Income Tax Form Templates

Documents:

2505

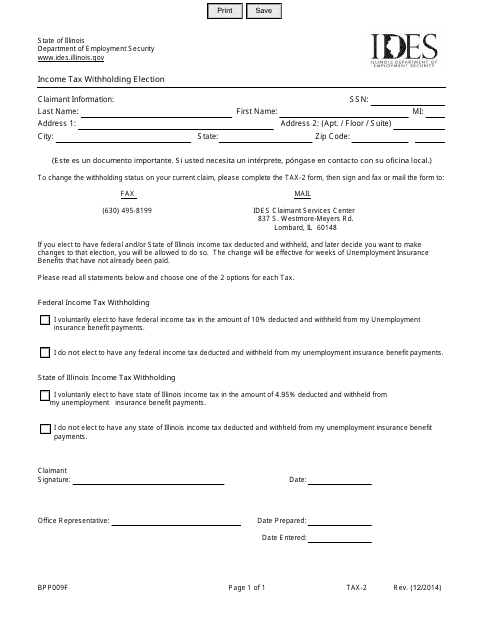

This Form is used for making an income tax withholding election in the state of Illinois.

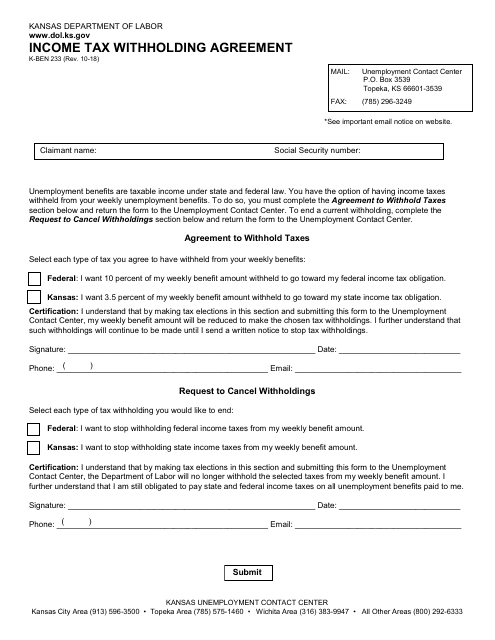

This form is used for an Income Tax Withholding Agreement in the state of Kansas. It allows individuals to authorize employers to withhold a specific amount of income tax from their wages.

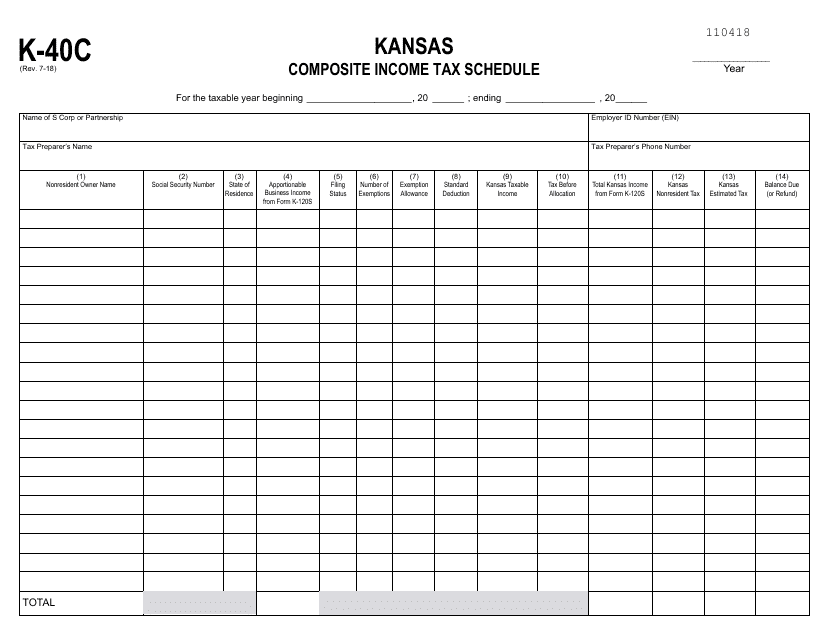

This form is used for reporting composite income tax for individuals in the state of Kansas.

