Income Tax Form Templates

Documents:

2505

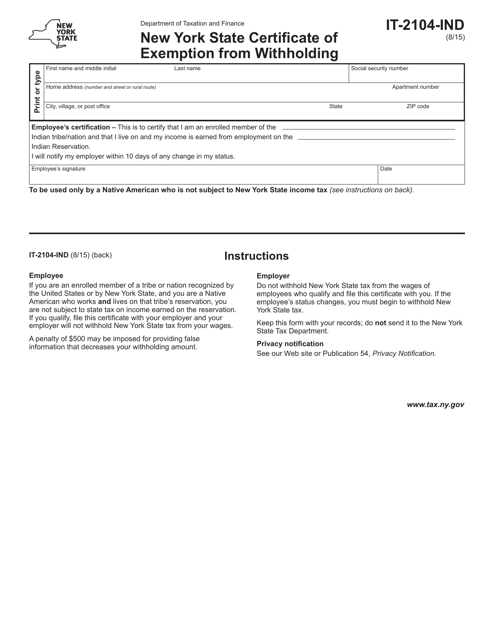

This Form is used for exempting individuals in New York State from income tax withholding. Individuals can use this form to claim an exemption from having taxes withheld from their wages.

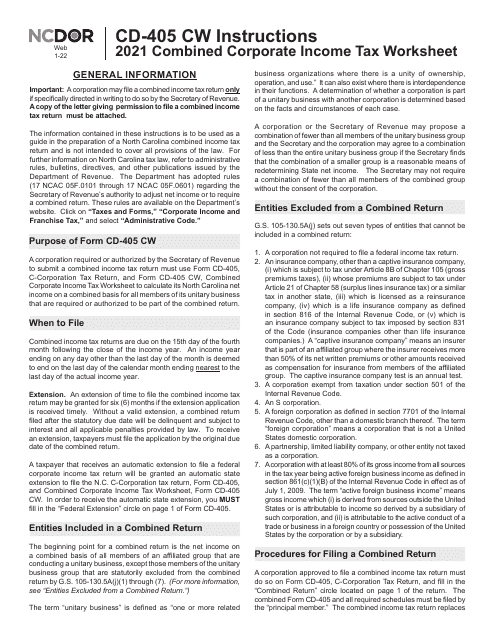

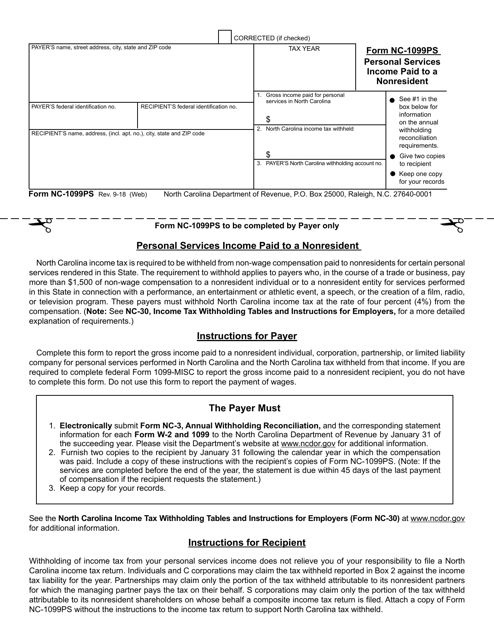

This Form is used for reporting income paid to nonresidents for personal services in North Carolina.

