Income Tax Form Templates

Documents:

2505

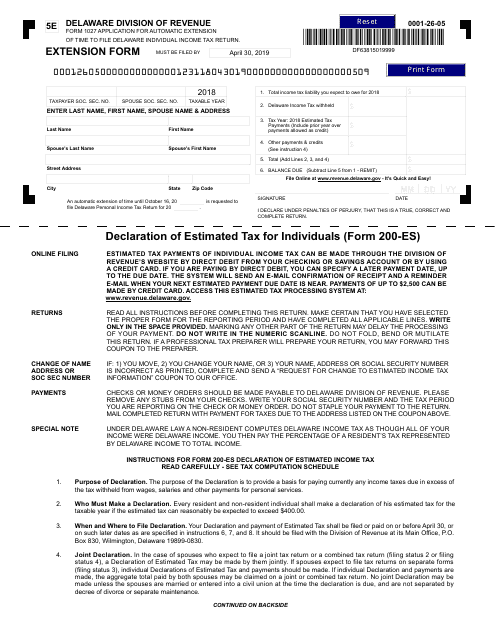

This Form is used for requesting an extension for filing Delaware Estimated Income Tax Return for Individuals in Delaware.

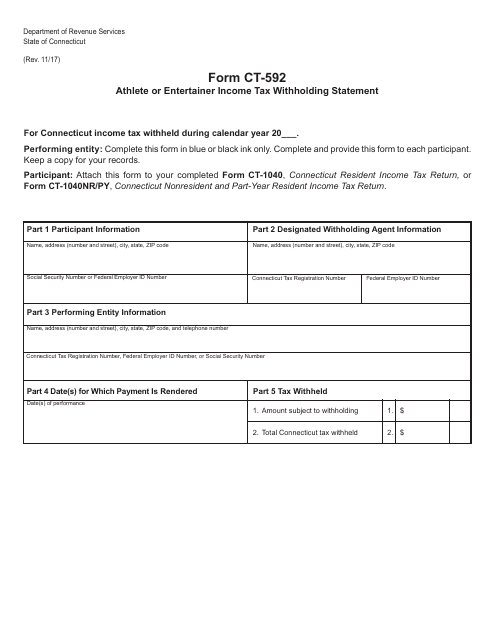

This form is used for reporting income tax withholding for athletes or entertainers in Connecticut.

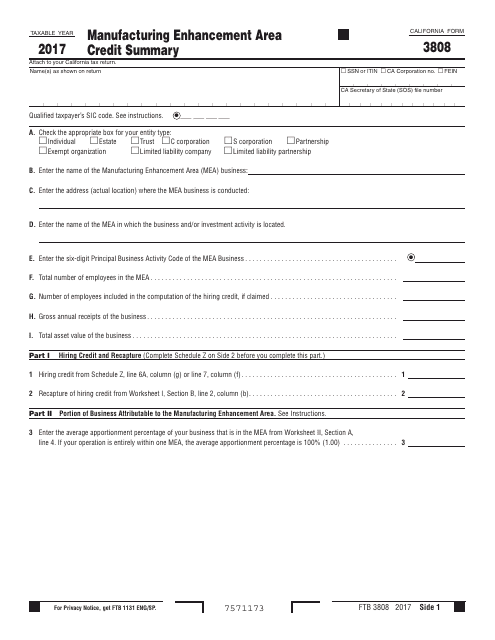

This form is used for summarizing the manufacturing enhancement area credits in California.