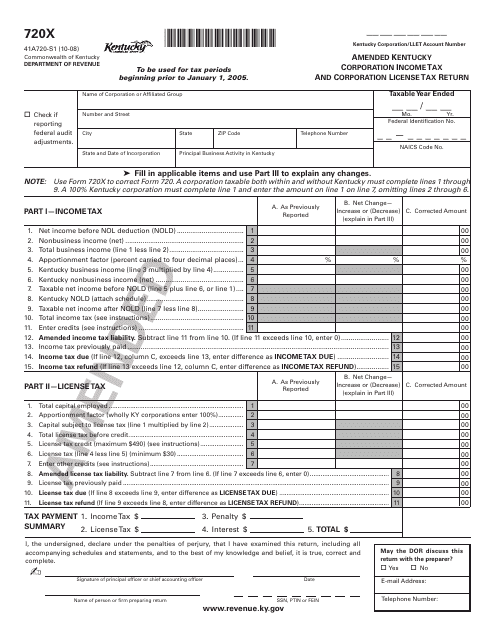

This form is used for amending the Kentucky Corporation Income Tax and Corporation License Tax Return for Kentucky corporations.

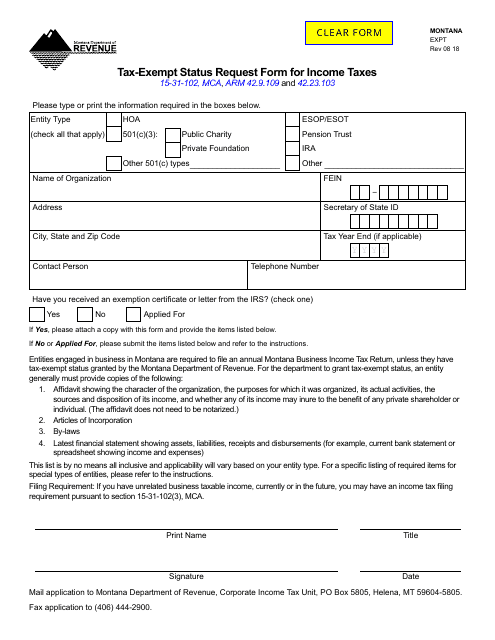

This form is used to request tax-exempt status for income taxes in Montana.

