Income Tax Form Templates

Documents:

2505

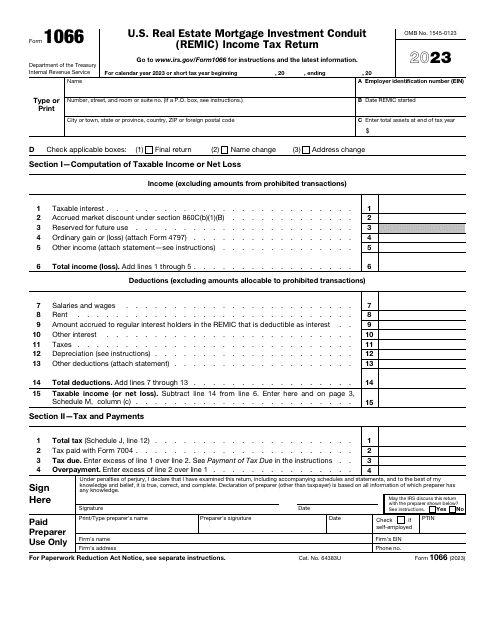

This is an IRS tax form used by a REMIC to inform the fiscal authorities about the details of its operation.

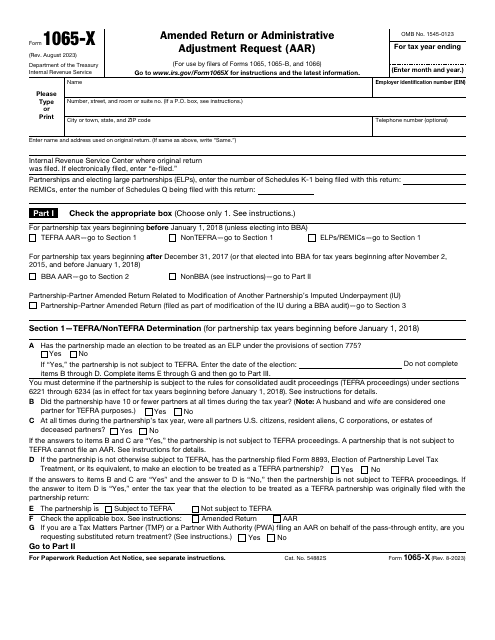

This is a fiscal statement used by partnerships and real estate mortgage investment conduits to fix the errors in previously filed IRS Form 1065, IRS Form 1065-B, IRS Form 1066.

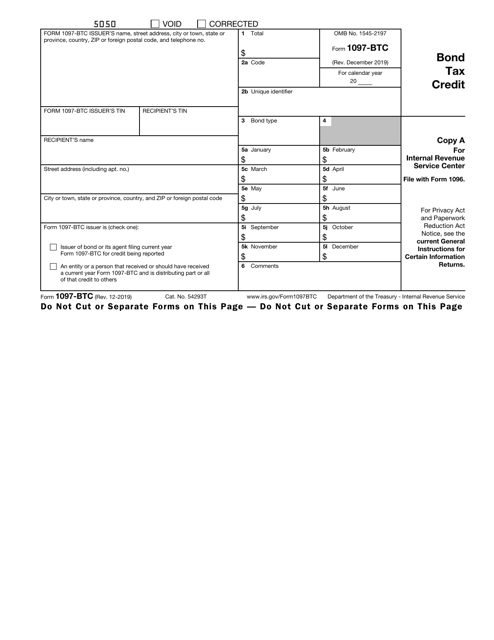

This is a formal IRS document prepared by tax credit bond issuers and taxpayers that distribute the credit in question.