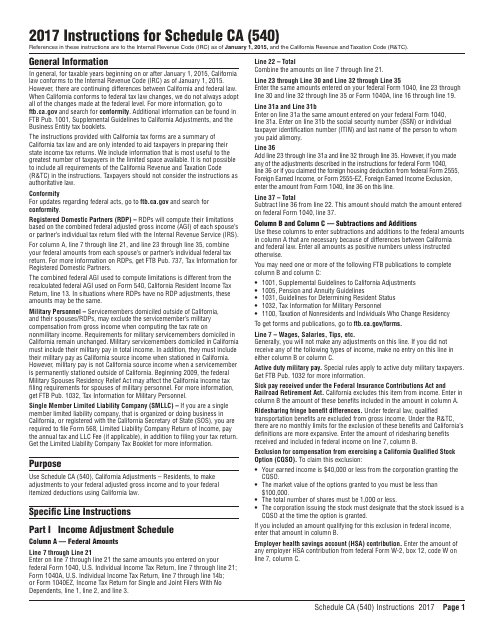

This Form is used for reporting California-specific tax adjustments for residents of California on their Form 540 tax return. It ensures accurate calculation of state tax liability for California residents.

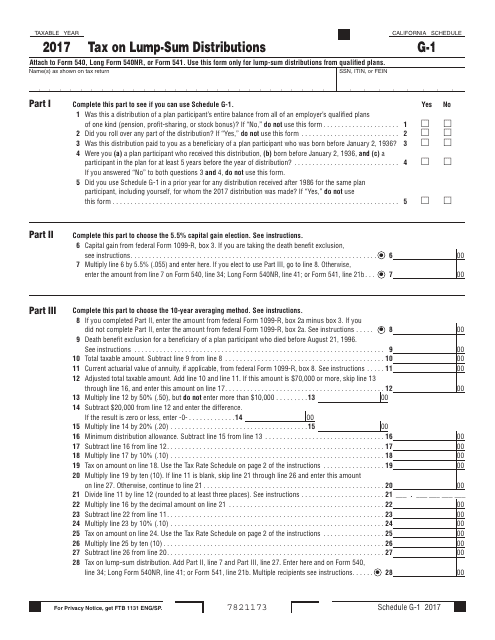

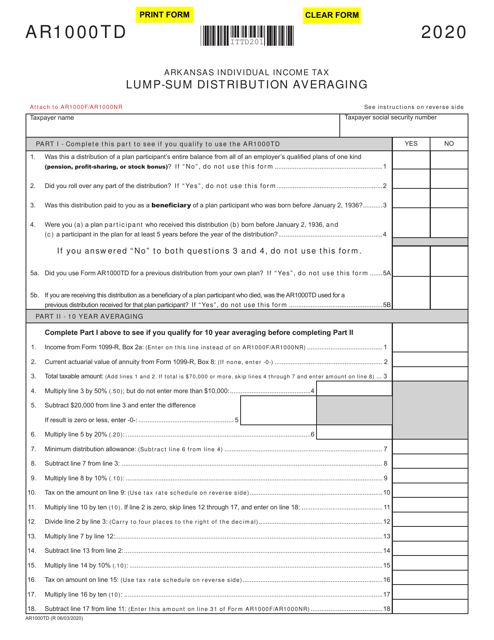

This Form is used for reporting and calculating the tax on lump-sum distributions in the state of California.

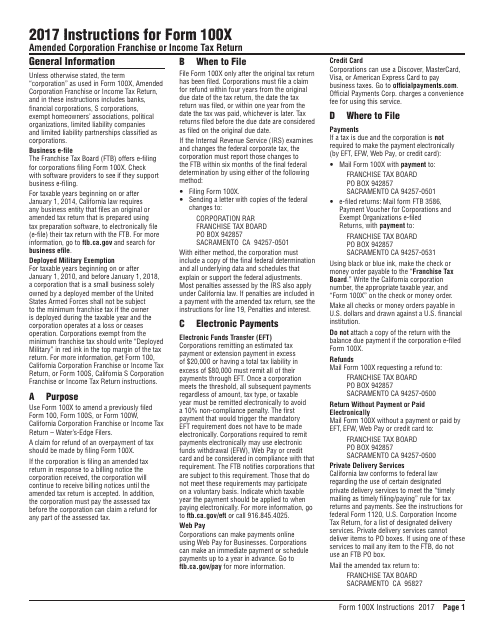

This Form is used for filing an amended corporation franchise or income tax return in California. It provides instructions on how to correct errors or update information on a previously filed return.