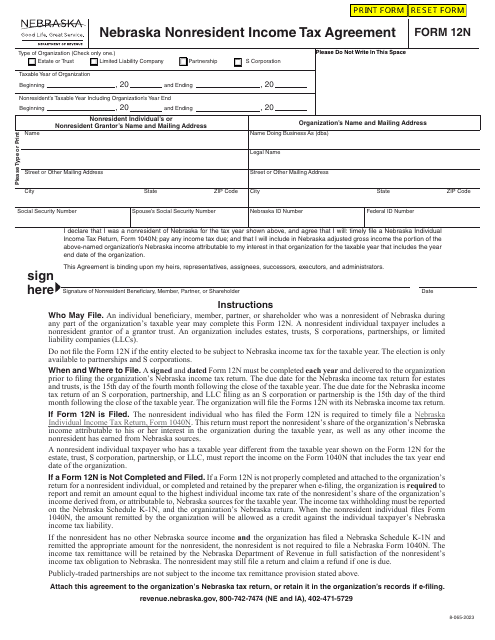

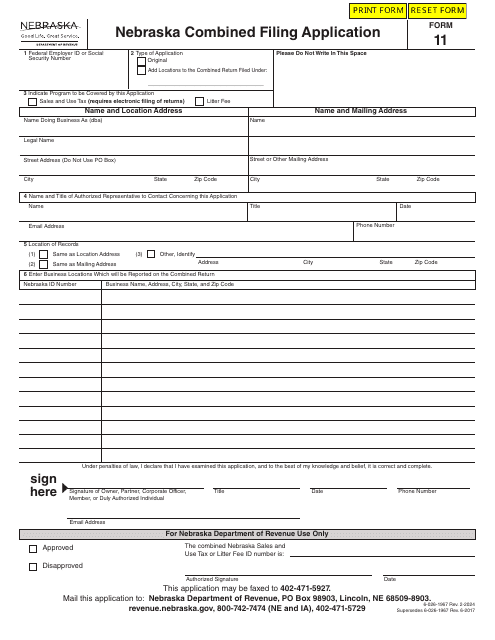

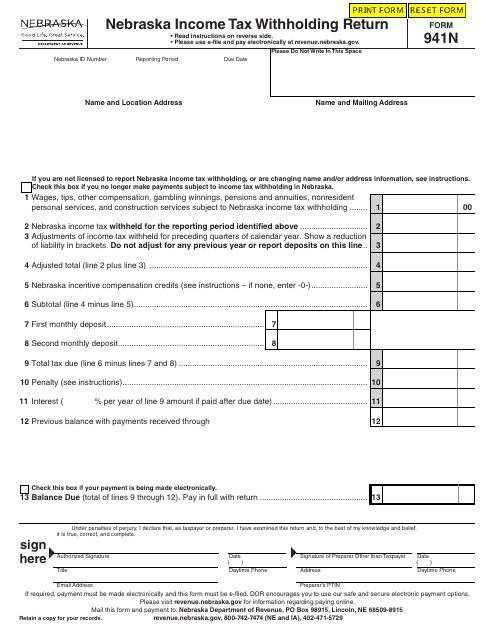

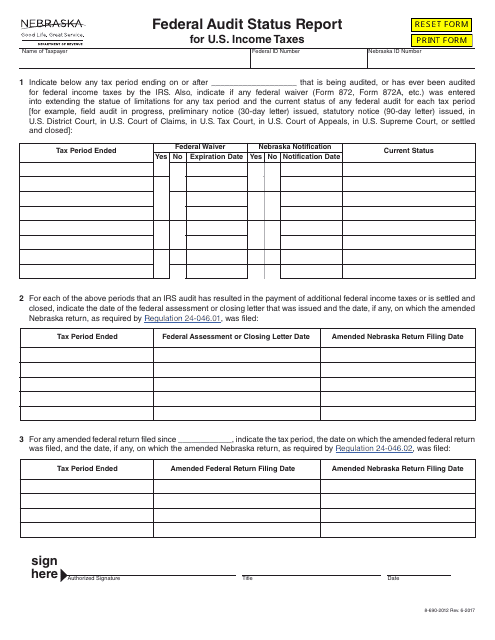

This type of document provides a status report on the federal audit of U.S. income taxes specifically for residents of Nebraska.

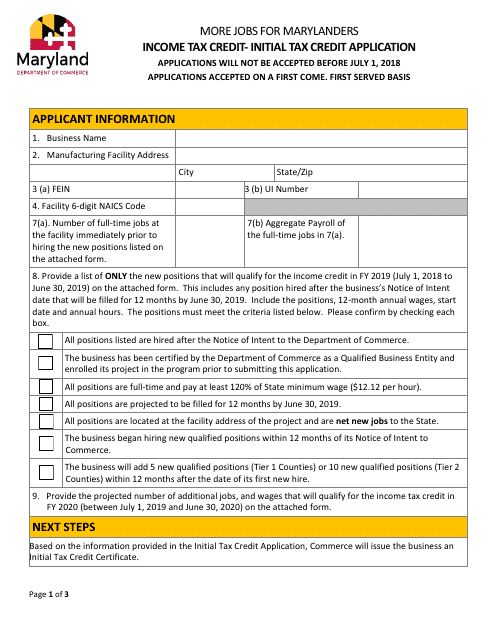

This Form is used for applying for the Initial Tax Credit in Maryland.

