Income Tax Form Templates

Documents:

2505

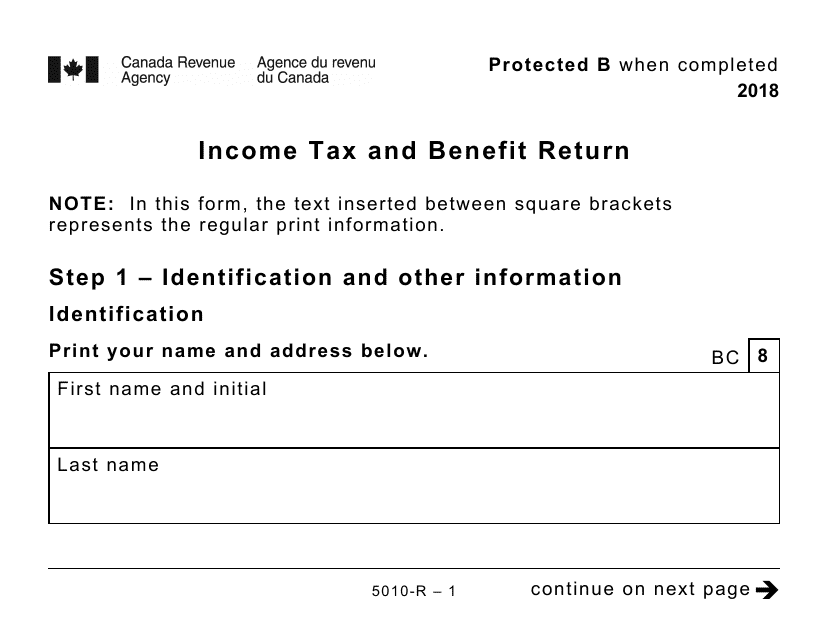

This Form is used for reporting income, claiming deductions and credits, and calculating tax liability for individuals in Canada. It is specifically designed for those who require a large print format.