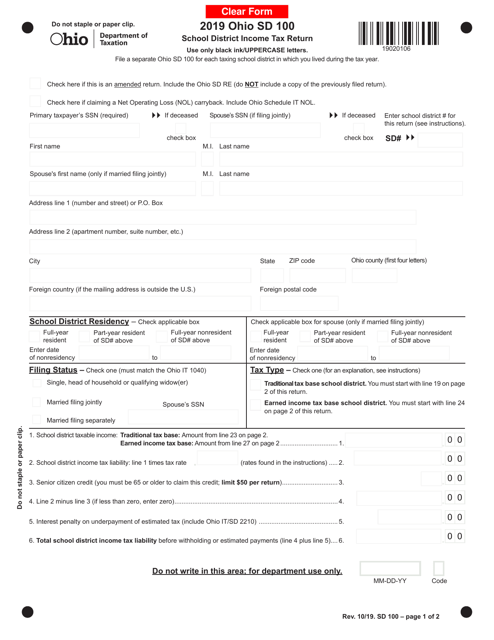

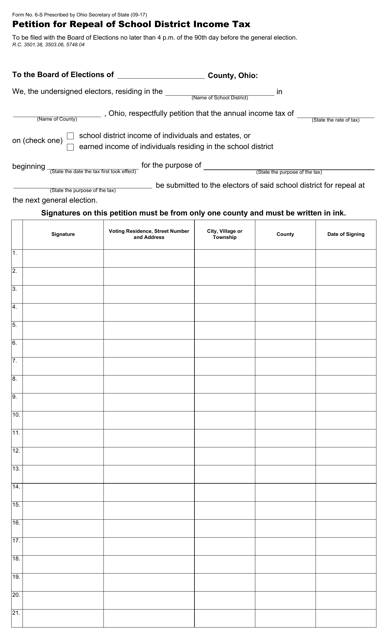

This Form is used for petitioning the repeal of a school district income tax in Ohio.

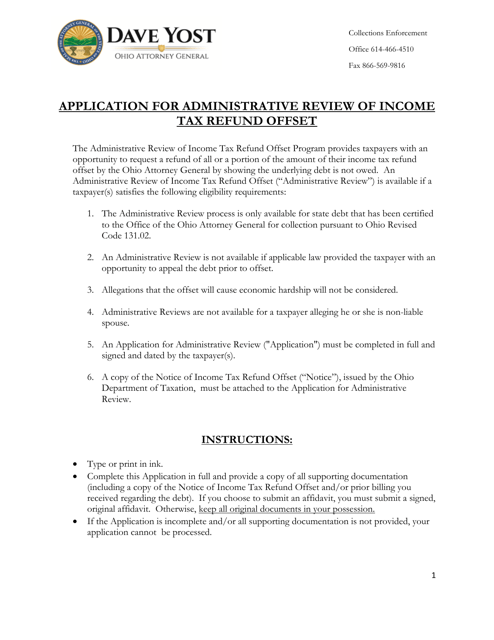

This document is used for applying for an administrative review of an income tax refund offset in Ohio.