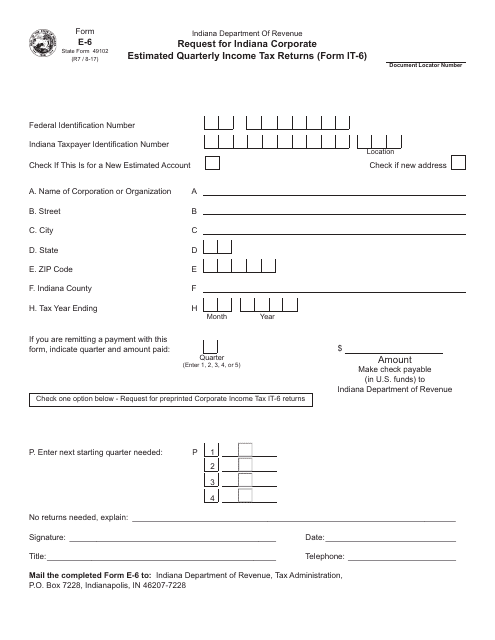

This form is used for requesting Indiana corporate estimated quarterly income tax returns.

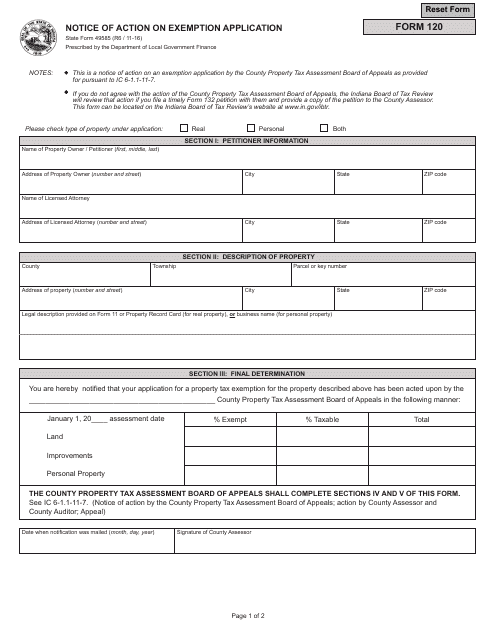

This form is used in Indiana to notify individuals about the action taken on their exemption application.

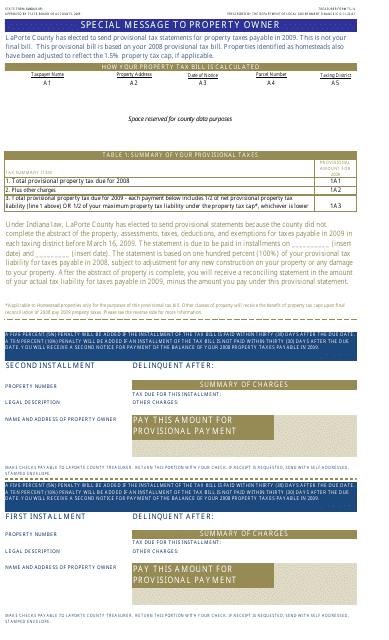

This form is used for filing your tax statement in the state of Indiana.