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

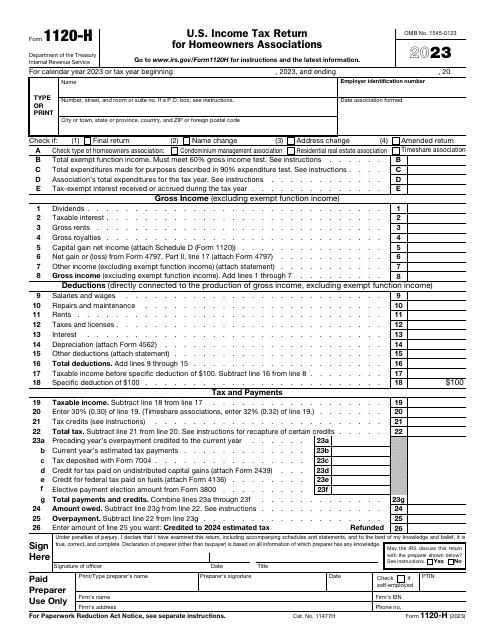

Fill out this form if you represent a homeowner's association in order to make use of certain tax benefits. That means, that the association can exclude the Exempt Function Income from its gross income.

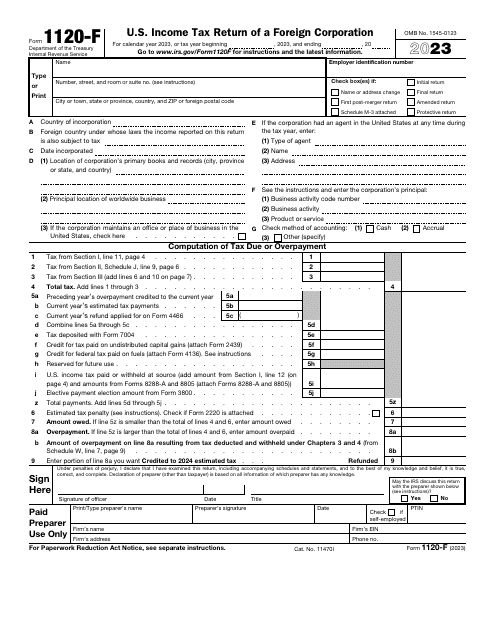

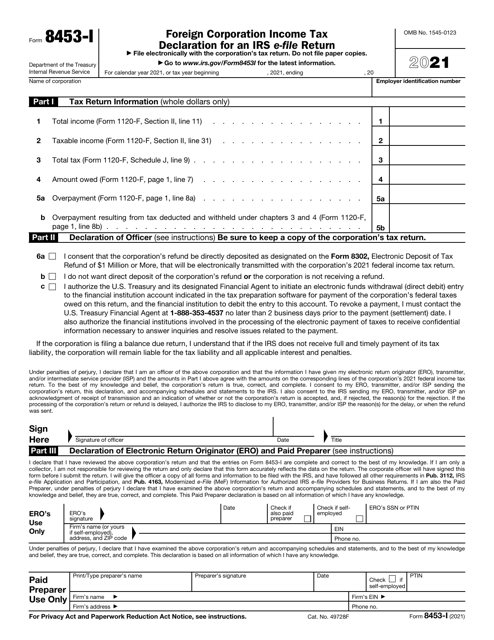

File this form if you are a foreign corporation and maintain an office within the United States in order to report your income, deductions, and credits to the Internal Revenue Service (IRS), as well as to figure your U.S. income tax liability.

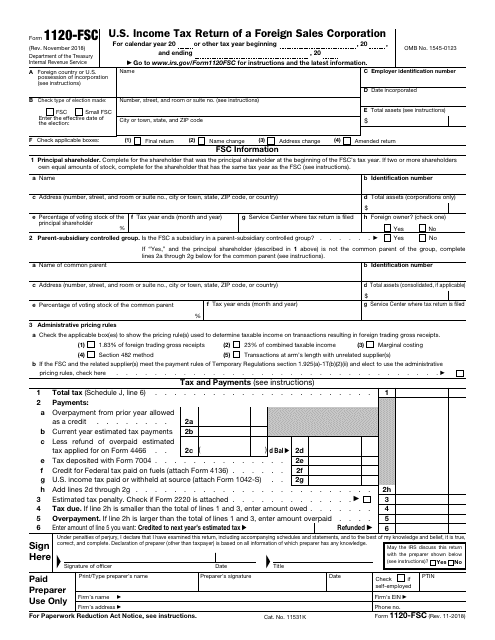

This is a fiscal document filled out by entities that export goods produced in the United States to inform tax organizations about the income they generated during the year, the deductions they qualify for, and the tax they are supposed to pay.