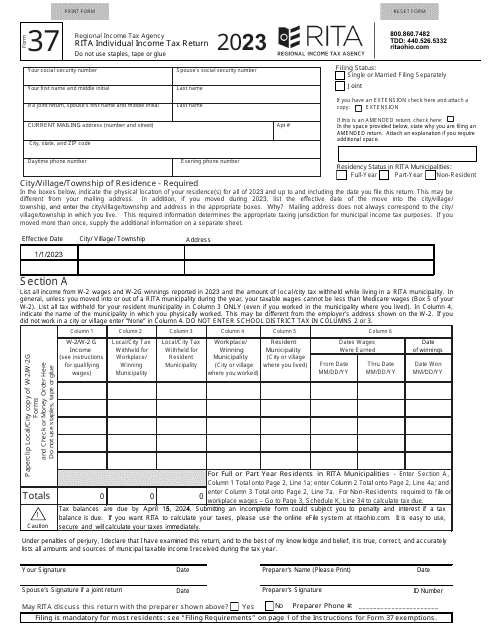

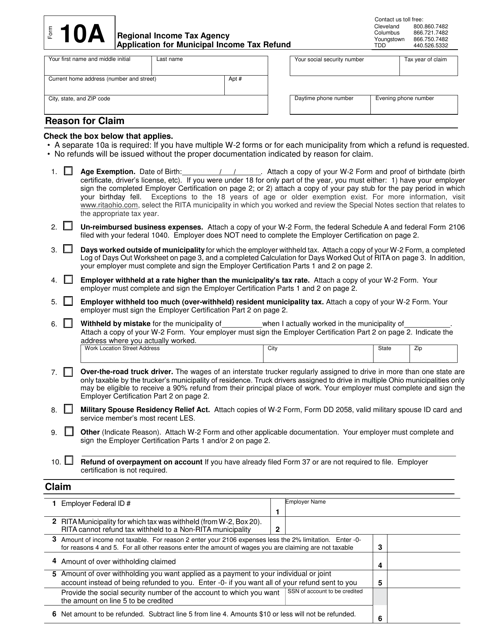

This Form is used for residents of Ohio to apply for a refund of municipal income tax paid.

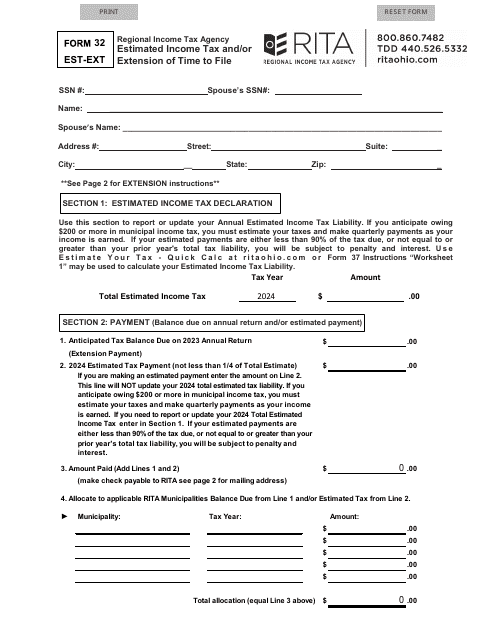

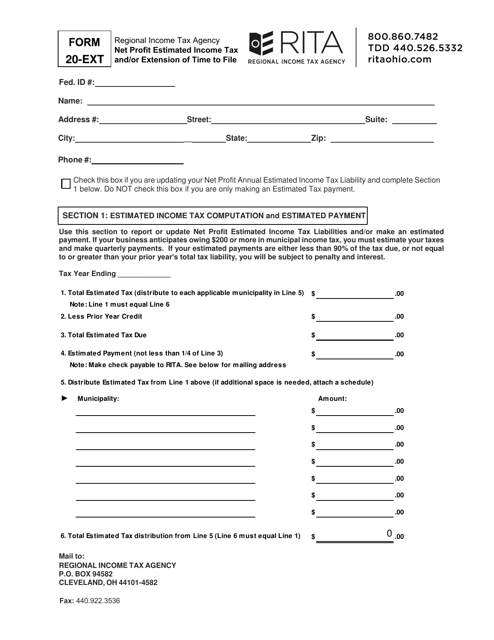

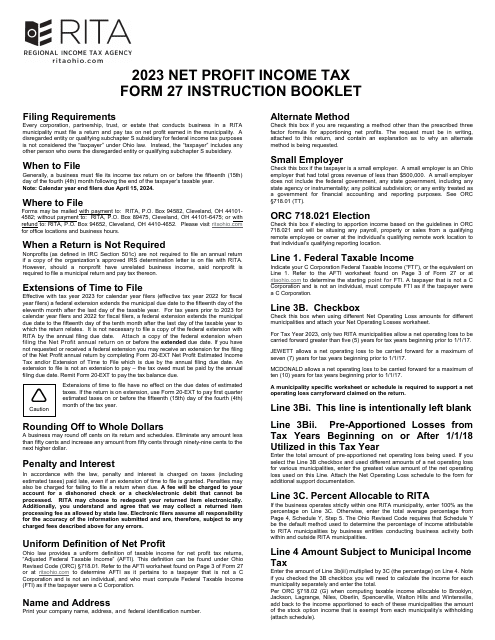

This Form is used for estimating net profit income tax and requesting an extension of time to file taxes in Ohio.