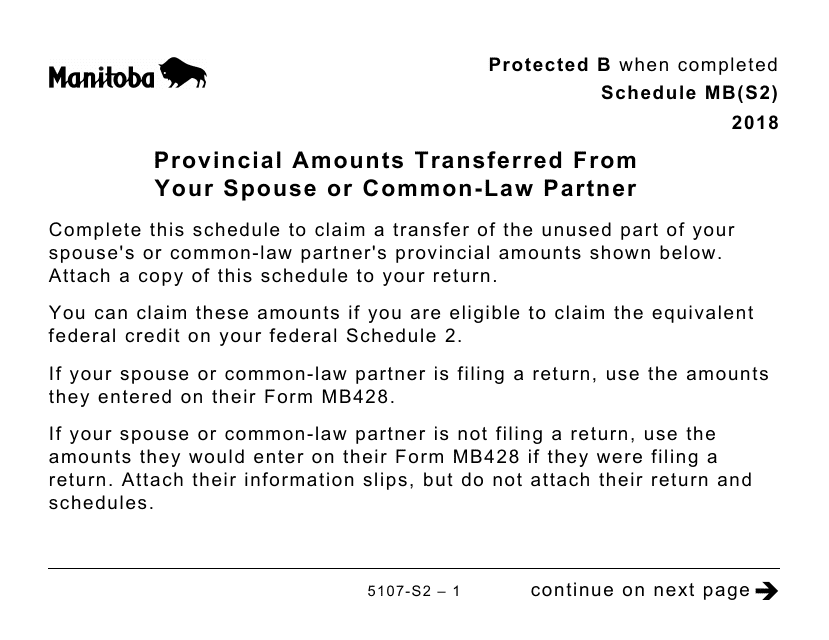

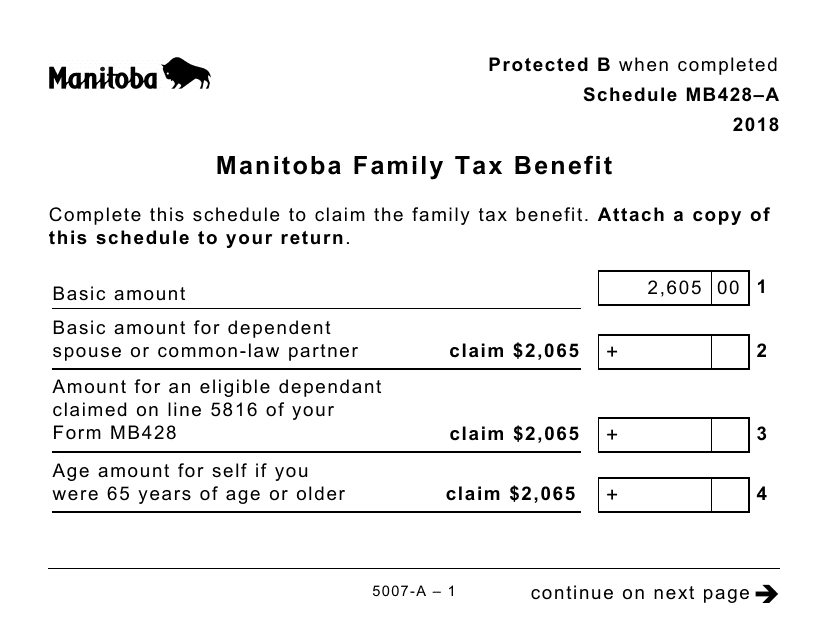

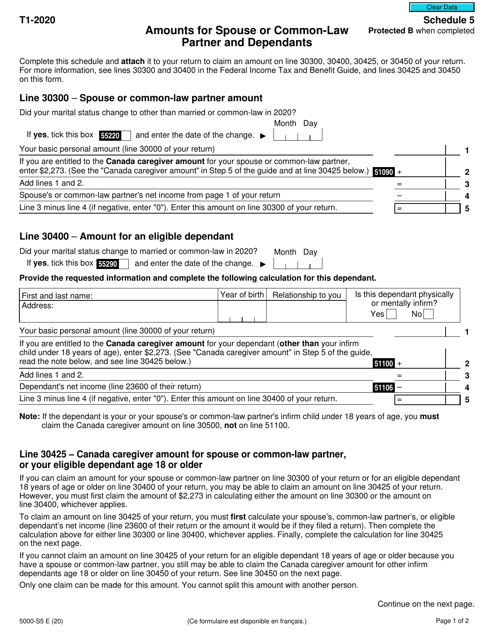

This form is used for reporting the provincial amounts transferred from your spouse or common-law partner on your Canadian tax return. It is in large print format for easier reading.

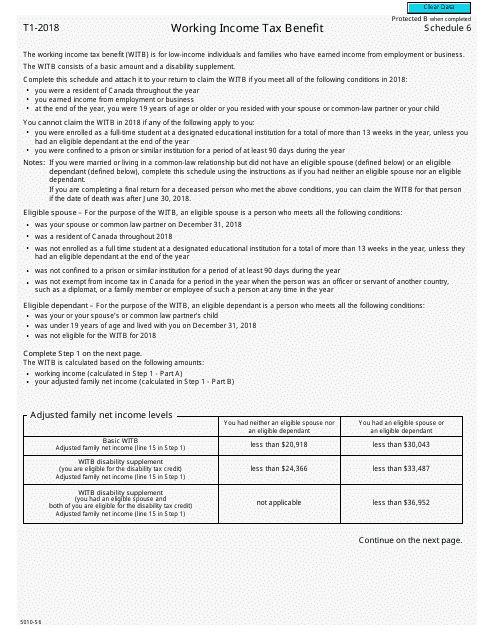

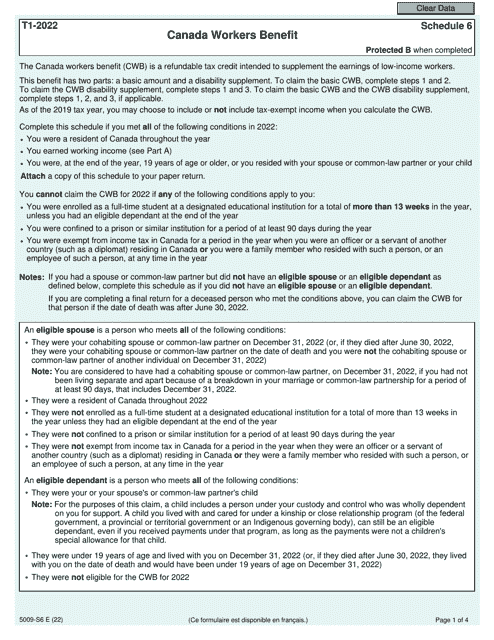

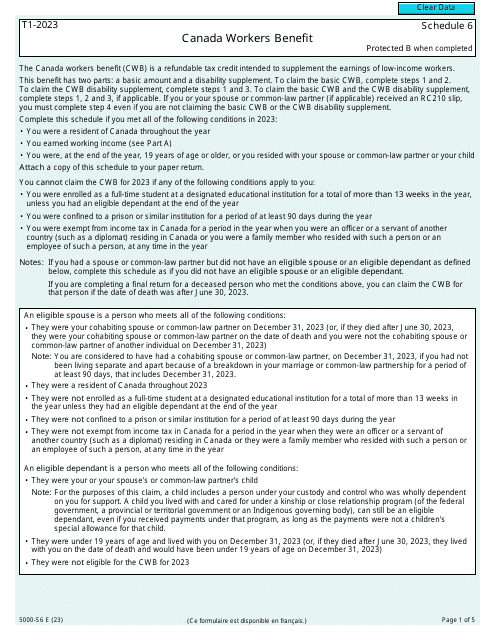

This form is used for reporting the Working Income Tax Benefit in Canada.