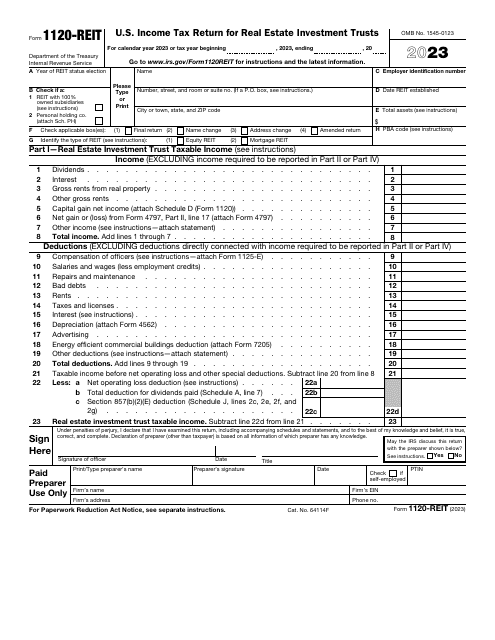

File this form if you are a corporation, trust, or an association electing to be treated as Real Estate Investment Trusts (REITs) in order to report your income, deductions, credits, penalties, as well as your income tax liability.

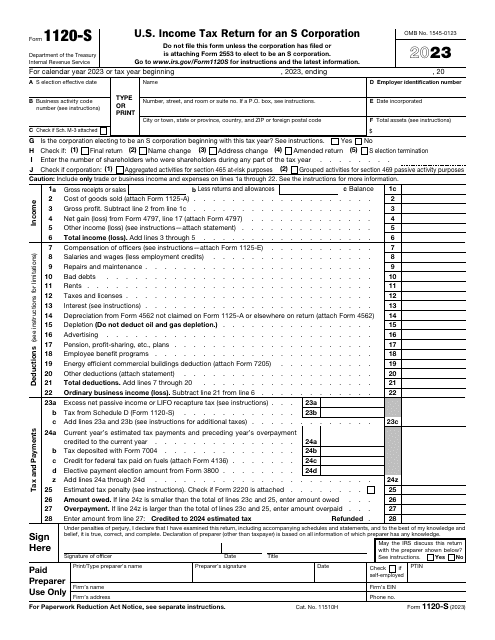

This form is used for reporting income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. The information is sent to the Internal Revenue Service (IRS).

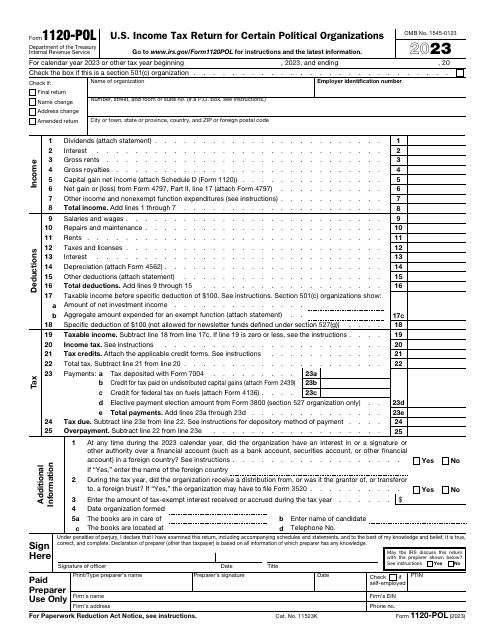

Use this form to inform the Internal Revenue Service (IRS) about the taxable income of your political organization, as well as about your tax liability according to Section 527.