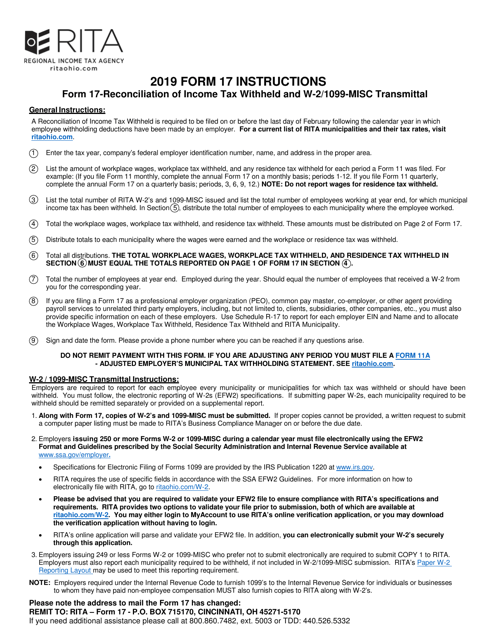

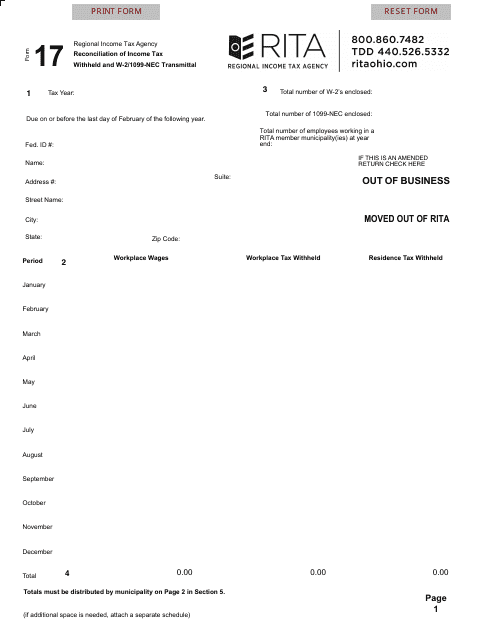

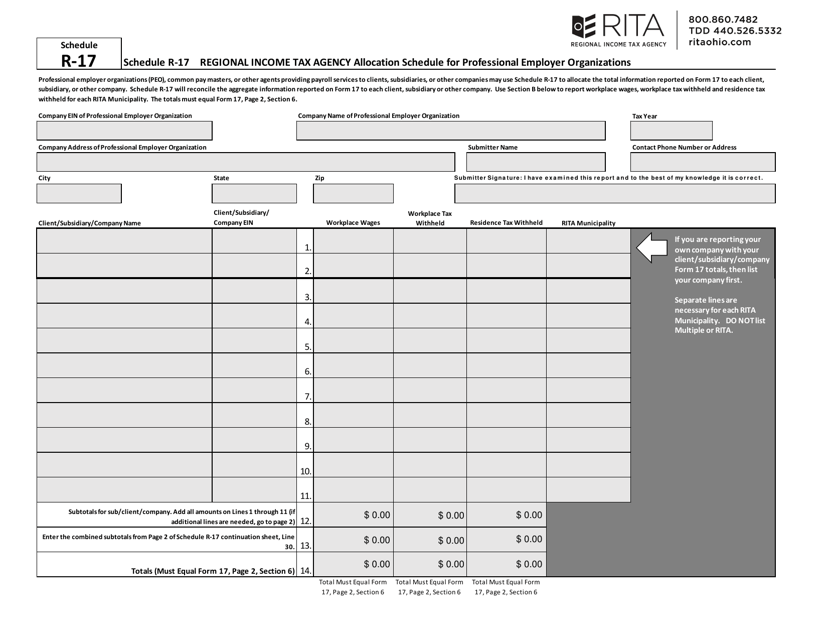

This document is a Schedule R-17 used in Ohio for the allocation of income tax agency for Professional Employer Organizations (PEOs). It is used to determine appropriate tax allocation for PEOs operating in different regions within Ohio.