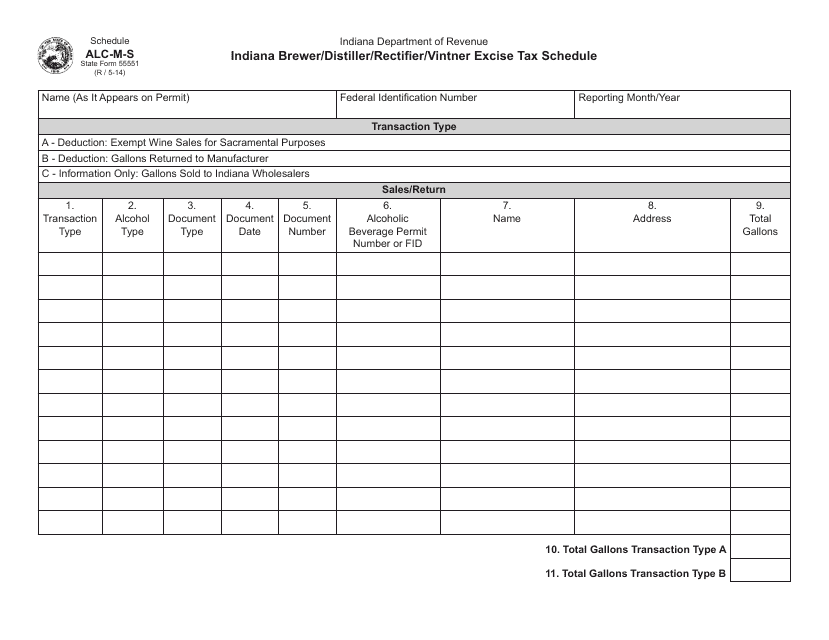

This document is a tax form used by brewers, distillers, rectifiers, and vintners in Indiana to report and pay excise taxes.

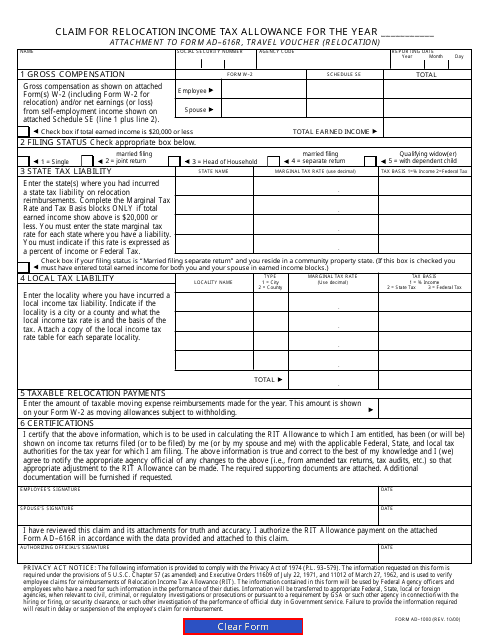

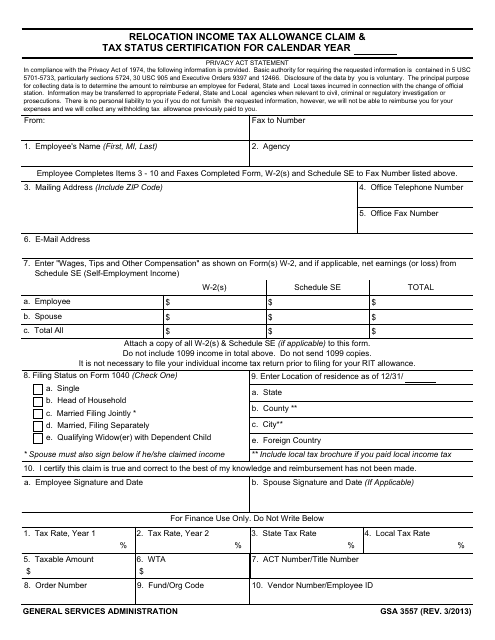

This Form is used for claiming the Relocation Income Tax Allowance for qualified expenses incurred during a relocation.