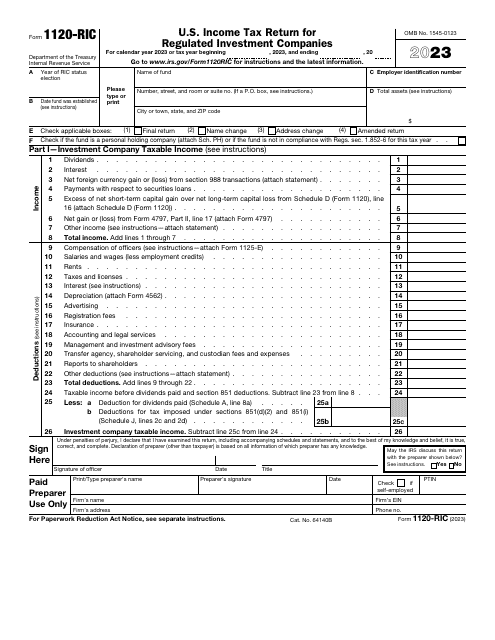

This is a fiscal form used by regulated investment companies to inform the government about their revenue over the course of the tax year, describe their losses and gains, claim tax deductions and credits, and compute their tax liability correctly.

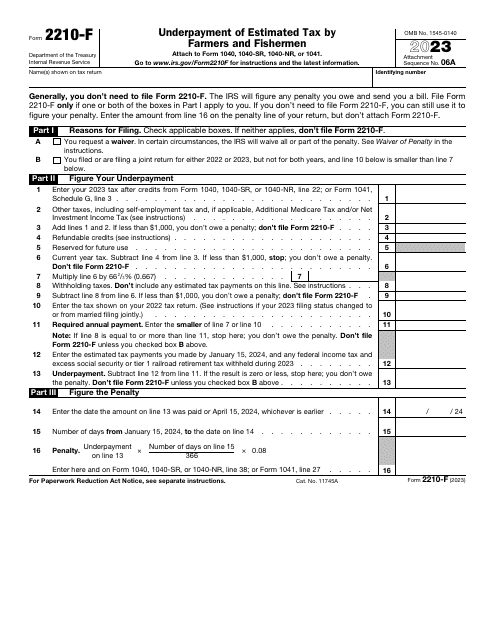

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.

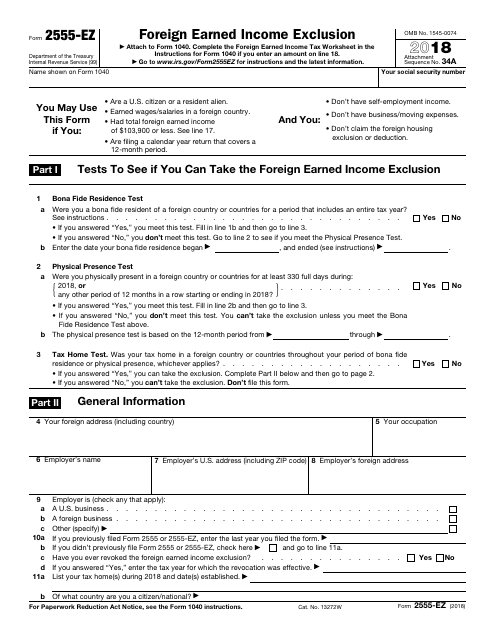

This document is used for claiming the Foreign Earned Income Exclusion on your taxes.