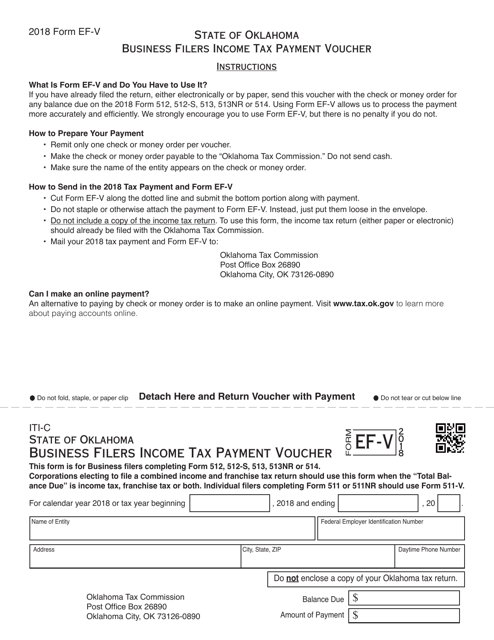

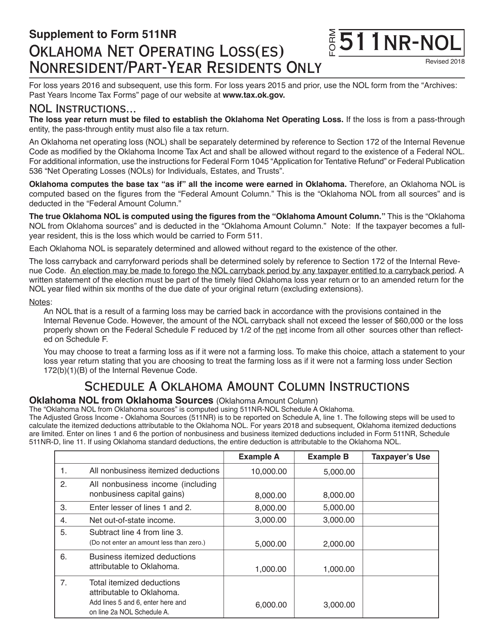

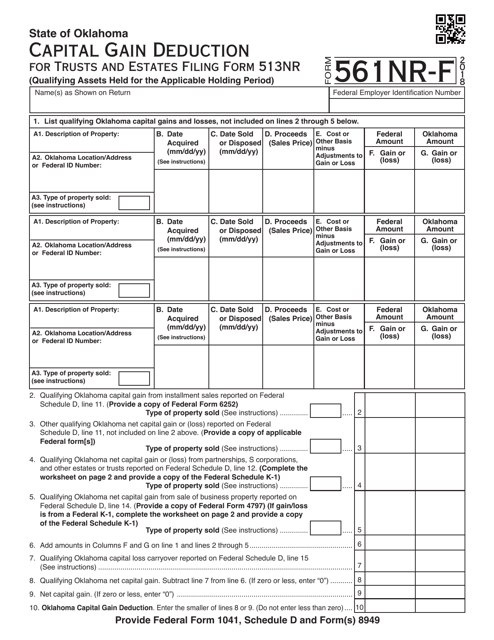

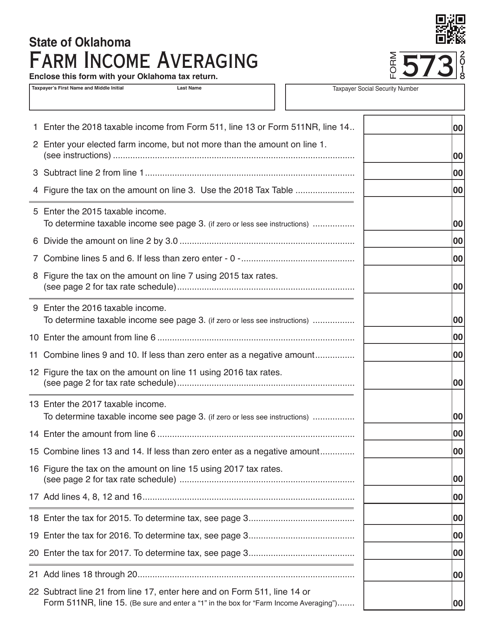

This Form is used for making income tax payments by business filers in Oklahoma.