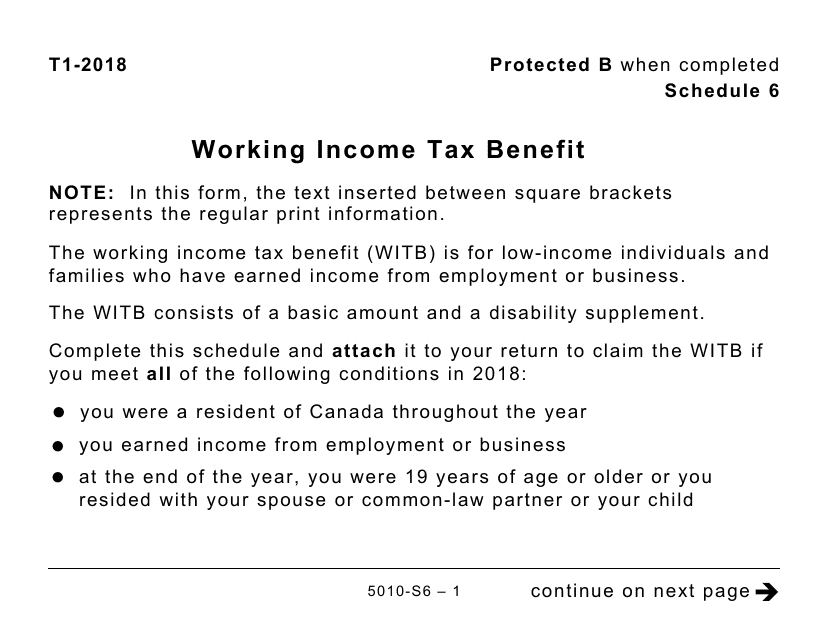

This form is used for reporting the Working Income Tax Benefit in Canada. It is specifically designed for individuals who prefer a large print version.