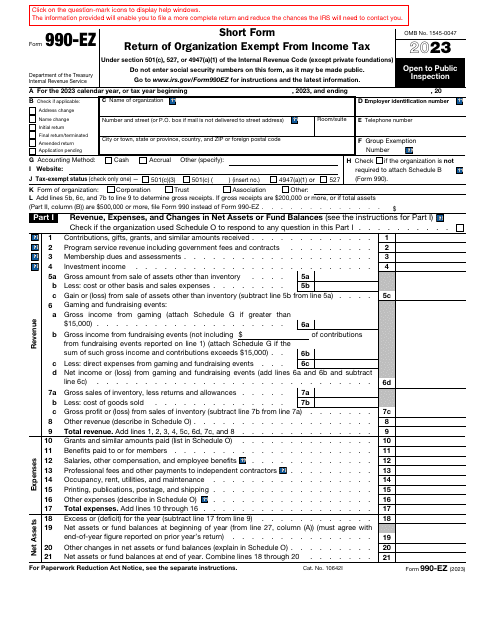

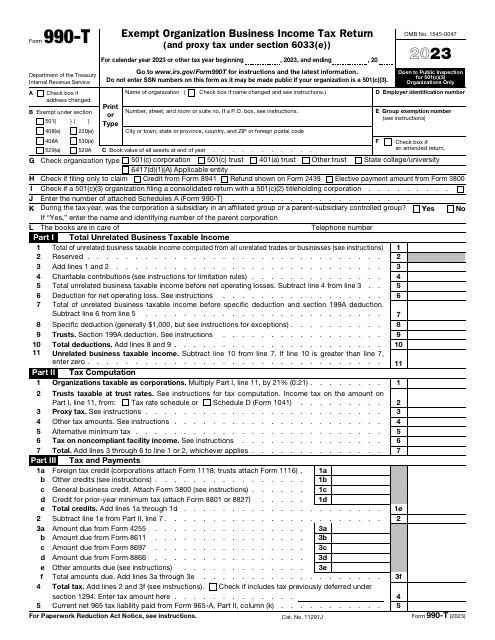

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.