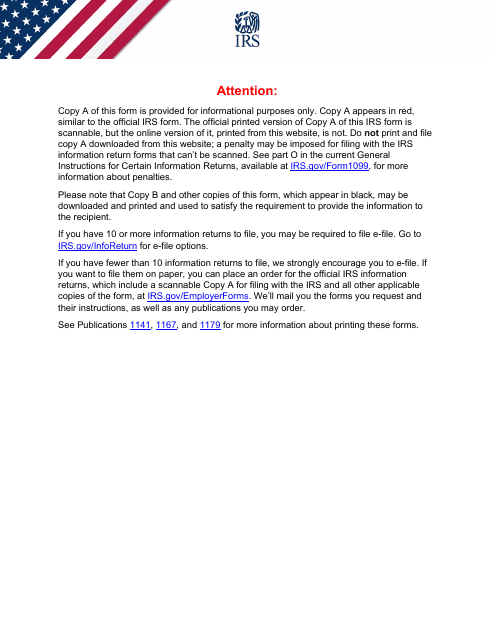

This is a formal IRS document completed to outline the discount received on particular debt instruments.

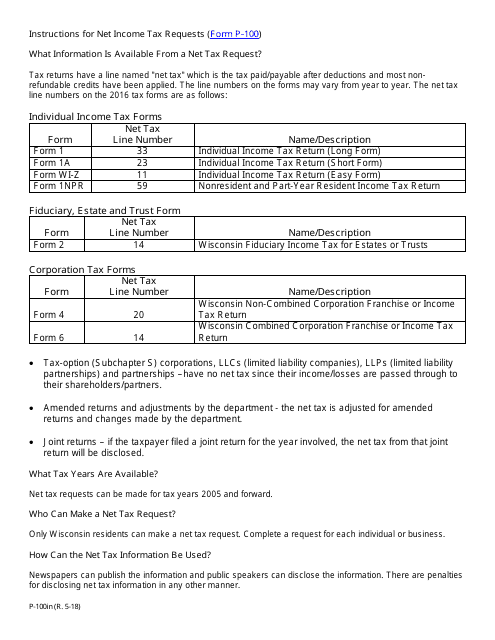

This Form is used for applying to determine the amount of Wisconsin net income tax reported as paid or payable.

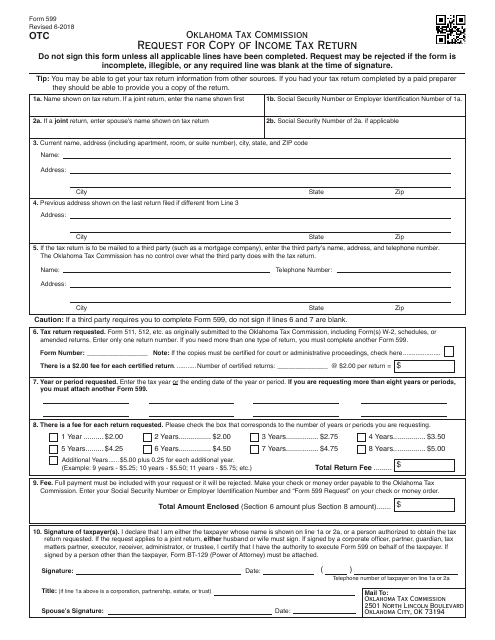

This form is used to request a copy of your income tax return in Oklahoma.