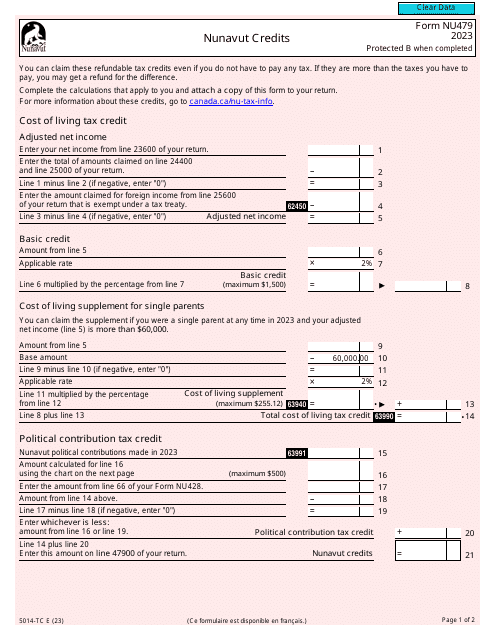

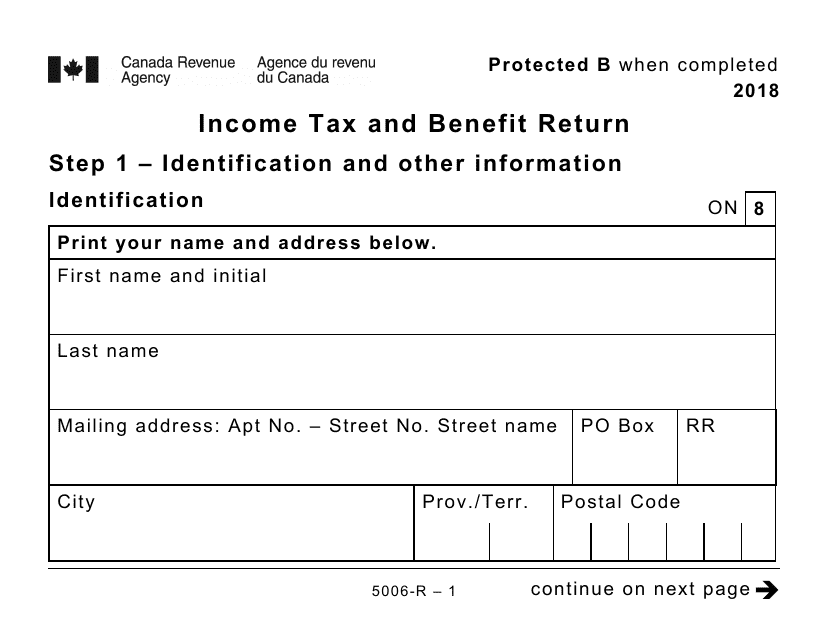

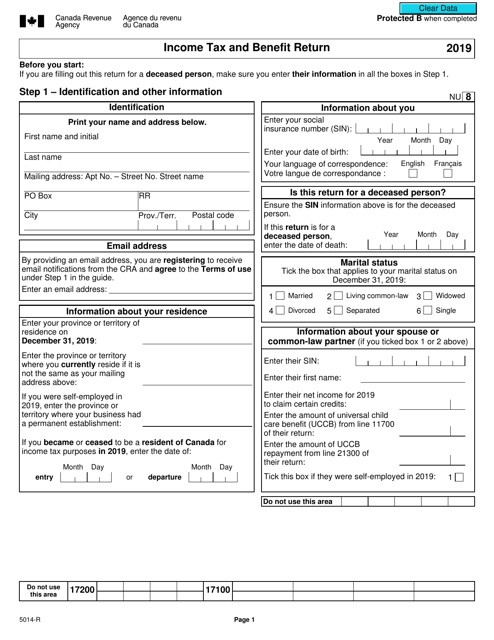

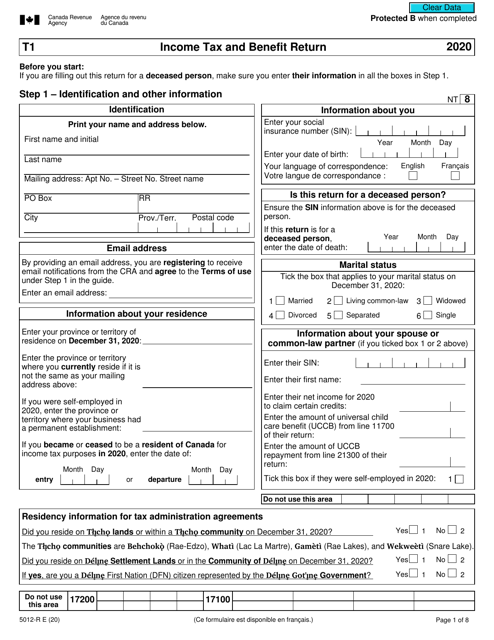

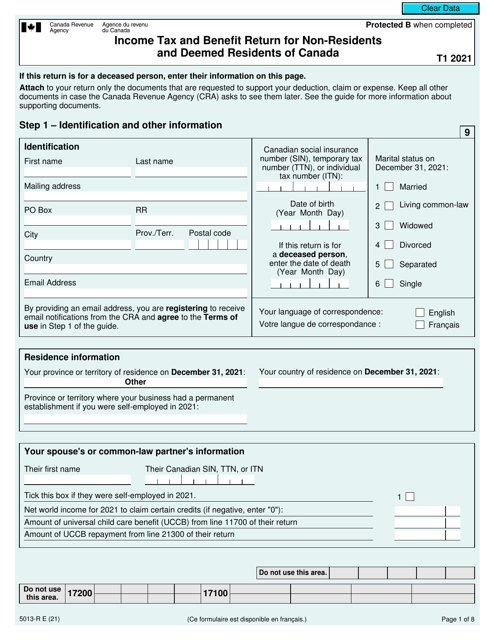

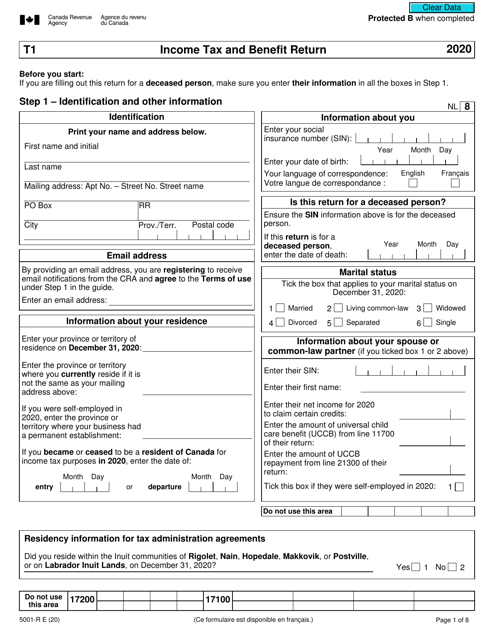

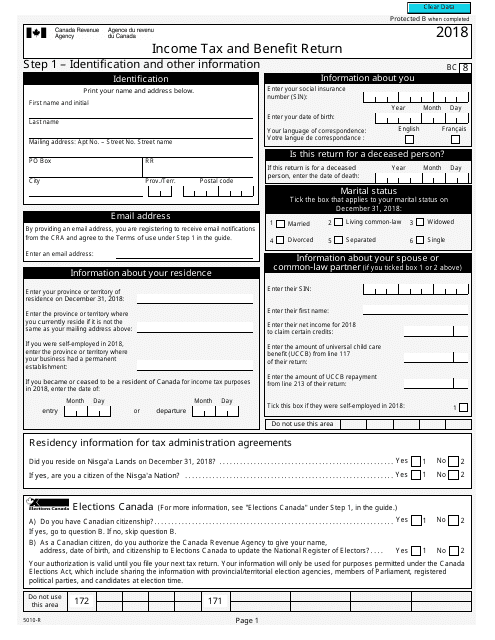

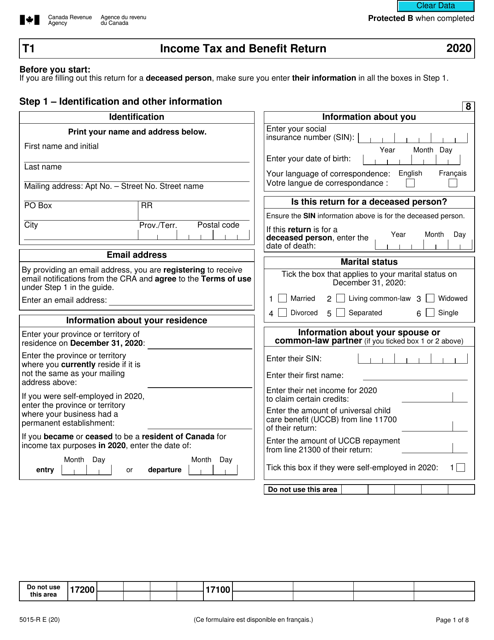

This form is used for filing income taxes and reporting benefits in Canada.