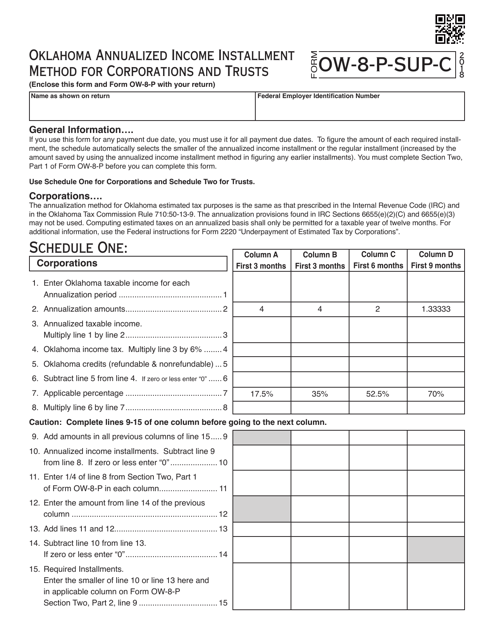

This Form is used for calculating annualized income installment method for corporations and trusts in Oklahoma.

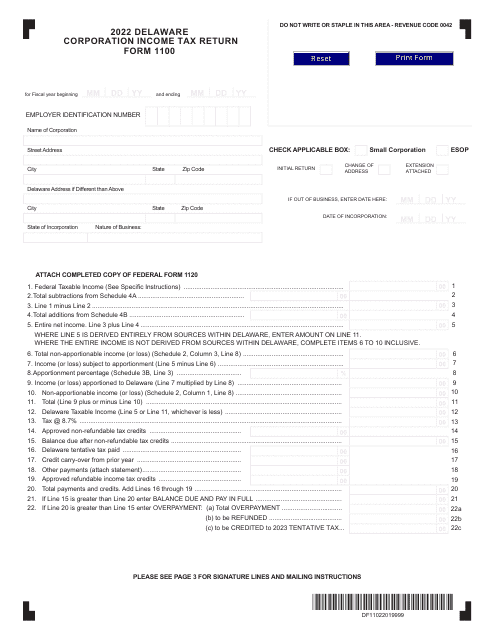

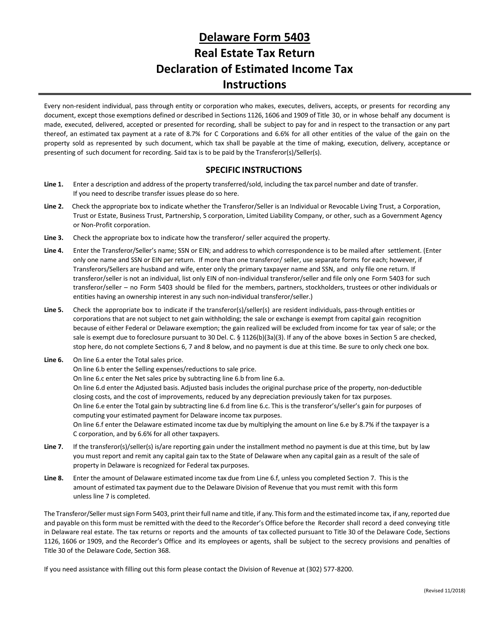

This form is used for declaring your estimated income tax and real estate tax return in the state of Delaware. It provides instructions on how to accurately complete the form and submit it to the appropriate authorities.