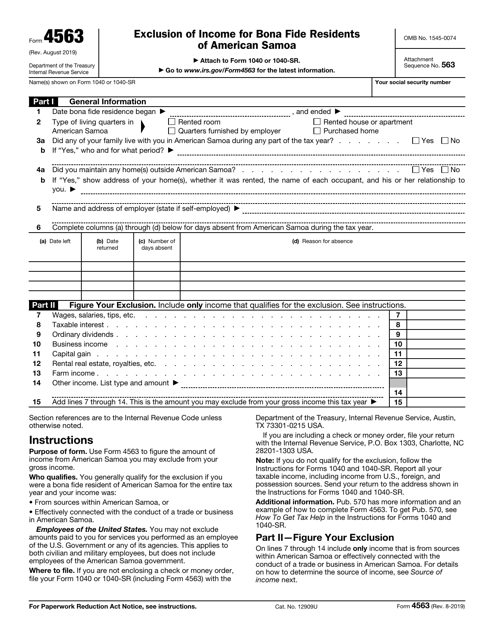

This is a tax form people permanently residing in American Samoa can use to exclude certain income from their gross income.

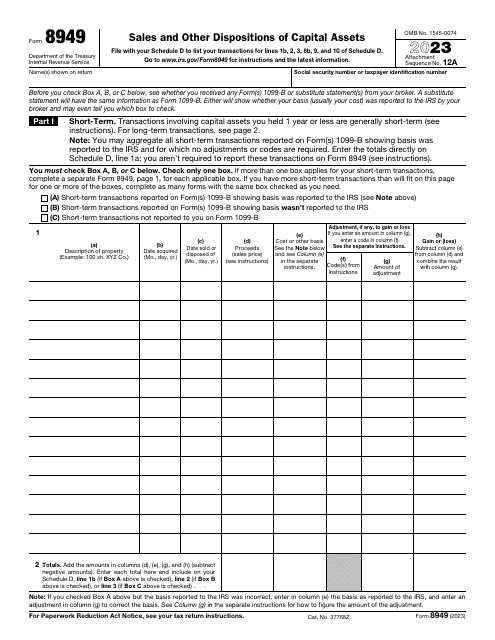

This is a legal document used to report exchanges and sales of capital assets, both long- and short-term capital gains and losses, to the IRS.