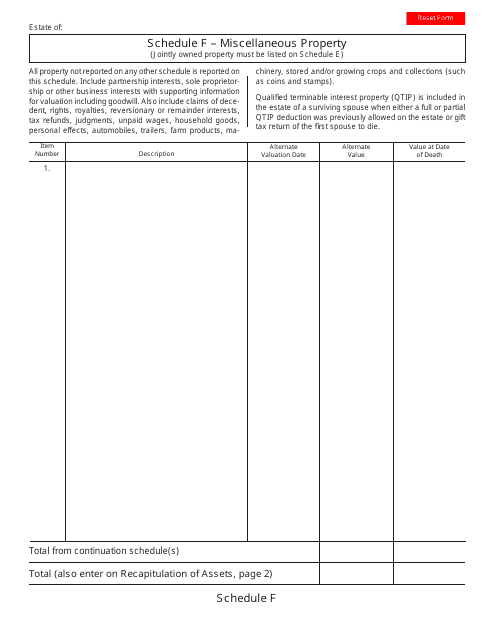

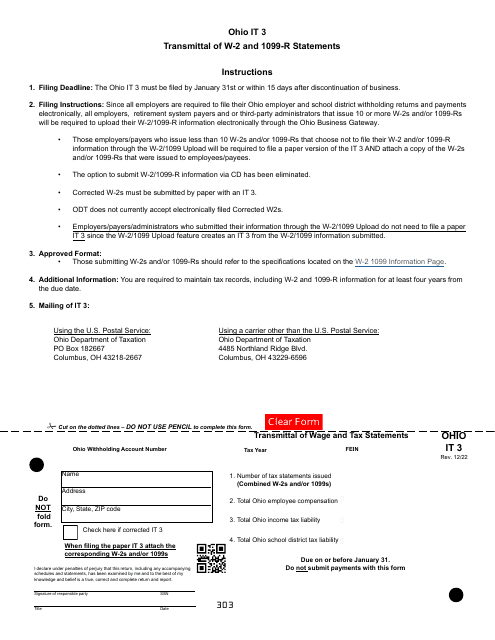

This form is used for reporting miscellaneous property in the state of Ohio. It is used to report items such as unclaimed funds, abandoned property, and safe deposit box contents.

This Form is used for claiming relocation income tax allowance and certifying tax status during a relocation. It helps individuals calculate and claim tax deductions related to their relocation expenses.

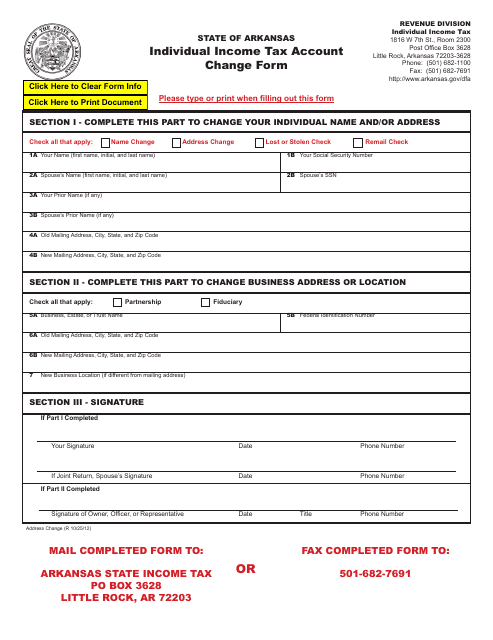

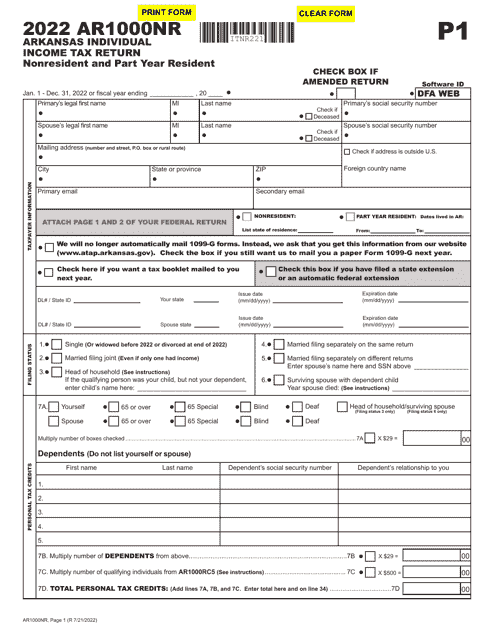

This Form is used for updating your name and address for individual income tax purposes in Arkansas.