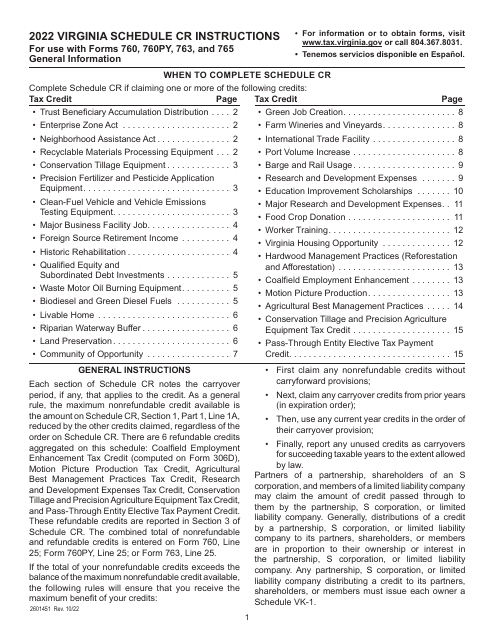

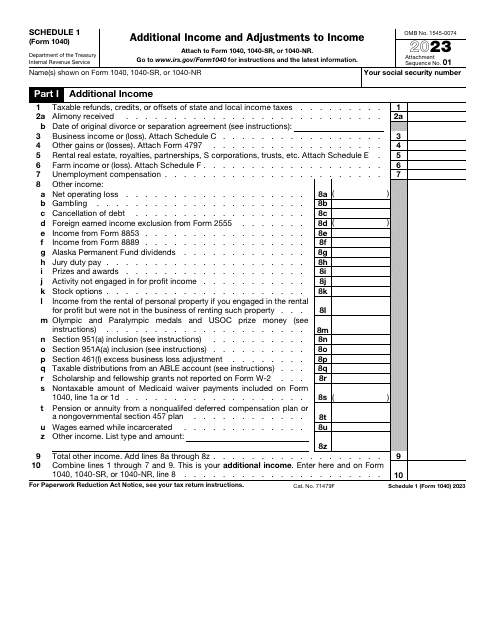

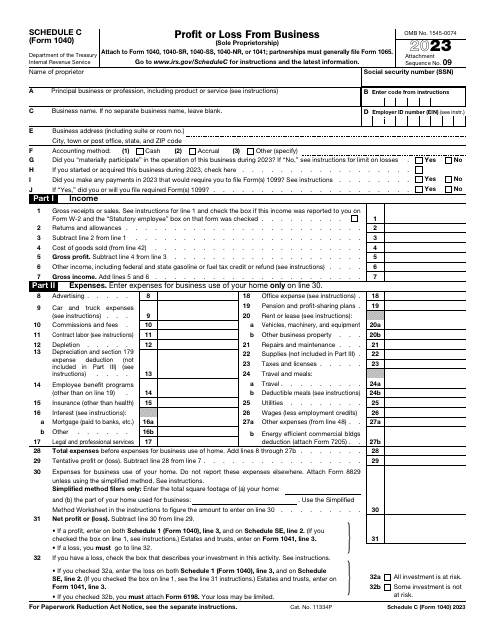

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

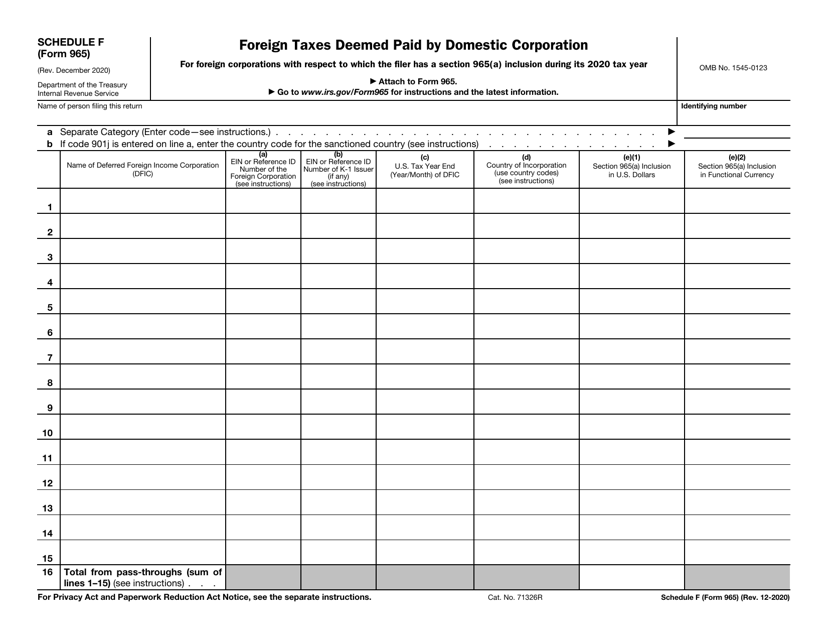

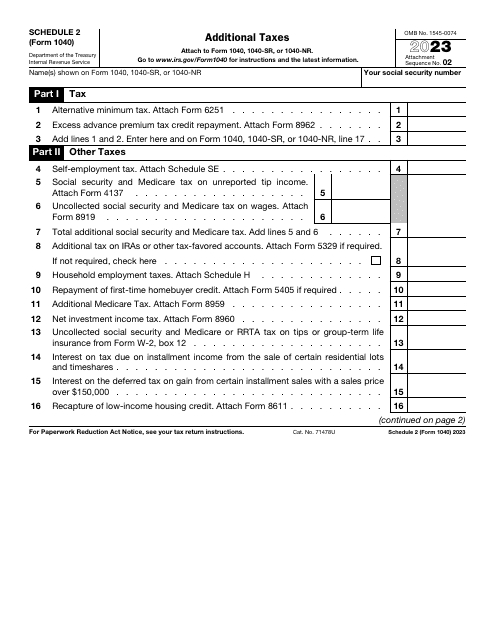

This is a supplementary document designed to allow taxpayers to list taxes they do not outline on the main income statement they are supposed to file annually.

