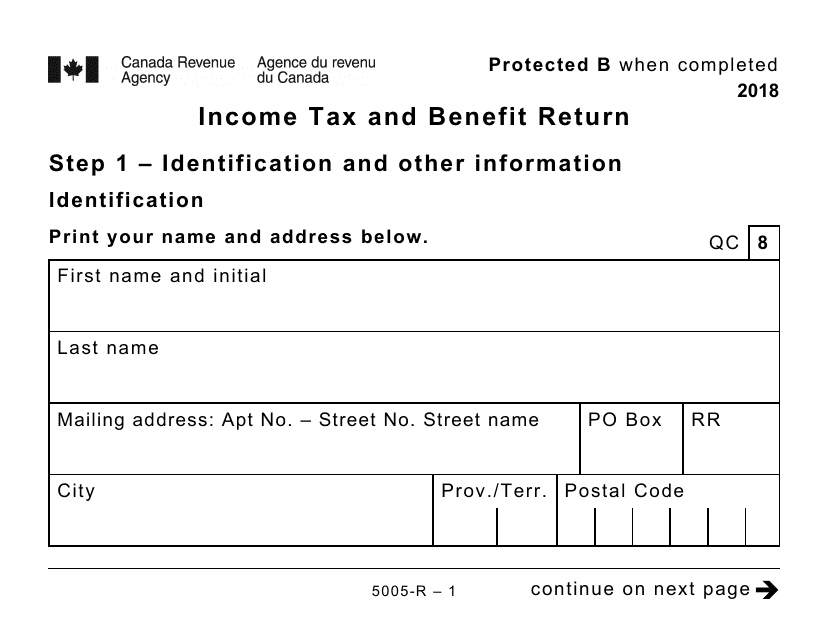

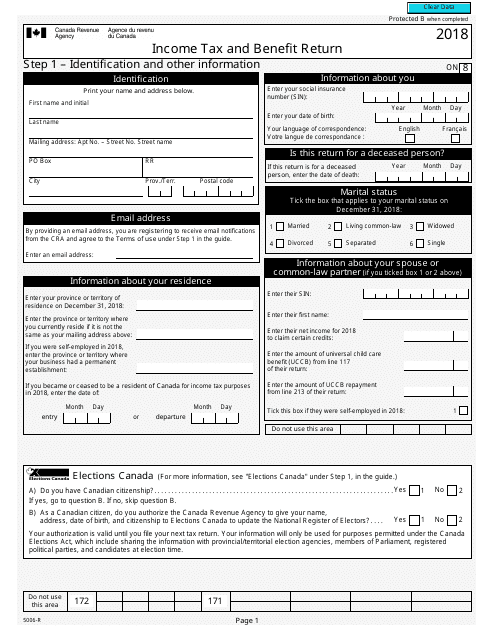

This Form is used for filing your annual income tax and benefit return in Canada. It helps you report your income, claim deductions and credits, and calculate your tax payable or refund.

This form is used for filing income tax and benefit returns in Canada. It is specifically designed and formatted for individuals who require a larger print size for easier readability.

This form is used for filing income tax and benefit returns in Canada. It is used to report your income, deductions, credits, and other information that is necessary for calculating your tax liability or claiming any benefits you may be eligible for.