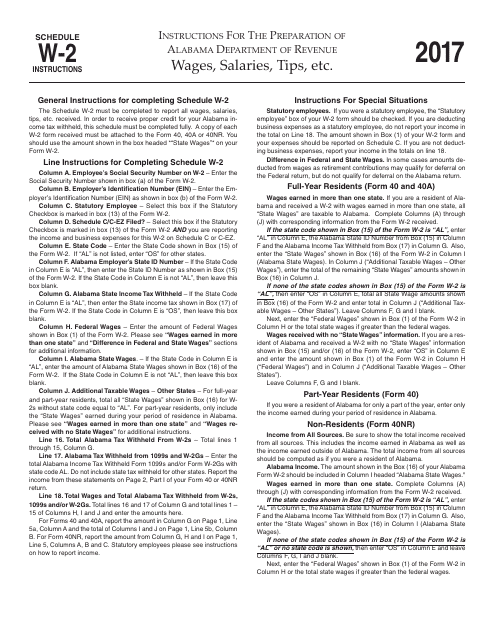

This Form is used for reporting wages, salaries, tips, and other income earned in the state of Alabama. It provides instructions on how to fill out Form W-2 for tax purposes.

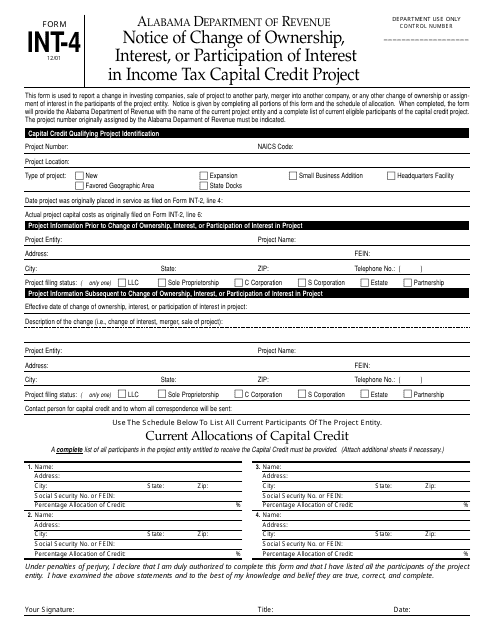

This form is used for informing the Alabama Department of Revenue about any change in ownership, interest, or participation of interest in an income tax capital credit project in Alabama.

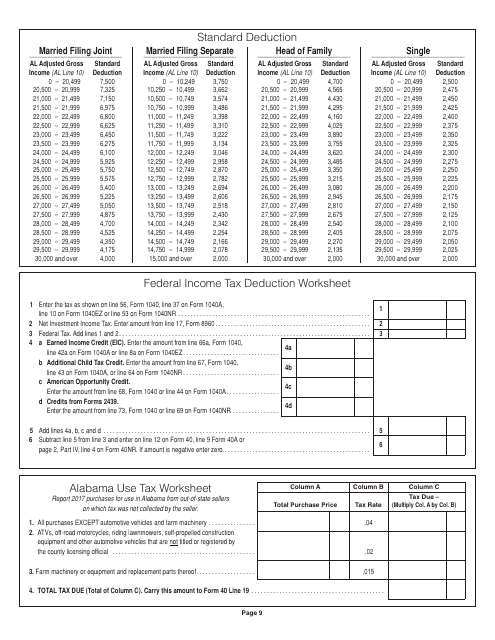

This document provides a worksheet for Alabama residents to calculate their federal income tax deductions.

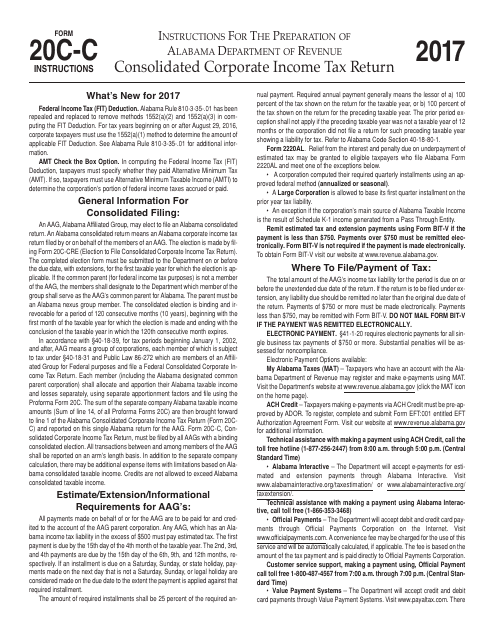

This Form is used for filing consolidated corporate income tax returns in the state of Alabama. It provides instructions for completing and submitting Form 20C-C.