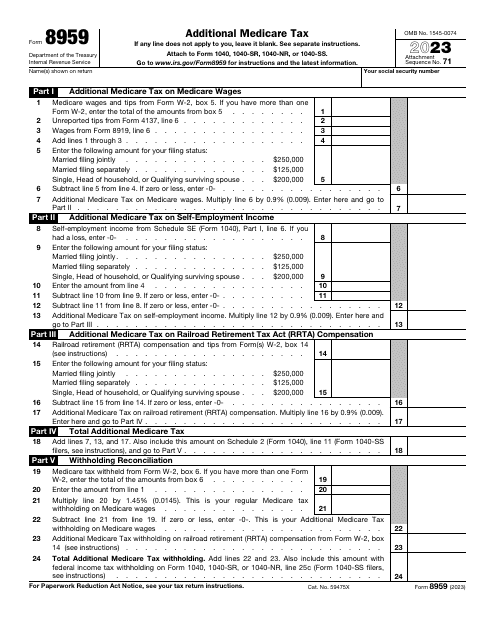

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

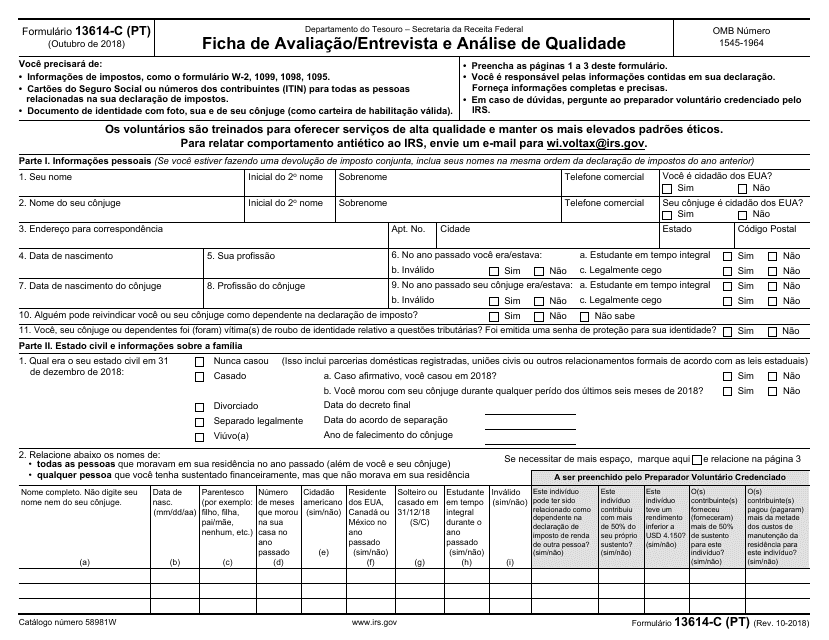

This document is used for the intake, interview, and quality review process for taxpayers who speak Portuguese. It is a form provided by the IRS.

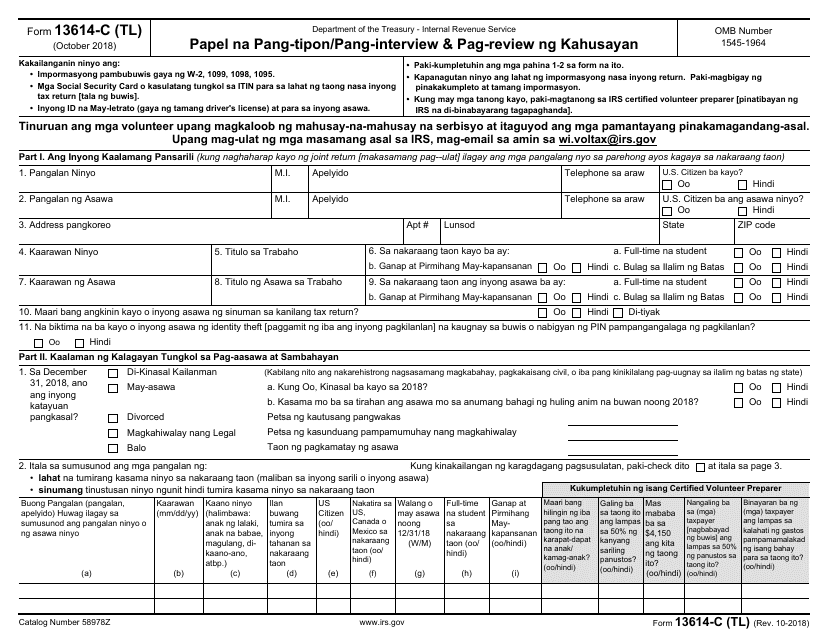

This document is for individuals who speak Tagalog and need assistance with their tax intake process. It is used to gather information about the taxpayer's financial situation for the IRS.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

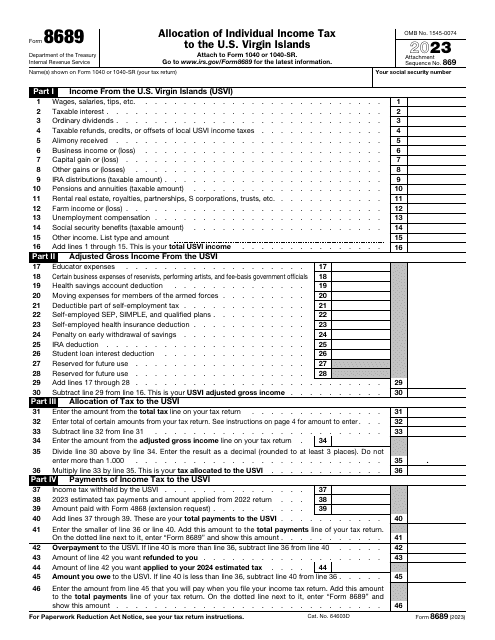

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.