This Form is used for filing income tax and benefit return in large print format in Canada.

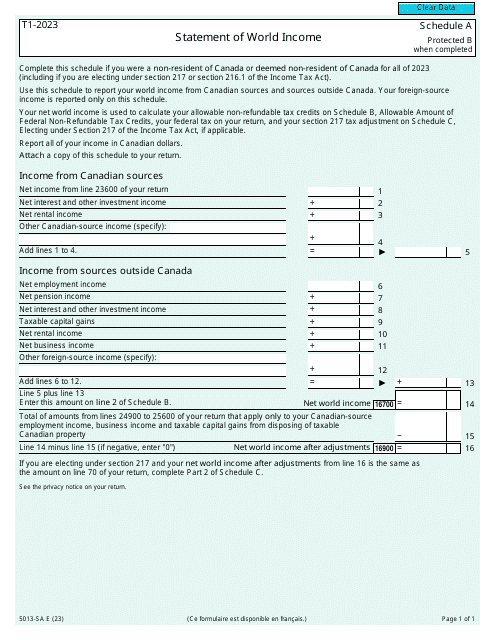

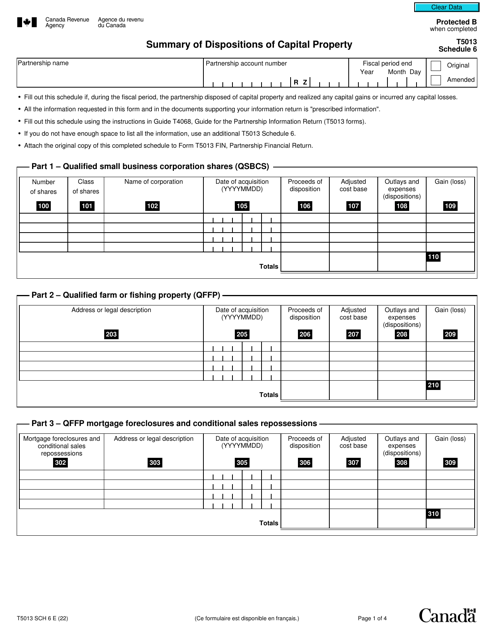

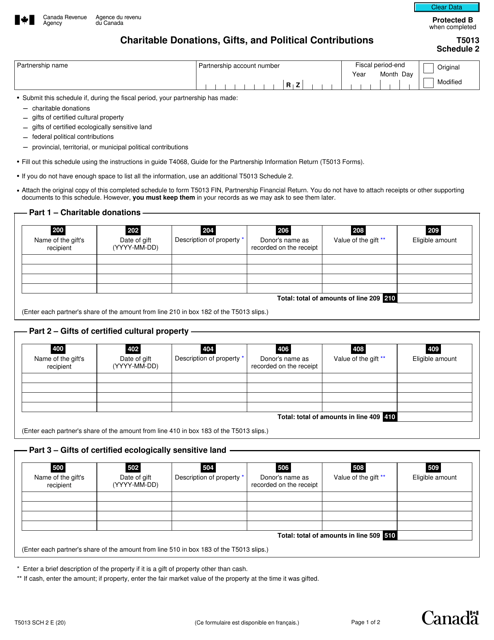

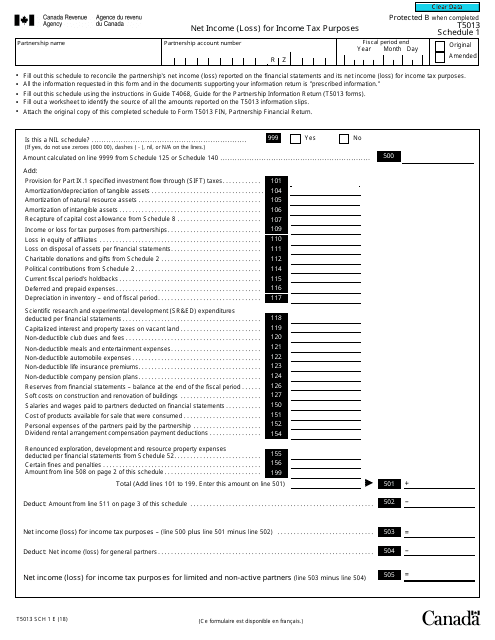

This Form is used for reporting the net income or loss for income tax purposes in Canada.

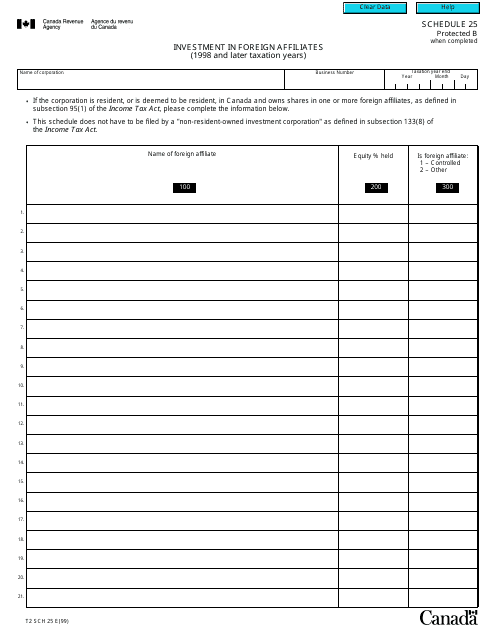

This form is used for reporting investment in foreign affiliates for taxation years 1998 and later in Canada.