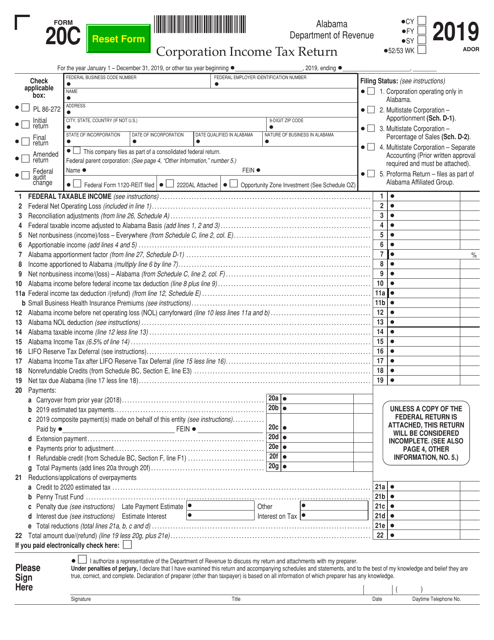

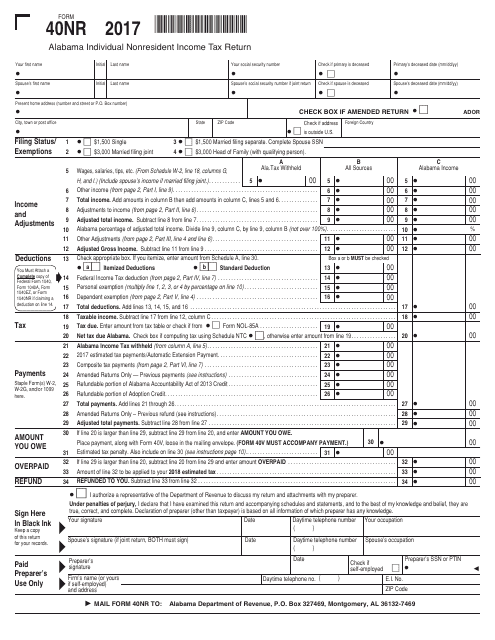

This Form is used for filing Alabama individual nonresident income tax return for taxpayers who earned income in Alabama but are not residents of the state.

This is an IRS form that includes the details of an installment sale.

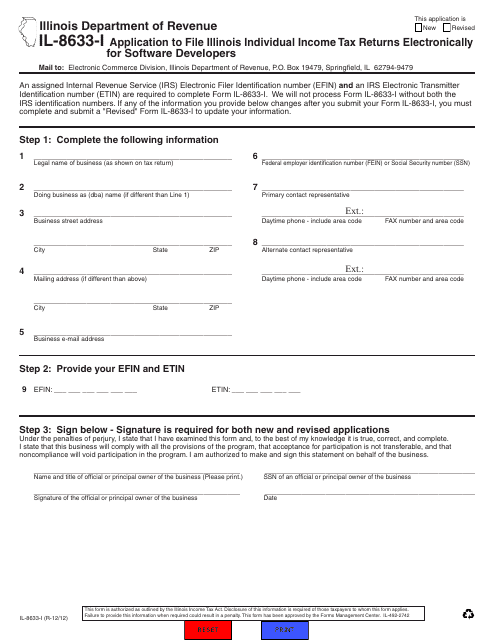

This Form is used for software developers in Illinois to apply for electronic filing of individual income tax returns.