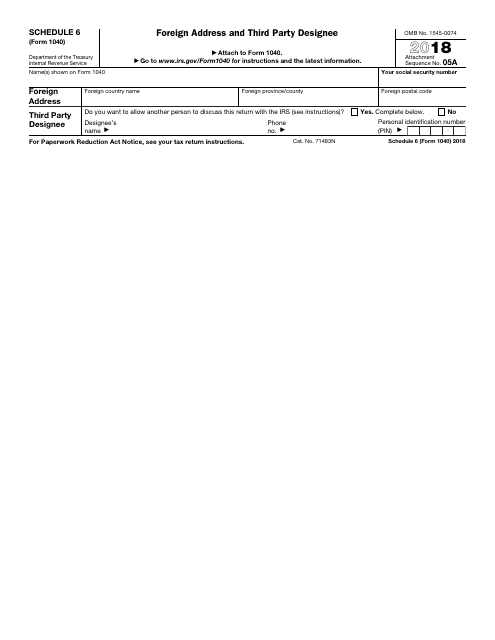

This form is used for providing a foreign address and designating a third party for tax purposes on IRS Form 1040.

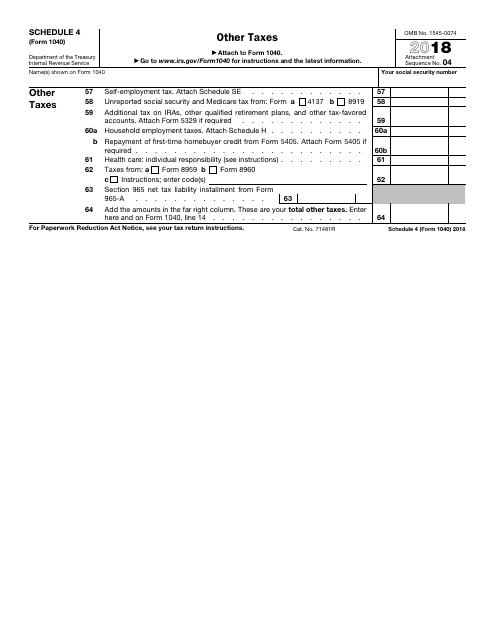

This Form is used for reporting other types of taxes that do not fit on the main IRS Form 1040.

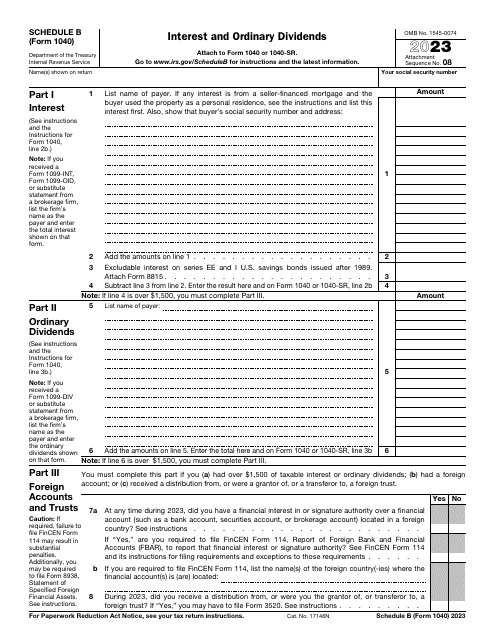

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

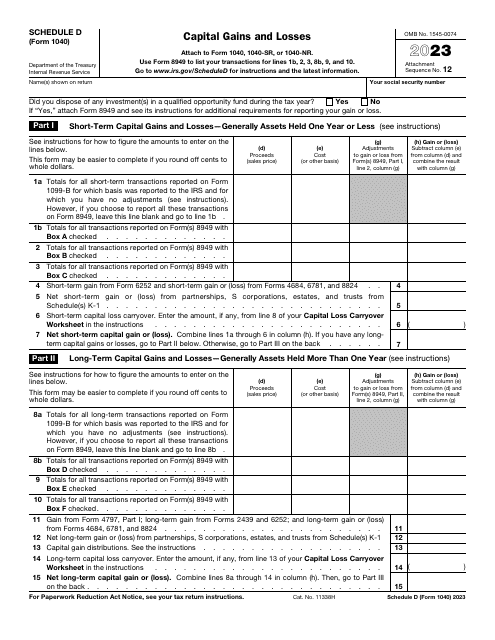

This is a supplementary document taxpayers have to attach to their tax return to outline capital gains and losses that were the result of property sales.