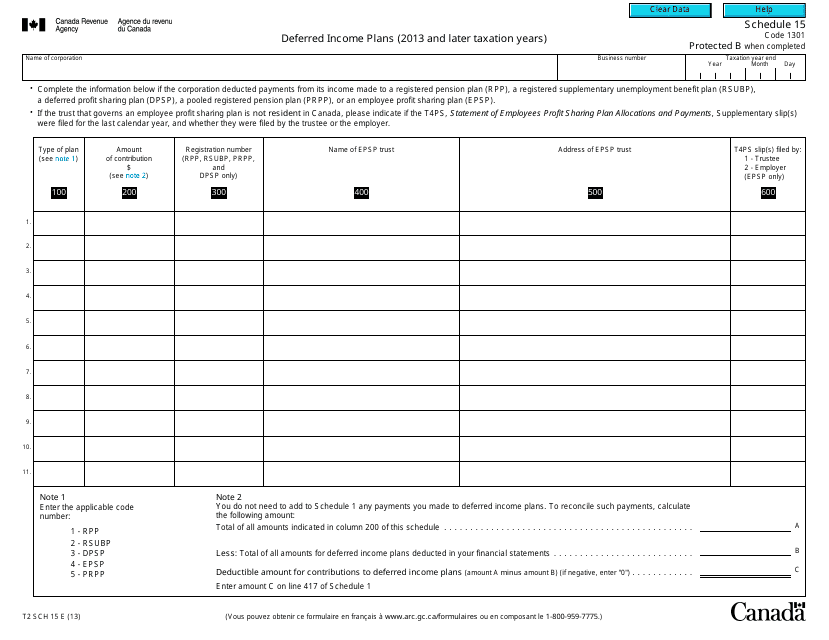

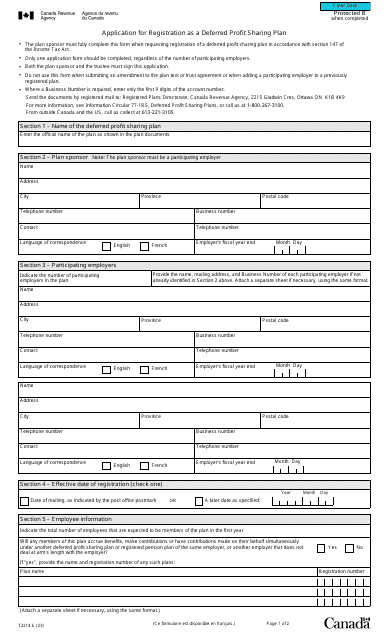

This Form is used for reporting deferred income plans for the 2013 and later tax years in Canada.

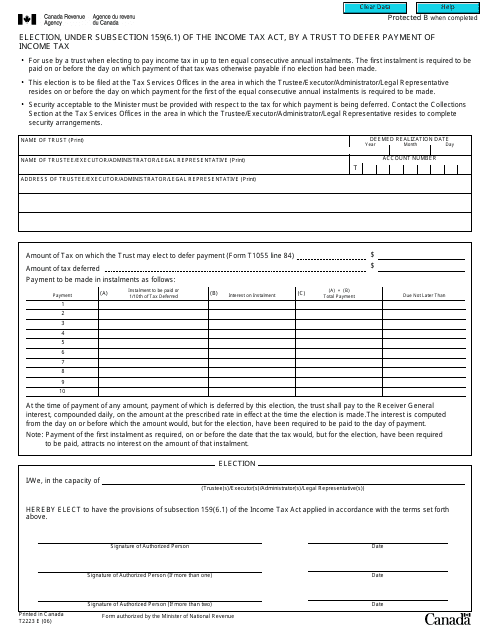

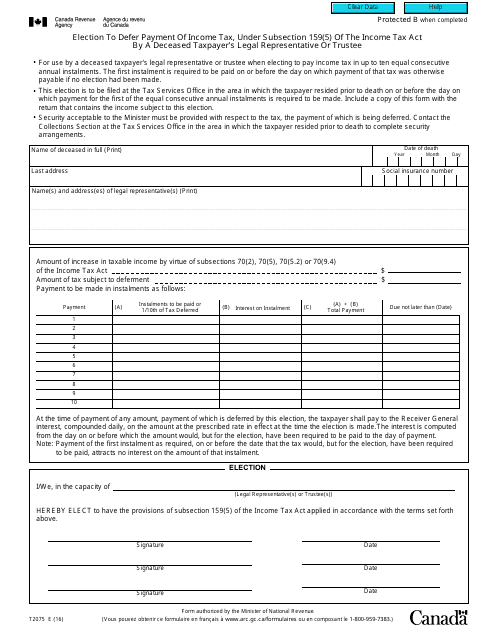

This form is used by a trust in Canada to make an election under subsection 159(6.1) of the Income Tax Act. It allows the trust to defer the payment of income tax.