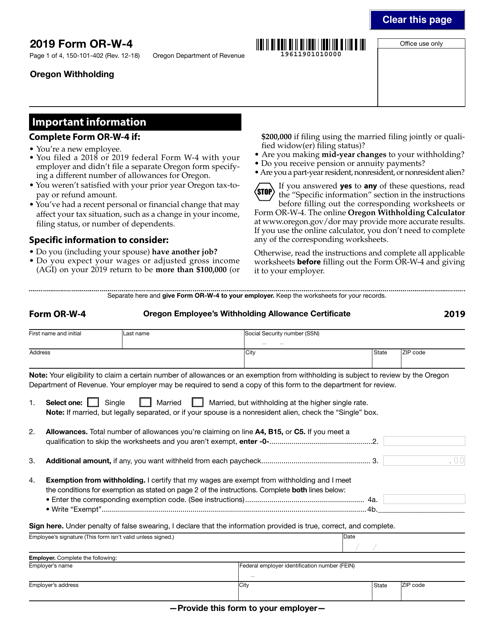

This form is used for Oregon residents to determine the correct amount of state income tax to withhold from their wages.

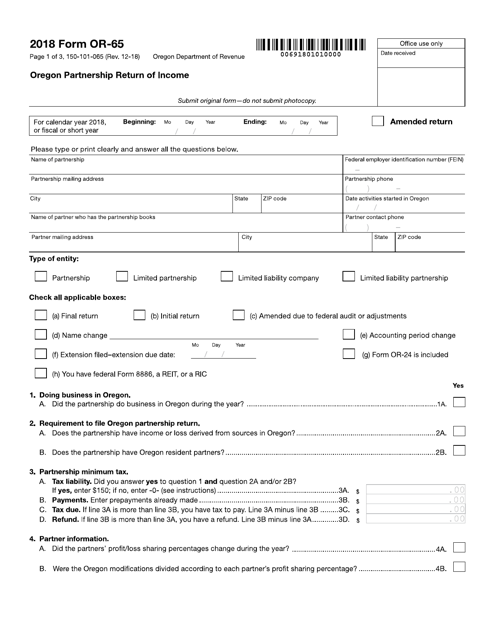

This form is used for filing the Oregon Partnership Return of Income for Oregon residents.

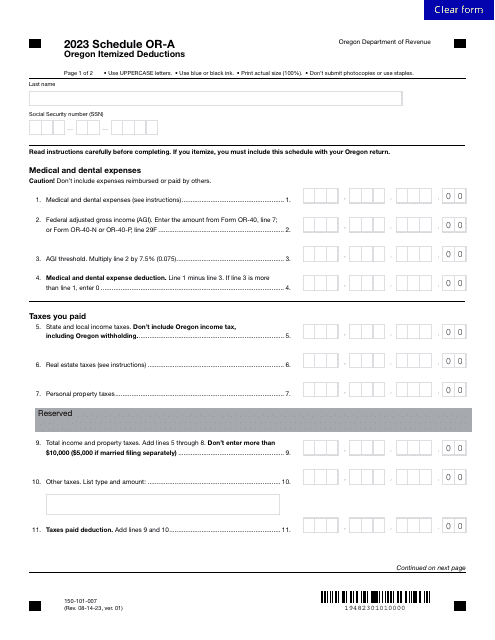

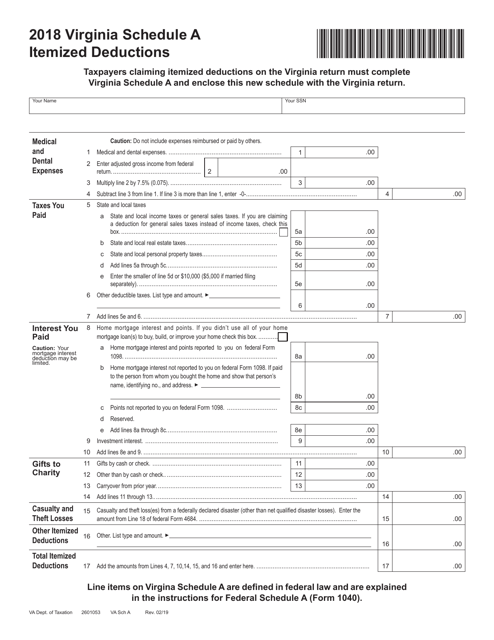

This form is used for reporting itemized deductions on your Virginia state tax return. It allows you to claim deductions such as medical expenses, mortgage interest, and charitable contributions to potentially reduce your taxable income.