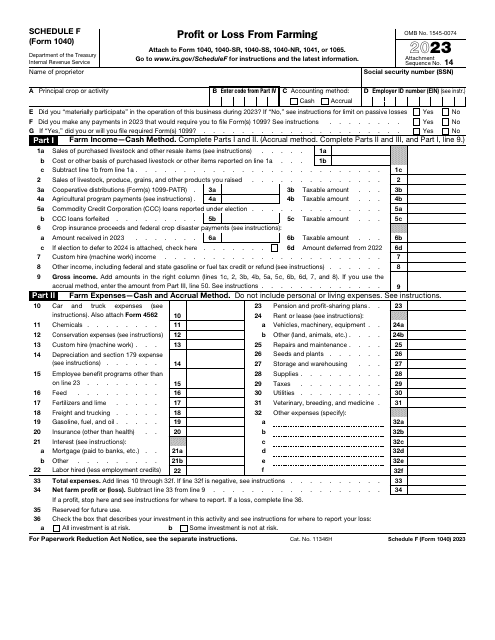

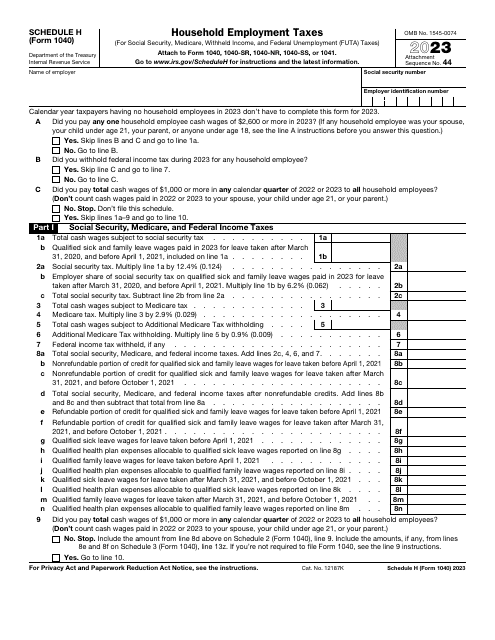

This is a supplementary document that has to be attached to a tax return, if the taxpayer employed people that worked in their house helping the owner to manage the place in a certain capacity.

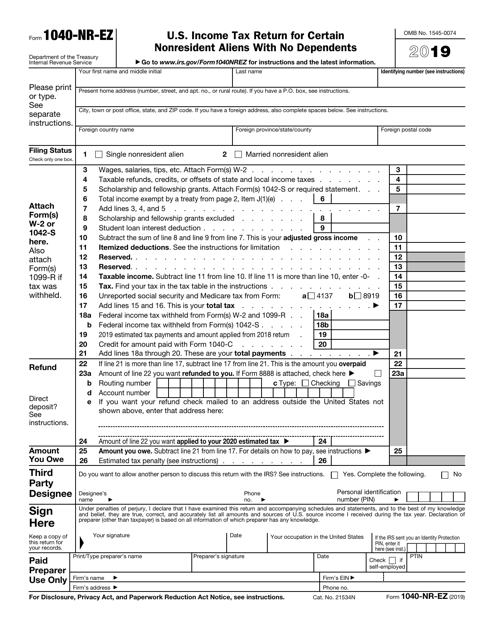

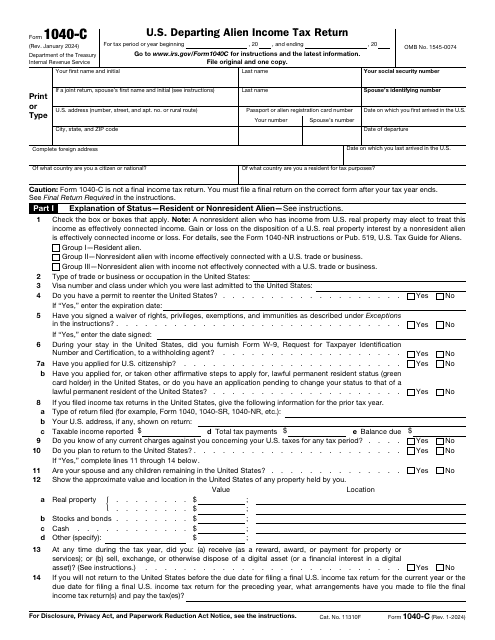

Use this form if you are a non-resident alien (non-United States citizen who has not passed the green card or the substantial presence test) and claim no dependents. This form was issued by the Internal Revenue Service (IRS).