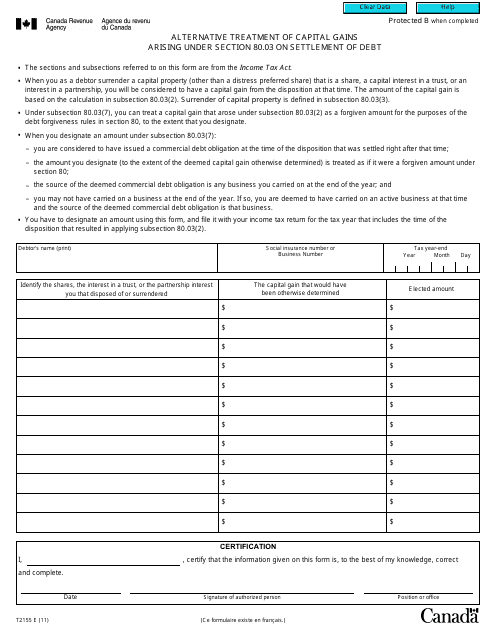

This form is used for reporting alternative treatment of capital gains that arise from the settlement of debt under Section 80.03 in Canada. It helps individuals comply with tax regulations and accurately report their capital gains.

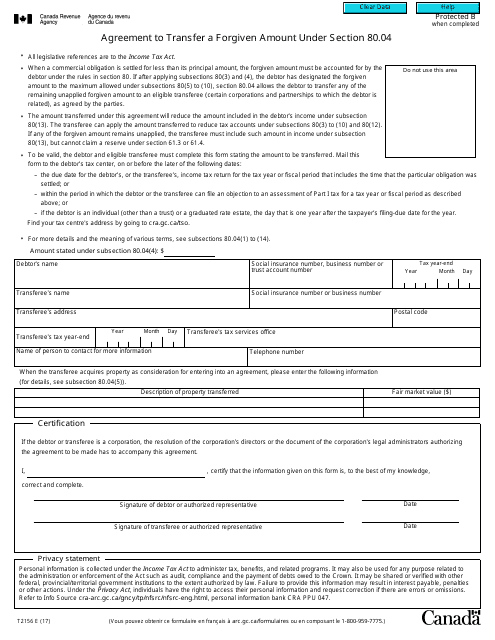

This form is used for transferring a forgiven amount under Section 80.04 in Canada.

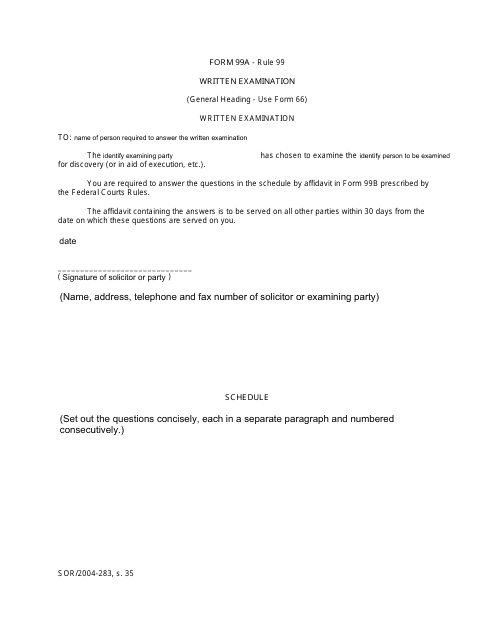

This type of document is used for conducting written examinations in Canada. It is often referred to as Form 99A.

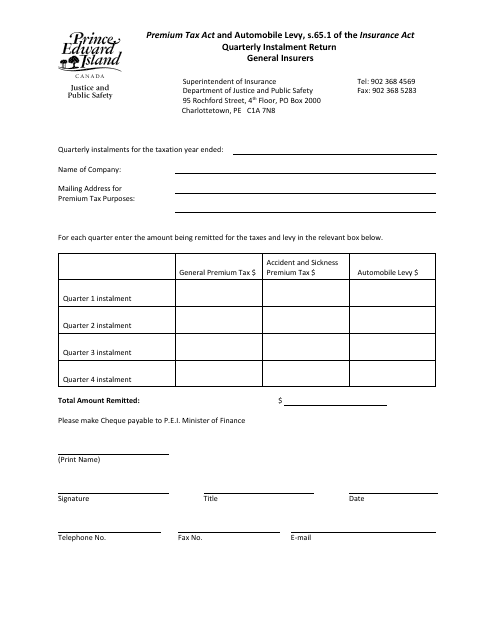

This document is used by businesses in Prince Edward Island, Canada to report their quarterly instalment payments to the government. It is a form that helps businesses calculate and remit the amount they owe for income tax or sales tax on a quarterly basis.

