Income Tax Form Templates

Documents:

2505

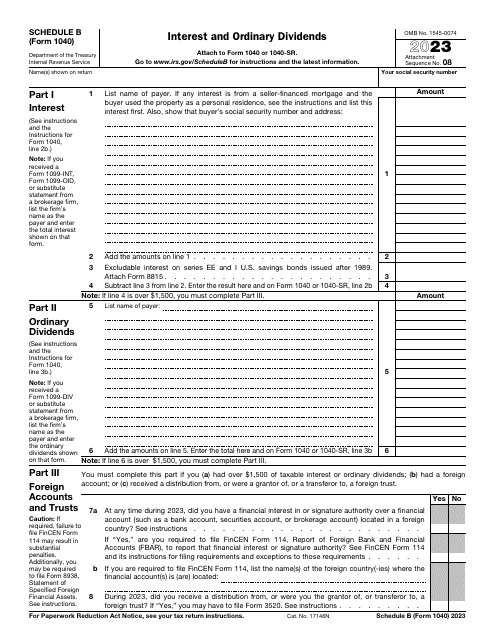

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

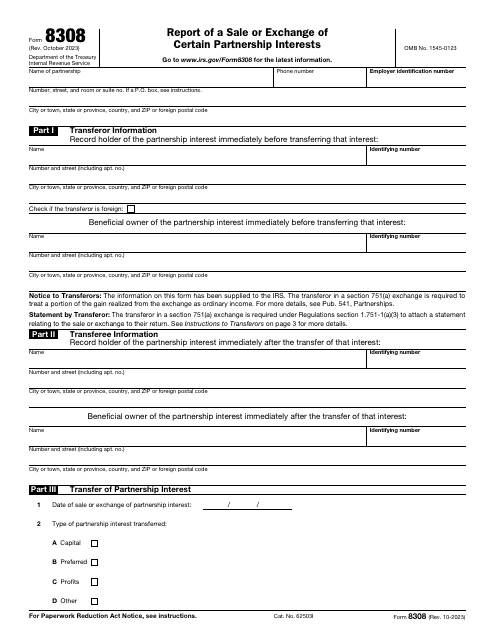

This IRS form is used by a partnership to report the exchange or sale by a partner of a partnership interest.

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.