Use this form to report the income you received or expect to receive for the tax year and to pay the expected tax on that income (only if you are required to do so).

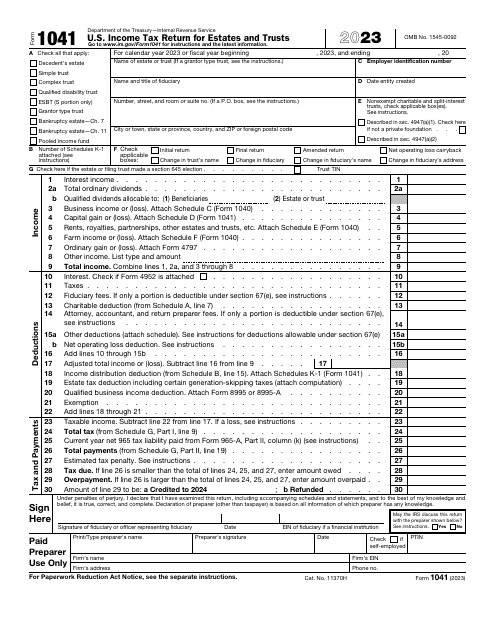

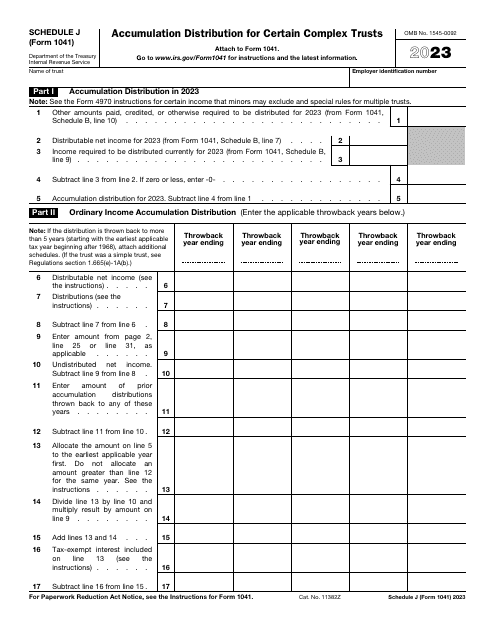

File this document, also known as the Estates and Trusts Tax Return, as an income tax return to the Internal Revenue Service (IRS) if you are a fiduciary of a bankruptcy estate, domestic decedent's estate, or a trust.

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

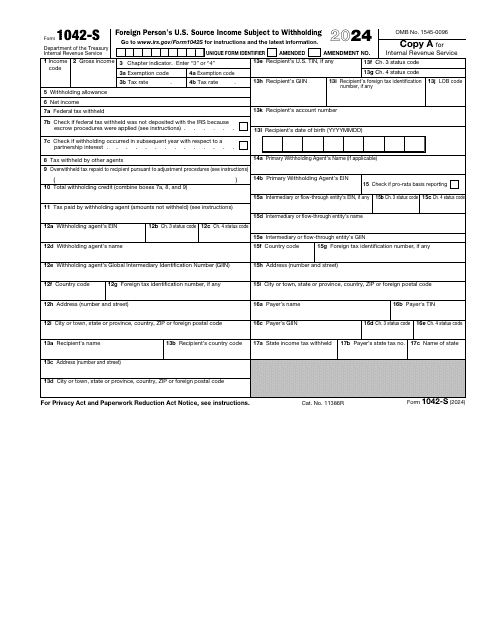

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.