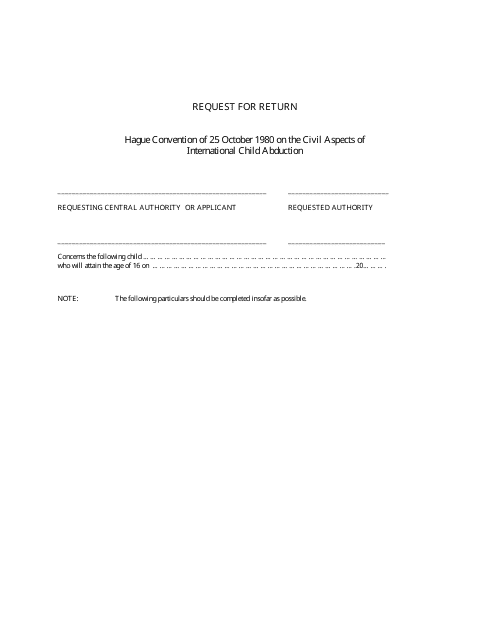

This document is used to request a return in the province of Saskatchewan, Canada.

This is a formal statement prepared by an employee after figuring out how much tax an employer has to deduct from their paycheck.

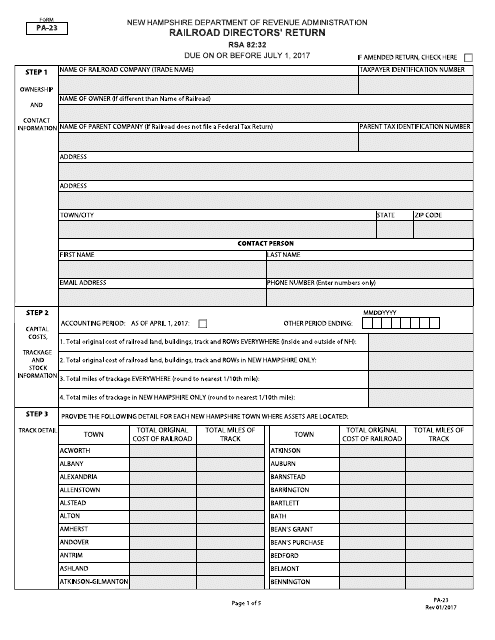

This form is used for filing the Railroad Directors' Return in the state of New Hampshire.

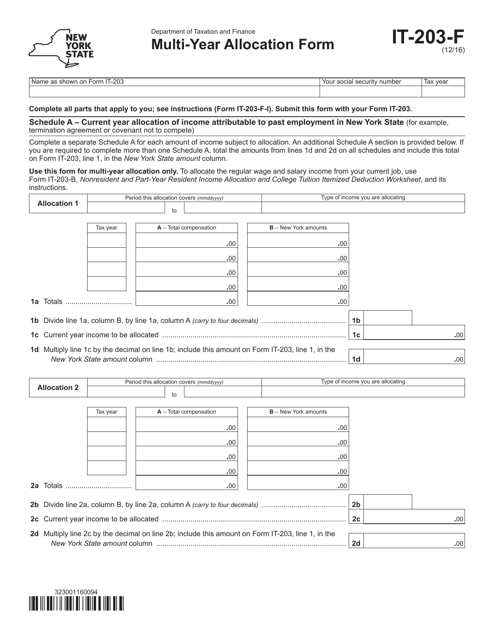

This Form is used for allocating income and deductions for multiple years in New York.

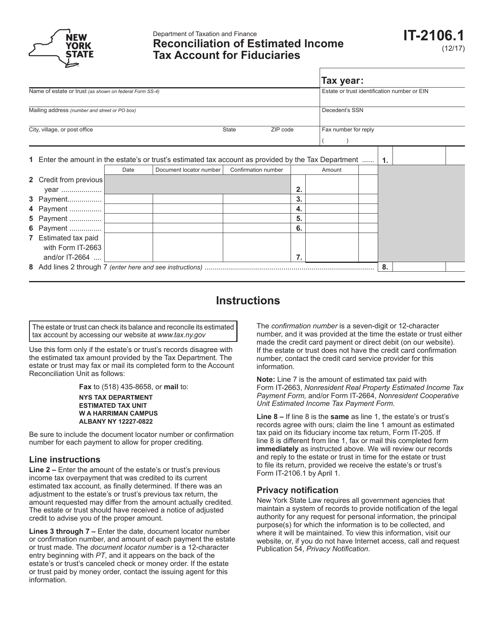

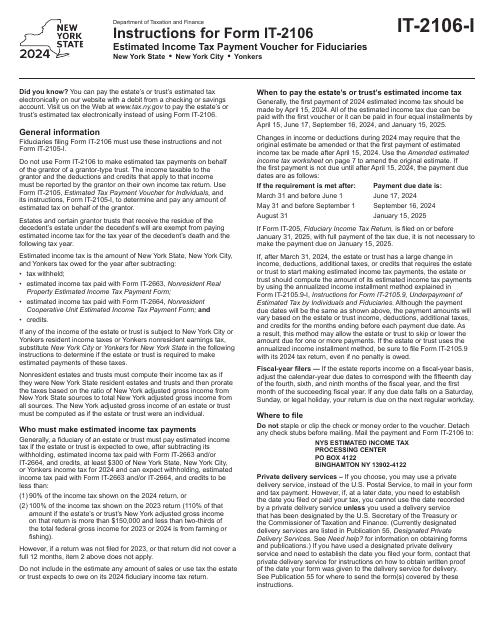

This form is used for reconciling the estimated income tax account for fiduciaries in the state of New York.